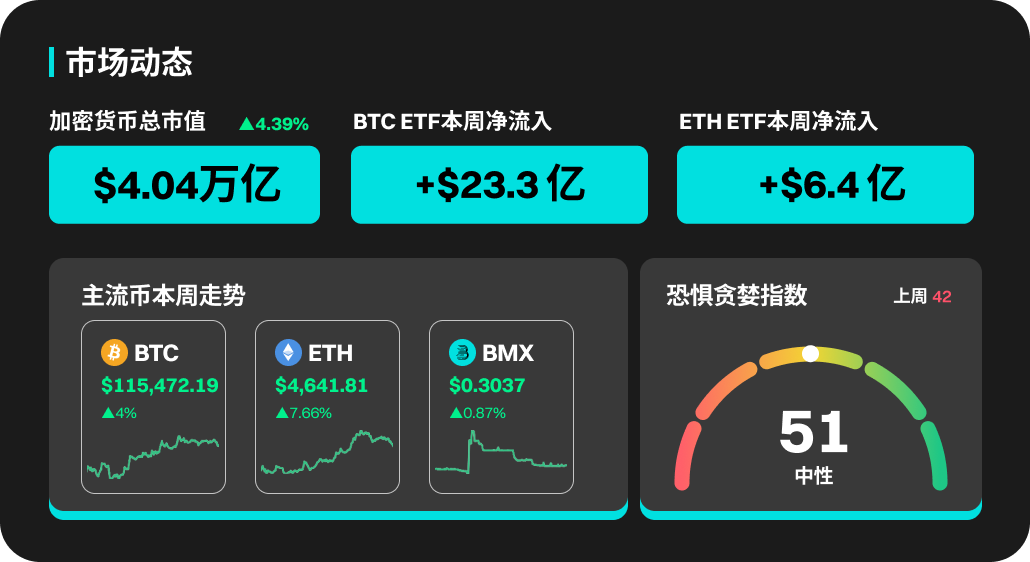

This Week's Cryptocurrency Market Dynamics

Last week (9.08-9.14), the net inflow amount for BTC ETFs was $2.33 billion. BTC found a bottom near $110,000 and peaked at around $116,600, showing good overall market performance. Currently, BTC's market share is reported at 56.9%, marking a new low since 2025, while altcoins performed strongly during the same period. After the U.S. CPI data was released last Thursday, expectations for a rate cut in September became clearer, with the market even betting on the possibility that the Federal Reserve might announce a 50 basis point rate cut this week.

Last week, ETH ETFs saw a net inflow of $640 million. On the trading day following the CPI data release last Thursday, ETH ETFs had a single-day inflow of over $400 million, driving ETH to a weekly high of $4,769. ETH's market share is currently reported at 13.8%, up nearly 0.3% from last week; the ETH/BTC exchange rate is reported at 0.04, an increase of over 5% from last week, indicating that ETH outperformed BTC during this cycle. ETH is currently down 7% from its historical high set in August, as the market awaits the Federal Reserve's FOMC announcement on interest rate decisions and economic projections at 2:00 AM Beijing time on September 18, when market volatility may be significant.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, MYX, OVPP, PEAQ, PUMP, and ITO have all performed well. MYX's price increased by 196.1% this week, with a 24-hour trading volume of 16.3M. OVPP's price rose by 136.2%, reaching a peak price of 0.178 USDT. PEAQ and PUMP increased by 77.3% and 68.7% respectively this week.

U.S. Market Overview and Hot News

Last week, U.S. stocks experienced overall fluctuations: the Dow Jones Industrial Average fell slightly by about 0.3%, the S&P 500 rose slightly by 0.3%, and the Nasdaq performed the strongest, rising by about 1.1%.

This week's market drivers are mainly the weak non-farm payroll and related employment data, which further raised market expectations for the Federal Reserve to initiate a rate cut at next week's meeting, thereby boosting risk appetite for risk assets. In terms of sectors, technology stocks, especially growth stocks represented by AI-related and semiconductor sectors, led the gains, becoming the main force driving the Nasdaq higher; meanwhile, the energy sector faced pressure due to supply and demand and inventory data, performing relatively weakly.

The Federal Reserve will hold a meeting on September 16 and 17, where it is expected to implement its first rate cut since December of last year;

At 2:00 AM Beijing time on September 18, the Federal Reserve's FOMC will announce the interest rate decision and economic projections; at 2:30 AM, Federal Reserve Chairman Powell will hold a monetary policy press conference;

Popular Sectors and Project Unlocks

AI Sector

The AI sector performed strongly last week, with a cumulative increase of about +10.0% for the week, with RNDR standing out with an increase of about +10%, and FET recording a weekly increase of about +9%. The momentum comes from increased trading volume, product and ecosystem news related to generative/inference AI projects, and ongoing capital attention to AI themes, all of which supported the short-term strength of the sector.

If the sector continues to gain project implementations, sustained trading volume, and inflows from institutional/retail funds, it still has short-term resilience; however, caution is needed regarding the risks of unlocks, large sell-offs, or reversals in key macro data leading to pullbacks.

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9:00 PM Beijing time on September 16, accounting for 2.03% of the current circulating supply, valued at about $49.2 million;

The decentralized trading platform Aster announced that it will conduct the ASTER token generation event on September 17, during which it will airdrop 7.04 million ASTER tokens to eligible users participating in the reward program;

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7:00 PM Beijing time on September 20, accounting for 8.53% of the current circulating supply, valued at about $52.5 million;

Optimism (OP) will unlock approximately 116 million tokens at 8:00 AM Beijing time on September 21, accounting for 6.89% of the current circulating supply, valued at about $93.4 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。