1. Track Background Introduction

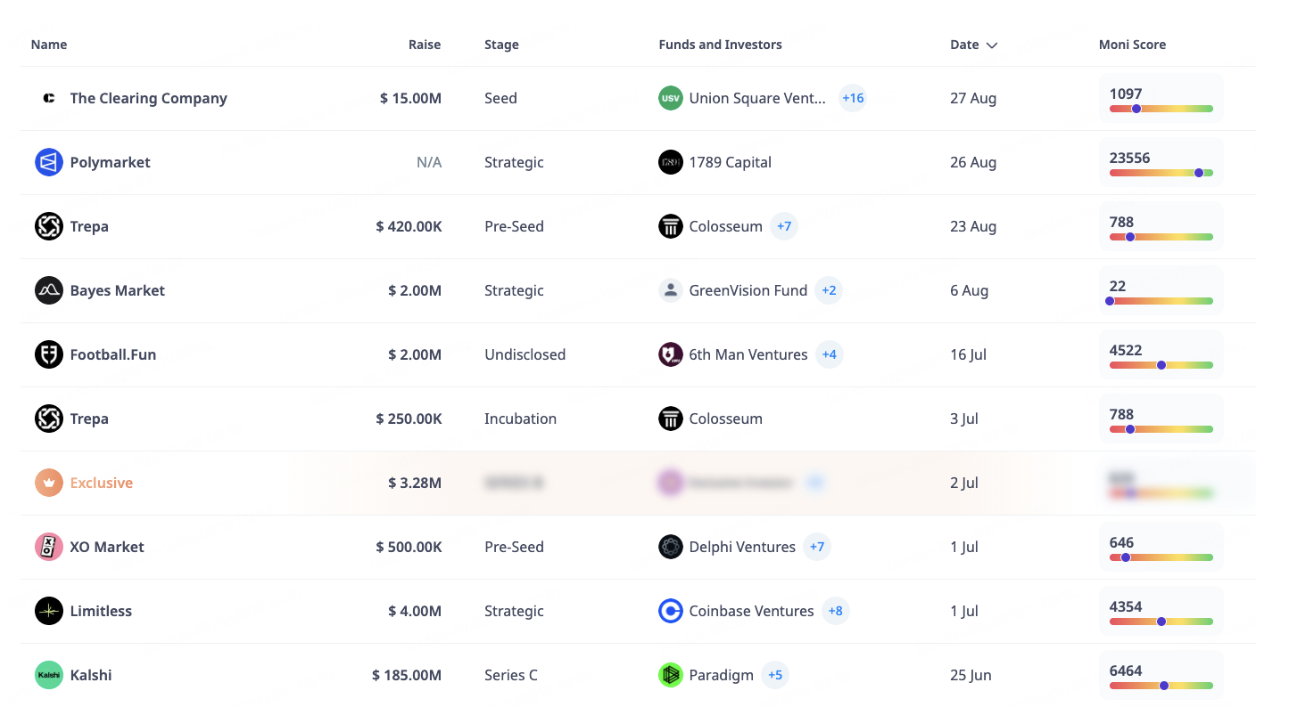

Since the 2024 U.S. election propelled Polymarket to fame, prediction markets have become a cutting-edge track of joint interest between Web3 and traditional financial institutions. During the election period, on-chain markets demonstrated faster and more accurate predictive capabilities than traditional polls, allowing the outside world to truly feel the power of "price as probability" for the first time. In 2025, this trend further evolved into a comprehensive upgrade at both the capital and product levels, with nearly ten related projects completing financing since June, backed by top institutions such as Coinbase, Paradigm, and Delphi. Behind the capital bets lies the unique structural advantages of blockchain prediction markets: an open access mechanism significantly lowers participation barriers, all transaction records are transparent and immutable, and users can place bets with real money without relying on intermediaries, making the final price a quantitative expression of collective wisdom.

