"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis pieces, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

The Liquidity Frenzy Resumes, a Violent Bull Market May Arrive by Year-End

This marks the beginning of a liquidity cycle, during which capital appreciates while labor becomes differentiated, the dollar weakens while alternatives strengthen, and Bitcoin transitions from a speculative asset to a systematic hedging tool.

Gold will play its role. However, Bitcoin, with its higher beta value to liquidity, institutional channels, and global accessibility, will be the leading asset in this cycle.

Goodbye to Flooding Capital, Has the "Blind Buy" Season of Shanzhai Become History?

The Shanzhai season is more likely to unfold in a slow bull pattern, characterized by greater differentiation. Liquidity is flowing to two extremes: on one end are blue-chip DeFi and infrastructure projects. These projects have cash flow, network effects, and institutional recognition, attracting the vast majority of funds seeking stable appreciation. On the other end are purely high-risk speculative assets—memecoins and short-term narratives. This portion of assets does not carry any fundamental narrative but serves as high liquidity, low-threshold speculative tools, meeting the market's demand for extreme risk and return.

Digging Deep into the True Value of CARDS: The Five Moats of Collector Crypt

The moats of Collector Crypt can be summarized as: token barriers, strong distribution and logistics capabilities, high alignment of interests between the founder and the project, unique supply-side advantages, and a highly resilient business model. Upcoming growth catalysts include: horizontal expansion to other IPs and risk resistance brought by audience diversification. Major risks include: inventory risk and valuation risk.

Policy

Derivatives, prediction markets, and DeFi become "policy-friendly tracks."

From Frenzy to Regulation, US Regulators Begin to Cool Down the "Crypto Heat" for Listed Companies

US regulators are intensifying enforcement against listed companies holding large amounts of cryptocurrency and high-risk enterprises suspected of money laundering.

Stablecoins

What Will the "Ultimate Form" of Stablecoin Chains Look Like?

Stablecoins have become an important sector exceeding $280 billion, with issuers enjoying substantial profits; meanwhile, Layer 1 blockchains based on stablecoins are emerging, showing three key trends: (1) driving traditional finance to access crypto-native channels, tapping into the continuously growing foreign exchange market; (2) reshaping the payment sector by removing intermediaries like Mastercard and Visa; (3) pushing the market structure from a "dual oligopoly" (HHI 4600) to an "oligopoly."

These transformations point towards a grander direction: issuers of stablecoins like Circle and Tether, along with new entrants like Stripe's Tempo, are no longer just "bridges between cryptocurrencies and fiat currencies," but are gradually positioning themselves as "the core of future financial infrastructure."

Is the End of Stablecoins Public Chains? New Attempts by the Three Giants

The three-layer logic behind the trend of stablecoins becoming public chains is: stablecoins have become the entry point for ecosystems, the strategic value of the settlement layer, and ecological stickiness and bargaining power.

Comparing the directions and differentiations of the three stablecoin giants' public chains: Plasma uses Bitcoin for security, Converge cleverly integrates traditional finance and DeFi applications, Stable serves institutions, and Arc targets financial institutions.

Hyperliquid Stablecoin USDH Becomes "Industry Darling," Giants Battle for Distribution Rights

On September 5, Hyperliquid announced that the stablecoin code USDH reserved by the protocol will be released through an on-chain validator voting process, with voting conducted entirely on Hyperliquid L1, similar to the delisting voting process. The selected team must participate in regular spot deployment gas auctions. The official stated that USDH, as a high-demand regulatory code, will be used to build a compliant, Hyperliquid-prioritized native stablecoin.

