Author: 0xjacobzhao

Undoubtedly, Pendle is one of the most successful DeFi protocols in this crypto cycle. While many protocols have stagnated due to liquidity depletion and narrative decline, Pendle has successfully established itself as a "price discovery venue" for yield-bearing assets through its unique yield splitting and trading mechanism. By deeply integrating with stablecoins, LSTs/LRTs, and other yield assets, it has solidified its unique positioning as the "DeFi yield infrastructure."

In the research report titled "The Smart Evolution of DeFi: The Evolution Path from Automation to AgentFi," we systematically sorted and compared the three stages of DeFi's intelligent development: Automation Tools, Intent-Centric Copilot, and AgentFi (On-chain Agents). Beyond the two most valuable and easily implementable scenarios of lending and yield farming, Pendle's PT/YT yield rights trading is viewed as a highly compatible high-priority application for AgentFi in our advanced conceptualization. With its unique "yield splitting + maturity mechanism + yield rights trading" architecture, Pendle provides a natural strategy orchestration space for agents, enriching the possibilities for automated execution and yield optimization.

I. Basic Principles of Pendle

Pendle is the first protocol in the DeFi space focused on yield splitting and trading. Its core innovation lies in tokenizing and separating the future cash flows of on-chain yield-bearing assets (such as LSTs, stablecoin deposit certificates, and lending positions), allowing users to flexibly lock in fixed yields, amplify yield expectations, or engage in speculative arbitrage in the market.

In short, Pendle has built a secondary market for the "yield curve" of crypto assets, enabling DeFi users to trade not only "principal" but also "yields." This mechanism is highly similar to zero-coupon bonds + coupon splitting in traditional finance, enhancing the pricing accuracy and trading flexibility of DeFi assets.

Pendle's Yield Splitting Mechanism

Pendle splits a yield-bearing underlying asset (Yield-Bearing Asset, YBA) into two tradable tokens:

- PT (Principal Token): Represents the principal value that can be redeemed at maturity but does not enjoy any yield.

- YT (Yield Token): Represents all the yield generated by the asset before maturity, but will be worth zero at maturity.

For example, after depositing 1 ETH in stETH, it will be split into PT-stETH (redeemable for 1 ETH at maturity, principal locked) and YT-stETH (receiving all staking yields before maturity).

Pendle is not just a simple token split; it also provides a liquidity market for PT and YT through a specially designed AMM (Automated Market Maker), equivalent to a secondary liquidity pool in the bond market. Users can buy and sell PT or YT at any time to flexibly adjust their yield risk exposure; typically, the price of PT is below 1, reflecting its "discounted principal value," while the price of YT depends on market expectations of future yields. More importantly, Pendle's AMM is optimized for assets with maturity dates, allowing different maturities of PT/YT to form a yield curve in the market, highly similar to traditional financial bond markets.