At the same time, the development of prediction markets has also shown diverse paths. On the compliance front, Kalshi obtained compliance licenses for all 50 states in the U.S. under CFTC approval and regulation, while Polymarket acquired the Florida-based derivatives exchange QCX to gain a regulated entity for contract trading within the U.S. In terms of product innovation, projects like Myriad and Flipr have embedded prediction scenarios into social media, allowing users to place bets directly through platforms like X, thus socializing the betting process. Limitless leverages the high-performance CLOB model of the Base chain to reshape the liquidity experience, while Drift attempts to combine predictions with high-leverage derivatives to expand trading dimensions. Overall, compared to 2024, the prediction market track in 2025 has seen significant positive changes in compliance, model innovation, and use cases.

2. Mechanism Characteristics of Prediction Market Projects

The main mechanism characteristics of prediction market projects include trade matching, contract forms, liquidity, oracle, and other features. These mechanisms are key conditions for the long-term sustainable operation of prediction markets. They can be roughly divided into the following categories:

- Trade Matching Model

In prediction markets, the trade matching mechanism directly determines market activity and price performance. The two mainstream models include: order book model and automated market maker (AMM) model. The order book model is typified by Polymarket and Kalshi. This model relies on market makers or traders actively placing buy and sell orders, which can accelerate transaction speed and reduce slippage when market liquidity is sufficient. However, in times of weak liquidity, issues such as widening spreads and difficulty in execution may arise. The second model is the automated market maker model. The advantage of AMM lies in its ability to automatically adjust the prices of trading pairs through algorithms, allowing transactions to be completed without a counterparty, thus maintaining continuous trading capability. However, in extreme liquidity situations, slippage can significantly increase, and the mechanism's parameter settings can be sensitive, potentially leading to security risks.

- Contract Design and Problem Definition

In prediction markets, the clarity of contract design and the verifiability of determination methods are crucial. The mainstream contract types include:

Binary Contracts: The most common form, where the contract pays a fixed amount (e.g., $1) if the event occurs, and nothing if it does not. They have high liquidity and are easy to price, widely used in scenarios with clear outcomes such as elections and sports.

Categorical Contracts: Suitable for scenarios with multiple mutually exclusive outcomes, allowing traders to bet on specific outcomes, such as predicting "who will be the next CEO."

Scalar/Index Contracts: Used to predict numerical changes, such as a company's quarterly revenue, where the payment amount varies with the result value, and the price is multiplied by a factor to map the prediction target.

- Oracles

The credible determination of event outcomes is a core aspect affecting the credibility of prediction markets. Traditional platforms rely on operators or third-party arbitration, while crypto-native prediction markets introduce oracle mechanisms to ensure on-chain contracts can obtain reliable real-world data. For example, Polymarket uses the UMA Protocol to write real-world event results on-chain, enabling automatic settlement. A robust determination system can not only reduce disputes and manipulation risks but also build trust among users, thereby enhancing market activity.

- Other Key Elements

Beyond mechanisms, the user experience in prediction markets is influenced by various factors, including: choice of underlying chain and transaction gas costs, platform user interface design, and fee structures (market creation fees, transaction fees, etc.). These elements collectively form the platform's comprehensive competitiveness, playing a decisive role in user retention and market expansion.

3. Analysis of Popular Projects

Polymarket

In the 2024 U.S. election and several global focal events, Polymarket has demonstrated faster and more accurate predictive advantages compared to traditional polls, gradually becoming an important information source for media organizations and investors, establishing its leading position in the prediction market. The platform relies on the Polygon Layer 2 network, utilizing a low-fee and high-throughput trading environment to support market operations, primarily adopting a binary outcome market mechanism: users place bets on the future direction of political, economic, sports, and social hot events by buying "YES/NO" shares.