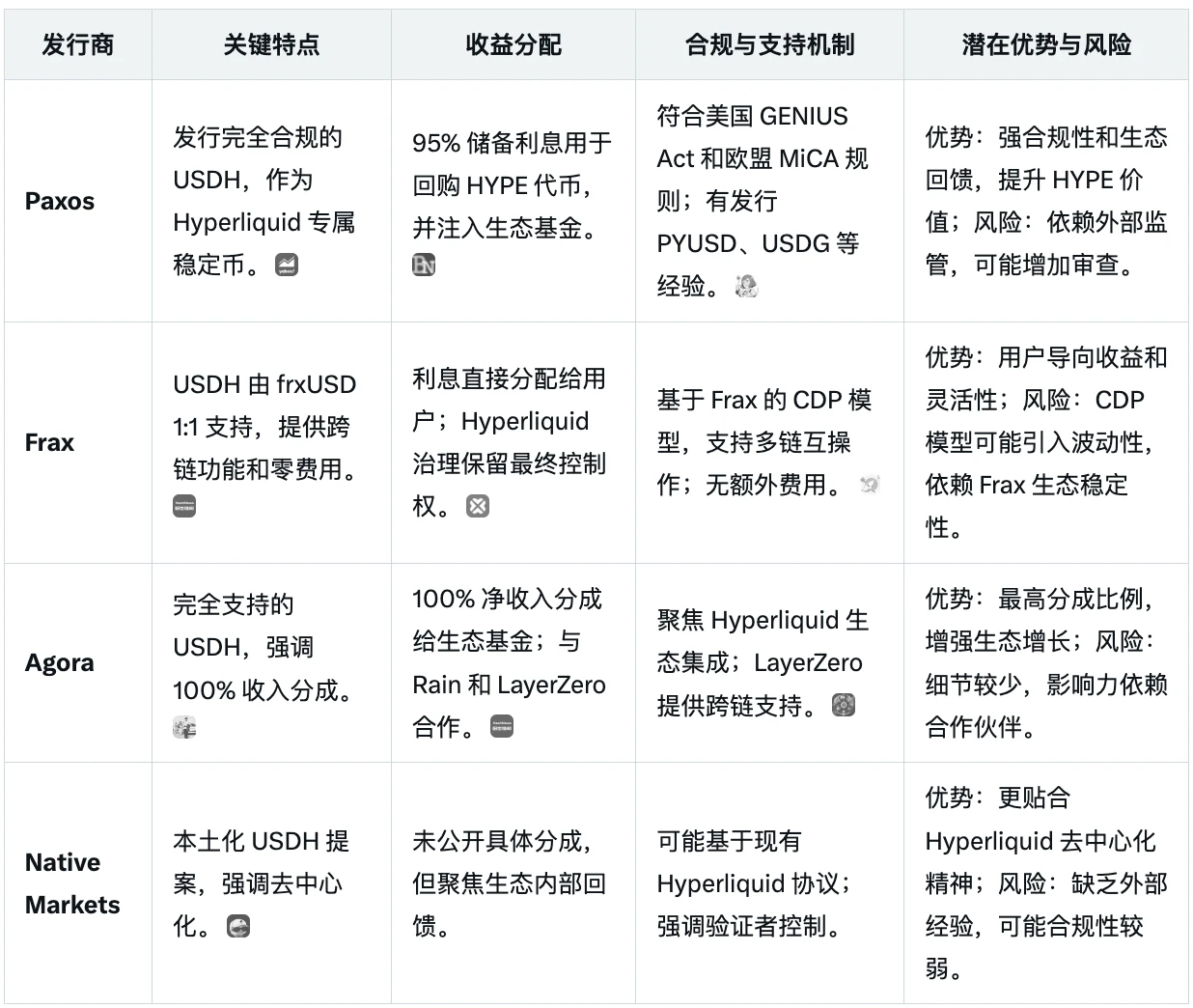

Following the announcement, major stablecoin issuers presented their own "USDH issuance plans":

Also recommended: "USDH Voting in Progress: 'Preordained Script,' 'CEO's Pursuit of Love,' 'Brave Withdrawal' in Turn" and "Beosin: 2025 Stablecoin Anti-Money Laundering Research Report."

Airdrop Opportunities and Interaction Guide

Hyperliquid Airdrop Project Ratings, Which Ones Are Worth a Shot?

S Level: Unit, Kinetiq; A Level: Liminal, Hyperbeat; B Level: Hyperlend, Felix, Project X, Ventuals; C Level: Hypurrfi, Hyperswap.

