Written by: Thejaswini M A

Translated by: Saoirse, Foresight News

In 1979, the Republic National Bank offered its customers a choice: deposit $1,475 for 3.5 years and receive a 17-inch color television; if they deposited the same amount for 5.5 years, they would get a 25-inch model. Want a better deal? Just deposit $950 for 5.5 years and receive a sound system with built-in disco lights.

This "goods-for-savings" approach stemmed from the regulatory policies on banking during the Great Depression that prohibited "competitive interest rates." In 1933, the Q Regulation, part of the Banking Act, came into effect, banning banks from paying interest on demand deposits and setting a cap on savings account rates. At that time, money market funds could offer higher returns, while banks could only attract customers by giving away toasters, televisions, and other tangible items, unable to compete through "real returns."

The banking industry referred to money market fund investors as "smart money," while viewing their own depositors as "dumb money"—in their eyes, these depositors were completely unaware that they could achieve higher returns through other channels. Wall Street readily accepted this notion, using "dumb money" to describe all investors who "buy high, sell low, chase trends, and make decisions based on emotions."

Fifty years later, the once-ridiculed "dumb money" has finally had the last laugh.

The concept of "dumb money" is deeply rooted in Wall Street's investment perception system. Professional investors, hedge fund managers, and institutional traders have always considered themselves "smart money"—they believe they are "seasoned players" who can see through market noise and make rational decisions when retail investors panic.

In the past, retail behavior seemed to confirm this narrative: during the dot-com bubble, short-term traders mortgaged their homes and blindly bought at the peak of tech stocks; during the 2008 financial crisis, individual investors fled the market in a panic when it hit bottom, completely missing the subsequent recovery.

The pattern at that time was clear: professionals "buy low and sell high," while retail investors "buy high and sell low." Academic research has also confirmed this behavioral bias, with professional fund managers using it as evidence of their "superior skills" to justify charging high management fees.

So why has everything changed now? The answer lies in the three dimensions of "investment accessibility, investor education, and tool optimization."

A New Era of Retail Investing

Current data tells a completely different story. In April 2025, U.S. President Trump announced new tariffs, triggering a $6 trillion market sell-off within two trading days—while professional investors were selling off stocks, retail investors viewed this plunge as a "buying opportunity."

During the entire market turmoil, individual investors rushed to buy stocks at a record pace: starting from April 8, they net invested $50 billion into the U.S. stock market, ultimately achieving about a 15% return. During this period, retail clients of Bank of America maintained a "net buying" status for 22 consecutive weeks, the longest continuous buying cycle recorded by the institution since 2008.

Meanwhile, hedge funds and systematic trading strategies kept their stock exposure at the "lowest 12% percentile," completely missing the subsequent rebound.

A similar scenario played out during the market volatility of 2024. Data from JPMorgan showed that the market gains in late April that year were primarily driven by retail investors, with individual investors accounting for 36% of trading volume from April 28 to 29, setting a historical record.

Steve Quirk from Robinhood described this shift: "Every IPO stock in the market is oversubscribed on our platform. Retail demand consistently exceeds supply, and issuers are eager to allow 'brand fans' to qualify for allocations."

