Bitcoin maintains its leading position in the cryptocurrency market with a market capitalization exceeding $2.2 trillion. The core driving force behind this is the narrative of "digital gold"—a secure, scarce, and highly liquid reserve asset. However, this positioning has also kept Bitcoin in a long-term "sleeping" state.

The "Real-World Bitcoin (RWB)" movement is emerging, aiming to mobilize this vast capital stock, transforming Bitcoin from a passive reserve into an asset class that can generate returns, circulate compliantly, and be used by institutions.

To gain a deeper understanding of how "Real-World Bitcoin" is changing the ecosystem, Plume conducted research on 15 leading protocols building BTC-supported products on its network. These partners revealed why they chose to integrate Bitcoin and how they create value for institutional users.

The results show that Bitcoin is gradually evolving from a singular store of value to a global financial foundation with yield attributes, compliance, and institutional applicability.

Here are the core trends we summarized.

1. Bitcoin liquidity becomes "productive"

A common point emphasized by builders is that Bitcoin is shifting from traditional high-risk custodial lending models (such as Celsius, BlockFi) to a self-custodied, transparent, and compliant framework.

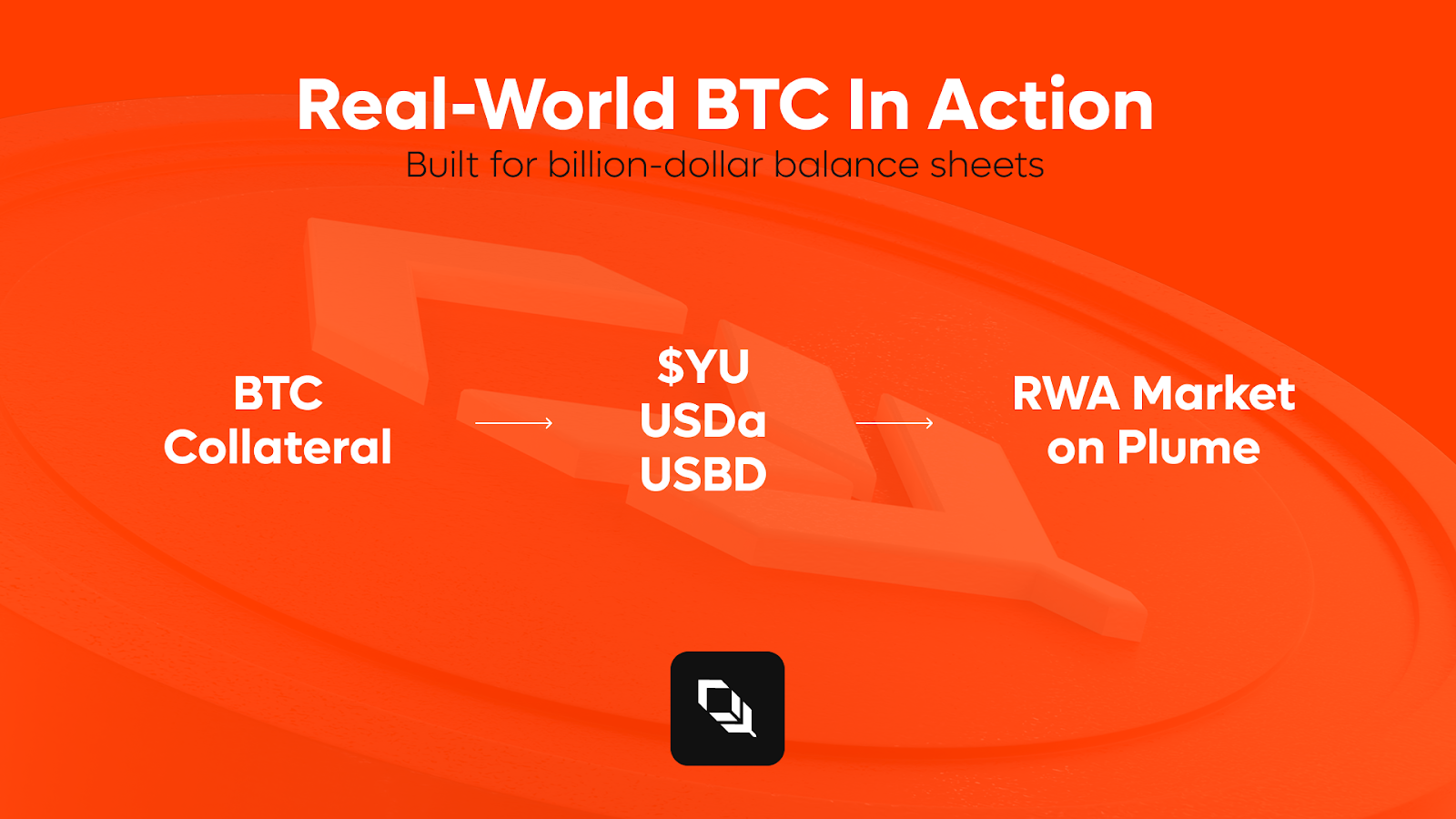

- Projects like Yala, @avalonfinance_, and @BimaBTC support stablecoins (such as $YU, USDa, USBD) backed by Bitcoin collateral, allowing users to maintain BTC holdings while gaining liquidity.

- These stablecoins are not only active in DeFi but are also beginning to enter the RWA market, linking BTC liquidity with real financial instruments like credit and commodities.