Example of a series of operations: Conduct spot trading on the Unit platform, converting part of the investment portfolio into Hyperliquid assets; perform liquid staking of HYPE to generate kHYPE, then deploy it to the Kinetiq treasury or other DeFi protocols (such as Hyperbeat, Hyperlend, Felix); use spot assets on the Unit platform (such as uBTC or other mainstream assets) for lending operations; allocate stablecoins to Liminal (institutional mode) and Hyperbeat's stablecoin treasury.

Also recommended: "Understanding OKX Boost Participation Rules and First Project Linea Qualification Inquiry," "OpenSea's New Odyssey: The Last 'Airdrop' Opportunity Before Token Issuance," "This Week's Selected Interaction Projects: Aster Phase Two Points Airdrop, SoSoValue Season Two Activities, Sentient New Galxe Tasks," "Reflections After Linea's Launch: 'Airdrop' Is Not Dead, But Thinking Needs to Change," and "Blockchain Rialo Built for the 'Real World,' How the Project Interacts."

Ethereum and Scalability

Revealing the ETH Holding Rankings: Who Will Own the Most ETH in 2025?

About 61% of ETH is held by just 10 addresses, but most of these belong to staking contracts, exchanges, or funds, rather than individual whales.

Nearly half of the ETH is stored in a smart contract: the Beacon deposit contract, which powers Ethereum's proof-of-stake system.

Large institutions like BlackRock and Fidelity now hold millions of ETH, making ETH an important reserve asset.

The ownership of ETH has shifted from early adopters. Now, everything depends on the platforms and services built on it.

Linea has finally issued tokens, but L2 activity has significantly decreased. In terms of results, the L2 route has still made a huge contribution to the development of the Ethereum ecosystem. Beyond the substantial gas fee savings, the strategic value of L2 mainly lies in two aspects: first, the capital sinking price of TVL; second, the seamless connection with traditional financial assets.

Multi-Ecosystem and Cross-Chain

Multicoin, Jump, and Galaxy Join Forces to Launch the Largest SOL Treasury in History

NASDAQ-listed Forward Industries (NASDAQ: FORD) officially announced that it has secured a total of $1.65 billion in cash and stablecoin commitments to initiate a SOL-centered digital asset treasury strategy through a PIPE transaction (private financing for public companies). This financing is led by Galaxy Digital (NASDAQ: GLXY), Jump Crypto, and Multicoin Capital, with one of the company's largest existing shareholders, C/M Capital Partners, participating.