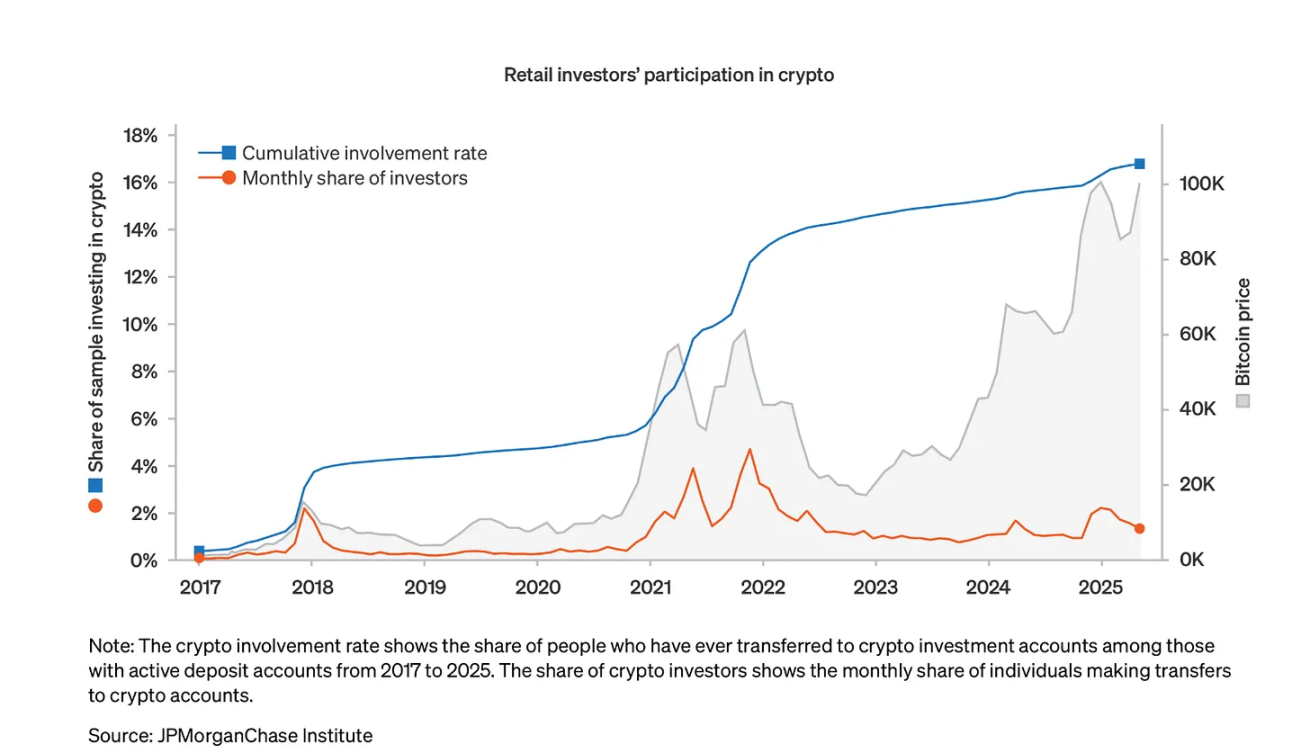

In the cryptocurrency space, retail behavior has also shifted from the stereotype of "chasing trends" to a more mature model of "precisely timing the market." Data from JPMorgan indicates that between 2017 and May 2025, 17% of active checking account holders transferred funds to cryptocurrency accounts, with their participation often surging at "strategic nodes" rather than during "emotional peaks."

Source: JPMorgan

Data also shows that retail investors' characteristic of "buying on dips" has become increasingly evident: in March and November 2024, when Bitcoin reached new all-time highs, retail participation significantly increased; however, when Bitcoin hit a higher peak in May 2025, retail investors remained restrained and did not fall into frenzy—indicating that retail investors in the cryptocurrency space have shed the traditional label of being "FOMO-driven" and demonstrated stronger learning abilities and self-control.

Moreover, retail investment in cryptocurrencies has been relatively rational: the median investment amount is less than "one week's income," reflecting a cautious risk management mindset rather than excessive speculation.

Some may argue that there is still a continuous influx of "dumb money" in areas like gambling, sports betting, and Memecoins—but the data tells a different story.

Indeed, the trading volume in casinos and sports betting platforms can reach tens of billions of dollars: the global online gambling market was valued at $78.66 billion in 2024, expected to grow to $153.57 billion by 2030; the Meme coins in the cryptocurrency space often trigger speculative frenzies, leaving latecomers holding "zero-value tokens."

However, even in these areas deemed "irrational," retail behavior is becoming increasingly mature. Take the Memecoin platform Pump.fun as an example: although the platform earned $750 million through the issuance of Meme coins, its market share plummeted from 88% to 12% when competitors launched "more transparent and smoother communication" services. Clearly, retail investors are not blindly "loyal to established platforms" but are actively shifting towards options that can provide "better value."

