Original Author: Beosin

Abstract

This report is supported by the Digital Asset Anti-Money Laundering Professional Committee (DAAMC) under the Hong Kong Virtual Asset Industry Association (HKVAIA) and is led by Beosin. It focuses on the core issues of anti-money laundering (AML) related to stablecoins, systematically sorting out the basic concepts of stablecoins, global regulatory differences, and financial security risks. It emphasizes the construction of AML technical solutions and ecological governance paths in Hong Kong, providing professional references for the compliant development of stablecoins.

The report clarifies that stablecoins are digital assets pegged to fiat currencies and other assets, primarily dominated by fiat-collateralized types (such as USDT, USDC). Their applications cover scenarios such as cross-border remittances, daily consumption, and value storage. The regulatory policy section compares the differences between Hong Kong's "Stablecoin Ordinance" and the U.S. "GENIUS Act," while also analyzing policies from countries such as Singapore, Japan, South Korea, and the UAE.

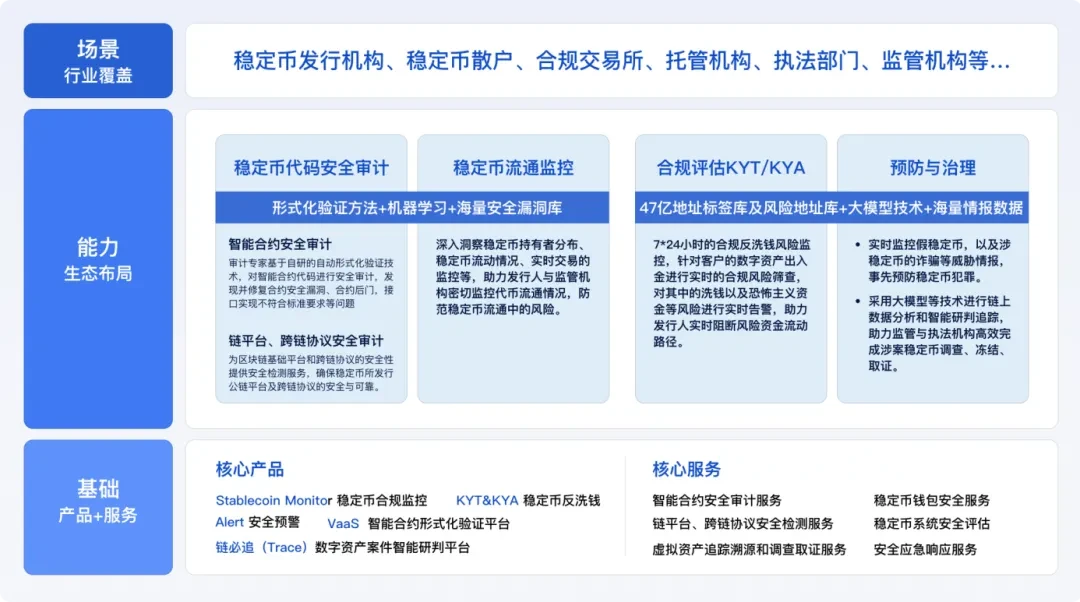

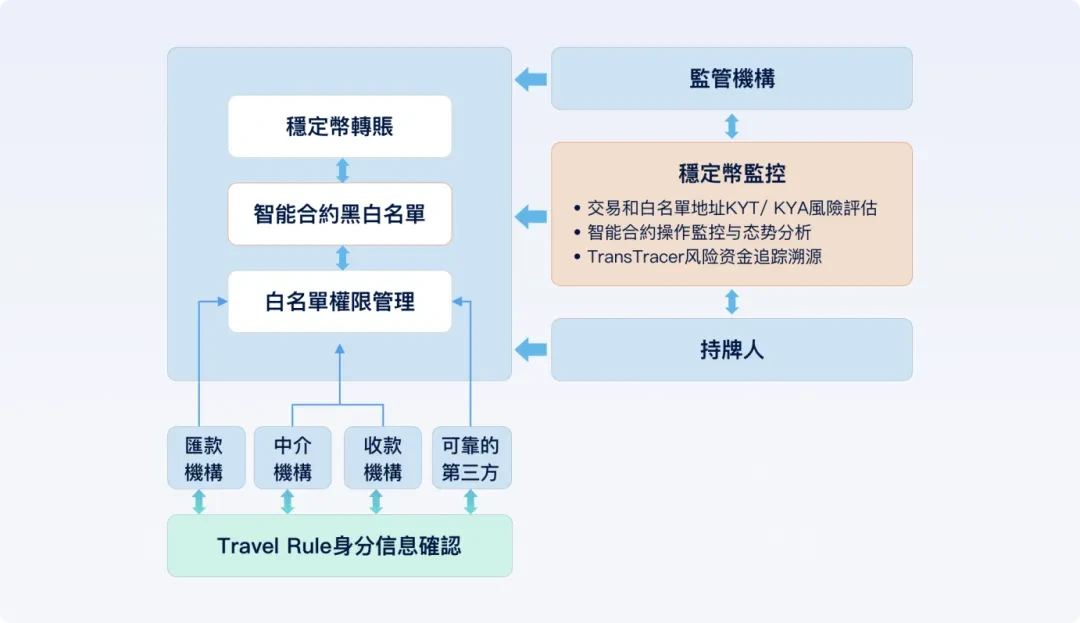

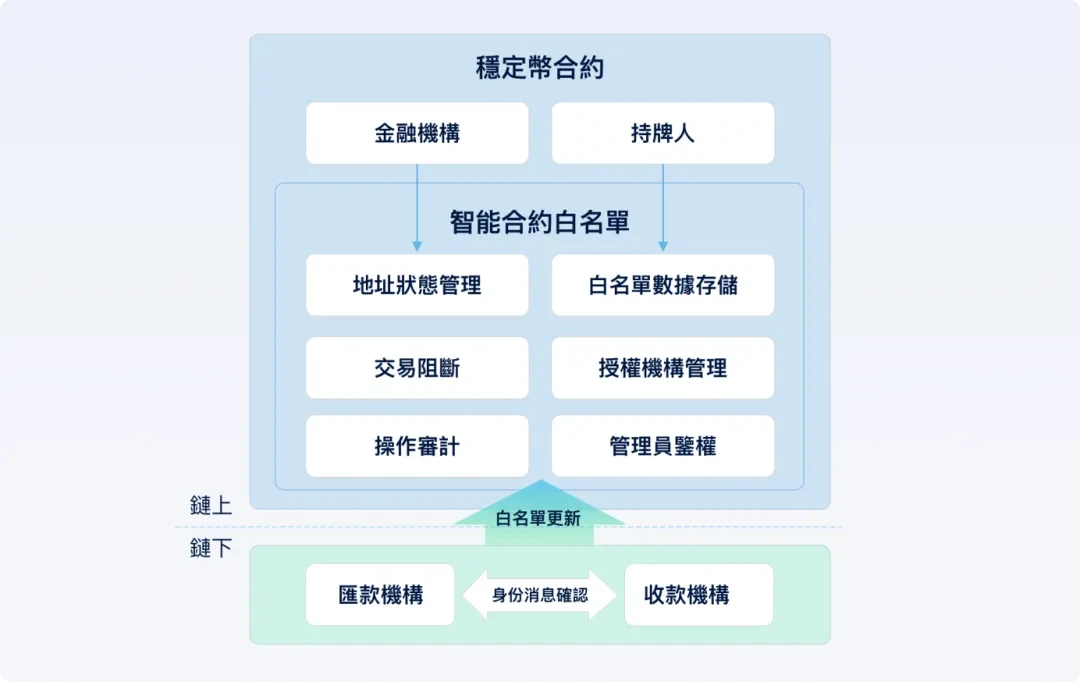

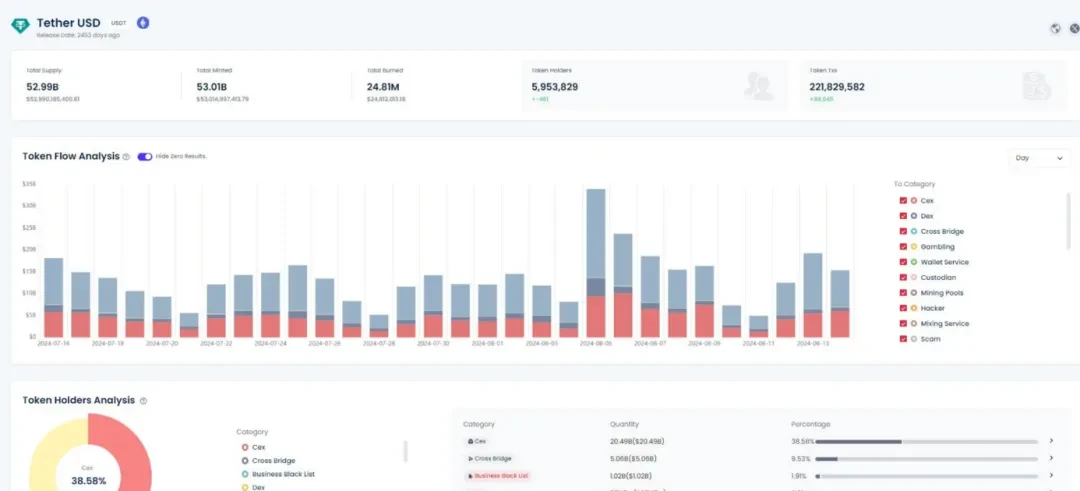

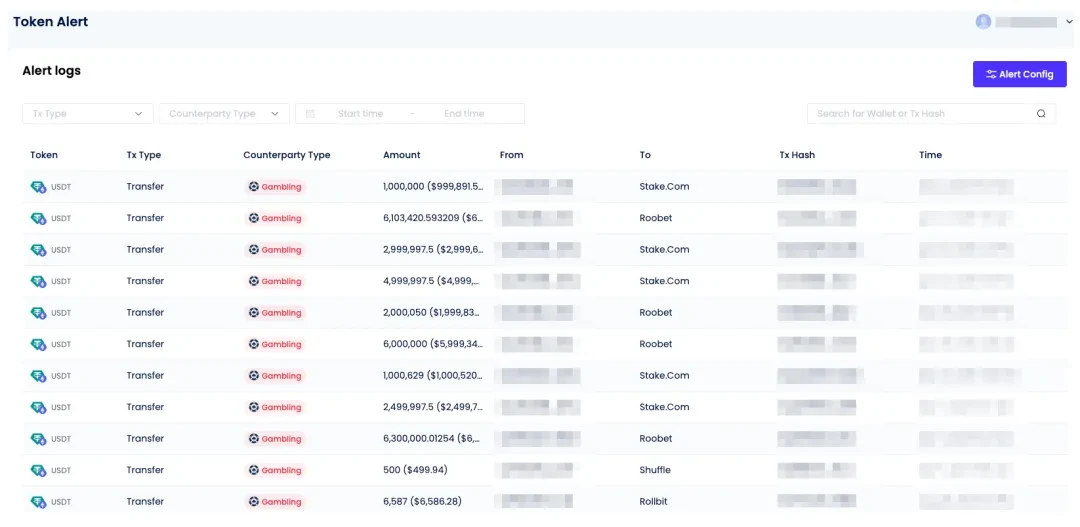

