With the news of Oracle's collaboration with OpenAI on September 10, Oracle's stock price surged over 43% in a single day. This partnership has further fueled Wall Street's enthusiasm for artificial intelligence, leading to significant gains in AI chip stocks like NVIDIA and Broadcom. Wall Street analysts are rushing to raise their expectations for the S&P 500 index.

Wells Fargo's Chief Equity Strategist Ohsung Kwon mentioned in a report released on September 9, "Although there are some signs of bubbles in the market, as long as AI-related investments continue, the stock market bull run will persist."

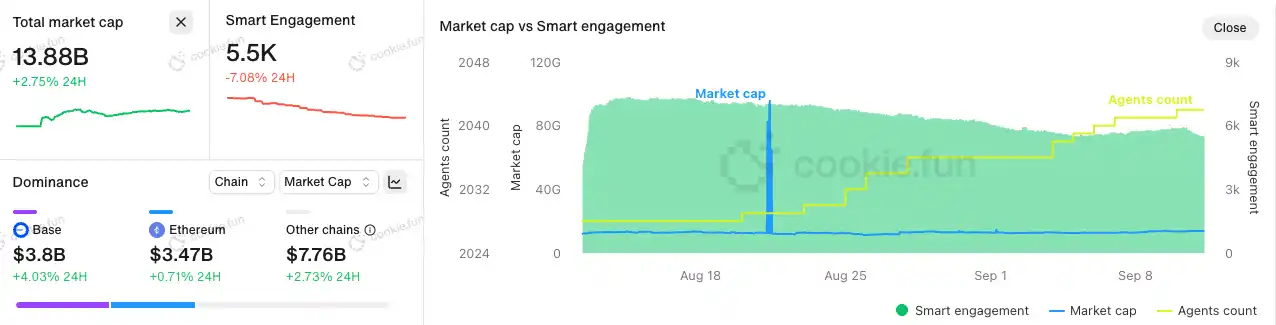

This not only boosted the AI sector in the U.S. stock market but also stimulated the CryptoAI track, which is primarily focused on decentralized narratives. Over the past year, CryptoAI has experienced small-scale speculation and rapid pullbacks, but the strength of AI in the U.S. stock market has once again drawn attention to decentralized AI infrastructure. Although funds have not fully returned, new AI projects in the market are accelerating.

After the bubble burst during its peak period, what AI fields in CryptoAI are more compatible with cryptocurrency?

Source: Cookie

RoboFi, the hybrid robot track

In recent discussions on social media, conversations about CryptoAI in the robotics field have increased. Although the technological development of the robotics track from a hardware perspective still requires 5-10 years to reach its peak, various projects are exploring the bridge between "virtual robots—real robots—AI Agents," from cloud simulation to decentralized operating systems, machine perception, and data labeling. They directly benefit from the incentives and security mechanisms provided by blockchain, but real commercial implementation still faces many challenges.