In fact, the popularity of Meme coins does not prove "retail stupidity," but rather reflects their resistance to "venture-backed tokens"—these tokens often reject "fair access." As one cryptocurrency analyst stated: "Meme coins allow holders to gain a sense of 'belonging' and form connections based on shared values and culture. They are not just speculative tools but a dual expression of 'social + financial.'"

Revolution in the IPO Space

The rise of retail influence is most evident in the IPO market: an increasing number of companies are beginning to abandon the traditional model of "serving only institutional investors and high-net-worth individuals," actively opening IPO allocations to retail investors.

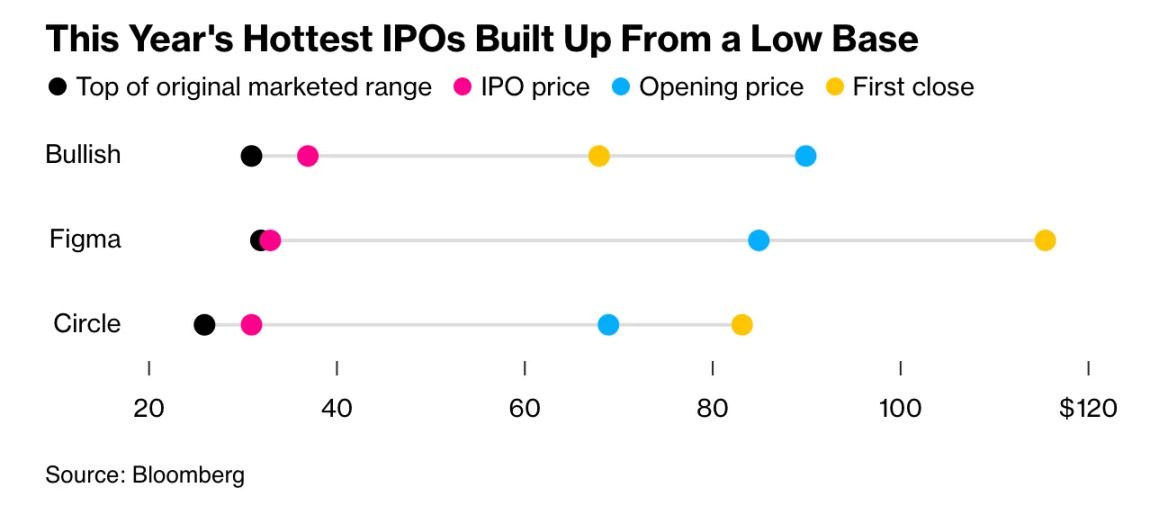

The IPO case of Bullish marks a watershed moment in the "transformation of corporate distribution models." Founded by Block.one and backed by institutions like Peter Thiel's "Founder Fund," the company combines attributes of both a "cryptocurrency exchange" and an "institutional trading platform." In its $1.1 billion IPO, Bullish allowed retail investors to participate directly in stock subscriptions through platforms like Robinhood and SoFi.

Strong retail demand led Bullish to set the offering price at $37 per share—nearly 20% higher than the upper limit of the initial pricing range, with the stock price soaring 143% on its first day of trading. Notably, Bullish sold "one-fifth of its shares" (worth about $220 million) to individual investors, a ratio four times the industry norm; just the customers of the Moomoo platform placed orders exceeding $225 million for the stock.

This is not an isolated case: Gemini, owned by the Winklevoss twins, explicitly allocated 10% of its IPO quota to retail investors; companies like Figure Technologies and Via Transportation also completed IPO issuances through "retail platforms."

Source: Bloomberg

As Becky Steinthal from Jefferies stated: "Compared to the past, issuers can now choose to allow retail investors to occupy a larger proportion of IPOs—this is all driven by technology." This statement encapsulates the core logic behind the shift in corporate attitudes towards retail investors.

