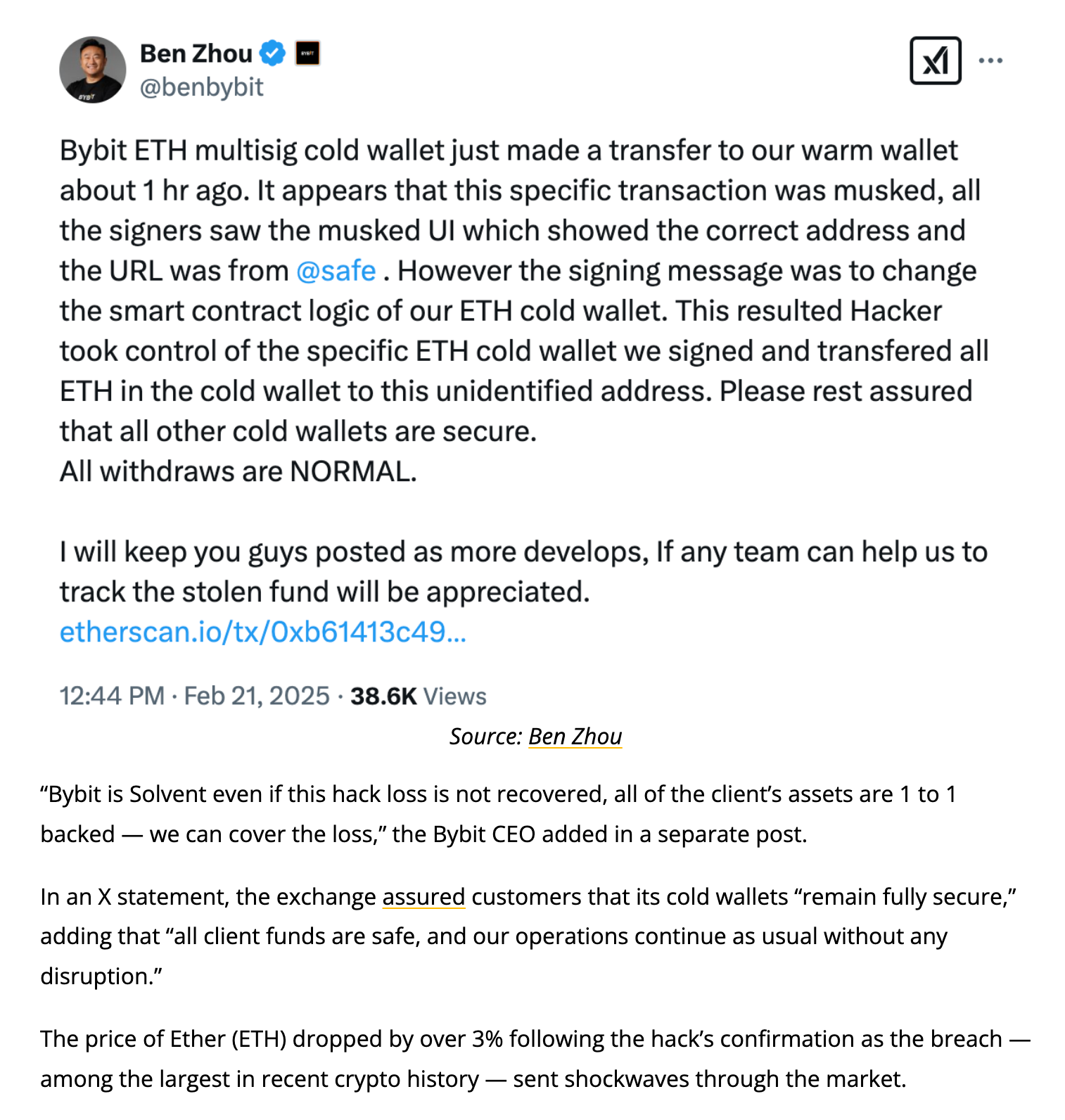

On the night of February 21, 2025, Bybit experienced the largest hacker attack in the history of the cryptocurrency industry, with nearly $1.4 billion worth of assets stolen. The hackers attacked the third-party wallet service SafeWallet, stealing funds that were supposed to be transferred to the hot wallet and dispersing them to multiple unknown addresses.

CEO Ben Zhou accomplished three things within 40 minutes:

Released an event announcement on the X platform

Activated a 1:1 reserve compensation plan

Started a two-hour live stream to face users directly

“Bybit will fully compensate, all assets are safe.”

In front of the camera, he spoke steadily, as if discussing routine operations.

This calmness stemmed from his experience of studying alone in New Zealand at the age of 12—while his peers were still growing under their parents' protection, he had already learned to handle water and power outages alone in a foreign country at night.