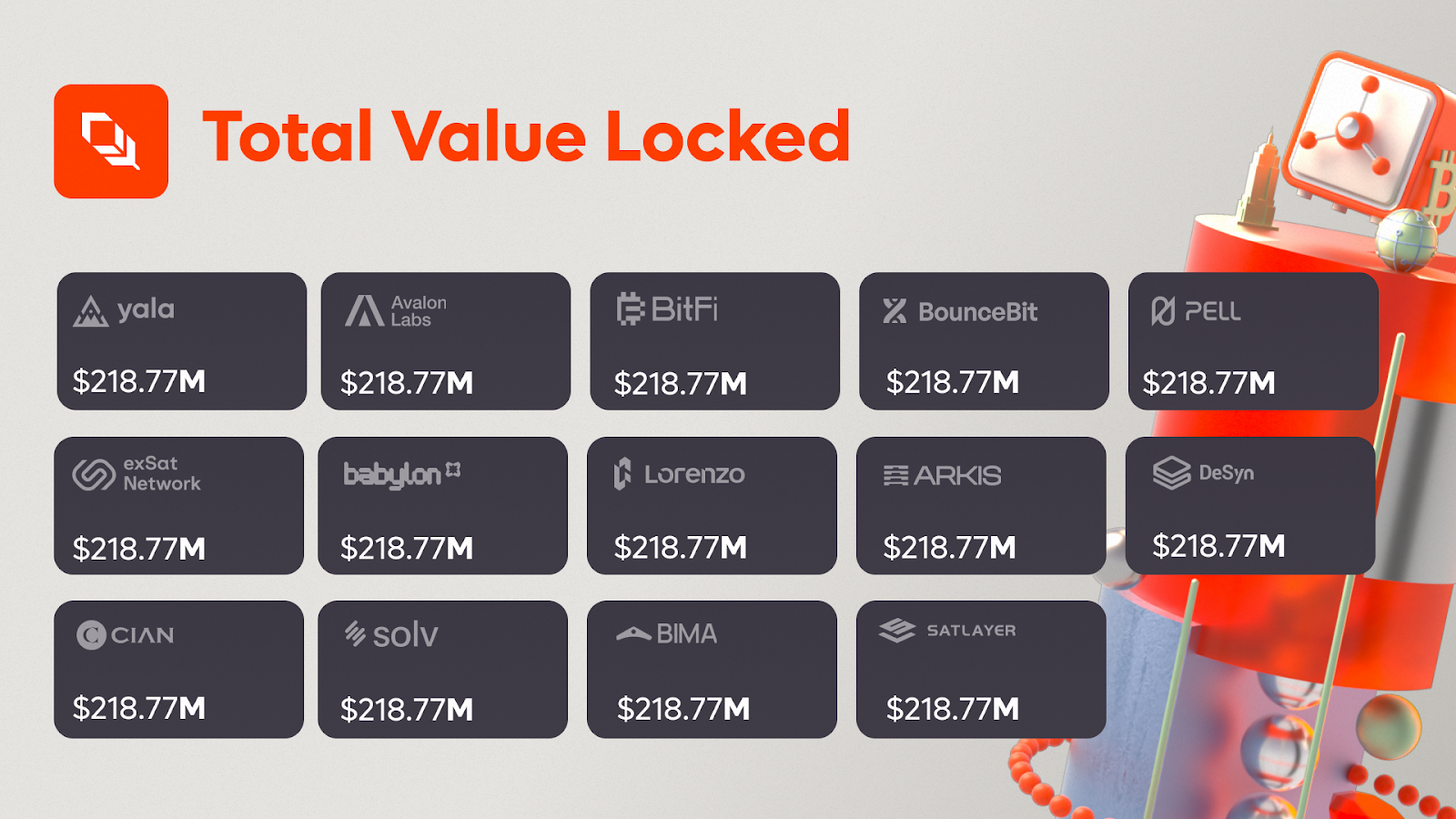

The scale of liquidity is also rapidly growing: Yala's TVL reached $230 million in August 2025; Avalon Labs' TVL exceeded $2 billion in January 2025, and the market cap of USDa has reached $260 million.

Meanwhile, @BitfiOrg and @bouncebit are bridging CeFi and DeFi, launching structured, neutral yield strategies, and combining on-chain transparency with institutional-grade security mechanisms (such as off-chain settlement), earning the trust of institutions and funds.

