Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $4.01 trillion, with BTC accounting for 57.21%, which is $2.29 trillion. The market cap of stablecoins is $287.8 billion, with a 7-day increase of -0.12%. For the first time in three months, there has been a weekly data decline, with USDT accounting for 58.88%.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: MYX with a 7-day increase of 1324%, WLD with a 7-day increase of 85.13%, MNT with a 7-day increase of 35.1%, ATH with a 7-day increase of 87.11%, and PLUME with a 7-day increase of 42.85%.

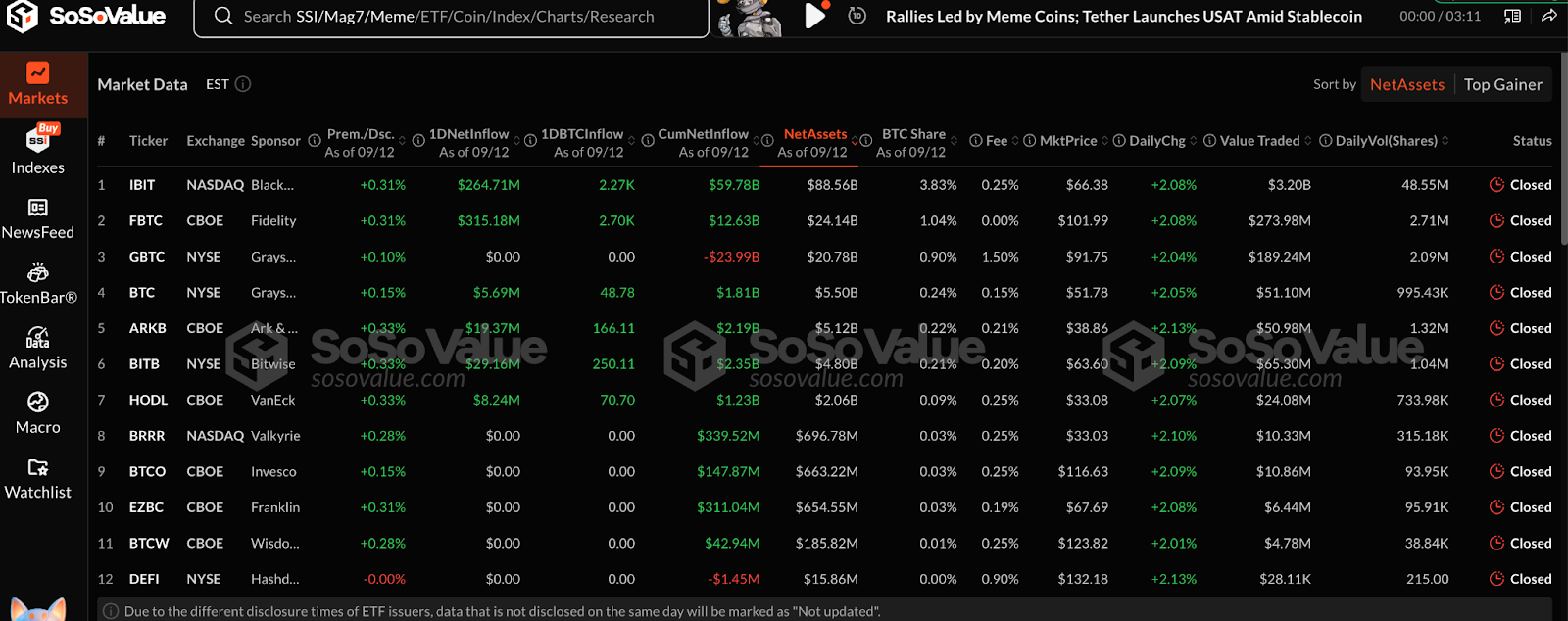

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $2.324 billion; the net inflow for Ethereum spot ETFs in the U.S. was $637.5 million.

Market Forecast (September 15 - September 19) :

Currently, the RSI index is at 63.05, showing a neutral to strong bullish trend. The Fear and Greed Index is at 53 (higher than last week), and notably, the Altcoin Season Index is at 78, entering the FOMO zone. On September 17, the Federal Reserve will announce its interest rate decision, with a 96.4% probability of a 25 basis point cut. If the cut is completed and a dovish stance is taken, it may push the market to break resistance; if unexpectedly hawkish (a low probability event), it may trigger a pullback.

BTC core range: $112,000-117,000

ETH core range: $4,500-4,800

SOL core range: $220-250

Conservative strategy: Gradually position near support levels (e.g., BTC ≤ $112k, ETH ≤ $4.5k, SOL ≤ $220), with stop-loss set 3-5% below support.