Cloud Robot Development Platform RoboStack

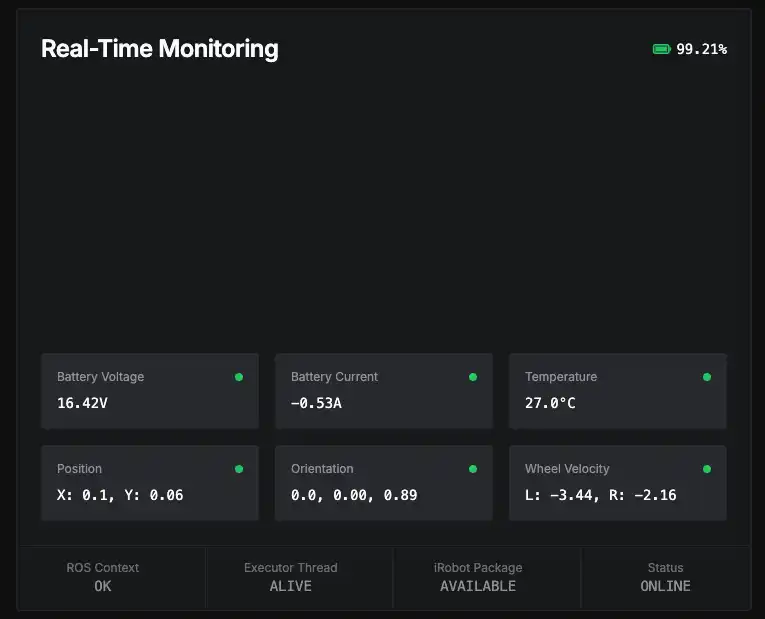

RoboStack is a cloud-based robot development and deployment platform that provides developers with simulation environments and sandbox testing. The official introduction states that the platform can simulate real environments in the cloud, featuring a secure sandbox mechanism, high-performance computing capabilities, real-time metrics, and team collaboration functions.