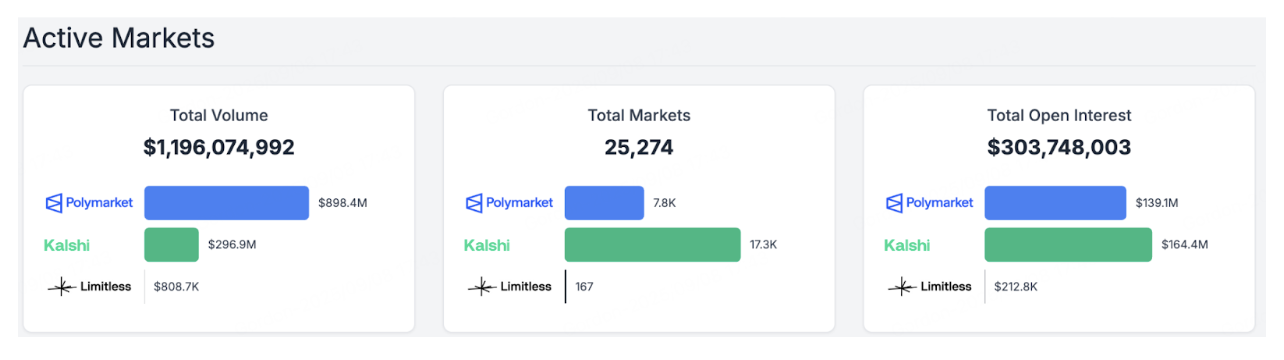

According to data from PolymarketAnalytics, Polymarket's cumulative trading volume has surpassed $898 million, maintaining its position as the global leader. However, in terms of user numbers and open contracts, Polymarket has been surpassed by Kalshi. The main reason for this situation lies in early compliance restrictions, which once prohibited U.S. users from directly using the platform. However, this disadvantage was reversed in 2025 — the U.S. Department of Justice officially ended its investigation in July, allowing it to smoothly return to the U.S. market. Polymarket acquired the CFTC-licensed derivatives exchange and clearinghouse QCEX for $112 million, further addressing compliance concerns. Meanwhile, in June, Polymarket announced a partnership with Musk's social platform X, combining its prediction market data with Grok launched by xAI to offer real-time prediction information services, further enhancing its influence in public opinion dissemination and market data application.

Currently, Polymarket's biggest competitor is Kalshi. The latter is gradually replacing Polymarket's leading position, leveraging its high compliance and endorsement from Donald Trump Jr. to achieve significant breakthroughs in user growth and activity. In contrast, Polymarket's core advantage lies in its on-chain operation, which naturally provides the potential expectation of token issuance, offering additional incentives for users and early participants. At the same time, Polymarket has also achieved key breakthroughs in compliance, eliminating the main obstacles that previously restricted its expansion in the U.S. market. With the dual support of blockchain and compliance pathways, Polymarket's future development still holds considerable potential.

Kalshi

Kalshi is the first prediction market platform to receive comprehensive regulation from the U.S. Commodity Futures Trading Commission (CFTC), holding compliance licenses covering all 50 states in the U.S. This legal status not only allows it to quickly accumulate trust among traditional investors and institutions but also opens up a broader user base. Unlike most on-chain prediction markets, Kalshi's model allows users to directly trade the outcomes of real-world events rather than indirectly betting on related asset prices. Its contract design primarily uses a "YES/NO" binary format, covering a wide range of topics, including macroeconomic data (such as inflation rates, unemployment rates), political elections, sports events, and even cryptocurrency price trends.

Kalshi's core competitive advantages mainly lie in compliance, capital support, and political resources. On the capital front, the platform has received support from top investment institutions such as Sequoia Capital, Paradigm, and Y Combinator, with cumulative financing exceeding $260 million, and its latest round of valuation has reached $2 billion, ranking among the top in similar projects. In terms of political resources, former CFTC chairman candidate Brian Quintenz has served on Kalshi's board, and Donald Trump Jr. has also participated as an advisor, providing additional support for the platform's public influence and compliance expansion. With compliance dividends and strong political capital, Kalshi has gradually established a competitive advantage over Polymarket.