Aggressive strategy: If resistance levels are broken (BTC > $117k, ETH > $4.8k, SOL > $250) and volume increases, consider light long positions.

Hedging risk: Avoid high leverage, as volatility may double around the Federal Reserve meeting.

Understanding Now

Review of Major Events of the Week

On September 8, stablecoin issuers Paxos, Frax Finance, Agora, etc., are competing for the issuance rights of the upcoming USDH stablecoin from Hyperliquid;

On September 8, Arbitrum's modular trading platform Kinto, which suffered a smart contract attack in July resulting in a loss of 577 ETH (approximately $1.55 million), announced it will close on September 30. Its founder Recuero promised to compensate some of the hacker's victims after Kinto shuts down;

On September 11, WLFI announced the launch of Project Wings on Solana in collaboration with ecosystem partners. This event focuses on traders and aims to bring a more vibrant and in-depth market experience to the community. Currently, the USD1 trading pair has been launched on BONK.fun and Raydium Launchlab, allowing users to participate in trading;

On September 11, SEC Chairman Paul S. Atkins reiterated the key points of his speech at the first OECD Global Financial Markets Roundtable, stating that the combination of blockchain and AI will usher in a new prosperity, and the SEC is determined to seize the current opportunities;

On September 12, gold prices exceeded the inflation-adjusted peak from 45 years ago, as concerns about the U.S. economic outlook intensified, continuing a strong bull market for gold over the past three years and entering uncharted territory.

On September 10, the SEC delayed the review of Franklin's spot ETF applications for SOL and XRP, pushing the original deadline from September 15 to November 14, 2025.

Macroeconomics

On September 9, the initial value of the U.S. 2025 non-farm employment benchmark change was -910,000, with an expectation of -700,000;

On September 10, the U.S. August PPI year-on-year was 2.6%, with an expectation of 3.3%, and a previous value of 3.30%, which was below market expectations;

On September 11, the U.S. August unadjusted CPI year-on-year recorded 2.9%, the highest since January, meeting market expectations;

On September 11, the European Central Bank maintained the benchmark interest rate at 2% for the second consecutive meeting, as officials assess the impact of trade agreements between the EU and the U.S.

ETF

According to statistics, from September 8 to September 12, the net inflow of U.S. Bitcoin spot ETFs was $2.324 billion; as of September 12, GBTC (Grayscale) had a total outflow of $23.947 billion, currently holding $20.803 billion, while IBIT (BlackRock) currently holds $88.187 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $153.567 billion.

The net inflow of U.S. Ethereum spot ETFs was $637.5 million.

Envisioning the Future

Upcoming Events

EDCON 2025 will be held from September 16 to 19 in Osaka, Japan, gathering members of the global Ethereum community to discuss protocol updates, ecosystem development, and the future of Web3;

Korea Blockchain Week 2025 will be held from September 22 to 28 in South Korea;

TOKEN2049 Singapore 2025 will be held from October 1 to 2, 2025, in Singapore.

Project Progress

The nationwide clothing brand Mac House in Japan plans to start purchasing Bitcoin from September 17, 2025, with a total investment amount reaching 1.715 billion yen, approximately $11 million;

The U Drop airdrop claim deadline for Union is September 18.

Important Events

On September 17 at 21:45, the Bank of Canada will announce its interest rate decision;

On September 18 at 02:00, the U.S. will announce the Federal Reserve's interest rate decision (upper limit) as of September 17;

On September 18 at 20:30, the U.S. will announce the number of initial unemployment claims for the week ending September 13 (in ten thousand).

Token Unlocking

Starknet (STRK) will unlock 127 million tokens on September 15, valued at approximately $17.04 million, accounting for 5.98% of the circulating supply;

Sei (SEI) will unlock 55.56 million tokens on September 15, valued at approximately $18.64 million, accounting for 1.18% of the circulating supply;

Arbitrum (ARB) will unlock 92.65 million tokens on September 16, valued at approximately $49.06 million, accounting for 2.03% of the circulating supply;

ZKsync (ZK) will unlock $173 million on September 17, valued at approximately $10.52 million, accounting for 3.61% of the circulating supply;

Fasttoken (FTN) will unlock 20 million tokens on September 18, valued at approximately $89.8 million, accounting for 2.08% of the circulating supply;

Velo (VELO) will unlock 3 billion tokens on September 20, valued at approximately $46.48 million, accounting for 13.63% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers will also interact with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。