Data from Robinhood also confirms retail enthusiasm for IPOs: in 2024, the demand for IPO subscriptions on the platform was five times that of 2023. To guide more rational investment behavior, Robinhood introduced a policy of "prohibiting sales within 30 days post-IPO," encouraging retail investors to develop a "buy and hold for the long term" habit—this benefits both the stability of corporate stock prices and allows retail investors to achieve long-term gains.

The influence of retail investors extends beyond "investment behavior," triggering structural changes in the market: currently, retail trading volume accounts for about 19.5% of total U.S. stock trading volume, up from 17% a year ago and significantly exceeding the pre-pandemic level of around 10%.

More importantly, the investment philosophy of retail investors has undergone a fundamental shift: in 2024, only 5% of investors in Vanguard's 401k retirement plan adjusted their portfolios; currently, the scale of Target-Date Funds has exceeded $4 trillion. This indicates that retail investors are increasingly trusting "systematic, professionally managed investment solutions" rather than frequent trading—this shift helps them avoid "emotion-driven high-cost trading mistakes" and achieve better retirement planning outcomes.

Data from eToro is even more compelling: in 2024, 74% of users on the platform achieved profitability, with the profit rate for premium members reaching as high as 80%—this performance completely shatters the conventional belief that "retail investors are destined to lose to professional managers."