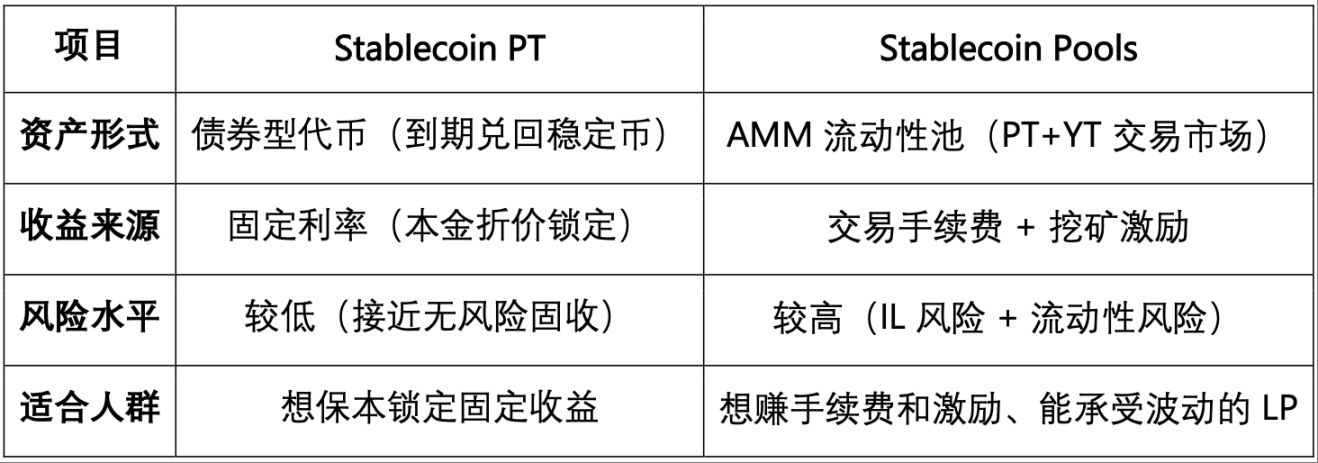

It is particularly noteworthy that in Pendle's stablecoin assets, PT (Principal Token, fixed income position) is equivalent to on-chain bonds, where buying locks in a fixed interest rate at a discount, redeemable 1:1 for stablecoins at maturity, providing stable returns with lower risk, suitable for conservative investors seeking certainty in returns. In contrast, the Stablecoin Pool (liquidity mining position) essentially operates as an AMM market maker, with LP returns coming from fees and incentives, resulting in significant fluctuations in APY and accompanied by impermanent loss risks, making it more suitable for active investors who can tolerate volatility and seek higher returns. In a market with active trading and generous incentives, Pool returns can significantly exceed PT fixed income; however, in a quiet market with insufficient incentives, Pool returns often fall below PT and may even incur losses due to impermanent loss.

Pendle's PT/YT trading strategies mainly cover four paths: fixed income, yield speculation, inter-period arbitrage, and leveraged yield, catering to different risk preferences of investors. Users can lock in fixed yields by buying PT and holding it until maturity, equivalent to obtaining a certain interest rate; they can also choose to buy YT, betting on rising yields or increased volatility for yield speculation. Additionally, investors can utilize price differences between different maturities of PT/YT for inter-period arbitrage or use PT and YT as collateral to layer on lending protocols, thereby amplifying yield exposure.

Boros' Funding Rate Trading Mechanism

In addition to Pendle V2's yield splitting, the Boros module further tokenizes the funding rate, transforming it from a passive cost of perpetual contract positions into a tool that can be independently priced and traded. Through Boros, investors can engage in directional speculation, risk hedging, or arbitrage opportunities, effectively introducing traditional interest rate derivatives (IRS, basis trading) into DeFi, providing new tools for institutional-level capital management and robust yield strategies.

Besides PT/YT trading and AMM pools, as well as the Boros funding rate trading mechanism, Pendle V2 also offers several extended features, which, while not the focus of this article, still constitute important supplements to the protocol ecosystem:

- vePENDLE: A governance and incentive model based on a vote-escrow mechanism, where users lock PENDLE to obtain vePENDLE, allowing them to participate in governance voting and enhance yield distribution weight, forming the core of the protocol's long-term incentives and governance.

- PendleSwap: A one-stop asset exchange entry that helps users efficiently switch between PT/YT and native assets, enhancing the convenience of capital use and protocol composability, essentially functioning as a DEX aggregator rather than an independent innovation.

- Points Market: Allows users to trade various project points in the secondary market in advance, providing liquidity for airdrop capture and points arbitrage, leaning more towards speculative and topical scenarios rather than core value.