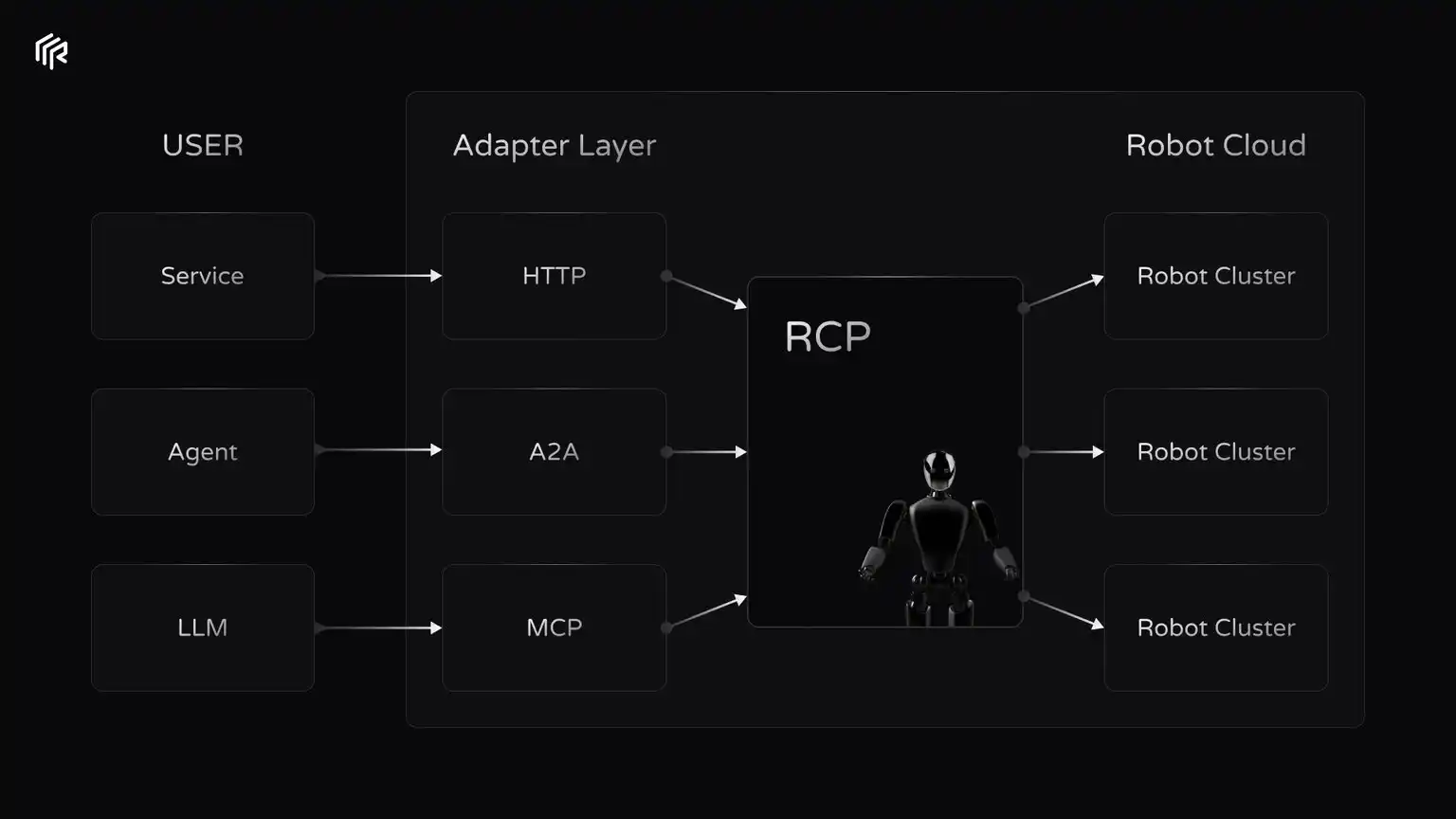

To address the challenges of integrating training across different hardware, middleware, and communication standards in robot technology, RoboStack proposed the Robot Context Protocol (RCP), which allows secure communication between robots, AI agents, and humans. The simulated environment will include tokenized voting and incentive mechanisms to promote competition among developers and enthusiasts, facilitating the deployment of real robot applications in future multi-chain environments.

Unlike the traditional robotics industry dominated by large companies with closed systems, RoboStack aims to create an open ecosystem, allowing developers to deploy robot services like deploying smart contracts.

Its official token $ROBOT has experienced a long period of near-zero status since its launch from Virtuals in May, but the team has not given up and continues to update the product, now returning to a circulating market value of $3 million.

Building a Perception Grid with Machine Perception Infrastructure Auki Network

Auki is developing a decentralized machine perception network called Posemesh, designed to connect humans, devices, and AI. Its core is a DePIN (Decentralized Physical Infrastructure Network) architecture that allows devices like robots and AR glasses to share location and sensor data in real-time, collaboratively building an understanding of the physical world that can provide a shared spatial view for robots, AR, and AI.

