Tossing, tossing, and tossing again! Anticipating economic downturns, Bitcoin's fluctuations and contract review

Although I summarized my arrogance and greed last time, I still fell into the trap of greed this time. I could have made at least three swings, but I made a mistake once. Fortunately, I wasn't arrogant this time, so I ended up with a 55% increase. Additionally, I always start with 0.5 BTC, as my familiar friends would know, and then gradually increase my position.

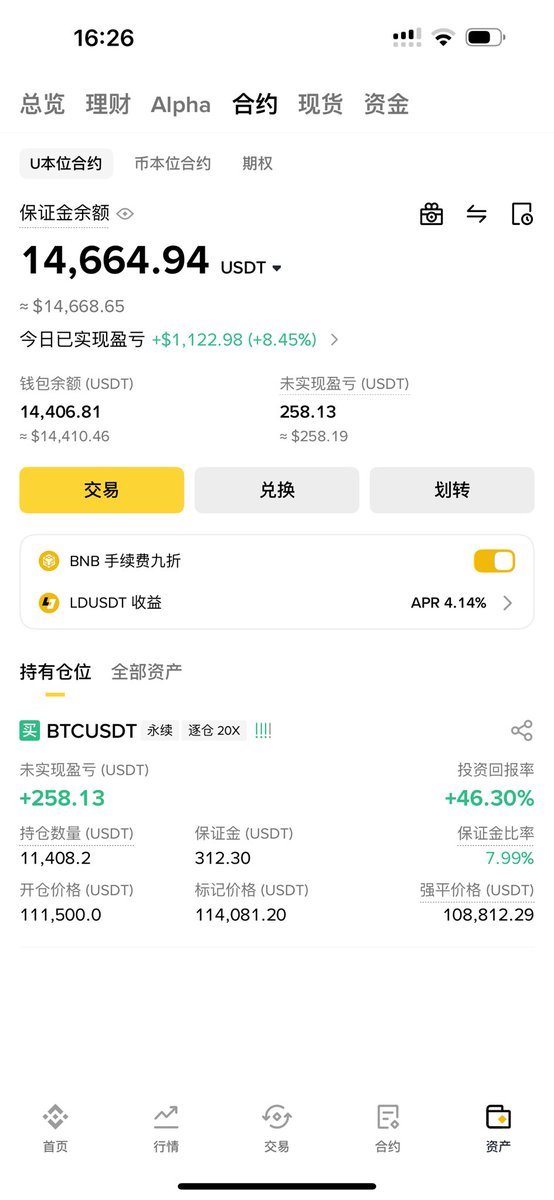

After the last review, I mentioned that at $111,500, on August 24, I didn't expect to hold for 20 days, which was driving me crazy. There were two instances when it reached around $113,300, giving me ample time to exit, but I felt the profit was too low, only about 35%, so I didn't exit. However, both times it dropped afterward. Looking back, if I had exited, I could have re-entered at $110,500.

Even though I missed those two opportunities, I still believe the current game is a battle between the Federal Reserve and Trump over interest rates. It's still early to say the U.S. economy is in recession. If there is a rate cut in September, it would still help the market. Next, every time the non-farm payroll data comes out, although the price of $BTC fluctuates, the U.S. economy remains relatively strong, allowing the price to fluctuate upward.

After the PPI data yesterday, the market's rebound sentiment was quite good, but today's CPI expectations are not favorable. Although I think it might affect sentiment, it won't impact the rate cut in September. Since I missed two swing opportunities, I don't plan to waste time this time. I originally intended to exit part of my position before today's CPI data.

I personally have a safety line of not gambling before major events, especially when expectations are not good, unless I'm truly stuck and too lazy to exit. Otherwise, I try to avoid gambling as much as possible.

This morning, I saw Bitcoin's price pushing towards $114,500, so I placed an order at $114,500. Before going to the doctor in the afternoon, I felt it hadn't pushed up, thinking investors might be worried about tonight's CPI data, so I placed an order at $114,333 and closed 80% of my position. Closing 80% is also my personal habit; those who often follow my reviews should know I like to leave a way out. If things go against my judgment, I can still take a bite.

This 20% is mainly to wait for the interest rate meeting on the 18th. Even if it blows up, I won't lose, and of course, I won't let it blow up easily. If there is a drop, I estimate I will continue to add positions around $111,500. I'm waiting for the dot plot and betting on Trump.

So after I got home last night and saw my order was filled, I reduced my margin and continued to hold 20% of my position. Within half an hour after the CPI data was released, the market was still okay, fluctuating around $114,000, so I didn't continue to reduce my position. However, while I was typing, it had already dropped to around $113,500. If it falls below $113,000, I will close my position and wait to add. But I personally think the situation isn't too bad; there's a high probability I can hold until the interest rate meeting.

At the same time, I also placed a backup order at $106,500, just in case, but it hasn't been used.

Overall, after the last time of holding positions and reviewing, my mindset has improved a lot. I can finally try to quit the problem of "arrogance" and have a better understanding of holding positions. I won't easily add to my position and always prioritize not getting liquidated and risk control. Although it may be a bit slow, the nature of contracts is inherently risky. If I can't control myself, I might lose opportunities.

As of now, my actual revenue has exceeded $14,000, of which $2,000 of the principal was already transferred last time. The current position is all profit, and compared to the initial position, it has increased sevenfold, but it has taken half a year, starting from March when I officially began recording trades until now. It is indeed quite slow, but I actually enjoy this process.

Although slow, this is my understanding of the market. I often talk with Kitty @CatoCryptoM and Da Le @DLW59, saying that the essence of analysis exists for trading. If it can't be applied to trading, then the analysis loses its meaning. Although I'm not a full-time trader and have no trading talent, being a low-risk enthusiast, I'm willing to use this method to validate my judgment. If I'm right, I can boast; if I'm wrong, I stand straight and take the hit, providing a negative teaching material for my friends, which is quite good.

Finally, I need to emphasize again that contracts are very dangerous, especially high-leverage contracts which carry even higher risks. I also place orders with small positions and am always prepared for total liquidation. My main position is still in spot trading; contracts are just a test of my judgment. I can afford to lose, but I do not encourage high-leverage contracts, as a slight misstep could lead to total loss.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。