Last Friday evening, despite some interruptions before the release of the U.S. non-farm payroll report, it was published as scheduled at 20:30 Beijing time. The data showed that the U.S. non-farm payrolls for August, seasonally adjusted, were only 22,000, far below the expected 75,000. The unemployment rate for August was recorded at 4.3%, in line with expectations, but it also reached a new high since October 2021.

At the same time, the non-farm payrolls for June were revised down from 14,000 to -13,000, a downward adjustment of 27,000. The non-farm payrolls for July were revised up from 73,000 to 79,000, an upward adjustment of 6,000. After revisions, the total non-farm payrolls for June and July were adjusted down by 21,000. However, on the evening of the 9th Beijing time, the U.S. Bureau of Labor Statistics released an updated report, significantly revising the non-farm payroll data for April 2024 to March 2025 down by 911,000, setting a historical record.

The latest revision of non-farm payroll data undoubtedly confirms the fact that the labor market is performing weakly. It also means that the previous belief in a strong U.S. labor market has been shattered. After the report was released, the market expected the Federal Reserve to restart interest rate cuts at the FOMC meeting in the middle of this month, raising the probability of a 25 basis point cut to 98.1%, which can almost be considered a certainty. Even the probability of a 50 basis point cut in September rose from 0 to 1.9%.

As a result, the price of Bitcoin quickly plummeted from $112,900, hitting a low of $110,700. As of the time of writing, the price is $112,244, down about 0.19% in the last 24 hours. Ethereum also fell, briefly dropping below $4,300 to $4,275, and as of the time of writing, the price is $4,318, down about 0.33% in the last 24 hours.

On the other hand, the U.S. data seems to confirm the possibility of an interest rate cut this month, with all four major indices rising against the trend. However, the U.S. Producer Price Index and Consumer Price Index reports for August will be released tonight and tomorrow night, so close attention should be paid to the data reports and the fluctuations in Bitcoin prices.