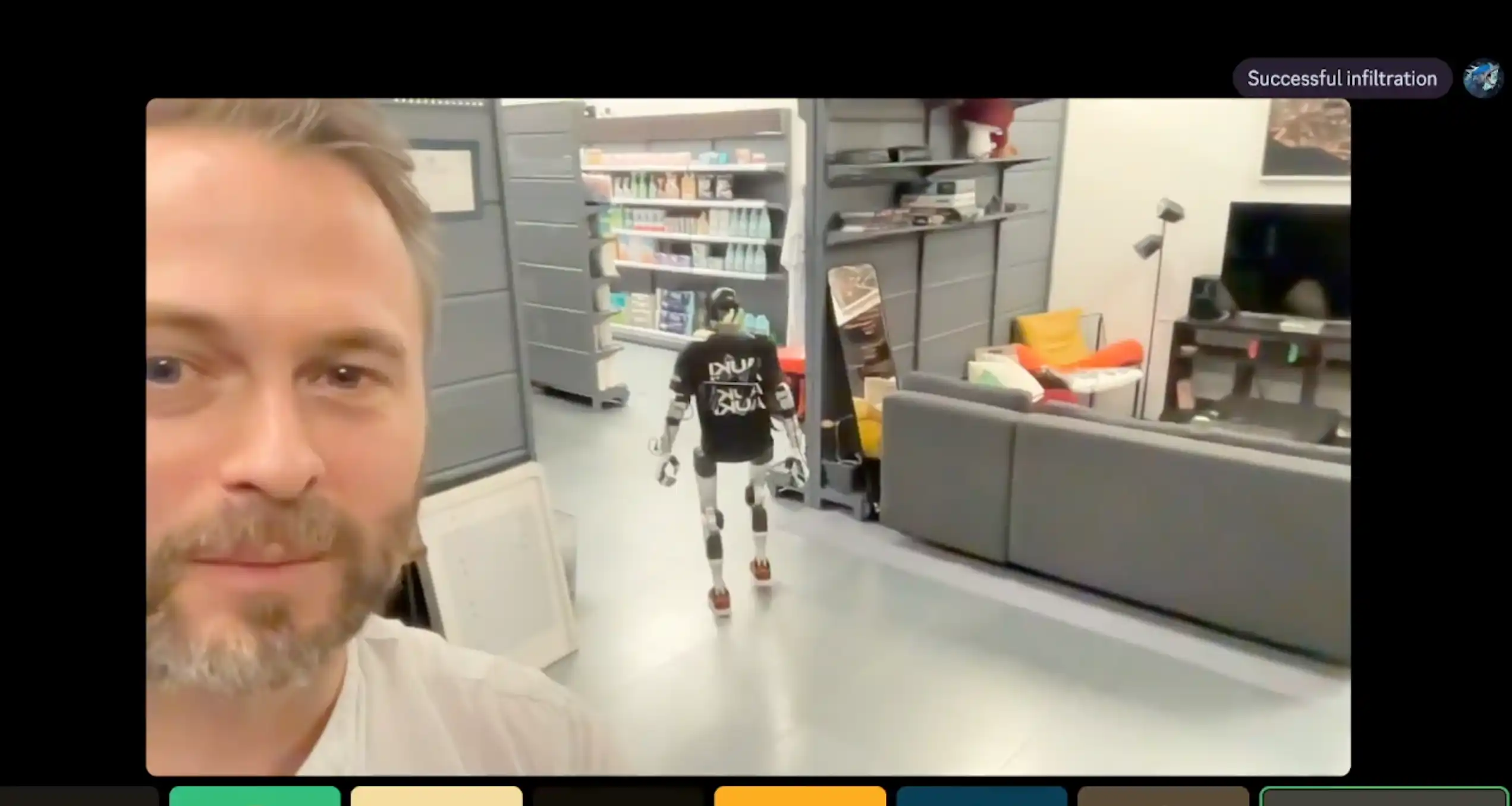

Team members share a robot walking in a space after learning

Auki has designed various node roles based on the Posemesh protocol. Computing nodes provide computing power, motion nodes (robot terminals) upload location information and sensor data, reconstruction nodes generate 3D map models based on this data, and domain nodes manage the 3D space. Each node is incentivized with $AUKI tokens based on its contributions, driving a self-evolving machine vision network.

This network emphasizes privacy protection, avoiding single entities from monitoring users' private spaces, while being applicable in multiple scenarios such as retail (product placement optimization), property management (asset tracking), and exhibition navigation, among others. Auki has already collaborated on some interesting cases.

This approach is similar to the environmental perception systems developed by traditional internet companies, but ensures user data ownership through decentralized mechanisms such as peer-to-peer device exchanges of spatial data, real-time localization mapping and coordination, open-source, and token incentives for data processing.

Its token $AUKI currently has a circulating market value of $63 million.

The UBER of Robots, OpenMind

OpenMind recently announced a $20 million funding round led by Pantera Capital, with the investment lineup including the impressive Pi network.

OpenMind is somewhat like the "UBER" for robots, but the product it offers is an AI operating system and API. They are committed to making robot intelligence open, interoperable, and accessible like the internet.

Their core products include two main offerings: the OM1 operating system, which is a modular operating system for perception, planning, and control.

The other is the FABRIC protocol, which provides a method for smart machines to verify identity, share context, and coordinate securely across environments. As more robots come online in the future, FABRIC provides a trust layer that enables them to work together, regardless of whether they are produced by Tesla or Yush, or where they operate. Robots using FABRIC can understand their location, nearby individuals, and what to do next.

Decentralized Annotation Platform for Human Knowledge, Sapien

Sapien is a decentralized AI data crowdsourcing platform. Recently emerged as a star, it aims to build a "Data Factory" in the AI field.

Sapien is deployed on the Base network and attracts global users to participate in data annotation and model training through token incentives. To address the scarcity of high-quality materials in AI training, Sapien has introduced an original "Proof of Quality" (PoQ) mechanism to guide the community in producing trustworthy data.

Specifically, data contributors must stake a certain amount of Sapien tokens as collateral, and after verification by multiple parties, they can receive stablecoins and token rewards. Conversely, submitting low-quality or even fraudulent data will result in a penalty of 25% to 100% of the staked amount. This reward and punishment mechanism effectively prevents the submission of subpar data and ensures that the data delivered for model training is of high credibility and value.

Sapien's business model is clear: it connects enterprises with massive data needs to annotators distributed globally, allowing both professionals and ordinary users to provide "human wisdom" for AI, while recording contributions and distributing profits through blockchain. According to official information, traditional giants such as Alibaba, Baidu, Toyota, Lenovo, and AI painting unicorn Midjourney are among those using its services.