II. Pendle Strategy Overview: Market Cycles, Risk Layering, and Derivative Extensions

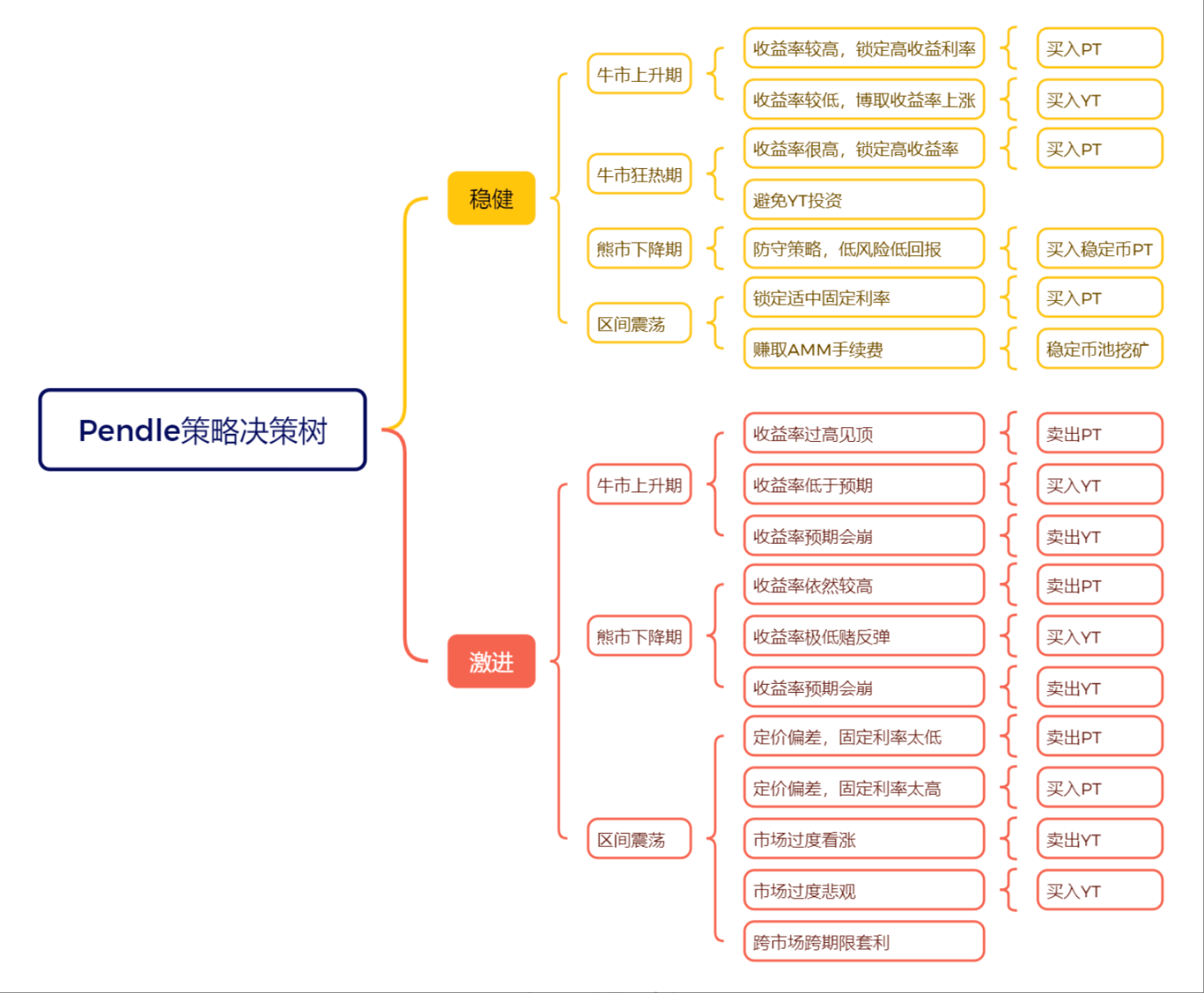

In traditional financial markets, retail investment channels mainly focus on stock trading and fixed-income financial products, often making it difficult to directly participate in the higher-threshold bond derivatives trading. Correspondingly, in the crypto market, retail users are also more inclined to accept token trading and DeFi lending. Although Pendle has significantly lowered the entry barrier for retail investors into "bond derivatives" trading, its strategies still require a high level of expertise, necessitating investors to conduct in-depth analysis of yield-bearing asset rates under different market conditions. Based on this, we believe that during different market phases such as the early bull market, bull market exuberance, bear market downturn, and range-bound oscillation, investors should match differentiated Pendle trading strategies according to their risk preferences.

Bull Market Ascending Phase: Market risk appetite gradually recovers, lending demand and interest rates remain low, making YT pricing on Pendle relatively cheap. At this time, buying YT is equivalent to betting on future yield increases; once the market enters an accelerated upward phase, lending rates and LST yields will rise, thereby increasing YT's value. This is a typical high-risk, high-reward strategy suitable for investors willing to position early and capture amplified returns in a bull market.

Bull Market Exuberance Phase: Market sentiment surges, driving lending demand to skyrocket, with DeFi lending protocol rates often climbing from single digits to over 15-30%, causing YT's value on Pendle to soar and PT to exhibit significant discounts. At this time, if investors buy PT with stablecoins, it is equivalent to locking in high interest rates at a discount, redeemable 1:1 for the underlying asset at maturity, effectively hedging against volatility risk through "fixed income arbitrage" in the later stages of the bull market. The advantage of this strategy lies in its stability and rationality, ensuring fixed returns and principal safety during market corrections or bear market onset, but the cost is the forfeiture of potentially larger gains from continued holding of volatile assets.

Bear Market Downturn Phase: Market sentiment is low, lending demand plummets, interest rates drop significantly, and YT yields approach zero, while PT behaves more like a risk-free asset. At this time, buying PT and holding it until maturity means locking in a certain return even in a low-interest environment, equivalent to establishing a defensive position; for conservative investors, this is the main strategy to avoid yield volatility and preserve principal.