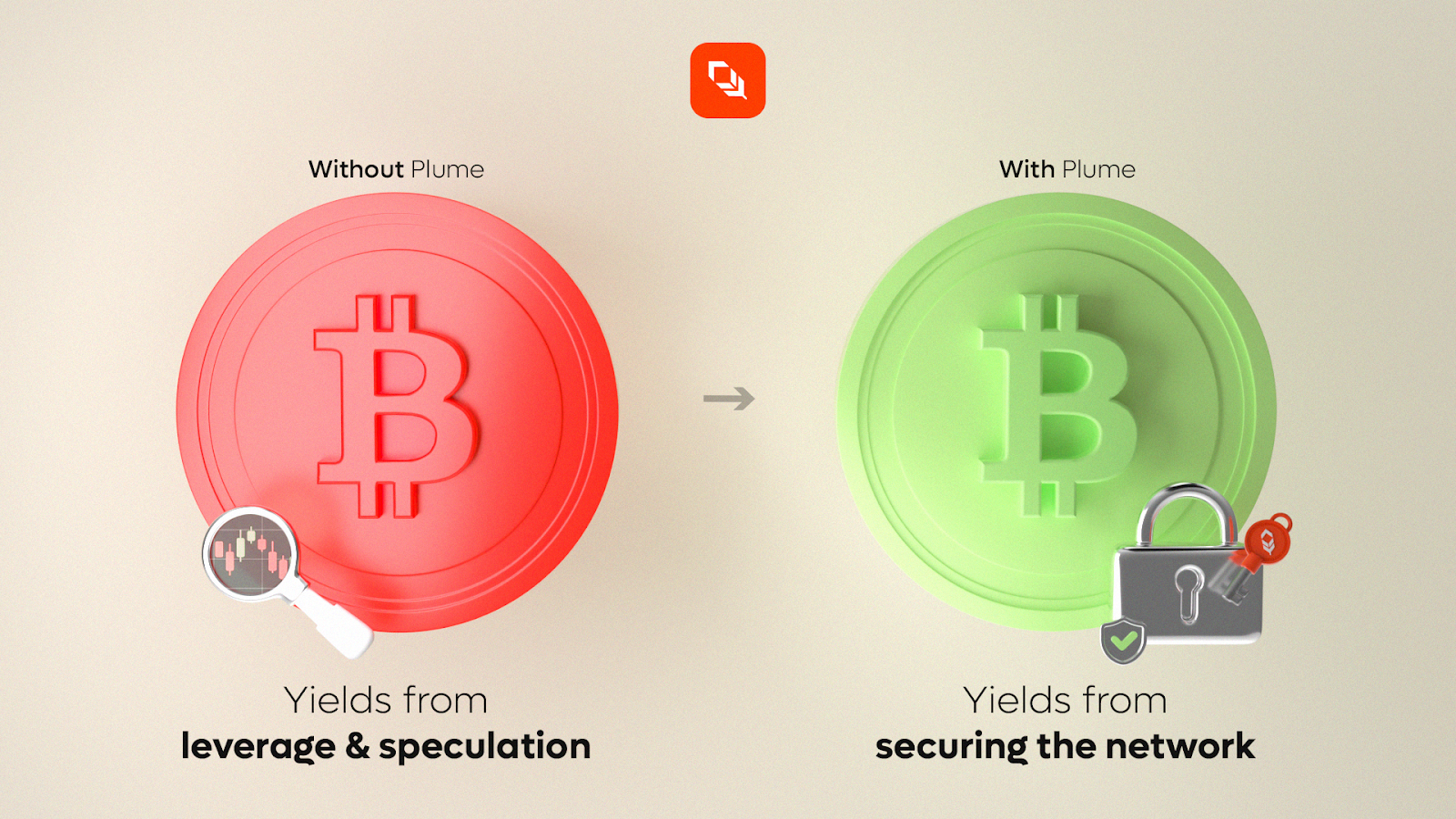

2. BTC becomes a security layer for decentralized infrastructure

Bitcoin's role is evolving beyond collateral to become an "infrastructure asset."

- Pell Network is using Bitcoin re-staking to secure applications on Plume.

- Babylon directly integrates BTC into a decentralized staking layer, providing security for applications and RWA protocols.

@satlayer utilizes re-staked BTC as programmable collateral, ensuring correctness through penalty mechanisms. This positions Bitcoin as a verification asset for cross-chain networks, using the most liquid crypto asset as a security cornerstone.

For institutions, this means new yield models: not relying on speculative leverage, but rather on contributions to network security. Combined with Plume's compliance modules, such models are providing an auditable and scalable path for institutional BTC staking.

3. The rise of Bitcoin-native financial products

Protocols @exSatNetwork and @LorenzoProtocol are building a full-stack asset management system for Bitcoin.

- exSAT positions BTC as the underlying asset for on-chain banking, integrating yield, compliance, and RWA to create a diversified financial platform.

- Lorenzo focuses on institutional-grade packaged products, such as enzoBTC and on-chain trading funds (OTF), allowing BTC to integrate into traditional investment portfolios.

@SolvProtocol's SolvBTC provides a cross-border, efficient circulation method for Bitcoin, enabling users to participate in liquid staking, lending, and yield strategies based on SolvBTC, further expanding BTC's role in TradFi, CeFi, and DeFi.

These projects collectively demonstrate how Bitcoin is evolving from a speculative reserve asset into an investment tool with standardized products, credit lines, and transparent performance metrics.

4. BTC as institutional collateral

The credit market is the final link in the expansion of "Real-World Bitcoin."

- @ArkisXYZ and @DesynLab provide institutional BTC collateral credit pathways. Arkis draws on traditional prime brokerage models to offer compliant lending and leverage management for institutions; Desyn packages BTC liquidity into risk management pools, showing strong market demand.

- @CIAN_Protocol simplifies the path for institutions to enter BTC structured products through multi-source re-staking yield layers, even offering white-label solutions for funds and custodians to quickly onboard.

5. Institutionalization of Real-World Bitcoin

All protocols share a highly consistent goal: targeting the institutional market. Compliance, transparency, and predictable performance are keywords that builders repeatedly emphasize.