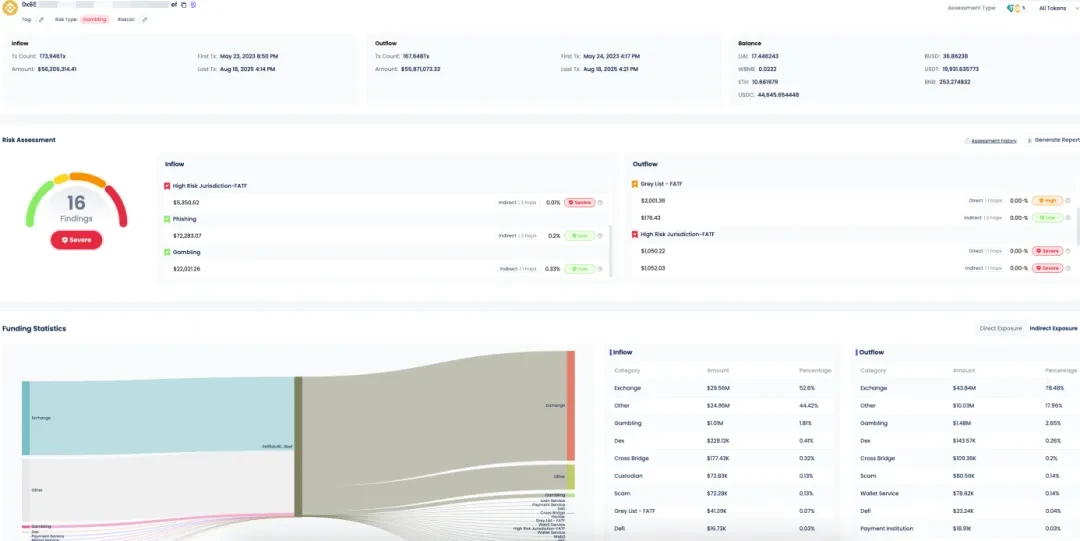

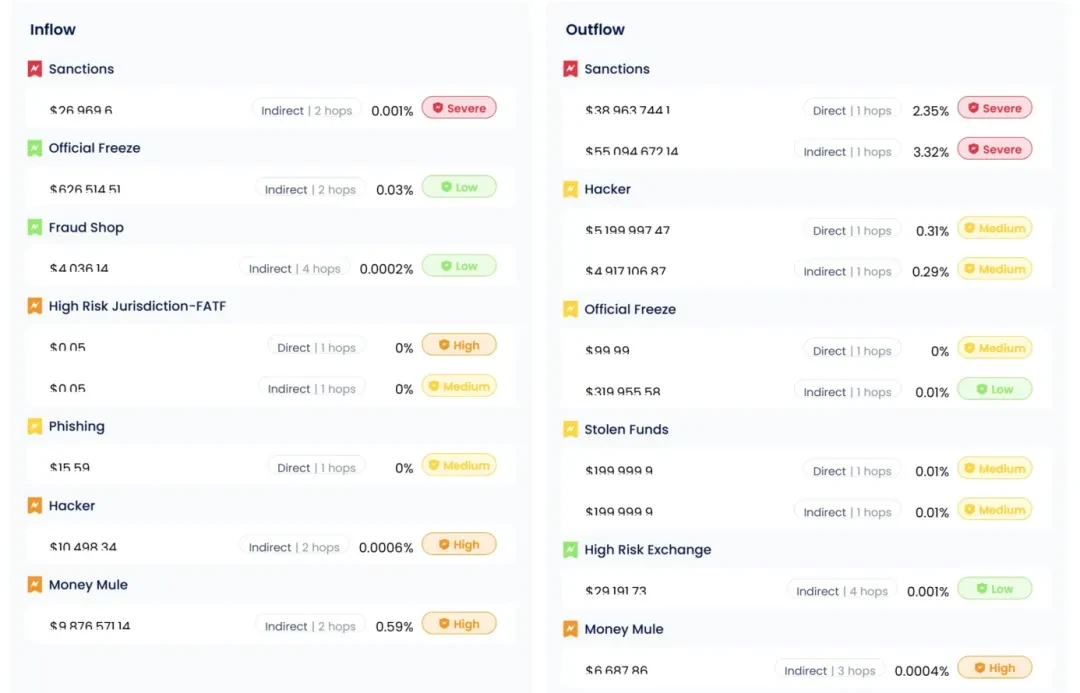

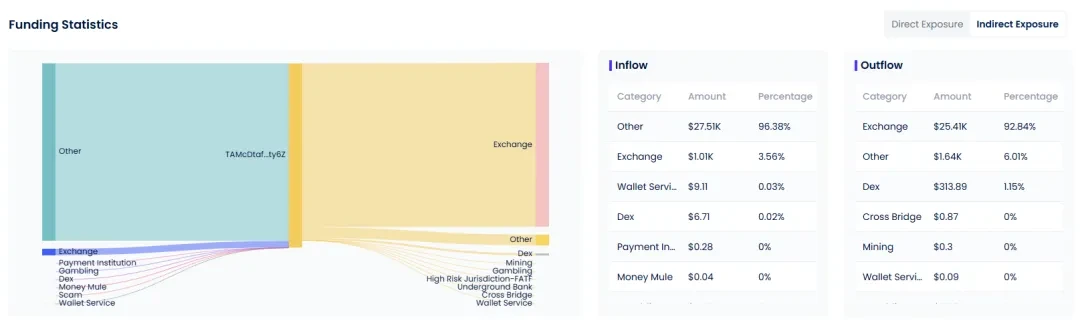

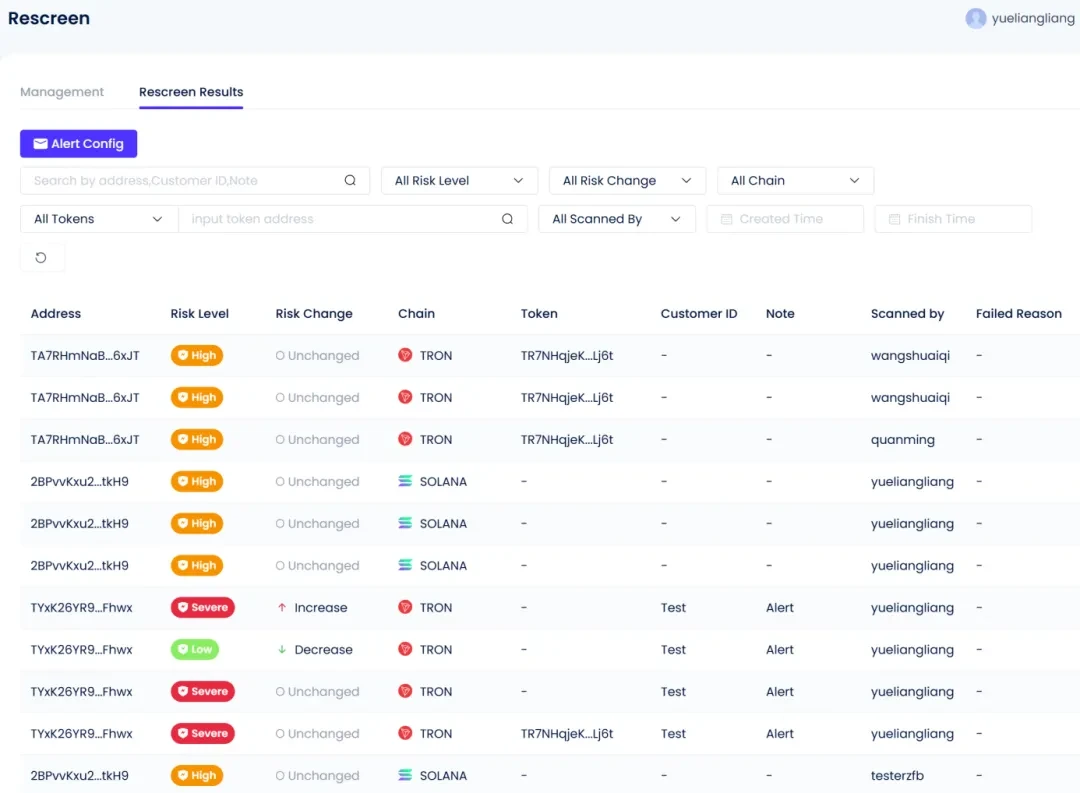

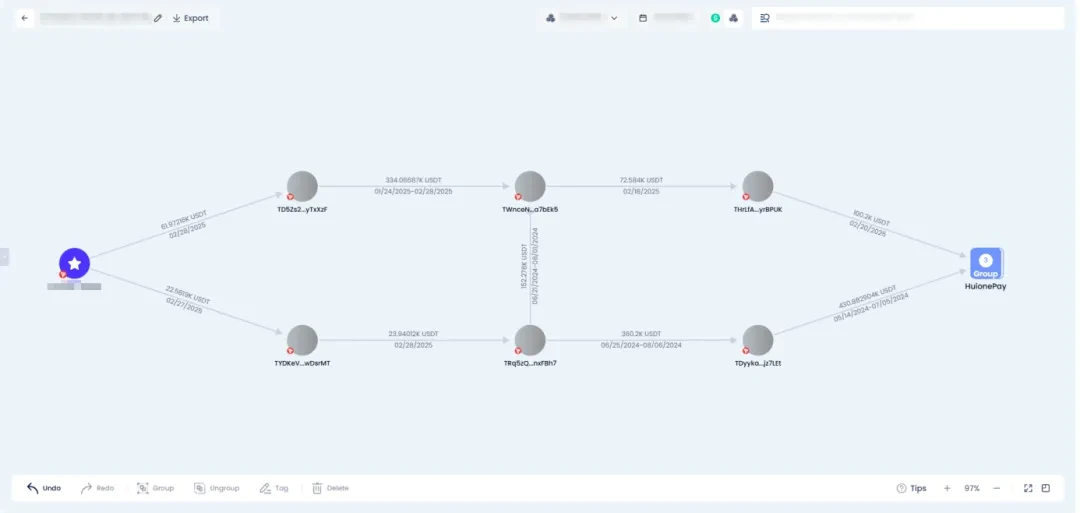

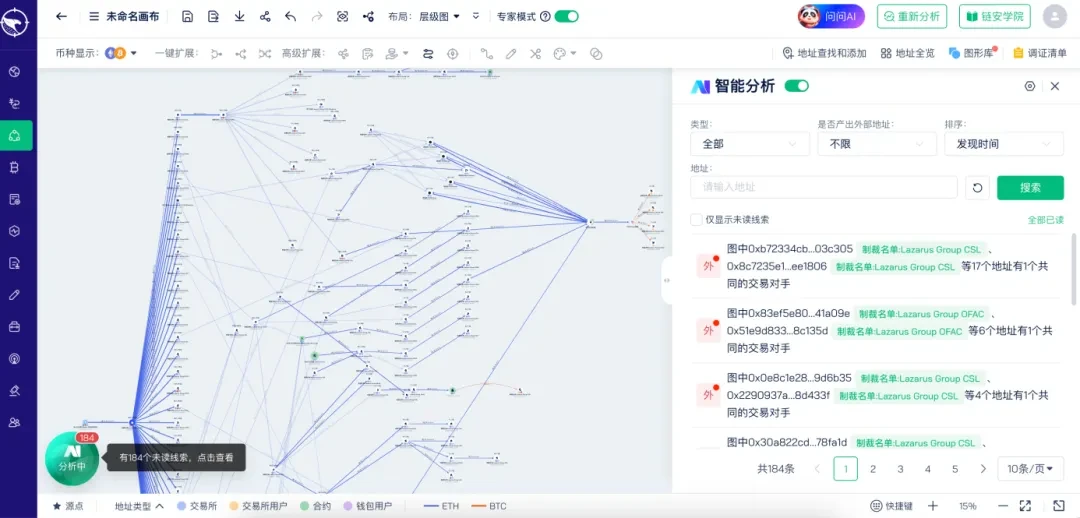

Regarding the financial security risks of stablecoins, their anonymity and cross-border convenience make them susceptible to illegal and suspicious activities such as terrorist financing, ransomware attacks, and dark web transactions, necessitating vigilance against the risks that may impact the development of stablecoins. Based on this, Beosin has proposed a targeted "source prevention - dynamic monitoring - precise governance" full lifecycle solution for Hong Kong, covering stablecoin smart contract security, on-chain monitoring of stablecoins, and KYT/KYA risk assessments, achieving AML monitoring and criminal intelligence analysis.

Finally, the report offers suggestions from the perspectives of industry self-discipline, inter-departmental collaboration, and user education, assisting DAAMC in promoting the construction of a compliant ecosystem for stablecoins in Hong Kong.

Chapter 1: Concept and Development Trends of Stablecoins

1.1 Definition and Classification of Stablecoins

Stablecoins are digital assets that are pegged to real-world assets (such as fiat currencies, gold, commodities, or real estate) to maintain a relatively stable value. In the field of digital assets, stablecoins have been widely used for trading, payments, and value storage, becoming a bridge between traditional finance and digital finance.

Currently, multiple countries and regions are legislating or have already legislated in the field of stablecoins to clarify the definition of stablecoins and establish an issuer licensing system, providing legal certainty for market participants.

Hong Kong's regulatory framework clearly defines "Fiat-Referenced Stablecoins (FRS)," which refers to stablecoins whose value is fully referenced to one or more official currencies, accounting units designated by the Monetary Authority, or forms of economic value storage, or their combinations, to maintain stable value. The U.S. "GENIUS Act" defines stablecoins as digital assets used as a means of payment or settlement tool, requiring issuers to maintain stable value relative to fixed currencies.

The implementation methods of stablecoins determine their operational models, regulatory difficulties, and risk levels within the financial system. In addition to fiat-collateralized stablecoins, there are other types of stablecoins in the blockchain ecosystem that anchor the value of the U.S. dollar.

