The essence of investment lies in entering at points of divergence and exiting at points of consensus.

Last month, when I wrote about $GIZA, I secretly built up a position. The point of divergence I saw: the market generally perceives @gizatechxyz as a "stablecoin yield aggregator," but in reality, what Giza is doing goes far beyond this vision.

So what exactly is Giza building?

It can be understood through a three-layer framework:

Bottom Layer: Giza Protocol — The cornerstone of DeFAi

As the foundational layer of DeFAi, the Giza Protocol consists of the following three core modules:

- Semantic Abstraction Layer

- Proxy Authorization Layer

- Decentralized Execution Layer

Middleware: Swarm Finance — Protocol Incentive Layer

Upper Layer Applications: AI Agent Ecosystem

Various AI agents built on the Giza Protocol.

Application Layer Strategy: Leading Construction, Incentivizing Attraction

At the application layer, Giza has adopted a strategy of "leading construction and incentivizing attraction," officially launching two AI agents:

- ARMA: A long-running stablecoin yield aggregator with a trading volume exceeding $15 billion.

- Pulse: Launched in collaboration with Pendle, aimed at revolutionizing the current fixed income market.

Pulse: An autonomous agent specifically designed for Pendle

In short, Pulse is the first autonomous agent designed specifically for the Pendle ecosystem, offering an annualized yield of 13% in ETH.

How Pulse Agent Works

Scanning: The agent monitors the Pendle PT market in real-time, tracking:

Yield rates

Expiration dates

Market depth

Gas costs

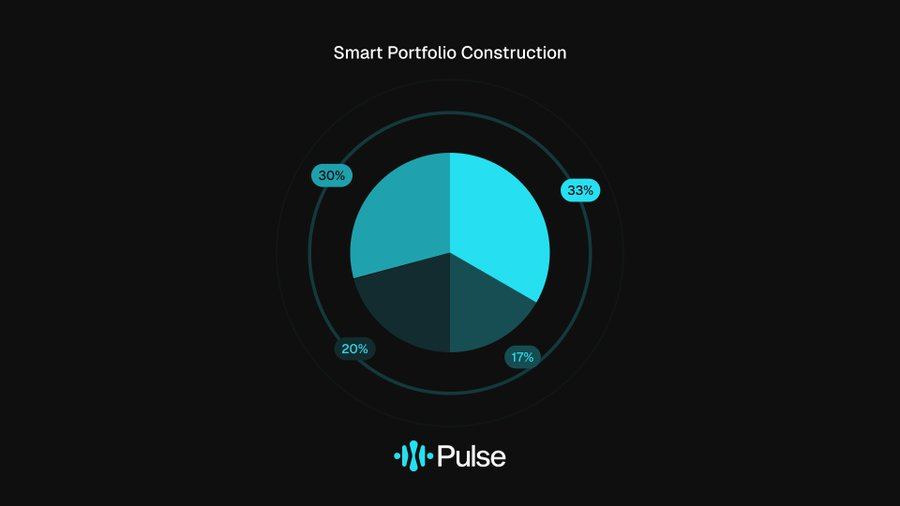

Allocation: The agent allocates funds across multiple PT markets to maximize returns while minimizing slippage and costs.

Compounding: The agent automatically compounds returns to enhance long-term gains.

Pulse addresses the "expiration cliff" issue in the Pendle ecosystem, bringing more stable TVL to the protocol. This mutually beneficial relationship is a true reflection of Giza's competitive moat. Combined with the success of ARMA, I am very confident about Pulse's future.

However, for $GIZA, while the success of Pulse and the resulting buyback pressure may be ongoing and long-term, it will not be immediate. The chain of product success → continuous buybacks → market recognition FOMO takes time. Investing in $GIZA requires sufficient patience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。