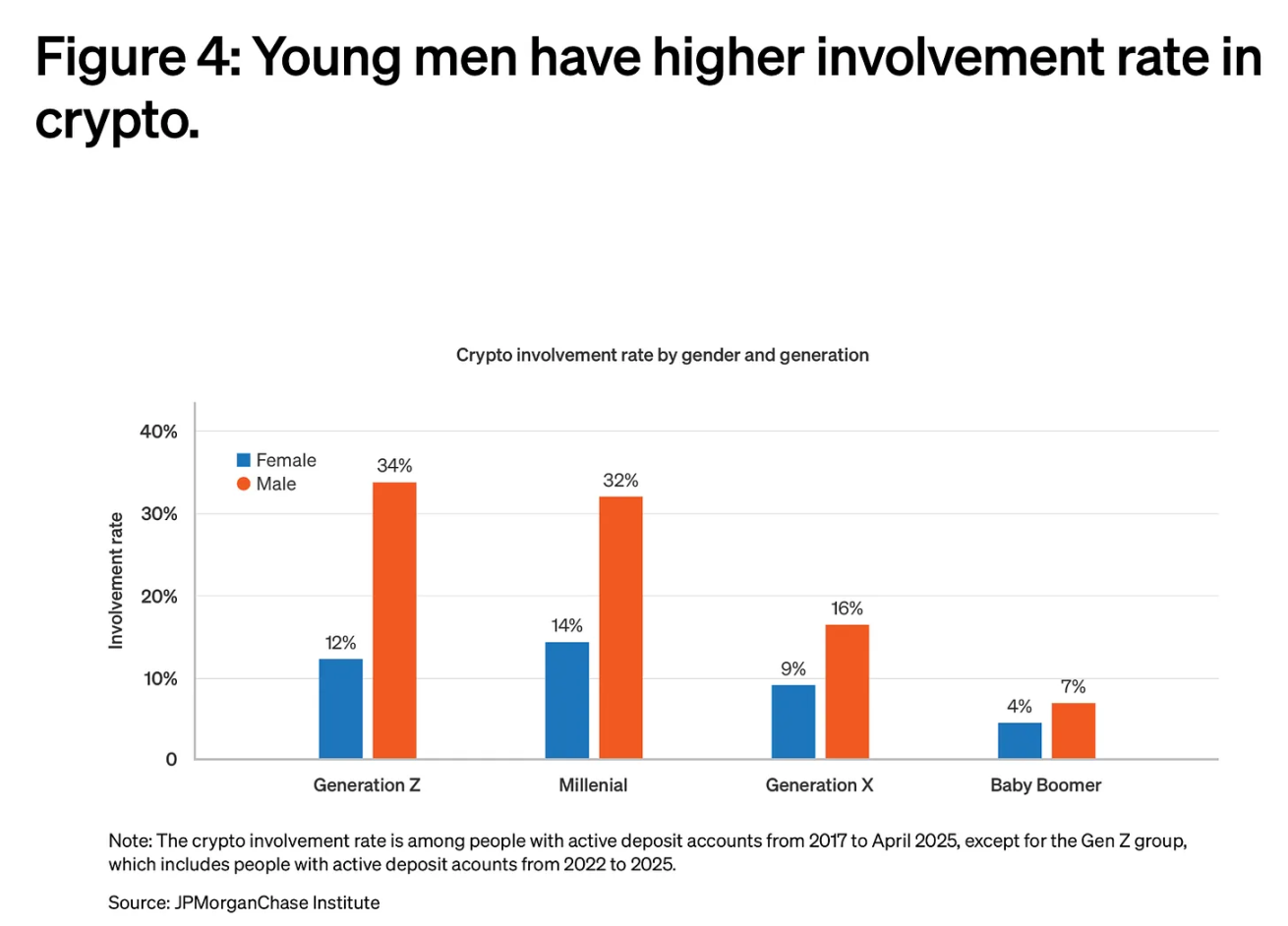

Demographic data also supports the "maturation of retail investors": younger investors are entering the market earlier—Generation Z starts investing at an average age of 19, far earlier than Generation X at 32 and Baby Boomers at 35. More crucially, they have access to educational resources that previous generations could not reach: investment podcasts, professional newsletters, social media finance influencers, and zero-commission trading platforms are all helping them build a more scientific investment understanding.

Source: JPMorgan

In the cryptocurrency space, the "maturation" and "dominance" of retail investors are particularly evident: despite frequent media reports on "institutional layouts for Bitcoin ETFs" and "corporate increases in cryptocurrency holdings," the actual usage of cryptocurrencies is largely driven by retail investors.

Chainalysis data shows that India has the highest cryptocurrency adoption rate in the world, followed closely by the United States and Pakistan—these rankings reflect the "grassroots usage of centralized and decentralized services," rather than large-scale accumulation by institutions.

The performance of the stablecoin market also confirms this: in 2024, the monthly trading volume of USDT alone exceeded $1 trillion, while USDC's monthly trading volume ranged between $1.24 trillion and $3.29 trillion. These transactions are not "institutional fund management flows," but rather millions of retail "payments, savings, and cross-border transfers."

When analyzing cryptocurrency adoption by World Bank income levels, it becomes evident that the adoption rates among "high-income, upper-middle-income, and lower-middle-income groups" have all peaked simultaneously—this indicates that the current popularity of cryptocurrencies is not exclusive to "wealthy early adopters," but has a broad base of support.

Although Bitcoin remains the primary channel for retail "fiat deposits" (from July 2024 to June 2025, the amount of Bitcoin purchased on exchanges exceeded $4.6 trillion), retail investors' portfolios have become increasingly diversified: Layer 1 public chain tokens, stablecoins, and altcoins have all seen significant inflows.

The narrative of "smart money vs. dumb money" is particularly ironic in light of recent institutional behavior: professional investors frequently misstep at critical market junctures, while retail investors demonstrate greater discipline and patience.

During the "institutional adoption phase" of cryptocurrencies, hedge funds and family offices frequently made headlines—they often included Bitcoin in their portfolios near "cycle peaks"; in contrast, retail investors continued to accumulate during bear markets and steadfastly held through volatility.

