Written by: BitpushNews

Following the successful launch of a Bitcoin spot ETF, global asset management giant BlackRock is once again turning its attention to blockchain.

According to Bloomberg, BlackRock is exploring the possibility of bringing funds linked to real-world assets (RWA), including traditional ETFs, onto the blockchain. This news has quickly sparked market discussions and brought "asset tokenization" back into the spotlight.

This is not an isolated event. Fidelity's tokenized money market fund (FDIT, corresponding to FYOXX) has gone live on Ethereum this week, having previously launched in "stealth mode" and held by institutions like Ondo, with an on-chain scale reaching hundreds of millions of dollars; Nasdaq has applied to the SEC, hoping to allow tokenized securities to trade alongside traditional stocks on the exchange. It is evident that Wall Street is initiating an "on-chain" experiment.

BlackRock's Crypto Landscape: From ETFs to On-Chain Funds

As the world's largest asset management company, BlackRock has established a comprehensive presence in the crypto space:

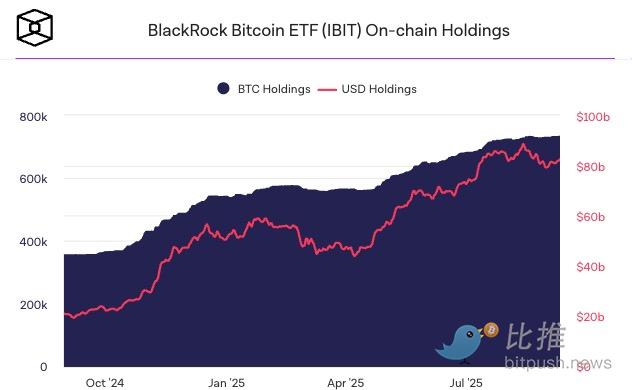

Two flagship products: The iShares Bitcoin Trust and iShares Ethereum Trust have seen cumulative inflows of $55 billion and $12.7 billion, respectively, both surpassing $10 billion in assets under management within a year. Such speed is extremely rare in the history of global ETF development.

Thematic funds: The iShares Blockchain and Tech ETF tracks a basket of stocks from blockchain and crypto-related technology companies, providing indirect exposure to the industry.

On-chain attempts: The BUIDL Fund (BlackRock USD Institutional Digital Liquidity Fund), launched in 2023, has become the first tokenized fund to exceed $1 billion in scale and is expected to surpass $2 billion in assets by 2025, currently operating on the Ethereum blockchain.

Its CEO Larry Fink has repeatedly stated, "All financial assets will eventually be tokenized." In his vision, blockchain will become the underlying operating system of future financial markets.

However, BlackRock's tokenization efforts are still in the exploratory stage. Whether pushing BUIDL to a larger scale or further bringing traditional ETFs onto the blockchain, there is an essential prerequisite—regulatory approval. Currently, the U.S. Securities and Exchange Commission (SEC) has not provided a clear framework, and there are some differences in opinions among market participants regarding the significance and prospects of tokenization.

Skeptics: Traditional ETFs Are Enough

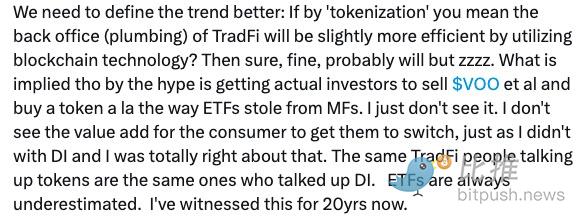

Some viewpoints argue that tokenization does not bring additional value to end investors. Bloomberg ETF analyst Eric Balchunas points out that ETFs themselves are already low-cost, highly liquid, and have low barriers to entry, leaving little reason for replacement.

Moreover, the current state of the tokenized stock market is quite niche. According to RWA.xyz data, the total scale of tokenized U.S. stocks on-chain (such as TSLA, AAPL) is less than $500 million, far from the trillions in the ETF market. Even though Robinhood and Kraken have launched tokenized stock trading, such products remain limited to the crypto-native population.

This perspective suggests that while tokenization may improve backend efficiency, it has little impact on the investor experience and is unlikely to disrupt the market as ETFs did when they replaced mutual funds.

Institutional View: A "Transitional Solution"

ETF research expert Dave Nadig emphasizes that current ETFs and tokenized stocks are more like "packaging layers," a "transitional solution" based on the existing system.

In simple terms:

It is not a true revolution: The current approach (such as turning stocks into tokens) does not fundamentally change the traditional financial system. It merely adds a layer on top of the existing system, giving stocks a new packaging—tokens—while the core of this package—the stocks themselves—still operates under traditional financial rules.

True tokenization requires legal reform: In Dave Nadig's view, this refers to assets being fundamentally created, traded, and settled on the blockchain, no longer relying on traditional brokers and clearinghouses. However, such a true transformation cannot be achieved without a complete rewrite of laws and comprehensive regulatory cooperation.

In summary, the "tokenized stocks" that are currently being discussed are merely a "superficial" improvement on the old system, while a true financial revolution requires a thorough overhaul from a legal and regulatory perspective. Current securities laws and clearing rules do not allow for a complete on-chain replacement; the SEC has yet to clarify the compliance framework for tokenized securities; and traditional finance relies on clearinghouses and custodians, which are difficult to replace quickly.

This means that unless there is a large-scale legal rewrite, tokenization will remain superficial and unable to achieve financial reconstruction.

Pragmatic View: Expanding the Boundaries of ETFs

The pragmatic voices focus on "incremental users" and "new play." Ondo Finance CEO Iandebode emphasizes that the value of tokenization lies not in replacing ETFs but in expanding their use cases and user base.

Accessibility: Hundreds of millions of people worldwide are unable to directly purchase index funds like VOO due to geographical, capital account restrictions, or investment thresholds. Tokenization can allow them to access these assets on-chain.

Usability: Tokenized ETFs are not just for "buy and hold"; they can also directly participate as on-chain assets in DeFi: collateral lending, joining liquidity pools, deploying automated strategies, etc.

This design is similar to the on-chain money market fund launched by Fidelity or the tokenized stocks offered by Kraken: they do not disrupt the original products but provide assets with more liquidity and composability, thus tokenization will become a "secondary growth curve" for ETFs, not a replacement, but an expansion.

Amid various disagreements, BlackRock's layout is particularly crucial. It represents the exploration of the world's largest asset management company and may become a model for the integration of Wall Street and the crypto world.

In the short term, tokenization is unlikely to compare with the trillion-dollar ETF market. However, in the long term, as more institutions enter the space and regulatory frameworks gradually clarify, this experiment may indeed move from the margins to the core, potentially changing the underlying logic of financial markets. Is BlackRock's move a "new bottle for old wine," or the prologue to a "great financial migration"? The answer may gradually be revealed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。