Range-Bound Oscillation Phase: Market interest rates lack a trend, and there are significant divergences in market expectations, leading to frequent short-term mismatches or pricing deviations between Pendle's PT and YT. Investors can engage in inter-period arbitrage between PT/YT of different maturities or capture yield rights mispricing caused by market sentiment fluctuations to obtain stable spread returns. Such strategies require higher analytical and execution capabilities, with the potential to achieve stable returns in a non-trending market.

Global Perspective: Pendle Strategy Market Cycle Comparison Table

Risk Layering: Pendle Decision Tree Under Conservative vs. Aggressive Strategies

Of course, the above strategies primarily focus on stable returns, with the core logic being to achieve a balance of risk and return through buying PT, buying YT, or participating in stablecoin pool mining under different market cycles. For risk-tolerant aggressive investors, more offensive strategies such as selling PT or YT can be chosen to bet on interest rate trends or exploit market mismatches. Such operations require higher professional judgment and execution capabilities, with greater risk exposure; therefore, this article will not elaborate further, and it is provided for reference only, with specific details available in the decision tree below.

Pendle Coin-Backed Strategy: Comparison of stETH, uniBTC, and Stablecoin Pools

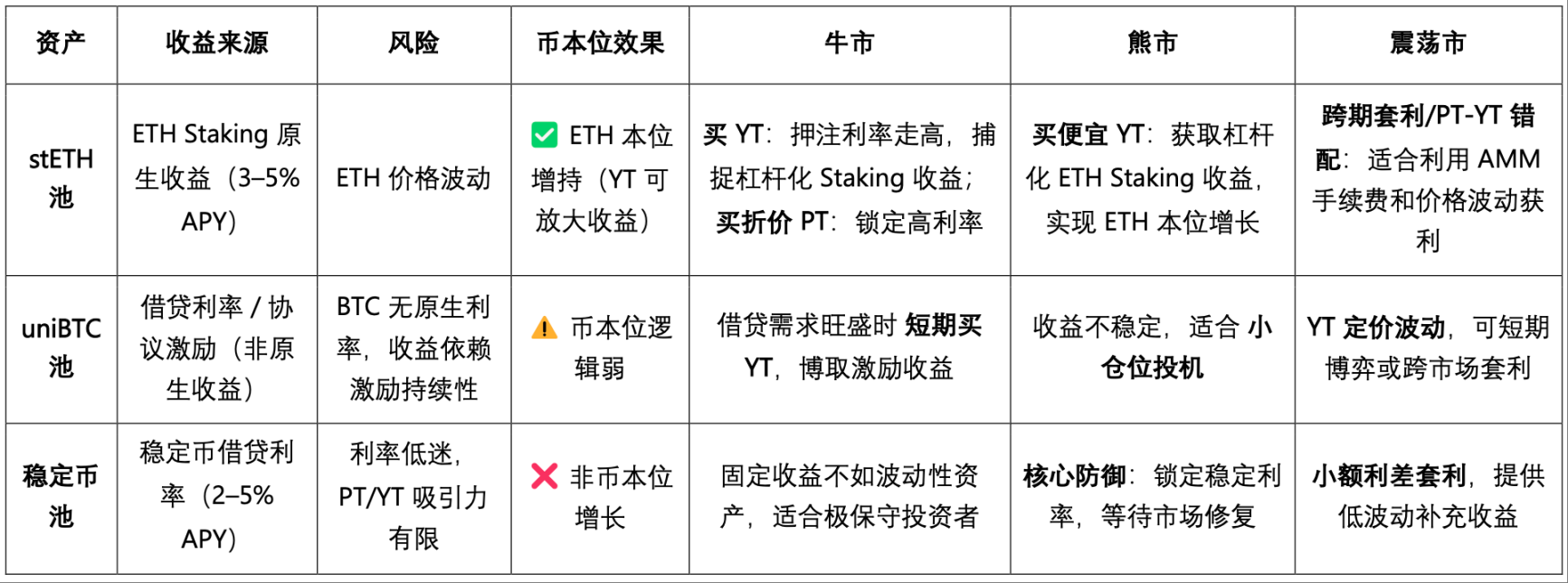

Of course, the analysis of the above Pendle strategies is based on a USD-pegged perspective. The focus of the strategies is on how to obtain excess returns by locking in high interest rates or capturing interest rate fluctuations; in addition, Pendle also offers BTC and ETH coin-backed strategies.

ETH is widely regarded as the best target for coin-backed strategies due to its ecological status and long-term value certainty: as the native asset of the Ethereum network, ETH is not only the settlement basis for most DeFi protocols but also has a stable cash flow source in the form of staking yield. In contrast, BTC does not have a native interest rate, and its yield on Pendle mainly relies on protocol incentives, making the coin-backed logic relatively weak; meanwhile, stablecoin pools are more suitable as defensive allocations, serving the role of "preservation + waiting."

