In the evolution of the cryptocurrency industry, centralized exchanges (CEX) continuously break boundaries through innovation: from laying out Web 3 wallets (OKX, Binance) to extending to on-chain secondary market point systems (Binance Alpha, Gate Alpha, Bitget Onchain, etc.), competition among exchanges has gradually permeated every corner of the on-chain ecosystem. Today, this competition has been further amplified into a "Meme-ification" wave—everything can be a Meme, with liquidity, narratives, and user sentiment being redefined. It is against this backdrop that LBank launched the first IDO platform driven by Meme logic, LBmeme Launch, opening up a new path for CEX to capture on-chain value.

Since its launch, LBmeme Launch has successfully launched two Meme tokens, achieving remarkable performance with a 4,850% increase over 48 hours:

- On August 29, the first Memecoin LDOG rose from an opening price of $0.00025 to 4,245%, and after landing in the LBANK EDGE section, it continued to soar to $0.0178486, with a maximum increase of 7,039%;

- On September 4, LRATS on the Solana chain also performed astonishingly, briefly rising to 4,380%, and after launching on LBANK EDGE, it reached a maximum increase of 5,940%.

With the support of LBANK EDGE's high liquidity and exclusive trading compensation services, both LDOG and LRATS achieved a leap in market capitalization from hundreds of thousands to tens of millions of dollars in just one week. This achievement not only highlights the immense potential of the Meme track but also explores an efficient and unique path for CEX in its Web 3 transformation.

The Watershed of CEX: The Game of On-Chain Layout

The Meme track, with its unique community attributes and explosive returns, has become a major gathering place for on-chain and market incremental funds. In 2025, CEX is showing an unprecedented aggressive posture, and we are witnessing a paradigm struggle across multiple dimensions: CEX represented by OKX chooses to enter through Web 3 wallet products, while CEX represented by Binance Alpha and Bitget Onchain opts for a "connector" model, attempting to filter tokens with growth potential into the main trading board by building a buffer zone for new projects to launch on CEX.

LBank has chosen an innovative path: launching LBmeme Launch, starting from the primary market, relaxing the issuance rights of Meme tokens, and constructing an ecological closed loop from issuance, acceleration to trading. This strategy avoids the congestion of secondary market competition and demonstrates deeper innovative thinking. Currently, the product is in the Alpha stage but has quickly broken through the market with its unique advantages.

This strategy of initially focusing on Meme as an entry point into the on-chain ecosystem has unique advantages: first, the Meme track, as one of the most active areas in the current market, not only has a large user base but also possesses strong market consensus and community drive; second, compared to assets like DeFi and NFTs, Meme tokens have a more direct value discovery mechanism, making them very suitable for large-scale management and trading on centralized platforms. Most importantly, as a representative of emerging on-chain assets, the rapid evolution of Memes requires platforms to provide both flexible innovation space and ensure basic trading efficiency, making it an ideal testing ground for CEX to explore Web 3 innovation.

Against this backdrop, LBmeme Launch reconstructs the user participation path in a more education-friendly manner by integrating all links within the CEX. From token issuance, early investment participation to secondary trading, users can complete the entire process in a unified interface. The platform provides clear guidance and risk warnings at each key node, including interpretations of token issuance standards, explanations of acceleration rules, and clarifications of trading mechanisms, helping users establish correct investment awareness. Especially in terms of risk control, the platform offers multiple guarantees such as setting acceleration standards, automatic refund mechanisms, and liquidity monitoring, providing users with a safer participation environment. This one-stop service model essentially extends the professional experience accumulated by CEX in traditional off-chain trading markets into the on-chain asset field, not only lowering the participation threshold for users but also bringing a more standardized investment education concept to the Meme market.

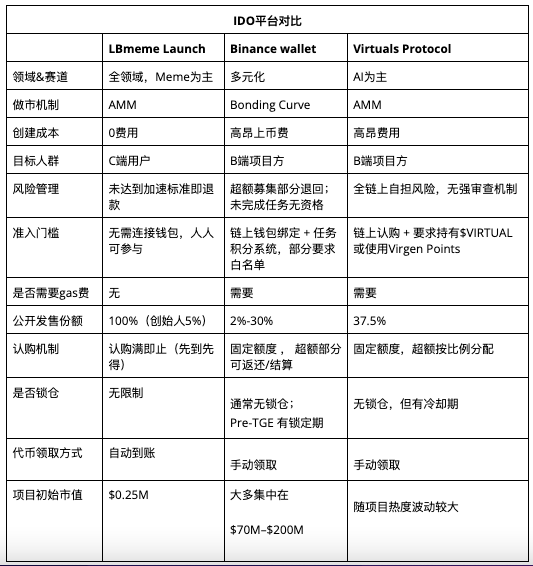

LBmeme Launch vs Binance Wallet vs Virtuals Protocol

The key innovations in the current IDO track focus on changes in issuance mechanisms and trading mechanisms. From the main platforms currently available, three different development paths are forming a clear differentiated competitive landscape.