Other Popular Projects

Limitless

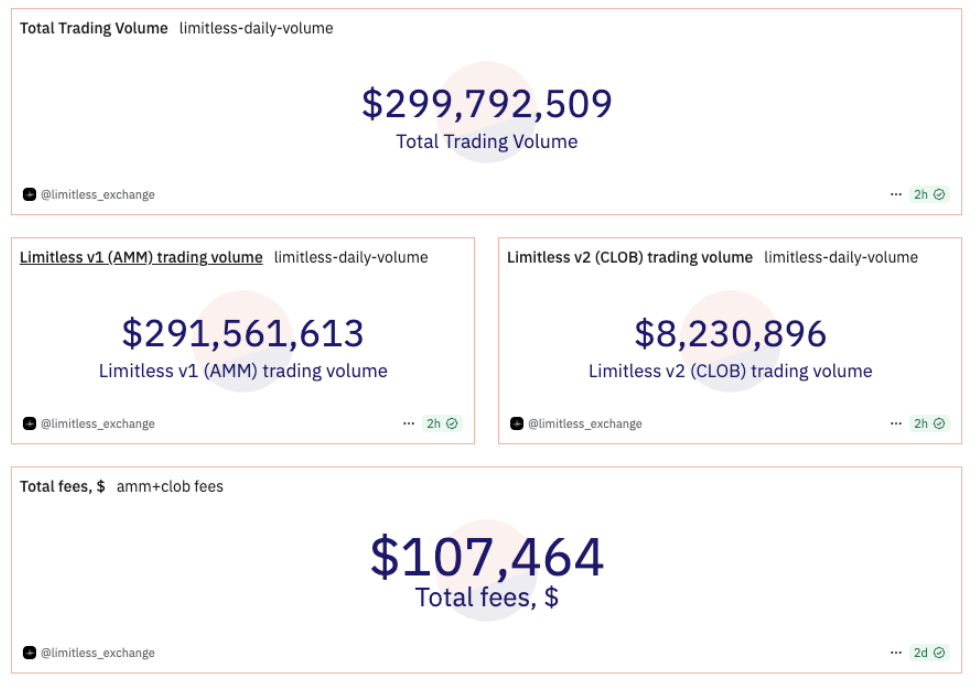

Limitless is an emerging prediction market platform based on the Base chain, utilizing a CLOB (Central Limit Order Book) system that supports limit orders, market orders, and multi-outcome contracts, allowing users to trade flexibly like on a centralized exchange while retaining on-chain transparency and verifiability. The platform achieves instant settlement through the Pyth Network oracle, covering various markets including Bitcoin, Ethereum, stocks, and macroeconomic indicators, with all transactions settled in USDC.

As of now, Limitless has a cumulative trading volume of approximately $299 million, with V1 contributing about $291 million and V2 around $8.23 million, totaling approximately $107,000 in fees. In July 2025, Limitless completed a $4 million strategic financing round, with participation from institutions such as Coinbase Ventures and 1confirmation, making it the largest prediction market on the Base chain.

Myriad Market

Myriad Markets is a decentralized prediction market protocol launched by media company DASTAN Inc., aiming to deeply integrate on-chain prediction trading with digital content. The platform embeds the prediction entry directly into news, social media, and video content through a Chrome extension, achieving "content as market," allowing users to place bets while reading or watching. Myriad uses an AMM combined curve model to support market liquidity, accommodating binary, categorical, and scalar contracts, and settles through on-chain oracles.