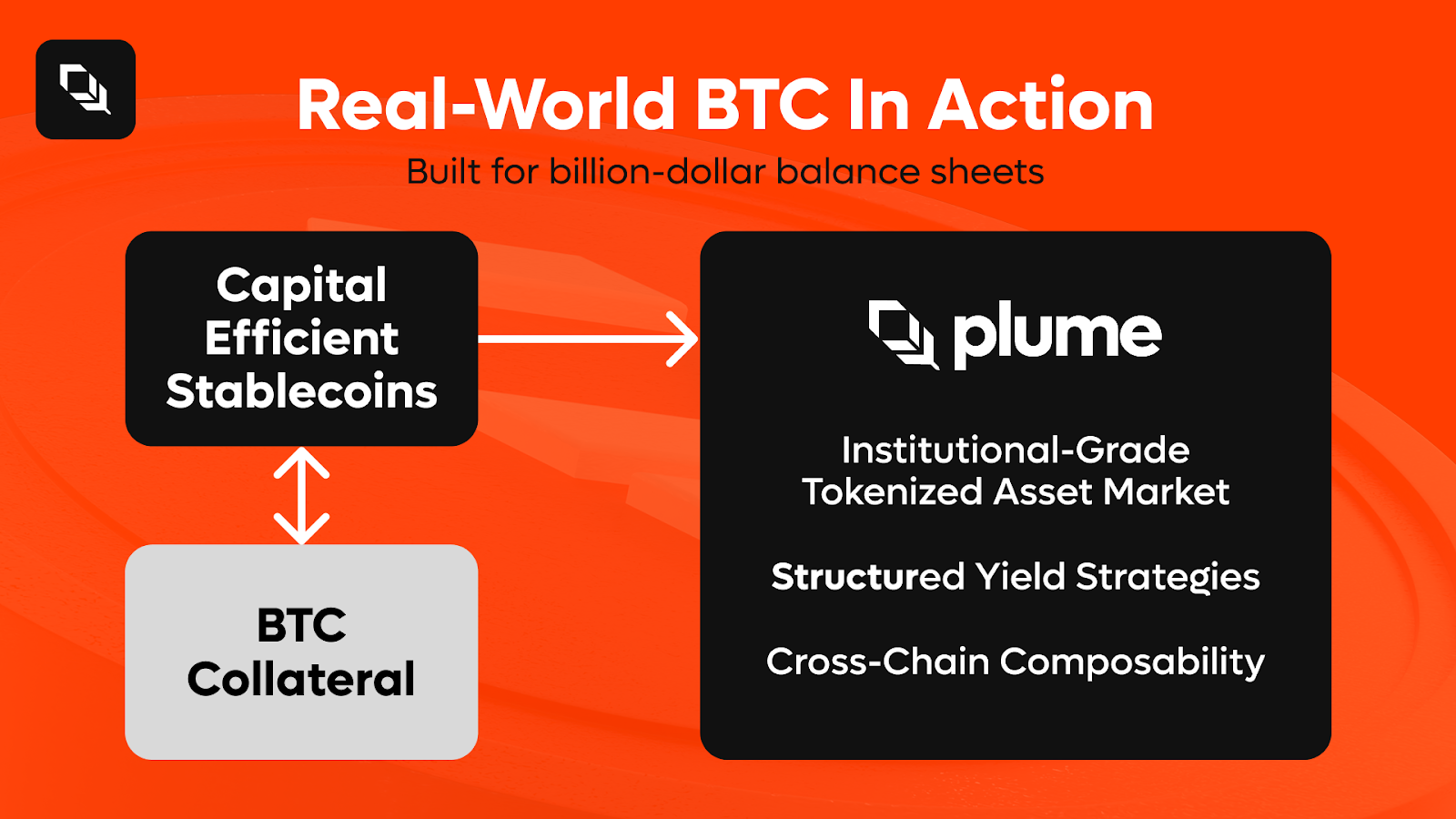

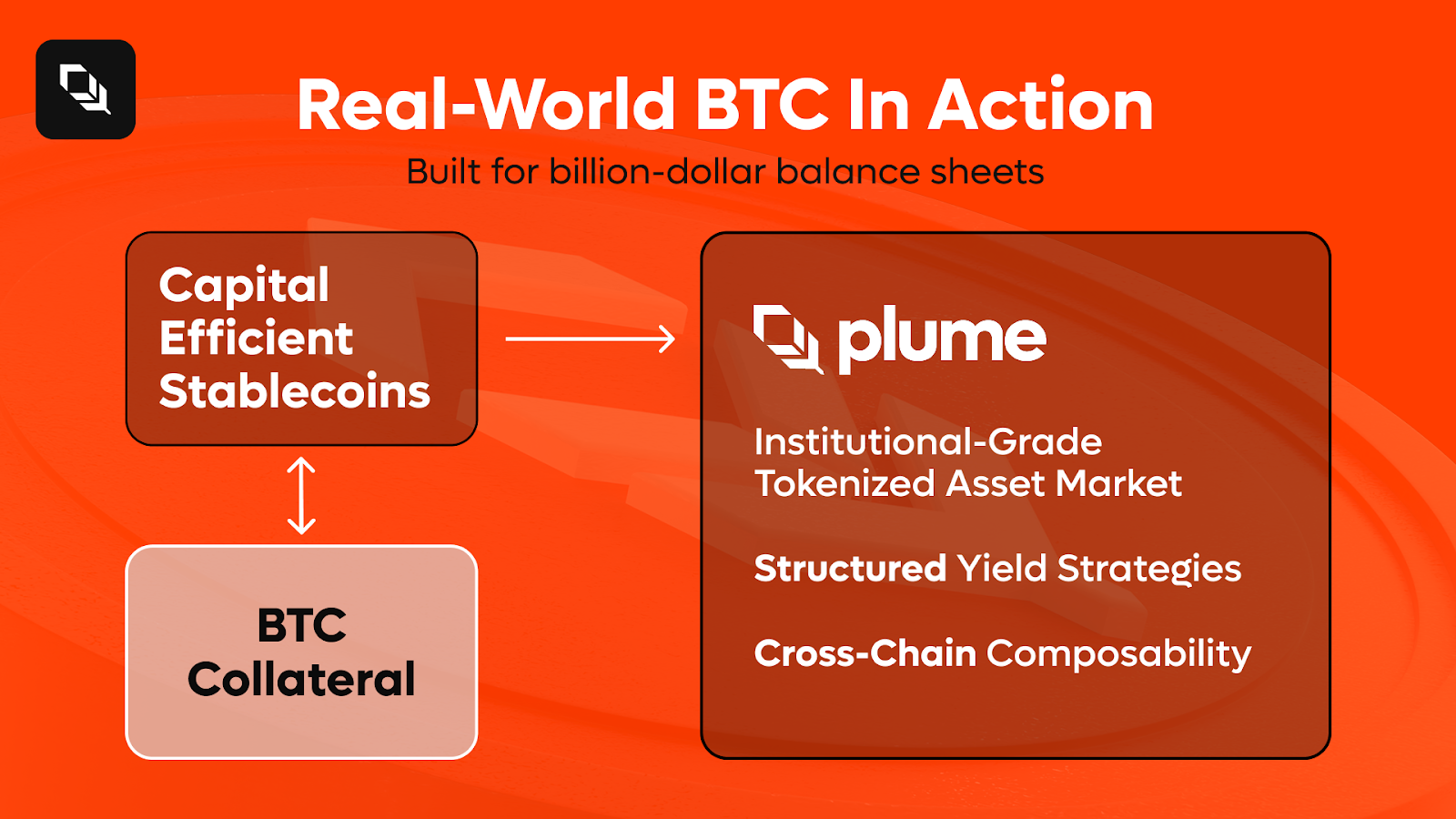

Plume's infrastructure (with built-in compliance, RWA channels, and EVM compatibility) is key to transforming BTC into an institutional-grade asset.

The end result is a multi-layered economy of Real-World Bitcoin: encompassing liquidity, security, asset management, and credit and collateral. Bitcoin thus evolves from a passive asset into a productive financial cornerstone supporting DeFi and TradFi.

Plume: The accelerator for Real-World Bitcoin

Every layer of evolution in Real-World Bitcoin relies on compliant, transparent, and scalable infrastructure.

- BTC stablecoins and liquidity strategies will only attract institutional capital if deployed securely. Plume's compliance modules and RWA-first architecture ensure that funders and trading institutions earn returns under compliance standards.

- Re-staking and security layers require cross-chain interoperability and auditable settlement. Plume provides this foundation, enabling protocols like @PellNetwork and @babylonlabsio to bring BTC into the security layer while ensuring transparency in pricing, penalties, and settlements.

- Asset management and investment tools must be able to integrate into institutional workflows. Plume's EVM compatibility makes product design closer to traditional financial logic, facilitating institutional adoption.

- The credit market relies on robust risk management. Plume provides on-chain margin accounts, management pools, and repayment logic, allowing institutions to safely use BTC as collateral.

Ultimately, the core market for Real-World Bitcoin is institutions. Plume bridges the gap between DeFi innovation and institutional adoption, making Bitcoin a compliant, auditable, and standardized financial asset.

The next chapter for Bitcoin

"Real-World Bitcoin" is not intended to replace Bitcoin's "digital gold" positioning but to expand its boundaries.

With self-custody, compliance, and RWA integration as core principles, Bitcoin is becoming the foundational asset of global finance: possessing liquidity, security, and yield attributes.

Just as gold was once a reserve asset for central banks, Bitcoin may become a universal reserve for decentralized finance and institutional finance—but this time, it will operate as a productive asset that functions efficiently in both digital and real markets.

Plume and its partners are jointly opening this future: unlocking the compliant, interconnected, and productive value of Bitcoin.

The complete research results have been published in Plume's “Bitcoin At Work” series.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。