Table 1-1 Classification of Stablecoins

1.2 Introduction to the Top 10 Stablecoins by Global Market Capitalization

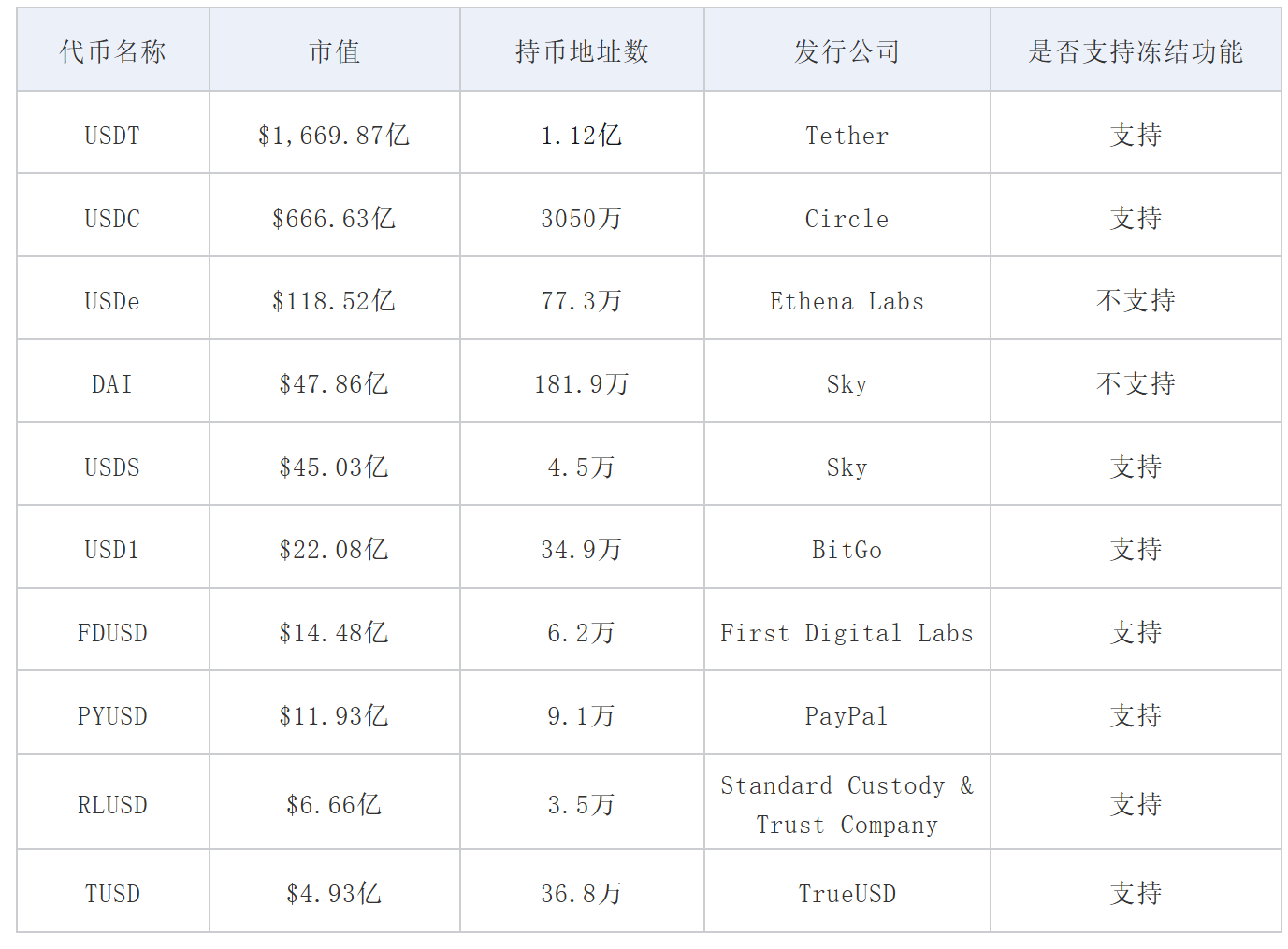

Stablecoins have a development history of over 10 years. Since the issuance of USDT in 2014, the stablecoin market has developed rapidly, with fiat-collateralized stablecoins occupying a leading position in the market. As of August 20, 2025, according to statistics from DefiLlama, the total circulating market capitalization of stablecoins globally reached $277.5 billion, with the top ten stablecoins by market capitalization being:

Table 1-2 Overview of Top 10 Stablecoins

Data Source: https://defillama.com/stablecoins

In terms of market share, fiat-collateralized stablecoins account for over 83.46%, including USDT, USDC, USD 1, FDUSD, PYUSD, RLUSD, and TUSD, dominating the market. USDe, as a synthetic dollar stablecoin, has gained attention and recognition in the crypto market by generating stablecoin yields through arbitrage trading of mainstream digital assets like ETH on centralized exchanges, becoming the third-largest stablecoin.

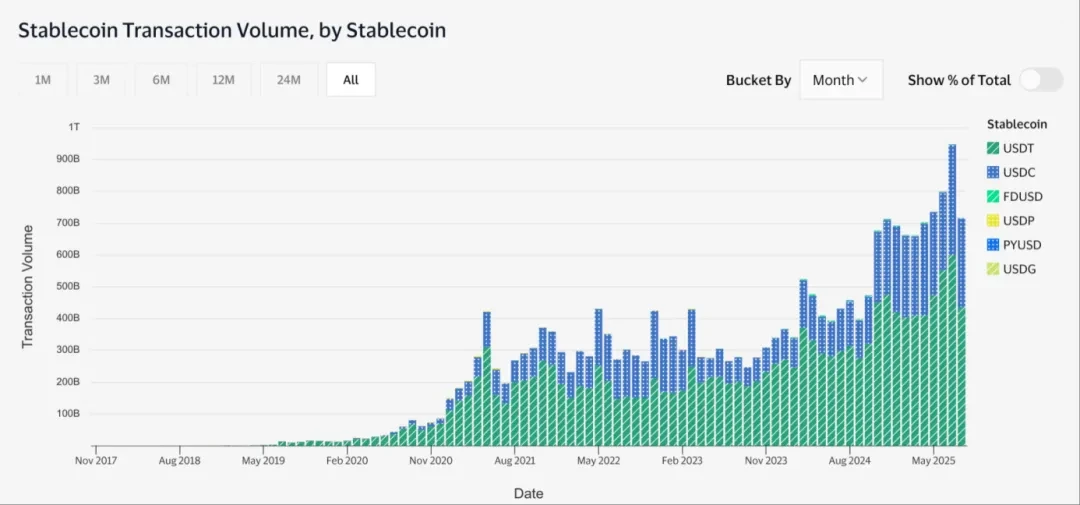

On the on-chain trading data level, the trading frequency of stablecoins shows an upward trend. According to Visa's statistics, the total trading volume of stablecoins exceeded $27.6 trillion in 2024, with an effective trading volume of $5 trillion. USDT has consistently been the most traded stablecoin, followed by USDC, together accounting for over 90% of stablecoin trading data.

Figure 1-1 Monthly Trading Volume of Stablecoins

Data Source: Transactions | Visa Onchain Analytics Dashboard

Note: Effective Transaction Volume excludes trades by bots, internal transactions of smart contracts, internal exchange trades, and trades by high-frequency traders.

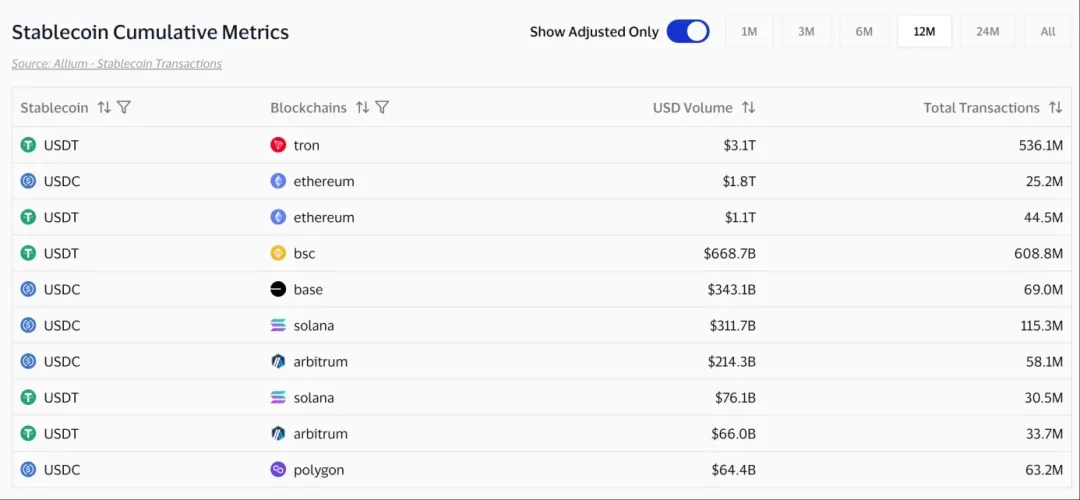

In the past year, USDT based on the TRON network has seen significant growth, with circulating USDT exceeding $82.6 billion, surpassing Ethereum to become the blockchain network with the largest circulation of USDT. BSC (also known as BNB Chain) has experienced a surge in trading volume due to Binance's support for free withdrawals of stablecoins to the BSC network, making it the blockchain network with the highest number of stablecoin transactions in the past year.