The strategy differences among the three types of asset pools under different market cycles are significant:

- Bull Market: The stETH pool is the most aggressive, with YT being the best strategy for leveraged ETH accumulation; uniBTC can serve as a supplement but is more speculative; the attractiveness of stablecoin pools decreases.

- Bear Market: Low-priced YT from stETH provides the core opportunity to accumulate ETH; stablecoin pools serve the main defensive function; uniBTC is only suitable for small-scale short-term arbitrage.

- Range-Bound Market: The PT-YT mismatch of stETH and AMM fees provide arbitrage opportunities; uniBTC is suitable for short-term speculation; stablecoin pools provide a robust supplement.

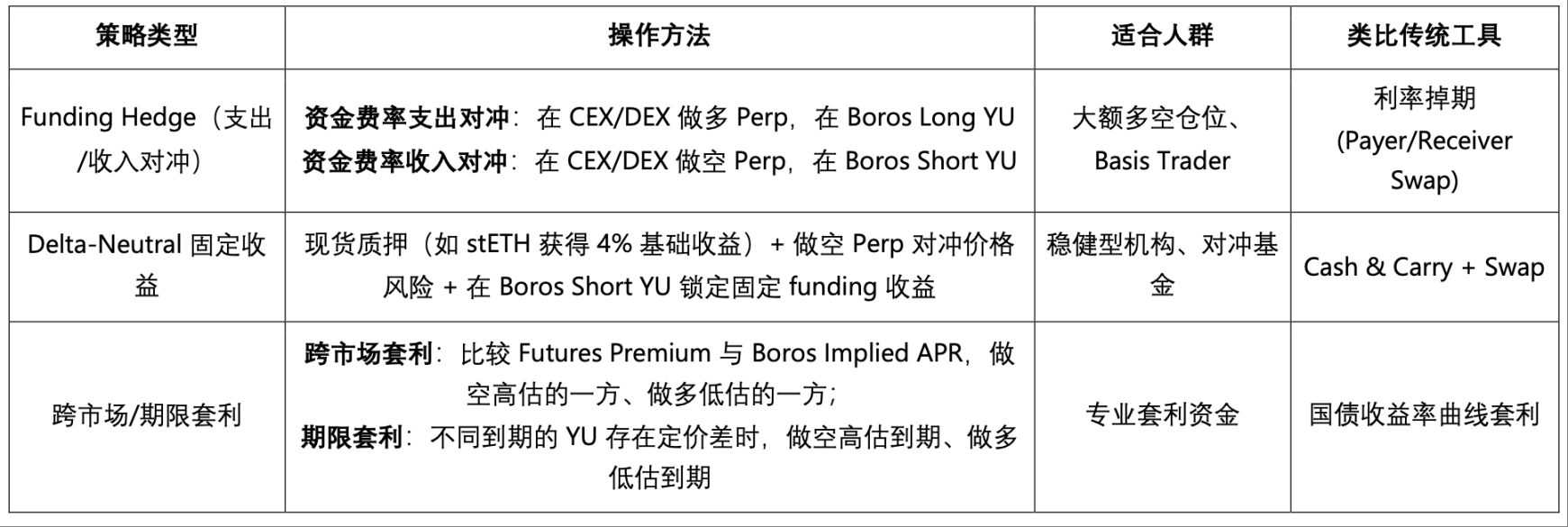

Boros Strategy Overview: Interest Rate Swaps, Hedging, and Cross-Market Arbitrage

Boros tokenizes the funding rate, a floating variable asset, effectively introducing traditional financial interest rate swaps (IRS) and basis trading into DeFi, transforming the funding rate from an uncontrollable cost item into a configurable investment tool. Its core instrument, Yield Units (YU), supports three main strategic paths: speculation, hedging, and arbitrage.

In terms of speculation, investors can bet on rising funding rates by going Long YU (paying a fixed rate Implied APR and receiving a floating rate Underlying APR) or bet on falling funding rates by going Short YU (receiving a fixed rate Implied APR and paying a floating rate Underlying APR), similar to traditional interest rate derivative trading.

- For hedging, Boros provides institutions holding large perpetual contract positions with tools to convert floating funding rates into fixed rates;

- Funding Rate Hedging: Long Perp + Long YU, locking floating funding rate expenses as fixed costs.

- Funding Rate Income Hedging: Short Perp + Short YU → locking floating funding rate income as fixed returns.