- Binance Wallet: TGE adopts a task points + BNB staking model, serving more for the project incubation needs within the Binance ecosystem. It uses a "task-oriented + review-led" mechanism, with the public sale ratio typically between 2%-30%, allowing project parties significant control.

- Virtuals Protocol: This is a typical on-chain native issuance platform, focusing on AI agents and virtual protocol projects. Its mechanism is open, requires no review, and has a very low technical threshold. However, the platform lacks effective risk control protection, and user participation risks are significantly higher than in the CEX system. Its 37.5% public sale ratio and 12.5% liquidity pool share also mean that investors face higher uncertainty. The entire model is closer to Degen culture, generating extremely high volatility and Alpha opportunities driven by speculation and narratives.

- LBmeme Launch: Represented by LBank, this IDO platform builds an integrated Meme issuance ecosystem from the idea of "everyone can issue tokens," allowing for zero-cost creation, spontaneous acceleration, and platform-based trading. The platform conducts risk screening through "acceleration standards," refunding if standards are not met, ensuring market health while protecting users. Its 80% public sale share (including 5% for founders) and 20% initial liquidity pool design ensure dual participation enthusiasm from the community and the market. Users can participate in the entire IDO process without connecting a wallet.

From the perspective of token launch entities, on the LBmeme Launch platform, ordinary users can create tokens at zero cost after obtaining a whitelist, achieving the concept of "everyone can issue tokens" in a communal governance manner;

From the subscription mechanism, LBmeme Launch adopts a no-threshold subscription model, allowing users to participate without any points, and it is integrated into LBank's ecosystem, requiring no wallet download or gas fees;

LBmeme Launch implements a "full stop" model, ceasing fundraising once the target is reached (achieving a goal of $250,000 within 24 hours after token creation). The fund allocation is clear, returns are predictable, and all tokens are fully circulated, allowing subscribing users to achieve up to 14.06 times returns before the opening, with creators potentially earning $12,500.

In terms of project market capitalization, LBmeme Launch features a core characteristic of an ultra-low starting market capitalization of $250,000, releasing enormous growth potential for early participants. This "starting from zero" market capitalization design grants quality projects the possibility of achieving tens or even hundreds of times growth, perfectly aligning with the core narrative logic of Meme culture.

After comparing the issuance mechanisms, trading processes, user thresholds, and market capitalization logic, it can be seen that the CEX issuance model represented by LBmeme Launch explores a new path for the Meme market that combines efficiency, safety, and broad participation in token creation, acceleration mechanisms, and trading links.

The LBmeme Launch platform mechanism encourages creators to launch quickly while ensuring the safety of participants' funds and participation efficiency, providing a more controllable growth path for the Meme market. For creators, the completely zero-cost creation cost, combined with the platform's high exposure, enables rapid project initiation, and the direct profit space of $12,500 provides a considerable incentive mechanism for quality projects.

For participating accelerators, the platform constructs an investment environment of "high certainty + limited risk" through subscription mechanisms, market-making models, and acceleration standards. This innovative model is expected to drive the Meme market from a speculative game for niche players to a truly structurally prosperous mass adoption.

Replication and Surpassing: CEX's On-Chain Breakthrough

Looking back, the Meme market has gradually matured, and the infrastructure innovations surrounding issuance, trading, and interaction have completed the leap from "experimental exploration" to "paradigm establishment." Pump.fun has solved the issuance efficiency bottleneck with a decentralized one-click token issuance mechanism, while Moonshot has redefined user trading paths and lowered on-chain operation thresholds from the perspective of interactive experience. These innovations have driven explosive growth in the Meme ecosystem and provided centralized platforms with referable technical paradigms and model templates.

Driven by this trend, CEX's understanding of its role in the Web 3 system has also become clearer, systematically exploring identity reconstruction and functional extension. LBank is a representative of this transformation wave. Its launch of LBmeme Launch retains the convenience of one-click token issuance while introducing fundraising thresholds, basic risk control mechanisms, and initial liquidity allocation, constructing a more compliant, professional, and user-friendly Meme launch system.

Relying on the exchange's mature matching system, ample liquidity resources, and large user base, LBank can provide comprehensive support for the value discovery, liquidity release, and continuous operation of quality Meme projects. This organic integration of mechanism layers and service layers not only reflects CEX's technological evolution and product upgrade in the Web 3 era but also indicates that the next round of institutional capital is expected to enter the Meme market in a more robust and transparent manner. For the entire ecosystem, this is not only an upgrade in infrastructure capabilities but may also become a key turning point for the Meme market to transition from wild growth to structural prosperity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。