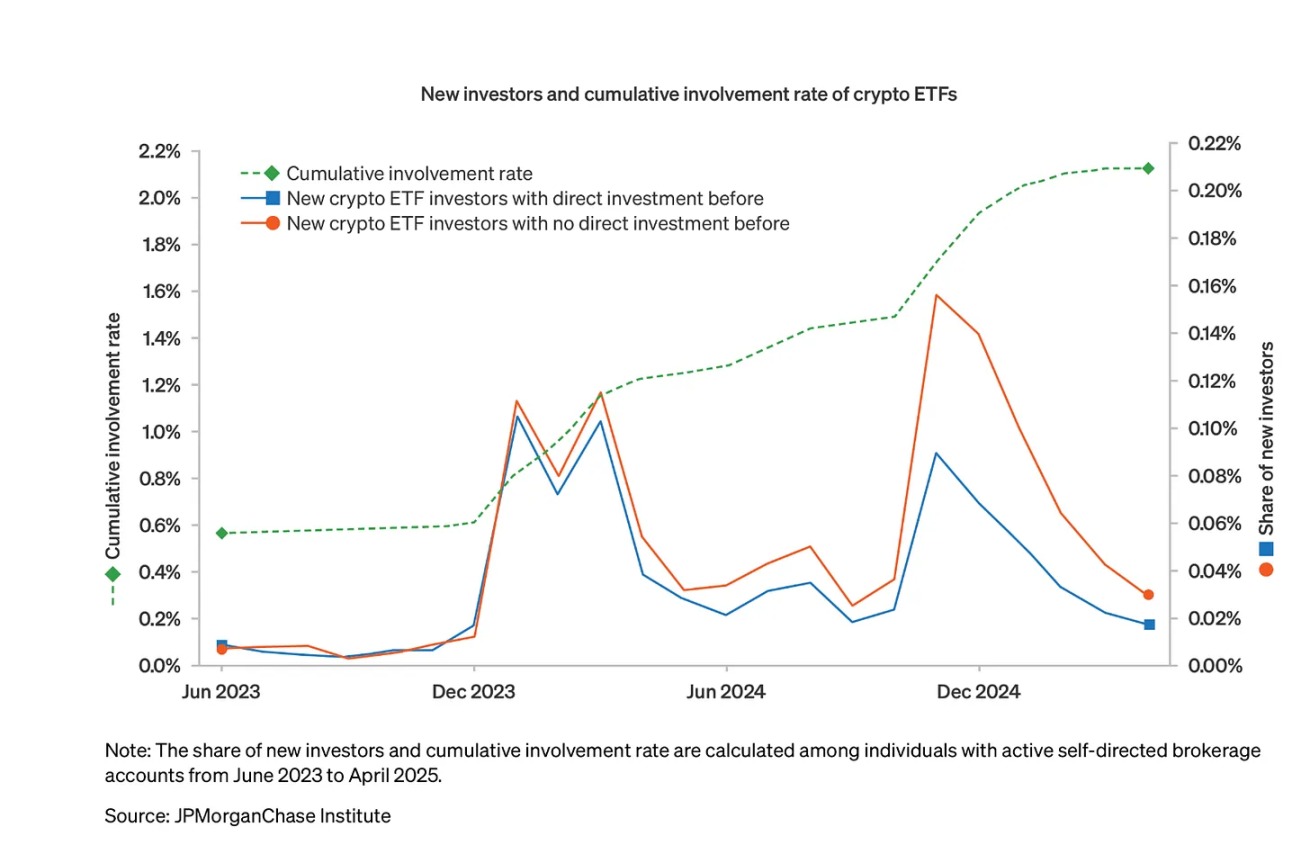

The rise of cryptocurrency ETFs further exemplifies this contrast: over half of cryptocurrency ETF investors "had never directly held cryptocurrencies before," indicating that traditional investment channels are "expanding the investor base," rather than "diverting existing retail investors"; moreover, the median allocation of cryptocurrency among ETF holders is only "3%-5% of their portfolios," reflecting a cautious risk management strategy rather than blind speculation.

Source: JPMorgan

Today, the behavior of professional investors has begun to replicate the "retail mistakes" they once criticized: whenever market volatility intensifies, institutions often choose to flee in a panic to "preserve quarterly performance metrics"; meanwhile, retail investors tend to buy on dips for "long-term account returns."

Technology: Reshaping the Market as an "Equalizer"

The shift in retail investment behavior is not coincidental—technological advancements have democratized "information, tools, and market access" that were once exclusive to professional investors.

Take Robinhood as an example; its innovations go beyond "zero-commission trading." It has launched "tokenized U.S. stocks and ETFs" for European users, opened "Ethereum and Solana staking services" in the U.S., and built a "copy trading platform" that allows retail investors to follow "certified top traders," each initiative aimed at lowering the investment threshold for retail investors.