Figure 1-2 Annual Trading Volume and Number of Transactions of USDT and USDC on Mainstream Chain Platforms

Data Source: Transactions | Visa Onchain Analytics Dashboard

The trading volume and number of transactions of stablecoins on networks such as Base, Solana, Arbitrum, and Polygon are also noteworthy. As shown in the above figure, although Ethereum remains the primary blockchain network for the circulation and trading of stablecoins, blockchains with lower transaction costs and faster speeds are becoming new choices for businesses and ordinary users to use stablecoins.

1.3 Main Application Scenarios of Stablecoins

In July 2025, the International Monetary Fund analyzed the effective trading volume (Adjusted Transaction Volume) of stablecoins totaling $2 trillion across six chains: Ethereum, Binance Smart Chain, Optimism, Arbitrum, Base, and Linea, to assess the global liquidity of stablecoins.

The research report shows that the largest liquidity scale of stablecoins is in North America, reaching $633 billion, followed by the Asia-Pacific region with $519 billion; in terms of the proportion of stablecoin liquidity relative to GDP, Latin America and the Caribbean account for 7.7%, while Africa and the Middle East account for 6.7%. Emerging markets (such as Latin America and the Caribbean, Africa, and the Middle East) use stablecoins more frequently due to capital controls and unstable fiat currencies, primarily for cross-border flows, with stablecoin liquidity accounting for only 12%-14% within the region.

From the above data, it can be seen that stablecoins have become an indispensable role in the global financial ecosystem, with the main application scenarios as follows:

- Cross-Border Remittances and Settlements

Traditional cross-border remittances rely on the SWIFT system, requiring multiple intermediaries such as banks and correspondent banks, which leads to issues such as slow speed, high costs, and low transparency. Stablecoins, based on blockchain technology, have rebuilt an efficient and low-cost global payment network through "peer-to-peer" transactions.

- Daily Consumption

Southeast Asian ride-hailing platform Grab has supported users in Singapore and the Philippines to recharge digital assets like USDC and USDT into GrabPay, which can be used for daily payment scenarios such as rides, food delivery, and coffee purchases.

E-commerce platform Shopify supports the integration of Solana Pay, allowing users to complete payments using USDC on the Solana chain. As of May 2025, over 2000 Shopify merchants have supported Solana Pay.

- Value Storage and Financial Management

The "value stability" characteristic of stablecoins makes them the "base currency" of the digital asset market, meeting the demand for hedging while also deriving rich financial scenarios due to their technological characteristics, becoming a bridge connecting traditional finance and digital finance.

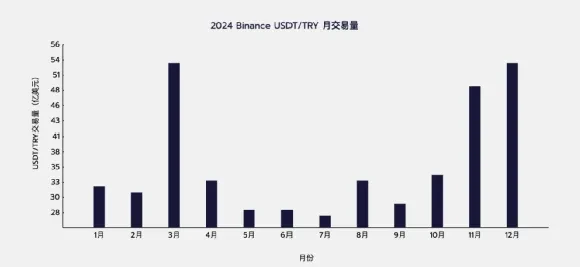

In countries with high inflation of their fiat currencies (such as Argentina and Turkey), local residents choose to exchange their fiat currencies for stablecoins like USDT (pegged to the U.S. dollar) to resist the depreciation of their fiat currencies. For example, in Turkey, due to long-term high inflation and currency depreciation issues, the adoption rate of local stablecoins and mainstream digital assets continues to rise. In 2024, the total trading volume of USDT/TRY (Turkish Lira) on Binance, the world's largest digital asset exchange, exceeded $43.82 billion.

Figure 1-3 Trading Volume of USDT Stablecoin Exchange with Turkish Lira on Binance in 2024

Data Source: https://www.tradingview.com/symbols/USDTTRY/

In addition to resisting fiat currency depreciation, stablecoins can also be used for financial management. In the decentralized finance (DeFi) sector, stablecoin holders can choose to deposit stablecoins into decentralized lending protocols (such as Aave) to earn interest from borrowers, with annualized returns determined by market demand; or provide liquidity for trading pairs like USDT-USDC on decentralized exchanges like Uniswap to earn trading fees.

1.4 The Rise of Stablecoins and Regulatory Trends

2025 is hailed as the "Year of Stablecoins," as stablecoins transition from being marginal tools in digital asset trading to the global financial mainstream stage. As a type of digital asset pegged to fiat currencies or commodities, stablecoins demonstrate disruptive potential not only in cross-border payments, supply chain finance, and asset tokenization due to their price stability, low transaction costs, and efficient settlement, but also become a new focus of competition in global financial infrastructure.

However, alongside its rapid development, stablecoins have also brought many potential risks, including challenges to monetary policy, financial stability, consumer protection, and illegal financial activities such as money laundering and terrorist financing. International financial institutions have maintained a high level of concern regarding the risks associated with stablecoins. For example, the Bank for International Settlements (BIS) issued a stern warning in its report about the performance of stablecoins as widely used currencies, pointing out their lack of central bank backing, insufficient measures to prevent illegal use, and deficiencies in generating loans in terms of funding flexibility. The BIS report indicates that the anonymous holding characteristics of stablecoins may help conceal "dirty money" and face the risk of rapid redemptions by investors, potentially undermining monetary sovereignty and triggering capital flight from emerging economies.

In response to the technical challenges and systemic risks posed by the high liquidity, cross-border convenience, and anonymity of stablecoins and other digital assets, the Financial Action Task Force (FATF) recommended in 2019 extending the travel rule to digital asset service providers, requiring them to adhere to transfer standards consistent with those of banks. According to the travel rule, digital asset transactions exceeding a certain threshold (usually $1,000) must be reviewed through KYC and due diligence procedures.

Countries and regions have gradually advanced regulatory frameworks related to digital assets based on the recommendations and guidelines issued by the FATF, covering aspects such as digital asset trading service providers, stablecoins, and digital asset custody. The year 2025 became a "watershed" for global stablecoin regulation, with the U.S. and Hong Kong respectively launching the "GENIUS Act" and the "Stablecoin Ordinance," while most provisions of the EU's "MiCA Act" also came into effect in 2025. Countries like Japan and South Korea began evaluating the issuance of their fiat-pegged stablecoins, and the global regulatory framework for stablecoins gradually became clearer.

Chapter 2: Research on Stablecoin Policies

2.1 Analysis of Hong Kong's Stablecoin Regulatory Policy

Hong Kong has clearly expressed its strategic goal of becoming a global leading center for digital asset innovation and investment. To achieve this vision, Hong Kong emphasizes the establishment of a robust and appropriate regulatory environment, viewing it as a prerequisite for the sustainable and responsible development of the stablecoin ecosystem. This strategy is based on its inherent advantages as an international offshore financial center, including a comprehensive financial infrastructure in areas such as cross-border payments, asset management, clearing, and custody.

Hong Kong's linked exchange rate system provides a high degree of stability for the Hong Kong dollar, creating a solid monetary foundation for issuing stablecoins denominated in Hong Kong dollars and backed by fiat currency reserves. This strategic integration of digital assets into the existing financial infrastructure and monetary system indicates that Hong Kong does not view digital assets as a completely independent domain but strives to integrate them into the established financial ecosystem. The stability of the Hong Kong dollar provides a credible anchor for stablecoins, allowing Hong Kong to stand out when competing with jurisdictions that have underdeveloped financial infrastructures or high volatility in fiat currencies.

2.1.1 Regulatory Policy Goals and Guiding Principles

The core goal of Hong Kong's stablecoin regulatory system is to prevent potential risks that fiat-referenced stablecoins (FRS) may pose to monetary policy, financial stability, and investor protection. Its guiding principle is "same activity, same risk, same regulation," which runs throughout the "Stablecoin Ordinance," aiming to ensure that regulatory requirements meet international standards while being tailored to local conditions in Hong Kong. This approach aims to promote the healthy and orderly development of the digital asset market.