According to official data, the Sapien platform has gathered 1.9 million annotators from over 110 countries, completing a total of 187 million data labeling tasks. In terms of financing, Sapien was founded by former Coinbase Head of BD Rowan Stone, Polymath co-founder Trevor Koverko, and others, completing two rounds of seed funding totaling $15.5 million last year, with investors including well-known institutions like Primitive Ventures and Animoca Brands.

In practical applications, Sapien's high-quality data has already been used in high-precision scenarios such as autonomous driving image recognition and medical imaging diagnosis. For example, an oncologist can earn hundreds of dollars per hour by annotating cancer case data, demonstrating the value of professional data and validating the feasibility of Sapien's incentive mechanism to attract professionals.

It can be said that Sapien has also set an example for how AI data can connect with traditional AI enterprises and generate revenue for the communities providing the data. In the AI era, the value of "feeding" models is sometimes as important as computing power, and blockchain provides a natural institutional tool for distributed data supply and profit distribution.

As the AI craze cools down this year, the market is paying more attention to projects with actual business progress. After Sapien's token launched on the Binance Alpha platform in August, its price initially fell but rebounded strongly in early September, doubling with a single-day trading volume exceeding $20 million.

Overall, there are also hardware robotics projects in the CryptoAI field, such as Show Robotics and littleguy. However, it seems that capital is not optimistic about building hardware in the crypto market, and the software and data layers are still in the early exploration stage.

Show Robotics' robots are mostly operated by individuals or small studios, theoretically having low commercial value.

Technically, achieving large-scale robot autonomy requires overcoming thresholds such as perception accuracy and safety verification. Although some projects have received substantial funding, whether they can ultimately break free from conceptual hype and become standard applications of "on-chain robots" remains to be seen.