- In terms of arbitrage, investors can utilize a Delta-Neutral Enhanced Yield or Arbitrage/Spread Trade to exploit pricing differences across markets (Futures Premium vs Implied APR) or across periods, obtaining relatively stable spread returns.

Overall, Boros is suitable for professional capital used for risk management and stable gains, but it has limited friendliness for retail users.

III. Complexity of Pendle Strategies and Unique Value of AgentFi

Based on the previous analysis, Pendle's trading strategies are essentially complex bond derivative trades. Even the simplest strategy of buying PT to lock in fixed returns requires consideration of multiple factors such as maturity rollover, interest rate fluctuations, opportunity costs, and liquidity depth, not to mention YT speculation, inter-period arbitrage, leveraged combinations, or dynamic comparisons with external lending markets. Unlike floating yield products like lending or staking, which allow for "one-time deposits to earn continuously," Pendle's PT (Principal Token) must have a clearly defined maturity date (usually ranging from weeks to months), and the principal is redeemed 1:1 for the underlying asset at maturity; if one wishes to continue earning yields, a new position must be established. This "periodicity" constraint is a necessary prerequisite for the fixed income market and is a fundamental difference between Pendle and perpetual lending protocols.

Currently, Pendle does not have a built-in automatic rollover mechanism, but some DeFi strategy vaults offer "Auto-Rollover" solutions to balance user experience and protocol simplicity. There are currently three types of Auto-Rollover modes: passive, intelligent, and hybrid.

- Passive Auto-Rollover: Simple logic, where PT automatically reinvests into new PT after maturity, providing a smooth user experience. However, it lacks flexibility; if the floating rates of Aave or Morpho are higher, forced rollover can lead to opportunity costs.

- Intelligent Auto-Rollover: The vault dynamically compares Pendle's fixed rates with the floating rates in the lending market, avoiding "blind rollovers," enhancing returns while maintaining flexibility, better aligning with yield maximization needs.

- If Pendle's fixed rate > lending floating rate → reinvest PT, locking in a higher certainty fixed return;

- If lending floating rate > Pendle's fixed rate → switch to lending protocols like Aave/Morpho to obtain higher floating rates.

- Hybrid Configuration: Part of the funds are locked in PT fixed rates, while part flows into the lending market, forming a combination that balances robustness and flexibility, avoiding being "left behind" by a single interest rate environment in extreme situations.

Therefore, AgentFi has unique value in Pendle's trading strategies: it can automate complex interest rate games. The real-time fluctuations of Pendle's PT fixed rates and the floating rates in the lending market are difficult to monitor and switch manually; ordinary Auto-Rollover is merely passive rollover, while AgentFi can dynamically compare interest rate levels, automatically adjust positions, and optimize position configurations based on user risk preferences. In the more complex Boros strategies, AgentFi can also handle funding rate hedging, cross-market arbitrage, and term arbitrage operations, further unleashing the potential for specialized yield management.

IV. Pulse: The First AgentFi Product Based on Pendle PT Strategy

In the previous AgentFi series report "A New Paradigm for Stablecoin Yields: From AgentFi to XenoFi," we introduced the stablecoin yield optimization agent ARMA launched on the Giza infrastructure layer. This product is deployed on the Base chain and can automatically switch between lending protocols like AAVE, Morpho, Compound, and Moonwell to maximize cross-protocol yields, consistently ranking among the top tier of AgentFi.