The regulatory framework also pays special attention to the unique challenges posed by stablecoins, such as their anonymity and convenient cross-border usage, which may increase the risks of anti-money laundering (AML) and counter-terrorism financing (CFT). The combination of the "same activity, same risk, same regulation" principle with a clear understanding of the unique risks associated with stablecoins (such as anonymity and cross-border nature) reflects the maturity of Hong Kong's regulatory philosophy. This is not simply a matter of transplanting existing rules into the digital asset space but involves tailored adjustments based on the unique technological characteristics of digital assets while acknowledging their functional equivalence to traditional financial instruments. This meticulous approach aims to prevent regulatory arbitrage and ensure effective mitigation of emerging risks. If the functions of stablecoins are similar to those of traditional financial instruments (such as payment and value storage), they should be subject to similar regulations to fill potential regulatory gaps. However, their technological characteristics (such as distributed ledger technology and potential anonymity) introduce new risks that traditional rules do not fully cover. Therefore, the Monetary Authority must adjust based on existing principles and introduce new measures (such as strict AML/CFT requirements for distributed ledger technology) to achieve comprehensive regulation.

2.1.2 Definition of Regulatory Scope

- Clear Definitions: "Fiat-Referenced Stablecoins (FRS)"

Hong Kong's regulatory framework has clearly defined "stablecoins" and "fiat-referenced stablecoins (FRS)" to ensure precision and effectiveness in regulation.

Definition of "Fiat-Referenced Stablecoins (FRS)": FRS refers to stablecoins whose value is fully referenced to one or more official currencies, accounting units designated by the Monetary Authority, or forms of economic value storage, or their combinations, to maintain stable value. Currently, the scope of "designated stablecoins" is limited to fiat-referenced stablecoins. The regulatory framework covers FRS that reference a single currency and those that reference multiple currencies.

The Monetary Authority focuses its main regulatory efforts on FRS, reflecting a risk-based regulatory strategy. FRS, particularly those pegged to major fiat currencies, are considered to pose the most direct and significant risks to monetary and financial stability due to their widespread adoption potential as payment means and their direct connection to the traditional financial system. In contrast, stablecoins pegged to commodities (such as gold) or other digital assets typically have narrower use cases and smaller direct systemic impacts. By prioritizing the regulation of FRS, the Monetary Authority first addresses the most pressing regulatory needs while retaining the flexibility to expand the regulatory scope as the market evolves.

- Licensing Requirement: Stablecoin Activities Must Apply for Licenses

In Hong Kong, any entity engaging in any of the "regulated stablecoin activities" must obtain a license from the Monetary Authority in advance: issuing designated stablecoins while conducting business in Hong Kong, issuing designated stablecoins pegged to the Hong Kong dollar outside of Hong Kong, and actively promoting the issuance of their fiat-referenced stablecoins to the public in Hong Kong.

The determination of "active promotion" is based on a comprehensive assessment, including marketing language (especially the use of Chinese), whether it targets Hong Kong residents, whether it uses Hong Kong domain names, and whether there is a detailed marketing plan. "Issuing" or "minting" typically refers to the initial recording and allocation of stablecoins on a distributed ledger to digital wallet addresses. The determination of "issued in Hong Kong" also takes a comprehensive approach, considering factors such as the location of daily management and operations, registration location, minting and destruction locations, reserve asset management locations, and the location of bank accounts handling cash flows.

- Treatment of Algorithmic Stablecoins: De Facto Exclusion

Hong Kong's regulatory framework takes a de facto exclusionary stance towards algorithmic stablecoins. Due to the lack of actual reserve asset support, algorithmic stablecoins will not meet the Monetary Authority's strict reserve asset-related licensing conditions for FRS issuers. Although algorithmic stablecoins may technically meet the definition of "designated stablecoins," their inability to meet minimum standards, particularly reserve requirements, effectively prevents them from obtaining licenses.

This de facto exclusion of algorithmic stablecoins, despite their theoretical inclusion in the definition of "designated stablecoins," represents a strong prudential stance. It reflects the global consensus among regulators following the Terra/Luna incident that unsupported or under-collateralized stablecoins pose unacceptable systemic risks, thereby prioritizing stability and investor protection over speculative innovation. The Monetary Authority's approach aligns with international standards (such as those from the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision (BCBS)), which emphasize that stablecoins used for payments must have adequate reserve support. By setting strict reserve requirements, the Monetary Authority effectively filters out inherently unstable algorithmic models, indicating a cautious attitude towards innovation while prioritizing financial stability.

2.1.3 Licensing System for Fiat-Referenced Stablecoin Issuers

The core of Hong Kong's stablecoin regulatory system is a mandatory licensing framework that imposes strict requirements on fiat-referenced stablecoin (FRS) issuers. The "Stablecoin Ordinance" establishes a "license-first" or "closed-loop" regulatory model that emphasizes prior authorization. This model is generally stricter than the "post-compliance" paths in some other jurisdictions. The Monetary Authority is the primary regulatory body, with comprehensive functions for licensing, auditing, revoking licenses, and issuing operational guidelines. The Monetary Authority has the authority to establish a "designated stablecoin list" and prohibit unauthorized stablecoins from circulating or being used for payments in Hong Kong.

The "license-first" approach, combined with the Monetary Authority's broad discretion (including the establishment of the "designated stablecoin list"), indicates that Hong Kong's regulatory environment is highly controlled and centralized. This contrasts with more lenient or decentralized regulatory concepts, reflecting Hong Kong's emphasis on prudent regulation and market integrity from the outset. By requiring prior authorization, the Monetary Authority can review the business models, financial soundness, and control systems of stablecoins before they enter circulation, significantly reducing risks. The "designated stablecoin list" provides a dynamic market control tool, allowing the Monetary Authority to respond swiftly to emerging risks or non-compliant entities by restricting market access.

Obtaining and maintaining a stablecoin issuer license in Hong Kong requires meeting a series of strict conditions and ongoing regulatory requirements designed to ensure the issuer's sound operation and protection of stablecoin holders.

- Mandatory Requirements for Company Status and Local Presence

FRS issuers must be companies registered in Hong Kong. The senior management team and key personnel must reside in Hong Kong. Non-Hong Kong registered companies (except for institutions recognized and prudently regulated by Hong Kong) must establish a subsidiary in Hong Kong to apply for an FRS issuer license.

- Minimum Financial Resources and Capital Adequacy Ratio

FRS issuers must meet minimum financial resource requirements. The minimum paid-up capital requirement is HKD 25,000,000. The Monetary Authority reserves the right to impose additional capital requirements when necessary. Retaining the discretion to impose additional capital conveys a flexible yet firm risk management attitude. While maintaining adequate capital buffers is crucial for financial stability, excessively high initial capital requirements may stifle innovation and hinder new entrants. This reflects a nuanced consideration of ensuring sufficient financial support while encouraging participation, acknowledging that the stablecoin market is still in its early stages.

- Comprehensive Reserve Asset Management and Custody

FRS issuers must establish effective stabilization mechanisms. The total market value of reserve assets must at all times be no less than the total face value of circulating FRS (i.e., fully backed). Issuers should also consider the risk profile of reserve assets and ensure appropriate over-collateralization to provide a buffer. Reserve assets must be high-quality, highly liquid assets (e.g., bank deposits denominated in reference currencies). Reserve assets must be held in the same reference currency as the stablecoin, and the reserve assets for each stablecoin must be strictly separated from the issuer's other reserve pools and operational assets. Effective trust arrangements (e.g., appointing independent trustees or trust declarations) must be established to ensure that these assets are held for and in the interests of stablecoin holders.

The Monetary Authority will adopt a risk-based regulatory approach to assess the adequacy of reserve assets. The strict requirements for full backing of reserve assets, high liquidity, segregation, and sound trust arrangements are the cornerstones of Hong Kong's strategy for investor protection and financial stability regarding stablecoins. This effectively imposes "bank-like" prudential standards on stablecoin reserves, aimed at preventing liquidity crises and decoupling events that have occurred in more loosely regulated stablecoin models. Past failures of stablecoins often stemmed from insufficient reserves, poor liquidity, commingling of funds, or inadequate legal protections for holders. By imposing these strict requirements, the Monetary Authority directly addresses these vulnerabilities, ensuring that stablecoin holders have clear and enforceable rights to their underlying assets and that the peg of the stablecoin can be maintained even under stress.

- Robust Redemption Mechanism and Timeliness Standards

Holders of FRS must be able to redeem stablecoins at face value in a timely manner, without incurring undisclosed or disproportionate fees, or having to meet unreasonable redemption conditions. Redemption requests must be fulfilled within one business day of receipt. If the issuer anticipates difficulty in meeting redemption requests within one business day (for example, due to unforeseen market pressures), prior approval from the Monetary Authority should be sought.