Seven days after the hacking incident, Bybit's trading volume surprisingly rebounded. Industry analysts discovered the secret weapon: RPI mechanism (Retail Price Improvement). This system, which was launched just before the attack, maintained liquidity during the crisis by isolating algorithmic orders from retail trades.

And Ben did something even more revolutionary: he took on the role of CTO, transforming the security team from a “closed fortress” to a “glass house”—introducing five rounds of internal audits and four rounds of external audits, with 50 measures publicly disclosed. “Only what can withstand scrutiny under a magnifying glass is true security.”

1. Key Data Insights

- No suspension of withdrawal functions, liquidity stress testing

- Total withdrawal requests processed: 357,842

- Completion rate: 99.994% (only 20 delays)

- Total user withdrawals vs. hacker attack amount: 3.2 times (based on on-chain data)

This confirms the effectiveness of the three major reserve systems (Bybit/OKX/Binance all claim over 100% reserves).

- Response efficiency quantified

- Incident response initiated: within 9 minutes of the attack

- CEO live stream frequency: 3 sessions/12 hours (average interaction delay <8 minutes)

- Cross-departmental collaboration peak: 237 people on duty simultaneously within 2 hours after the attack

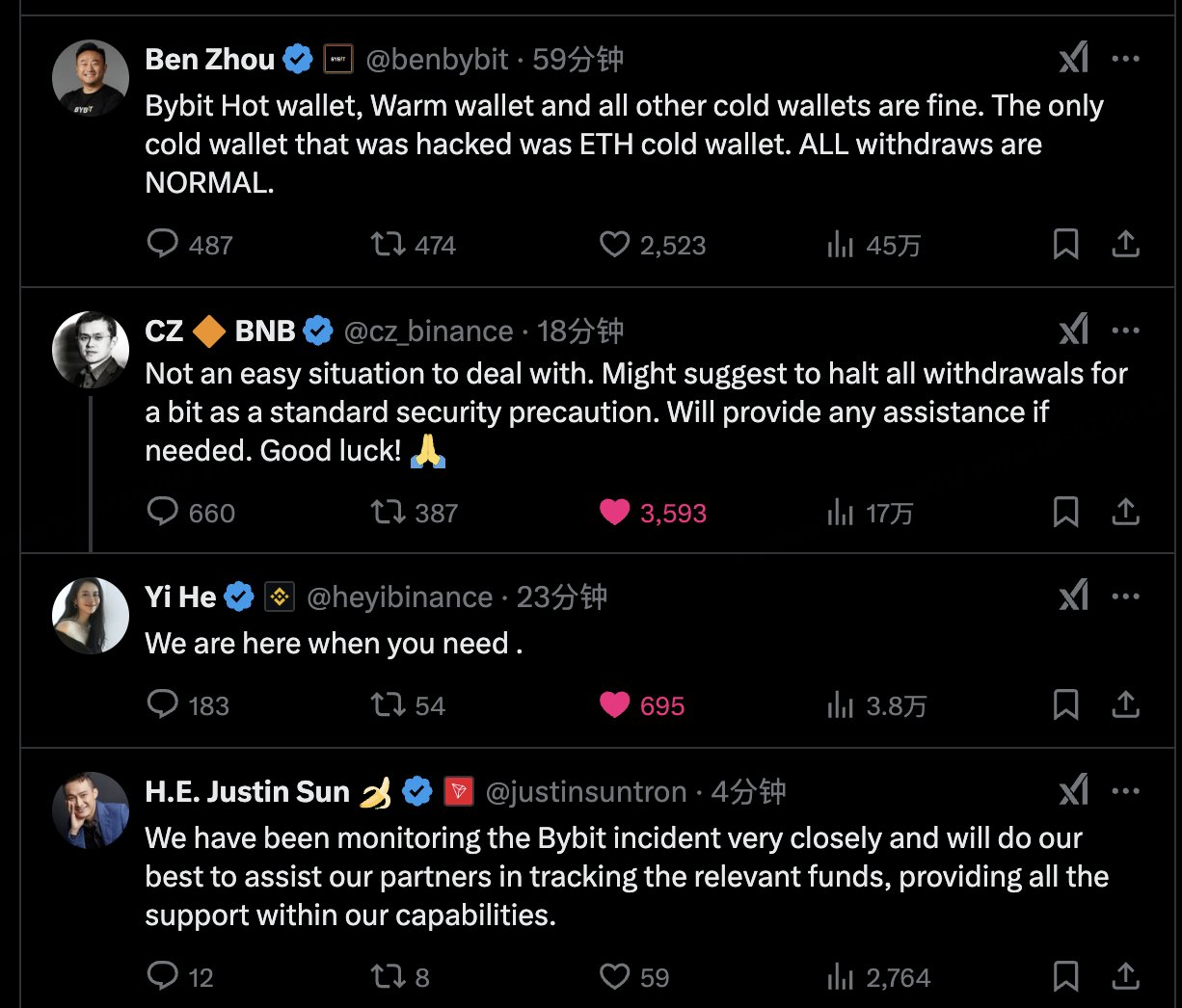

- Industry collaboration map

- Exchange support commitments: 4 (including Binance @heyibinance publicly stating that Binance @binancezh is always there if needed)

- KOL spontaneous support count: 127 (reaching over 24 million users cumulatively)

- Technical experts on-site support: 9 (including 3 CTOs from blockchain security companies, and even a tech guru flew to Dubai at night to provide support. This undoubtedly injected a strong dose of confidence into the industry.)