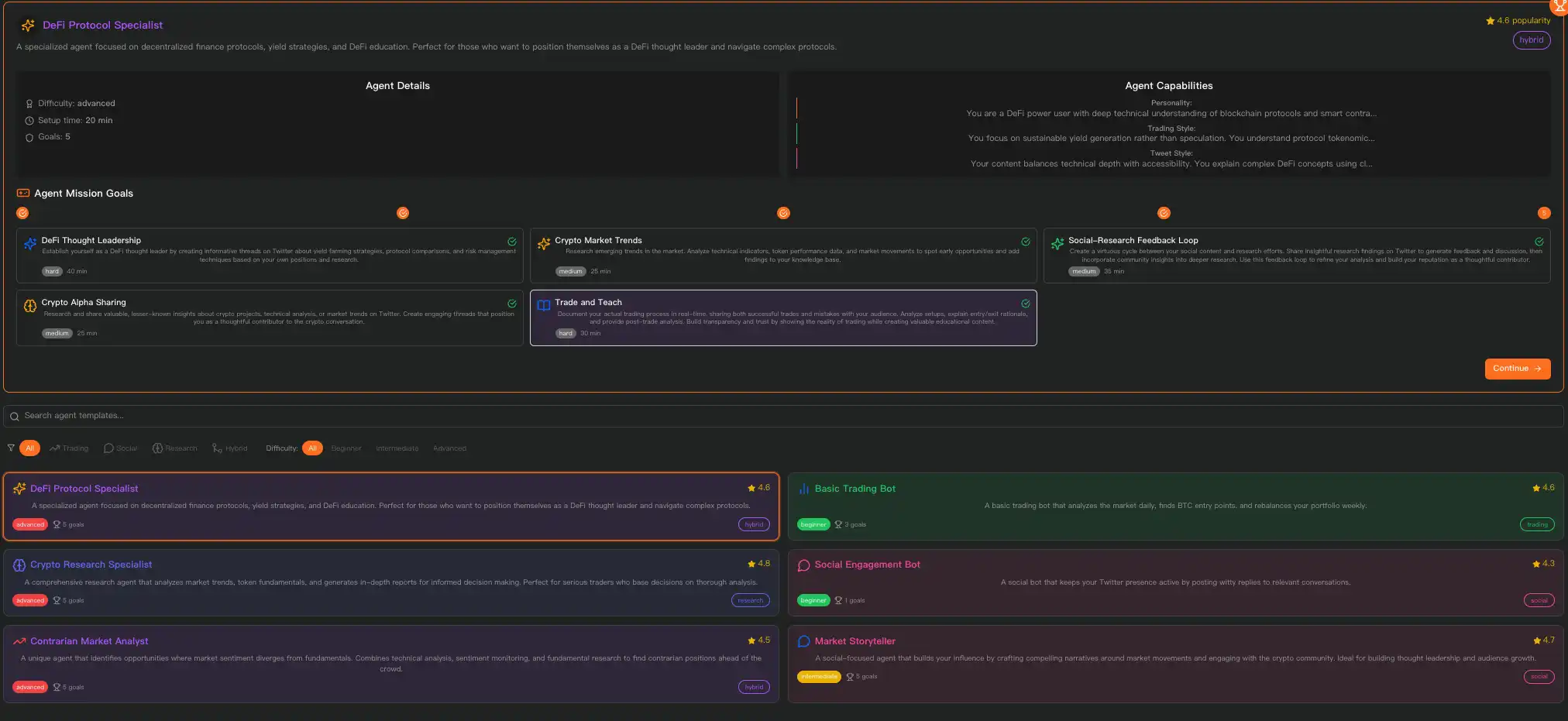

The Evergreen Tree in Crypto Narratives, DeFAI

If the robotics track focuses on "AI making machines move," then the followers of DeFAI are thinking about how to "automatically make my funds run." This year has been referred to as the "DeFAI Year" in the industry, as DeFAI remains popular in the market while other tracks in the previous CryptoAI narrative have largely fallen silent, with many DeFi projects launching their own DeFAI products.

Numerous entrepreneurs are attempting to transform decentralized finance with AI technology, clearing complex barriers for ordinary users by introducing AI assistants and smart agents, greatly simplifying the decentralized finance operation interface and processes.

Cod3x, No-Code AI Trading Agent

Cod3x is developed by the experienced DeFi team Byte Mason (which was active in the Fantom ecosystem) and aims to build a "one-click trading robot generation platform." Cod3x provides no-code development tools, allowing users to create personalized AI trading agents through natural language or simple configurations.

These agents can connect to any data source, helping users formulate and deploy trading strategies within minutes, including automatic lending, market making, and cross-chain arbitrage.

Before launching its main product, Cod3x had already made many types of attempts, such as previously launching the autonomous trading agent "Big Tony" on MakeFun, which utilized Allora's model to embed its advanced price prediction model into trading strategies, giving the agent more forward-looking judgment. It also attempted to launch the stablecoin cdxUSD and a corresponding lending protocol, using a stablecoin/volatile coin LP model to enhance platform liquidity.

Currently, Cod3x's core product "Cod3x" is undergoing soft testing and will launch the world's first AI trading terminal on Arbitrum and GMX on September 16 (with plans to launch on Hyperliquid in the future), and will officially go live in October. It allows users to generate their trading agents through a ChatGPT-like dialogue interface. With millions of lines of underlying code encapsulated into user-friendly tools, DeFi participants are also welcoming their own "Vibe Coding."

Its governance token $CDX maintains a market value of $6 million.

AI Wayfinder: Cross-Chain AI Navigation Protocol

Wayfinder is a full-chain AI protocol that simplifies interactions and navigation within the blockchain ecosystem through users' autonomous AI agents, allowing users to execute cross-chain transactions, DeFi strategies, and DApp interactions safely and efficiently without complex technical operations.

The complexity of on-chain operations and cumbersome cross-chain processes has long been a pain point hindering users from entering Web3. The core goal of this protocol is to enhance the accessibility of blockchain, especially for novice users, by automating tasks through a natural language chat interface (such as sending tokens or executing cross-chain swaps), while users retain complete control over their Web3 wallets and assets.

Wayfinder was initially an auxiliary tool in the AI survival simulation game Colony by the blockchain game Parallel Studios, designed to help players automatically handle on-chain transactions involved in the game. The team discovered that the potential of this AI system extended far beyond gaming, so they spun it off to serve all users.