The "one business day" redemption standard sets a very high threshold for the operational efficiency and liquidity management of FRS issuers. This directly addresses the inherent "run" risk of stablecoins, aiming to maintain confidence and prevent systemic contagion. The ability for rapid redemptions is crucial for maintaining the peg of stablecoins and preventing panic redemptions. By setting a strict one-day standard, the Monetary Authority compels issuers to maintain highly liquid reserves and sound operational processes, minimizing the risk of liquidity mismatches that could lead to instability in stablecoins.

- Requirements and Impacts on Ordinary Users

For digital asset wallet holders or ordinary users considering entering the stablecoin market, there are several points to note under Hong Kong's stablecoin regulations:

(1) KYC/AML Requirements

Users must complete real-name authentication when using regulated stablecoin issuers or related platforms (exchanges, custodial wallets) in Hong Kong.

(2) Source of Funds Review

Cross-border large transfers or frequent transactions may trigger anti-money laundering reviews.

(3) Restrictions on Stablecoin Use and Trading

In Hong Kong, the future use and trading of stablecoins may be subject to strict licensing requirements, and according to HKMA's requirements, the licensed stablecoins held by users can be redeemed at any time. Before the introduction of the Hong Kong OTC Act, ordinary users can still trade USDT and USDC on licensed digital asset trading platforms in Hong Kong (e.g., HashKey, OSL). However, under the future Hong Kong OTC licensing system, it is currently uncertain whether ordinary users will be able to trade unlicensed stablecoins like USDT and USDC.

(4) Taxation Requirements

Hong Kong currently does not impose capital gains tax, and buying and selling stablecoins themselves are generally not taxed, but commercial uses (e.g., payments, salary settlements) must be reported for tax purposes.

2.1.4 Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) Framework

- Adherence to International Standards: FATF Recommendations and "Travel Rule"

Hong Kong actively adopts international standards in AML/CFT, particularly the recommendations of the Financial Action Task Force (FATF). The updated anti-money laundering framework in Hong Kong, including regulations for virtual asset service providers (VASPs), aligns with FATF and its Recommendation 16—"Crypto Travel Rule." The travel rule applies to all digital asset transfers exceeding HKD 8,000 (approximately USD 1,000). VASPs are given a six-month window to comply with the travel rule, allowing for gradual integration and avoiding business disruptions.

Hong Kong's active implementation of FATF Recommendation 16 (the travel rule) demonstrates its commitment to global AML/CFT standards and its ambition to be a responsible leader in the field of digital asset regulation. This alignment helps facilitate cross-border interoperability and reduces the risk of being perceived as a weak link in the global financial crime prevention network. The travel rule requires financial institutions and VASPs to transmit information about the originator and beneficiary during digital asset transfers, similar to traditional wire transfers. By adopting this rule, Hong Kong enhances traceability, reduces anonymity, and addresses the AML challenges posed by the cross-border and potentially anonymous nature of stablecoins. This strengthens Hong Kong's position as a compliant jurisdiction, which is crucial for attracting legitimate digital asset businesses.

- Risk-Based Approach (RBA) for Money Laundering/Terrorism Financing Assessment and Mitigation

Licensees must adopt a risk-based approach (RBA) when designing and implementing AML/CFT policies and procedures. A money laundering/terrorism financing risk assessment must be conducted at the institutional level, considering risks related to customers, countries, products, and delivery channels. The assessment must be properly documented, approved by senior management, and kept up to date. For lower-risk situations, the system can be simplified, but it cannot be simplified when there are suspicions of money laundering/terrorism financing.

The use of RBA allows for flexible and proportionate AML/CFT measures, adjusting controls based on the specific risk characteristics of the issuer's business model and customer base. This avoids a "one-size-fits-all" approach that may impose excessive burdens on low-risk activities while ensuring sufficient rigor for high-risk activities. The money laundering/terrorism financing risks associated with stablecoin activities can vary significantly. RBA allows issuers to allocate resources effectively, focusing on high-risk areas. This also reflects international best practices in AML/CFT, promoting effective risk mitigation without stifling legitimate innovation.

- Wallet Management and Enhanced Customer Due Diligence (CDD)

Licensees must properly manage the AML/CFT risks associated with the wallets used by their customers for stablecoin transactions. Customer wallet addresses must be identified, and ownership must be verified through methods such as micro-payments, message signature tests, or obtaining evidence from custodial wallet providers.

For self-custodial wallets provided by custodial wallet providers or used by financial institutions/VASPs, due diligence measures include collecting owner information, assessing their reputation and AML/CFT quality, and evaluating the adequacy of their control measures.

The detailed requirements for wallet management and CDD, including wallet ownership verification and due diligence on custodial providers, directly address the challenges posed by pseudonymity in digital asset transactions. This is a key step in bridging the gap between blockchain anonymity and the need for financial transparency. One of the main AML challenges in the digital asset space is the ability to transact with "non-custodial wallets" without clear identification. By requiring verification of wallet ownership and due diligence on third-party wallet providers, the Monetary Authority mandates issuers to establish a clear link between stablecoin transactions and verified identities, significantly reducing anonymity risks and enhancing traceability.

- Ongoing Monitoring of Stablecoin Transactions and Strategies for Mitigating Illegal Activities

Licensees must monitor circulating stablecoins to prevent their use for illegal purposes, with the level of monitoring proportional to the money laundering/terrorism financing risks. Stablecoin transactions are recorded on the blockchain, providing traceability to identify illegal activities. Possible measures include using blockchain analysis technology to continuously screen transactions and wallet addresses, blacklisting sanctioned or illegal wallet addresses, and freezing stablecoins upon request from regulatory agencies/law enforcement. Unless the licensee can demonstrate the effectiveness of these measures to the Monetary Authority, the identity of each stablecoin holder must be verified by the licensee, a regulated financial institution/VASP, or a reliable third party.

The Monetary Authority has higher expectations for the effectiveness of blockchain analysis and blacklisting, and in the absence of proven effectiveness of anti-money laundering technologies, it defaults to requiring "identity verification for each stablecoin holder," indicating a highly conservative and risk-averse approach to emerging AML technologies. This means that relying solely on technological solutions may not be sufficient to meet Hong Kong's stringent AML standards, and manual verification remains crucial. While blockchain analysis provides promising tools for identifying illegal activities, the Monetary Authority acknowledges its limitations (e.g., difficulty in identifying ultimate beneficial owners, reliance on external data). By prioritizing direct identity verification, the Monetary Authority indicates that it will not compromise on fundamental AML principles, even while exploring technological advancements. Therefore, the current stablecoin ecosystem in Hong Kong has a robust "KYC" foundation.

2.2 Analysis of the U.S. Stablecoin Bill

2.2.1 Definition and Scope of "Payment Stablecoins"

The "GENIUS Act" primarily regulates a specific class of digital assets known as "payment stablecoins." These assets are typically defined as digital assets intended to serve as payment or settlement tools, with issuers obligated to redeem, repurchase, or exchange such assets at a fixed monetary value, and these assets are not considered national currency. A key aspect of the bill is the explicit statement that payment stablecoins issued by authorized issuers are not considered "securities" under U.S. federal securities laws, nor are they considered "commodities" under the Commodity Exchange Act. This legislative exemption aims to establish a clear regulatory path for compliant stablecoins, largely freeing them from direct oversight by the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

This clear definition primarily targets fiat-backed stablecoins that maintain a 1:1 peg. Therefore, algorithmic stablecoins that typically lack 1:1 reserve backing and rely on complex algorithms to maintain their peg may not qualify as "payment stablecoins" under this framework. This effectively excludes them from the regulatory "safe harbor" provided by the GENIUS Act's classification of securities/commodities, potentially leaving them still subject to existing securities or commodity laws.

The explicit exclusion of compliant payment stablecoins from the definitions of "securities" and "commodities" is a significant step in regulatory terms. This directly addresses one of the most important sources of regulatory uncertainty that has plagued the U.S. crypto industry for years. By clearly defining regulatory classifications, the bill places the regulation of these specific digital assets primarily under banking regulators rather than market regulators. This clarity aims to enhance the confidence of traditional financial institutions and businesses, encouraging them to use stablecoins for various purposes such as payments, cross-border transactions, and fund management. It also creates a unique segment within the broader digital asset market, where "payment stablecoins" are treated differently from other digital assets or tokenized assets, thereby establishing a more specialized and predictable regulatory environment for this specific asset class.