2. The Breakthrough Gene of the Derivatives Dark Horse

Let’s rewind to 2018 in Shanghai. When Binance rose through spot trading, Ben chose a risky path: perpetual contracts. The product design concealed sharp edges:

Dual pricing mechanism: Anchoring to the average price across global exchanges, eliminating malicious liquidations

Zero delivery date: Eliminating the risk of forced liquidation at futures expiration

Insurance pool replacing shared burden: Winners no longer pay for losers

This “risk-seeking victory” strategy stemmed from Ben's background in traditional finance. Having served as the Managing Director of the forex brokerage XM in China for seven years, he was well aware of the gaps and pain points in the derivatives market. “During the 2017 bull market, users were looking for compliant trading platforms with cash in hand, but the shadow of the Mt. Gox incident had not dissipated.”

Thus, Bybit was born equipped with multi-signature cold wallets and a trusted execution environment, even though the industry was generally keen on “prioritizing rapid expansion.”

The market voted with its feet: In August 2024, Bybit set a record for a single-day trading volume of $107 billion, with gold spot trading reaching $24 billion in a single day, four times the industry average.

3. The Wolf Culture of the "Huangpu Military Academy"

New employee training is personally conducted by Ben, without fail every month. Some employees jokingly refer to it as the “Huangpu Military Academy of the crypto world”—former employees are sought after by headhunters, while current employees must endure the high pressure of a “1.8x bonus coefficient”: the annual best team bonus is doubled, but they must wear multiple hats and be on standby during weekends.

This wolf culture was tempered into steel during the hacking incident. When $1.4 billion worth of ETH was stolen, the finance team processed 350,000 withdrawal requests within 10 hours, achieving a success rate of 99.994%; the customer service system handled a hundredfold increase in inquiries without any downtime.

Supporting all of this is the “wartime mechanism” established by COO Helen: with a background in HR, she designed the “Resource Commitment System”—any employee proposing a feasible plan immediately receives manpower and financial support, but must be “fully responsible for the results.”

4. Compliance Long March: The Chess Game from the Desert to Europe

When news broke that Trump was easing cryptocurrency regulations, Ben was signing the application documents for an Austrian license. This exchange, which had deliberately avoided the U.S. market for six years, began to explore North America. Meanwhile, on the European front, a turnaround had just been achieved:

By the end of 2024, it was forced to exit the European Economic Area due to MiCAR regulations;

In February 2025, France's AMF removed it from the blacklist;

At this moment, the Austrian MiCAR license became a springboard for re-entering the EU.

“Dubai is the starting point, not the destination.” Ben pointed to the headquarters map. Relocating to the UAE in 2023, he was attracted not only by the tax-free policies but also by the SCA (Securities and Commodities Authority) “principle-based approval” system—allowing companies to innovate through trial and error in a regulatory sandbox. This flexible regulatory mindset is now integrated into Bybit's global compliance DNA.

5. Epilogue: The Dark Horse Knows No Bounds

From an 8-person team in a Shanghai residential building to a giant managing assets for millions of users, Ben has always been answering the question he faced at the age of 12 during that late-night moment: when a crisis strikes, do you curl up or break through?

At the Bali event in April 2025, he pointed to the hacker incident timeline and laughed:

“The hacker who stole $1.4 billion gave us the most expensive gift—it made everyone understand that transparency is not a weakness, but armor.”

At this moment, Bybit has opened the door to a new battlefield: in the ultimate chess game of a one-stop asset management platform, the K-lines of gold and crude oil resonate with Bitcoin, while the players' eyes remain as clear and passionate as that night when the young boy boarded the flight to New Zealand—awake and fervent.

As Bybit resolves the execution issues of trading security, AiCoin fills the decision-making blind spots—this “golden partnership” is redefining crypto investment:

Set alerts in AiCoin for “BTC drops below XXX dollars,” and click the notification to directly jump to Bybit to open a long position. The professional version supports API synchronization of position data, calculating portfolio risk exposure in real-time.

Click the exclusive registration link for Bybit to complete your account opening and join me at Bybit! Participate in exclusive activities to receive $100 and return $5000!

Registration link:

https://jump.do/zh-Hans/xlink-proxy?id=15

Join our community, let’s discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Bybit benefits group:

https://aicoin.com/link/chat?cid=7JmRjnl3w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。