CeFi & DeFi

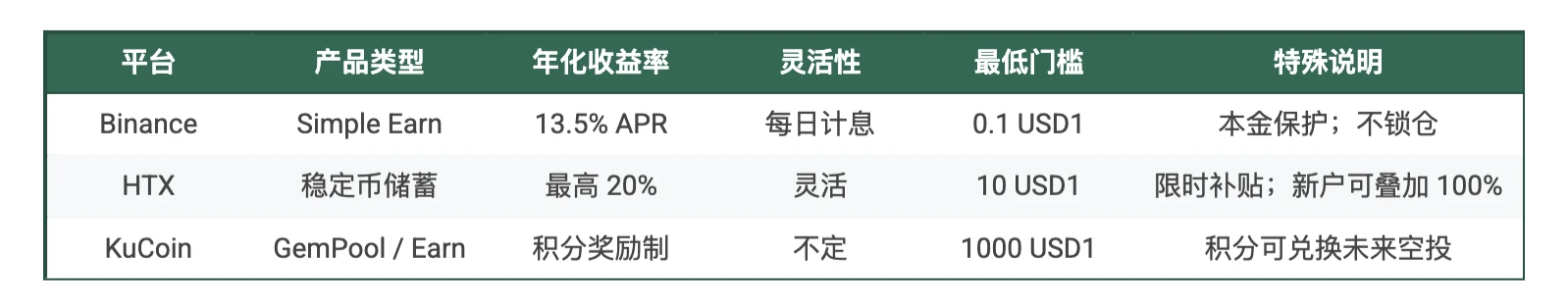

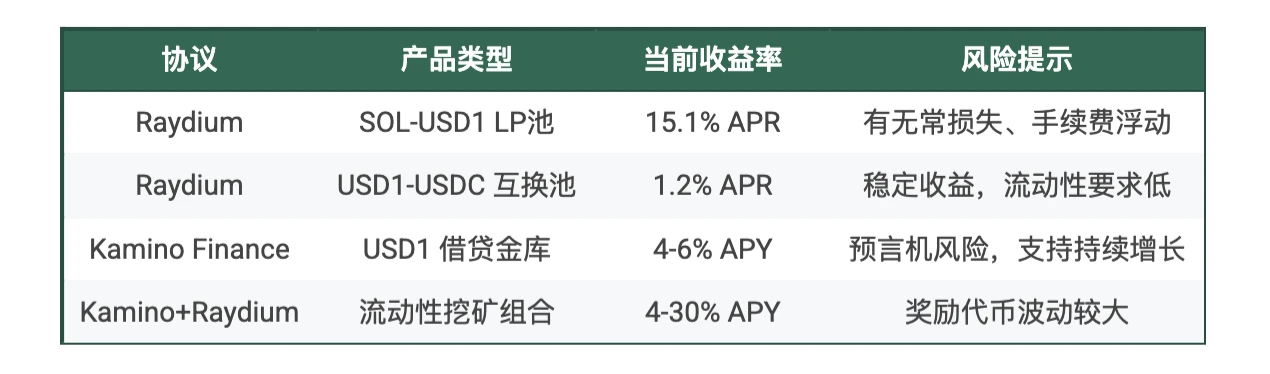

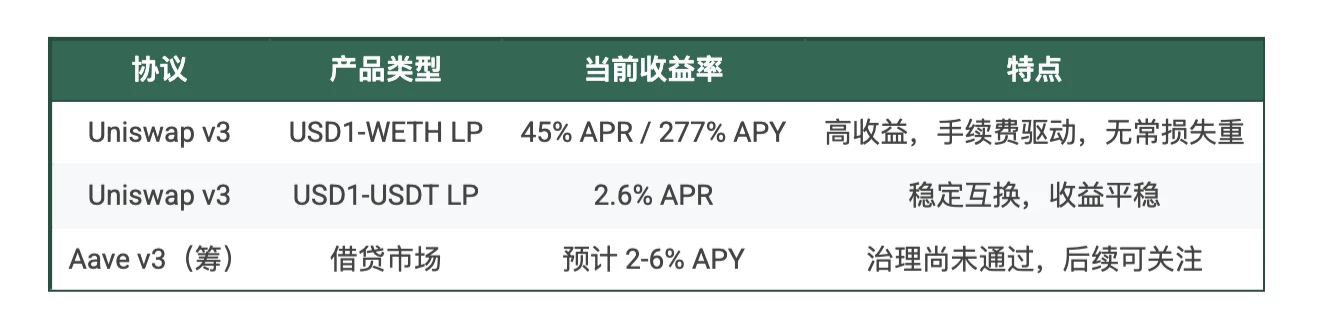

USD 1 Wealth Management Opportunity Overview: From Lazy "Lying Flat" to DeFi Annualized 45% Strategy

CeFi: The Most Suitable Principal Protection Channel for "Lazy People"

Solana Ecosystem: The Source of DeFi Vitality

Ethereum: A Breeding Ground for High-Risk, High-Return Strategies

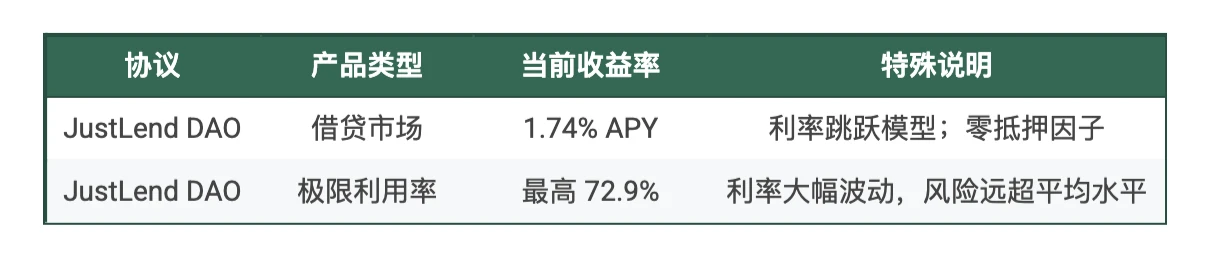

Tron: Hidden Risks of Interest Rate Jumps

Comprehensive Review of New Prediction Markets in 2025 (Part 1) (Part 2)

A selection of prediction markets based on new projects, potential, and profitability.