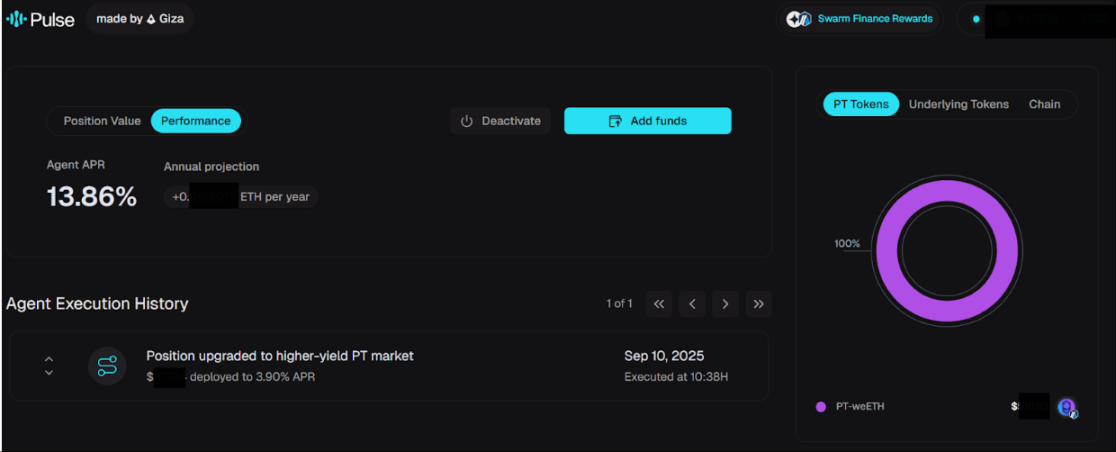

In September 2025, the Giza team officially launched Pulse Optimizer — the industry's first AgentFi automation optimization system based on the Pendle PT fixed income market. Unlike ARMA, which focuses on stablecoin lending, Pulse concentrates on Pendle's fixed income scenarios: it uses deterministic algorithms (not LLM) to monitor multi-chain PT markets in real-time, considering cross-chain costs, maturity management, and liquidity constraints, dynamically allocating positions using linear programming, and automatically completing rollovers, cross-chain scheduling, and compounding. Its goal is to maximize portfolio APY under controllable risk conditions, abstracting the complex process of "finding/APY/rolling over/cross-chain/timing" into a one-click fixed income experience.

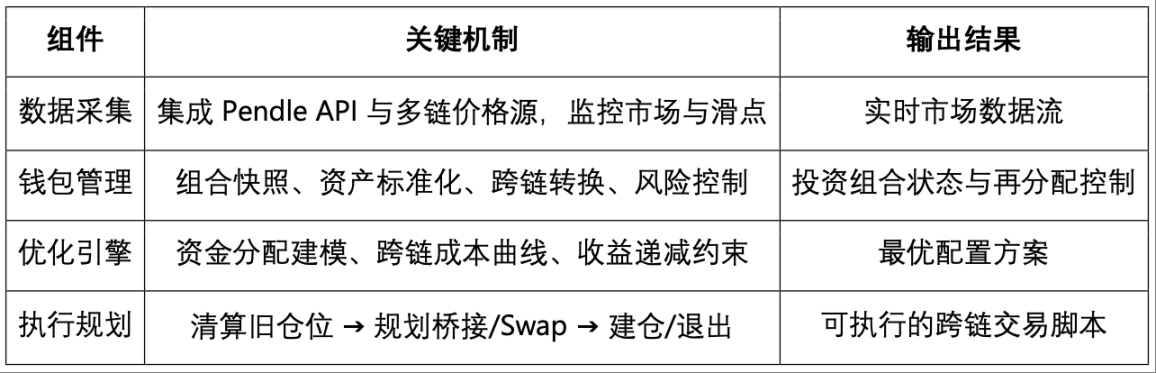

Core Components of Pulse Architecture

- Data Collection: Real-time capture of Pendle multi-chain market data, including active markets, APY, maturity times, liquidity, and cross-chain bridge fees, modeling slippage and price impact to provide precise inputs for the optimization engine.

- Wallet Manager: Serving as the asset and logic hub, generating portfolio snapshots, managing standardized cross-chain assets, and executing risk controls (such as minimum APY improvement thresholds and historical value comparisons).

- Optimization Engine: Based on linear programming modeling, comprehensively considering capital allocation, cross-chain sources, bridge fee curves, slippage, and market maturity, outputting optimal allocation plans under risk constraints.

- Execution Planning: Transforming optimization results into transaction sequences, including liquidating inefficient positions, planning bridging and swap paths, reconstructing new positions, and triggering full exit mechanisms when necessary, forming a complete closed loop.

V. Core Functions and Product Progress of Pulse

Pulse currently focuses on ETH-backed yield optimization, automating the management of ETH and its liquid staking derivatives (wstETH, weETH, rsETH, uniETH, etc.), and dynamically allocating across multiple Pendle PT markets. The system uses ETH as the base asset, automatically completing cross-chain token conversions to achieve optimal allocation. It is currently live on the Arbitrum mainnet, with plans to expand to the Ethereum mainnet, Base, Mantle, Sonic, and others, achieving multi-chain interoperability through the Stargate bridge.

Full User Experience Process of Pulse

Agent Activation and Fund Management: Users can activate the Pulse Agent with one click on the official website. The process includes connecting a wallet, network authentication, whitelist verification, and depositing a minimum of 0.13 ETH (approximately $500). Once activated, the funds are automatically deployed to the optimal PT market and enter a continuous optimization loop. Users can add funds at any time, and the system will automatically rebalance and redistribute; subsequent deposits have no minimum threshold, and large amounts can enhance portfolio diversification and optimization effects.