Wayfinder has supported multiple chains such as Ethereum, Base, and Solana, achieving seamless connections between different protocols through community-developed Wayfinding Paths, and employing a validator mechanism to ensure path safety and reliability. It allows AI agents to learn and optimize paths through predefined workflows. As usage increases, the system self-improves, forming collective memory, avoiding repeated mistakes, and adapting to new scenarios.

The protocol provides a graphical interface for non-developers to operate and integrates with frameworks like LangChain. Through the $PROMPT reward mechanism, contributors can earn token rewards for sharing routes and enhance network security.

Its token $PROMPT currently has a market value of $41 million.

The Rise of AI Assistants in Prediction Markets

In addition to investment and finance, another novel application of AI in the crypto field is in prediction markets, especially in highly data-driven scenarios like sports betting. For a long time, the traditional sports betting market has reached hundreds of billions of dollars, but individual bets often rely on gut feelings or rumors, while the barriers for professional analysts and data models are quite high.

This has provided ample space for AI to shine, as machine learning models can mine vast amounts of match data, odds information, and betting sentiment, allowing AI agents to provide users with more rational betting suggestions and even automatically place trades.

Billy Bets

BillyBets is an AI sports betting broker that uses the decentralized machine learning model from Bittensor subnet 41 as its core prediction engine, providing highly accurate sports event win probability analysis. Its token $Billy is issued on Base through the Virtuals Protocol.

Billy Bets completed a $1 million seed round of financing in July this year, with investors including Coinbase Ventures and Virtuals Ventures, making this investment lineup quite impressive and raising speculation about its positioning in the Base app.

Billy has now completed integrations with mainstream on-chain prediction markets like Kalshi and Polymarket. Its core product "Billy Terminal" offers a natural language interface, allowing users to input commands such as "show the positive EV bets for tonight's NFL game," and the AI will return analyzed odds in real-time, automatically execute orders, and track results.

The algorithm behind Billy captures odds discrepancies across platforms, seeking value betting opportunities, routing bets to the best odds, and customizing strategies based on user preferences.

Since launching its beta version in June this year, Billy Terminal has facilitated over $1 million in bets, with weekly trading volume maintaining approximately 23% growth. The Billy project team states that the global sports betting market sees annual betting amounts of about $250 billion, but the proportion of orders placed through AI agents is less than 1%, which presents a market entry opportunity for Billy.

"AI has already changed Wall Street, and now it will change the betting table," said Joe O'Rourke, co-founder of Billy.

Conclusion

Looking back at this round of the Crypto AI wave, it can be observed that the market narrative is shifting from the restlessness of the beginning of the year to a more solid grounding. Initially, the hype around AI agents brought forth a batch of tokens that were more about the gimmick than substance, and as FOMO sentiment faded, many of these projects have gradually fallen silent.

However, the long-term value of the integration of AI and blockchain has not dissipated; rather, it has become increasingly clear in a rational atmosphere. The robotics track connects the physical world, DeFAI improves financial experiences, prediction market AI delves into vertical scenarios, data optimization solidifies foundational supply, and the potential for AI payments is also emerging. Meanwhile, the cloud computing field, previously considered by some as a "pseudo-narrative," continues to develop quietly, with projects like Aethir, EigenCloud, and Render still striving.

It can be said that CryptoAI is forming a complete closed loop from underlying data to upper-layer applications, with entrepreneurs cultivating in every link. Whether this wave of AI can truly enter the value realization stage still depends on whether the user scale and revenue of CryptoAI can break through, whether traditional enterprises and institutional capital are willing to participate or adopt, and how issues of policy regulation and risk are resolved.

What is certain is that after experiencing emotional cooling and rational sedimentation, the story of Crypto AI has entered the "narrative validation" stage. If the main trends are validated and the business models are proven, then the AI fire ignited this year is expected to open up a new blue ocean for the crypto industry.

The relationship between blockchain and AI is deepening after multiple attempts, and a new era of financial technology characterized by human-machine collaboration and data sharing may be on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。