Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

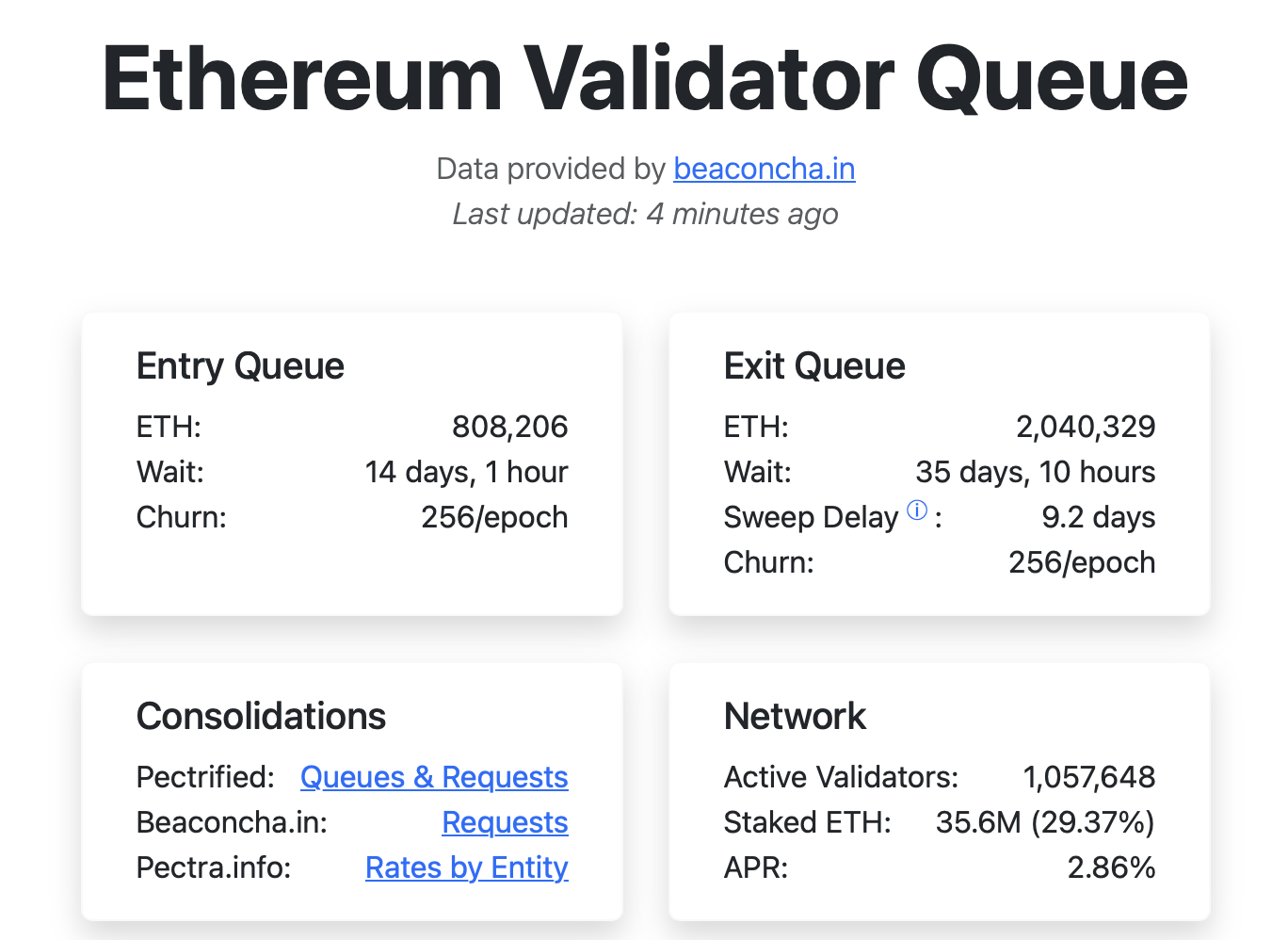

According to data from the Ethereum staking tracking website Validator Queue, as of 4:00 PM Beijing time on September 10, the amount of ETH queued for unstaking on the Ethereum network surged to 2,040,329, nearly doubling from the historical peak of 1,058,531 ETH unstaked on August 29, with withdrawal times significantly delayed to about 35 days and 10 hours; meanwhile, the current amount of ETH queued for staking is reported at 808,206, with a waiting time of about 14 days and 1 hour.

Such a large-scale sudden concentration of ETH unstaking is quite rare. Is there a super whale planning to withdraw? If so, a selling pressure of a million ETH would undoubtedly have a significant impact on ETH and the entire cryptocurrency market… However, after comprehensively understanding the market dynamics related to this event, we find that there are indeed clues, and ETH holders need not panic too much.

The incident originated from a security event that occurred yesterday. On the evening of September 8, the Switzerland-based cryptocurrency platform SwissBorg was hacked for 192,600 SOL (worth about $41.3 million). After the incident, SwissBorg revealed that the theft was due to a breach of an API from a staking partner, allowing hackers to access the staking wallet and transfer related assets without authorization.

The compromised partner was later identified as the staking service provider Kiln, which subsequently issued a statement indicating: “SwissBorg and Kiln are investigating an incident that may involve unauthorized access to the staking operation wallet. We became aware of this matter earlier on September 8, 2025. This incident resulted in the abnormal transfer of SOL tokens from the wallet used for staking operations. Upon discovering the situation, SwissBorg and Kiln immediately initiated an incident response plan to contain the related activities and contacted our security partners. SwissBorg has suspended Solana staking transactions on the platform to ensure that other users are not affected.