Also recommended: "Lazy Wealth Management Guide | River Launches Limited-Time 40.8% APR Yield Pool; Avantis LP Points to be Collected Tonight (September 9)" and "DeFi Beginner's Handbook (Part 1): How AAVE Whales Use $10 Million to Achieve 100% APR Through Interest Rate Arbitrage"

Security

Aqua Scam Warning: "Rug Pulls" Are Becoming More Sophisticated

Having products, partnerships, and code audits does not eliminate the possibility of a scam.

Weekly Hotspot Recap

In the past week, Nasdaq submitted an application seeking approval from the U.S. Securities and Exchange Commission for stock tokenization trading (Interpretation);

Additionally, in terms of policy and macro markets, the SEC established a cross-border special task force to combat securities fraud; Strategy was not included in the S&P 500 index; South Korea lifted the ban on VC financing for crypto companies, effective September 16; several internet platforms and central state-owned enterprises absent from the first batch of stablecoin license applications in Hong Kong; Hang Seng Index reached a nearly four-year high; Japanese and South Korean stock markets continued to set closing highs; Nasdaq and Dow Jones hit new historical highs; Japanese Prime Minister Shigeru Ishiba officially announced his decision to resign as president of the Liberal Democratic Party; American right-wing activist Charlie Kirk was attacked and killed during a speech in Utah;

In terms of opinions and statements, SEC Chairman: The era of cryptocurrency has arrived, and most crypto tokens are not securities; Gemini founders clashed with CFTC chairman candidates, and the White House halted confirmation votes; Ant Group CEO: We will not issue virtual currencies and will not participate in any form of speculation; Wang Feng: Blueport Interactive will not become a crypto treasury company and prefers the grayscale model; OKX Star: OKX Boost encourages real trading and does not recognize any false trading; Bitwise CIO: The SOL season is coming, and there may be "epic" performance by year-end; CZ: AI companions are a rapidly growing field, and we should combine them with cryptocurrency; STIX founder: "AVAX treasury" is another suspicious token lock-up exit plan;

Regarding institutions, large companies, and leading projects, Tether CEO disclosed the company's main Bitcoin holding addresses: the vast majority of BTC is held directly; Circle announced that USDC and CCTP V 2 will soon launch on Hyperliquid; 30% of Gemini's IPO shares will be allocated to retail investors; Eric Trump responded to being removed from the ALT 5 board: it is not a resignation; Robinhood will launch the social media platform Robinhood Social; HSBC and ICBC plan to apply for a stablecoin license in Hong Kong, potentially becoming one of the first approved institutions; Yunfeng Financial: has been approved to provide virtual asset trading services; South Korean cryptocurrency exchange Upbit will launch the "GIWA" chain; Christie's closes its NFT digital art department and will merge it into the contemporary art category; OKX Boost launches the first X Launch project Linea; Pendle introduces an AI agent tool focused on optimizing PT yields called Pulse; Avantis launches AVNT token airdrop checker; OpenSea will announce SEA token TGE details in early October and launch new features for OS AI mobile and flagship series; WLFI launches "Project Wings", with USD 1 trading pairs going live on Bonk.fun and Raydium; CyberKongz TGE, with 2% of KONG token supply allocated as an airdrop, available on a first-come, first-served basis; Aster opens airdrop check window; Magic Eden will launch the token launch platform SparkPad.

In terms of security, Ledger CTO: A large-scale supply chain attack is currently happening, and the entire JavaScript ecosystem may be at risk (Interpretation); Kiln: is withdrawing all Ethereum validator nodes as a precautionary measure related to a SwissBorg security incident, leading to over 2 million ETH queued for unstaking on the Ethereum network; Solana project Aqua suspected Rug Pull…… Well, it has been another eventful week.

Attached is the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。