Data Dashboard and Performance Monitoring

Pulse provides a visual data dashboard to track and evaluate investment performance in real-time:

- Key Metrics: Total asset balance, cumulative investment, principal and yield growth rates, and position distribution of different PT tokens and cross-chain positions.

- Yield and Risk Analysis: Supports trend tracking across daily/weekly/monthly/yearly dimensions, combining real-time APR monitoring, annual forecasts, and market comparisons to help measure the excess returns brought by automated optimization.

- Multi-Dimensional Breakdown: Displayed by PT Token (e.g., PT-rETH, PT-weETH), Underlying Token (LST/LRT protocols), and cross-chain distribution.

- Execution Transparency: Complete operation logs are retained, including rebalancing time, operation type, fund scale, yield impact, and on-chain hash, ensuring verifiability.

- Optimization Effectiveness: Indicates rebalancing frequency, APR improvement magnitude, degree of diversification, and market response speed, comparing with static holdings or market benchmarks to assess risk-adjusted real returns.

- Exit and Asset Withdrawal: Users can close the Agent at any time, and Pulse will automatically liquidate PT tokens and convert them back to ETH, charging a 10% success fee only on profits, with the principal fully returned. Before exiting, the system will transparently display yield and fee details, with withdrawals typically completed within minutes. After exiting, users can reactivate at any time, and historical yield records will be fully retained.

VI. Swarm Finance: Active Liquidity Incentive Layer

In September 2025, Giza officially launched Swarm Finance — an incentive distribution layer designed for Active Capital. Its core mission is to directly connect protocol incentives to the agent network through standardized APR feeds (sAPR), allowing capital to truly achieve "intelligence."

- For users: Funds can achieve real-time, automated optimal allocation across multiple chains and protocols without manual monitoring or reinvestment, capturing the highest yield opportunities.

- For protocols: Swarm Finance addresses the pain point of TVL loss due to maturity redemption in projects like Pendle, bringing more stable and sticky liquidity while significantly reducing the governance costs of liquidity management.

- For the ecosystem: Capital completes cross-chain and cross-protocol migration in a shorter time, enhancing market efficiency, price discovery capability, and capital utilization.

- For Giza itself: A portion of the incentive flow routed through Swarm Finance will flow back to $GIZA, initiating a Tokenomics flywheel through fee capture → buyback mechanisms.

According to Giza's official data, Pulse achieved approximately 13% APR when launching the ETH PT market on Arbitrum. More importantly, Pulse resolved the TVL loss issue caused by Pendle's maturity redemption through an automatic rollover mechanism, establishing a more robust capital accumulation and growth curve for Pendle. As the first practical implementation of the Swarm Finance incentive network, Pulse not only demonstrates the potential of intelligent agency but also marks the official start of a new paradigm for DeFi Active Capital.

VII. Summary and Outlook

As the industry's first AgentFi product based on the Pendle PT strategy, Pulse launched by the Giza team undoubtedly holds milestone significance. It abstracts the complex PT fixed income trading process into a one-click intelligent agency experience, achieving comprehensive automation in cross-chain configuration, maturity management, and automatic compounding, significantly lowering the operational threshold for users while enhancing the capital utilization efficiency and liquidity of the Pendle market.

Pulse currently still primarily focuses on the ETH PT strategy. Looking ahead, with continuous product iterations and the addition of more AgentFi teams, we can expect to see:

- Stablecoin PT strategy products — providing matching solutions for investors with more conservative risk preferences;

- Intelligent Auto-Rollover — dynamically comparing Pendle's fixed rates with floating rates in the lending market, maintaining flexibility while enhancing yields;

- Comprehensive strategy coverage based on market cycles — modularizing Pendle's trading strategies during different bull and bear phases, covering YT, stablecoin pools, and even more advanced plays like shorting and arbitrage;

- Boros strategy-based AgentFi products — achieving smarter Delta-Neutral fixed income and cross-market/term arbitrage than Ethena, promoting further specialization and intelligence in the DeFi fixed income market.

Of course, Pulse also faces risks common to any DeFi product, including protocol and contract security (potential vulnerabilities in Pendle or cross-chain bridges), strategy execution risks (failure in maturity rollover or cross-chain rebalancing), and market risks (interest rate fluctuations, insufficient liquidity, incentive decay). Additionally, Pulse's yields depend on ETH and its LST/LRT markets; if the price of Ethereum drops significantly, even if the ETH-backed quantity increases, there may still be losses in USD terms.

Overall, the birth of Pulse not only expands the product boundaries of AgentFi but also opens new imaginative spaces for the automated and scalable application of Pendle strategies across different market cycles, representing an important step in the intelligent development of DeFi fixed income.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。