So, what does this have to do with the concentrated unstaking of ETH? The key reason is that Kiln is not a staking service provider focused solely on the Solana ecosystem; its staking services cover most PoS networks, including Ethereum.

This morning, Kiln officially announced that “for security reasons, it will orderly withdraw all its ETH staking,” with the main content of the announcement as follows:

Following yesterday's announcement regarding the Solana incident involving SwissBorg, Kiln is taking additional precautionary measures to ensure the security of all network client assets. As part of the response plan, Kiln will begin an orderly exit of all its Ethereum (ETH) validator nodes today. This exit procedure is a precautionary measure aimed at ensuring the ongoing integrity of staked assets.

This decision prioritizes the interests of clients and the broader industry and is based on collaboration with key stakeholders and recommendations from leading security firms.

Client assets remain secure at all times. The exit process is expected to take 10 to 42 days (the specific duration varies by validator node), after which the network will complete fund withdrawals within 9 days as planned. Validator nodes can still earn rewards during the exit period. The delay is enforced by the protocol layer based on the number of exiting validator nodes, and Kiln cannot unilaterally change it.

Withdrawals are automatically handled by the Ethereum protocol and will be directly returned to your wallet or the smart contract used for staking, after which they can be withdrawn.

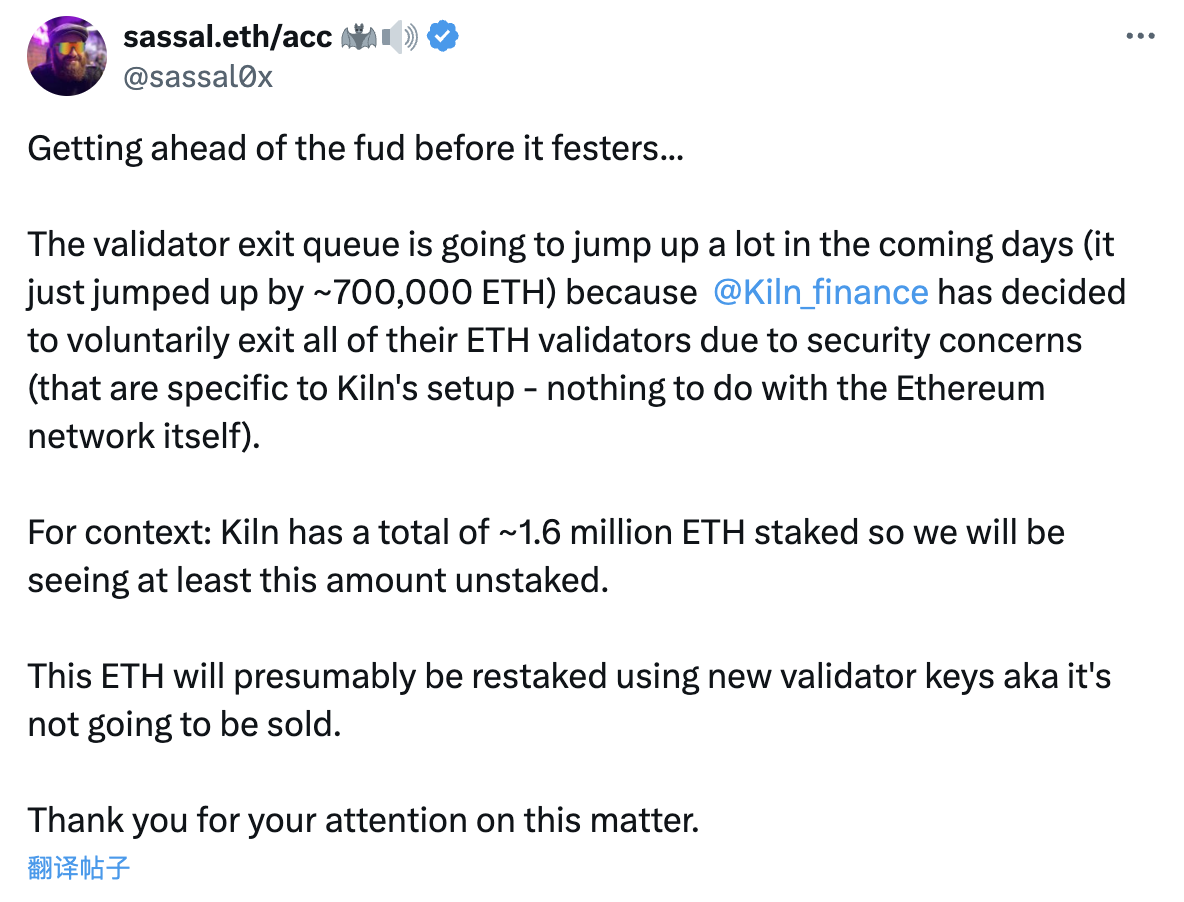

According to disclosures from well-known Ethereum developer sassal.eth, Kiln has staked a total of about 1.6 million ETH, so the market may see a corresponding amount of ETH appear in the unstaking queue in a short time, but this does not mean that these ETH will be sold off; Kiln may use new validator node keys to re-stake these ETH.

In short, the surge in the number of ETH queued for unstaking today is essentially Kiln conducting risk mitigation operations. Most of these ETH belong to clients like SwissBorg who staked through Kiln's services. While it cannot be ruled out that some clients may take this opportunity to sell, it is expected that most ETH will subsequently be re-staked through Kiln (after risk mitigation) or other staking solutions, so the market need not panic excessively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。