Aave DAO posted its 'State of the Union' via ACI with @lemiscate

Lots of lessons, more on $AAVE buybacks + clear roadmap for what’s next:

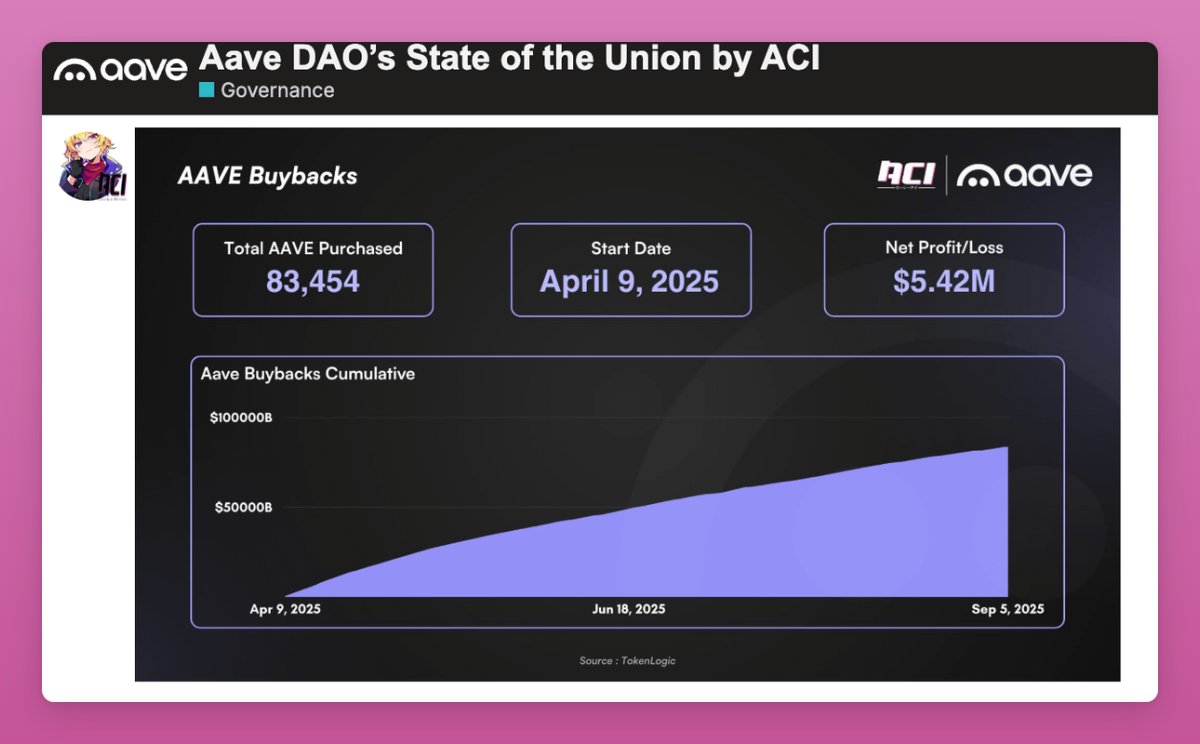

• DAO sitting on $130M of assets. Already bought back 0.5% of all $AAVE supply

• ~86.6% of Aave revenue is made on Eth L1

• Suggesting to enshrine $AAVE buybacks at $500K– $1M per week

• Many Aave instances on L2s / alt-L1s are not economically viable so ACI recommends shutting them down: Scroll, zkSync etc.

• Focus only on chains with strategic advantages (CeFi links, strong stablecoin bases, unique users) like @inkonchain and @PlasmaFDN

• Friendly forks underperformed or even hurt Aave. E.g. Spark was harmful: low revenue returned, helped competitors

• New framework coming: higher revenue share and no fork token launches that compete with AAVE

• Lending is a low-margin business (80–95% of revenue goes to LPs), so GHO becomes critical: it makes Aave the LP, captures more spread, and opens new growth channels.

• Instances model is obsolete. Prime works but most will be phased out as eModes cover the same use cases

• Growth plan: use the $130M treasury for offensive moves: distribution, partnerships, and expansion over the next 18 months

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。