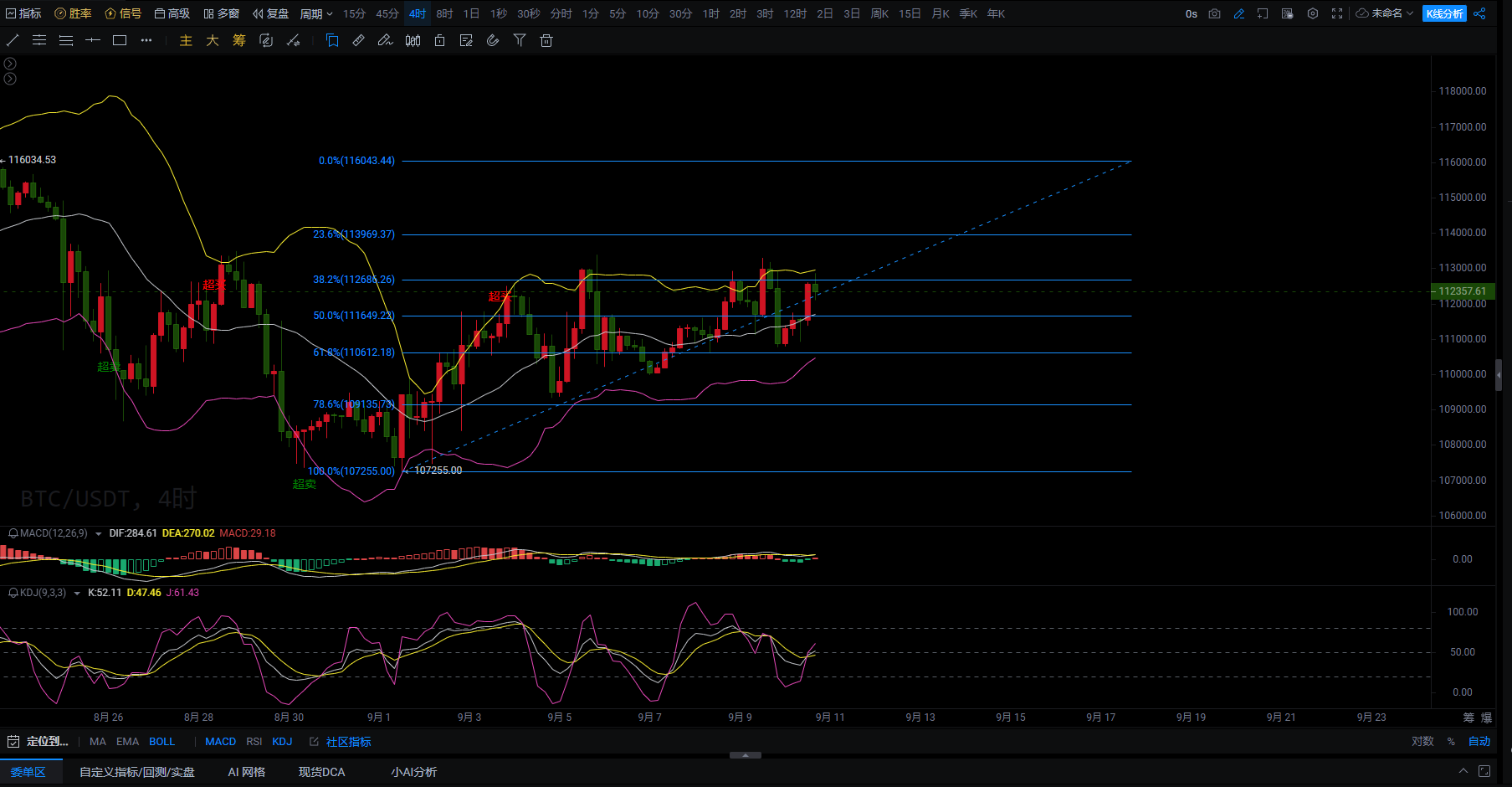

Bitcoin Four-Hour Chart

The current price is fluctuating below the upper Bollinger Band, with the Bollinger Band slightly narrowing, indicating that the market has entered a consolidation phase. The upper resistance level is around the $113,900-$114,000 range, while the lower support level is near $109,000, with clear short-term support and resistance.

From the MACD indicator perspective, the DIF line and DEA line are entangled near the 0 axis, and the MACD green histogram is gradually shortening, indicating that the forces of bulls and bears are temporarily balanced, and the market may soon choose a direction. If the DIF line breaks above the DEA line again, forming a golden cross signal, it may trigger a rebound. Conversely, if it breaks down, there is a risk of continued pullback.

The KDJ indicator shows that the K, D, and J lines have formed a golden cross at a low level and are moving upward, with the K line value rising to around 50, indicating that there is short-term rebound momentum, but the subsequent trend needs to be observed to confirm the strength of the rebound.

Fibonacci retracement levels provide several key points: for support, $111,600 (50%), $110,600 (61.8%), and $109,300 (78.6%) are worth paying attention to; for resistance, $112,680 (38.2%), $113,969 (23.6%), and $116,000 (previous high).

In summary, the current trend shows that the $111,600-$110,600 range constitutes an important support zone. As long as the price remains above this range, the market may still maintain a slightly upward oscillation pattern. The rebound target can focus on the $112,680-$113,969 range, and if it breaks out with volume, it is expected to challenge the previous high of $116,000. The risk to be wary of is if the $110,600 support is lost, the price may further test the support area of $109,300 to $107,200.

In conclusion, I offer the following advice for reference: when stabilizing in the $111,600-$110,600 range and accompanied by a MACD golden cross signal, a bullish approach can be taken. The upper target levels to watch are $112,680, $113,969, and $116,000. If the $110,600 support level is broken, caution is advised, as it may open up greater downside potential.

Giving you a 100% accurate suggestion is not as good as providing you with the correct mindset and trend. After all, teaching someone to fish is better than giving them fish; the advice may earn you a moment, but learning the mindset can earn you a lifetime! What matters is the mindset, grasping the trend, and planning the layout and positions. What I can do is use my practical experience to help everyone, guiding your investment decisions and management in the right direction.

Writing time: (2025-09-10, 18:00)

(Written by - Master Says Coin) Disclaimer: There may be delays in online publication, and the above suggestions are for reference only. The author is dedicated to research and analysis in the fields of Bitcoin, Ethereum, altcoins, forex, stocks, etc., having been involved in the financial market for many years and possessing rich practical experience. Investment carries risks, and caution is advised when entering the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。