Coinbase is also continuously optimizing cryptocurrency services for retail investors, upgrading mobile wallet features, launching prediction markets, and simplifying staking processes; Stripe, Mastercard, and Visa have all introduced "stablecoin payment features," enabling retail investors to use cryptocurrencies for purchases at thousands of retailers.

Wall Street's recognition of "retail influence" has created a positive feedback loop for "further empowering retail investors." After companies like Bullish achieved success through "retail-oriented IPO strategies," more companies began to follow suit.

A study by Jefferies also pointed out that stocks with "high retail trading volume and low institutional attention" (including Reddit, SoFi Technologies, Tesla, Palantir, etc.) present potential investment opportunities. The research noted that "when retail trading volume increases, traditional indicators of 'stock quality' seem to lose significance"—but this does not imply that retail decision-making is inferior; rather, it may indicate that retail investors have adopted "valuation standards different from those of institutions."

The cryptocurrency industry's evolution towards being "retail-friendly" also reflects this trend: the competitive focus of mainstream platforms has shifted from "maintaining institutional relationships" to "optimizing user experience," with the launch of features like "easy perpetual contract trading," "tokenized stocks," and "integrated payments" all aimed at "attracting widespread retail participation."

The persistence of the "dumb money" narrative can partly be attributed to its alignment with the economic interests of professional investors: fund managers justify management fees by claiming "superior skills"; investment banks maintain pricing power by "restricting access to high-yield trades."

However, data indicates that these advantages are gradually diminishing: retail investors are increasingly exhibiting the "discipline, patience, and market timing abilities" that professional investors once claimed as exclusive; meanwhile, institutions frequently display the "emotion-driven, trend-chasing behaviors" they previously attributed to retail investors.

Of course, this does not mean that every retail investor can make optimal decisions—speculative behavior, leverage abuse, and trend-chasing still exist. But the key distinction is that these behaviors are no longer "exclusive to retail investors," but rather situations that can occur across all types of investors.

This transformation will also trigger deeper structural impacts: as retail investors gain more voice in IPOs, they are likely to demand "better terms, higher transparency, and fairer access rights"; companies that align with this trend will benefit from "lower customer acquisition costs" and "more loyal shareholder bases."

In the cryptocurrency space, the dominance of retail investors means that products and protocols must prioritize "usability" over "institutional functionality"; only those platforms that can "enable ordinary users to easily access complex financial services" will ultimately succeed.

However, we must also acknowledge a "reality check" behind the recent successes of retail investors: over the past five years, nearly all assets have been in an upward cycle—the S&P 500 index rose by 18.40% in 2020, 28.71% in 2021, 26.29% in 2023, and 25.02% in 2024, with only a significant drop of 18.11% in 2022; from the beginning of 2025 to the present, it has already risen by 11.74%.

Bitcoin's performance has been similar: starting at around $5,000 in early 2020, it briefly surpassed $70,000 in 2021, showing an overall upward trend despite subsequent volatility; even traditional assets like government bonds and real estate have seen significant increases during this period.

In a market environment where "buying on dips guarantees profit, and holding any asset for over a year yields returns," it is challenging to distinguish whether "retail success stems from skill or luck."

This raises a critical question: can the seemingly mature investment behavior of retail investors withstand the test of a "real bear market"? For most Generation Z and millennial investors, the longest "market correction" they have experienced was merely a 33-day drop during the COVID-19 pandemic; while the inflation panic of 2022 caused short-term pain, the market quickly rebounded.

Warren Buffett's famous saying, "Only when the tide goes out do you discover who's been swimming naked," feels particularly relevant at this moment. Retail investors may indeed be smarter, more disciplined, and better informed than previous generations; but it is also possible that they are simply beneficiaries of a "bull market where nearly all assets are rising."

Only when the "loose monetary environment" ends and investors face sustained losses in their portfolios can we truly assess whether the shift from "dumb money" to "smart money" is a permanent evolution or merely a temporary phenomenon reliant on favorable market conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。