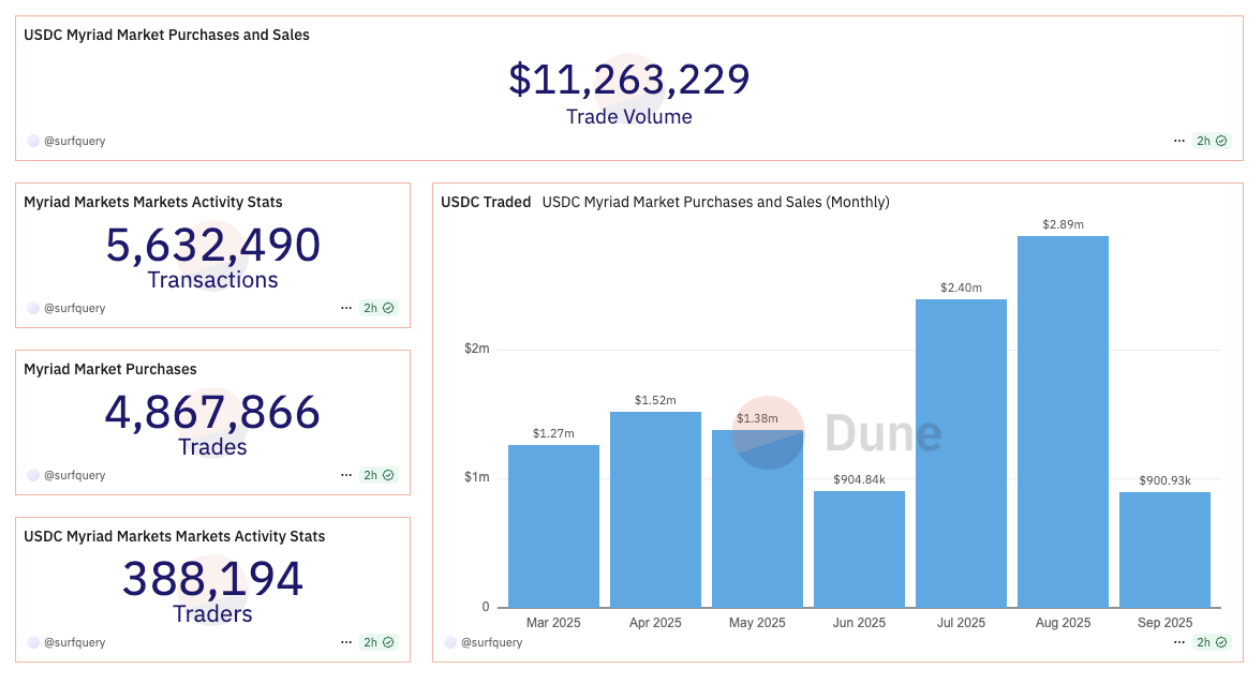

As of now, the platform has processed a total of 5.63 million transactions, with approximately 388,000 active wallets holding around 11.26 million USD. Myriad's core competitiveness lies in its native content embedding and on-chain transparent settlement, providing a new monetization model for the media ecosystem while attracting highly engaged users to participate in predictions across various themes such as politics, sports, cryptocurrency, and macroeconomics.

flipr

Flipr is a front-end trading tool that deeply integrates prediction markets into the social platform X, with the core entry being the trading bot Fliprbot. Users do not need to navigate to a separate website; they can simply tag @fliprbot in a tweet or send a direct message with natural language commands to place bets on events such as cryptocurrency prices, sports events, and macroeconomic indicators. The platform integrates leveraged trading, take-profit and stop-loss features, and volatility protection, while also supporting group chats and community embedding to make prediction activities a natural part of social interaction.

Currently, the price of $FLIPR is approximately $0.017, with a total market capitalization of about $17.21 million. Flipr's differentiated advantage lies in the fact that it does not directly compete with Polymarket or Kalshi in terms of liquidity or compliance; instead, it acts as a social front-end layered on top of existing markets, transforming prediction markets from professional tools into visible and interactive social content, thereby significantly lowering the participation threshold for new users and enhancing market dissemination.

4. Future Development

The future development direction of prediction markets is likely to present a "dual-track" pattern: on one hand, projects will continue to lower participation barriers and expand user bases through social platforms, such as Flipr embedding trading into conversational scenarios; on the other hand, the processes of compliance and specialization are also accelerating, with platforms like Kalshi attracting traditional capital into the market through regulatory licenses. This "dual-track model" means that prediction markets may enter daily life as tools for public entertainment and sentiment analysis, while also serving as financial infrastructure for professional institutions to conduct risk management and market pricing.

However, from the current situation, prediction markets still face three major pain points: first, insufficient liquidity limits market depth, and excessive spreads can affect user trading experiences; second, compliance issues arise because prediction markets inherently combine characteristics of both gambling and financial derivatives, often facing gray areas or direct regulatory restrictions in different jurisdictions. How to build an operational framework compatible with existing legal systems while maintaining decentralization and resistance to censorship is a key challenge for this track to attract institutional capital and mainstream users; third, there is a problem of capital efficiency, as the lack of competitive yield scenarios with real financial instruments makes it difficult to attract long-term capital accumulation. If these core challenges cannot be overcome, the growth of prediction markets will rely more on speculative drives and short-term trends; however, once capital efficiency and institutional frameworks improve, prediction markets are expected to scale up and become a key infrastructure connecting information aggregation, risk management, and financial innovation.

Risk Warning:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial management) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily represent future results. The value of digital currencies may rise or fall, and buying, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully assess whether participating in such investments is suitable for you based on your investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。