2.2.2 Core Prudential and Operational Requirements

- Reserve Asset Management

Authorized Payment Stablecoin Issuers (PPSIs) are strictly required to maintain at least a 1:1 reserve to support their circulating payment stablecoins. Eligible types of reserve assets include: U.S. coins and paper currency (including Federal Reserve notes), deposits at custodial institutions or foreign deposit institutions, short-term government securities with a remaining maturity of 93 days or less, repurchase agreements collateralized by short-term government securities, certain reverse repurchase agreements, money market funds that invest solely in the above eligible assets, and central bank reserve deposits. Notably, the bill does not grant major federal regulatory agencies the authority to expand the list of eligible reserve assets, even if they believe other assets have sufficient liquidity.

Reserve assets may not be pledged, re-pledged, or reused, except for the purpose of providing liquidity to meet reasonably anticipated stablecoin redemption requests. In this case, short-term government securities may be pledged as collateral for repurchase agreements, but these repurchase agreements must be cleared by an approved central counterparty or receive prior approval from the relevant regulatory agency. Reserve assets must be held by qualified third-party custodians and strictly segregated from the issuer's operating funds. Issuers must also publicly disclose the total amount of circulating payment stablecoins and the amount and composition of reserve assets on their website each month. Monthly reports must be reviewed by a registered accounting firm, and the CEO and CFO must certify the accuracy of the reports, with intentional false certification facing criminal penalties.

The strict limitations on reserve assets in the "GENIUS Act" are primarily confined to U.S. dollar-denominated assets and U.S. Treasury securities, which is not coincidental. This provision explicitly supports the dominant position of the U.S. dollar in the global digital economy and brings sustained demand for the U.S. Treasury market. This stands in stark contrast to Hong Kong's more flexible approach to reserve assets, reflecting the deep consideration of the U.S. in regulating stablecoins as a national economic strategy.

- Redemption Mechanism and Activity Restrictions

All authorized payment stablecoin issuers must establish procedures for "timely" redemption of circulating payment stablecoins and publicly disclose their redemption policies. The business activities of PPSIs are strictly limited, typically confined to issuing and redeeming payment stablecoins, managing related reserves, providing custodial and safekeeping services, and other activities directly supporting these functions. The act also prohibits "tying" practices, which condition the provision of services on customers obtaining additional paid products or services from the issuer or any of its subsidiaries, or on customers agreeing not to obtain any paid products or services. Furthermore, stablecoin issuers are explicitly prohibited from offering any form of interest or yield to stablecoin holders. In the event of the issuer's bankruptcy, stablecoin holders have priority over all other creditors regarding their claims against the issuer.

- Capital, Liquidity, and Risk Management

Federal and state regulators are required to establish capital requirement rules tailored to the business models and risk profiles of payment stablecoin issuers, with a regulatory threshold of $10 billion. Issuers must possess the technical capabilities, policies, and procedures to block, freeze, and refuse illegal transactions and must comply with all applicable court orders. Regulators will also incorporate Bank Secrecy Act and sanctions compliance standards into their risk management requirements. For banks holding stablecoins on their balance sheets, current U.S. banking rules may require them to hold additional capital. The act also outlines a timeline for rulemaking and implementation by regulators: unless otherwise specified, relevant rules must be promulgated by July 2026. The effective date of the act is 18 months after its enactment or 120 days after the primary federal stablecoin regulatory agency issues final implementing regulations, whichever comes first, meaning the latest effective date is January 18, 2027.

- Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT) and Privacy Requirements

Under the "GENIUS Act," authorized payment stablecoin issuers are designated as "financial institutions" under the Bank Secrecy Act. This means they must comply with strict anti-money laundering (AML), customer identification (KYC), and transaction monitoring requirements. They are also required to submit suspicious activity reports (SARs) to the Financial Crimes Enforcement Network (FinCEN) and comply with sanctions regulations from the Office of Foreign Assets Control (OFAC). In terms of privacy protection, the privacy requirements of the Gramm-Leach-Bliley Act apply to most authorized payment stablecoin issuers.

The comprehensiveness of the U.S. AML/CFT framework, including KYC, transaction monitoring, suspicious activity reporting, and sanctions compliance, will undoubtedly impose significant compliance costs on issuers. This may give companies with robust KYC, risk management, and regulatory change management processes a competitive advantage. This area is also a common point of strictness in both the U.S. and Hong Kong regulatory frameworks.

2.3 Comparative Analysis of Stablecoin Regulatory Frameworks in Hong Kong and the U.S.

2.3.1. Regulatory Philosophy and Strategic Goals

As Hong Kong's stablecoin licensing system is being initially refined, more market participants are beginning to compare it with the regulatory path in the U.S. There are certain differences in legal systems, financial positioning, and strategic goals between the two regions, which not only reflect the differing risk preferences of regulatory agencies but also their distinct strategic considerations regarding the future landscape of digital finance. The following analysis compares regulatory philosophies and strategic goals.

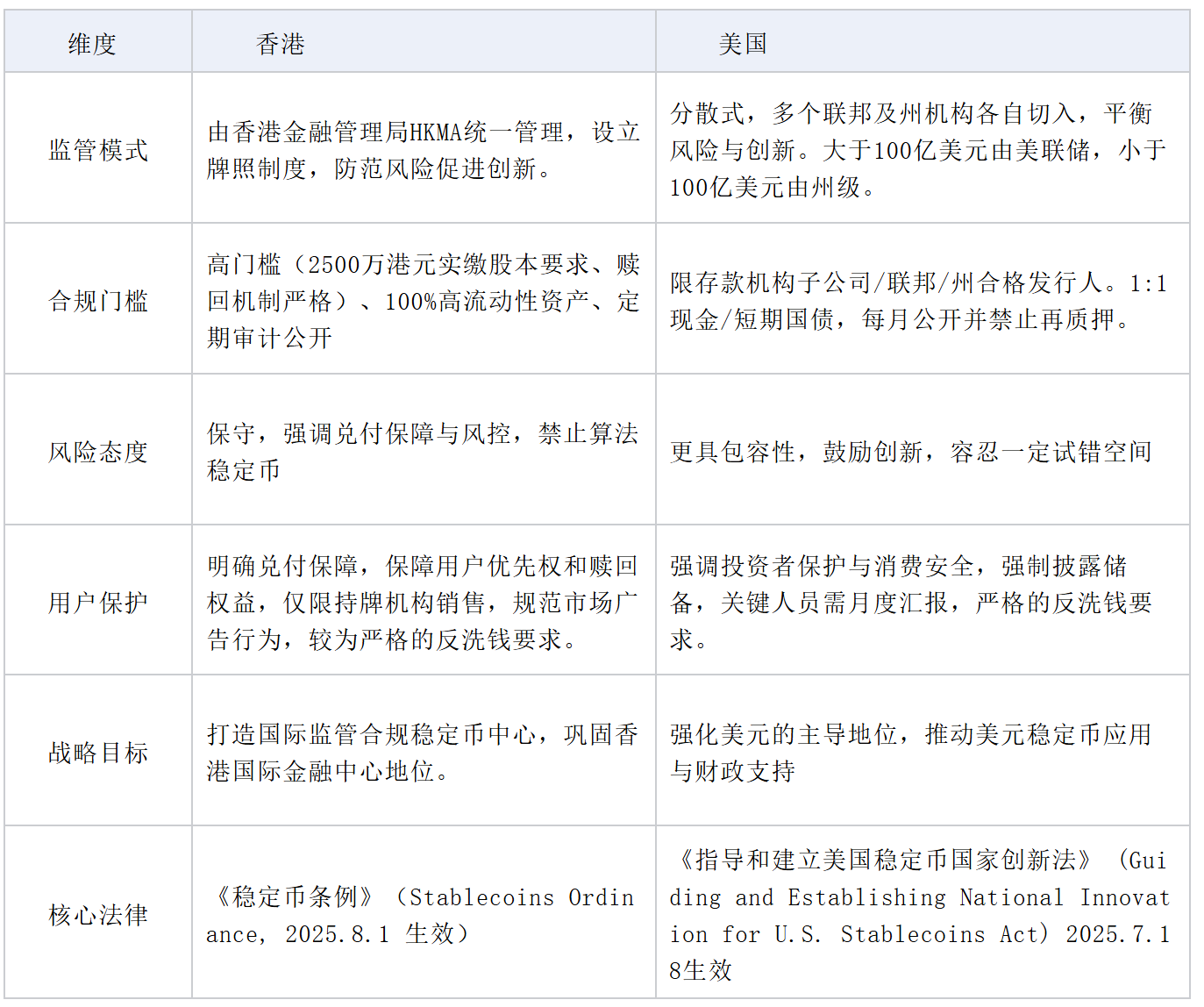

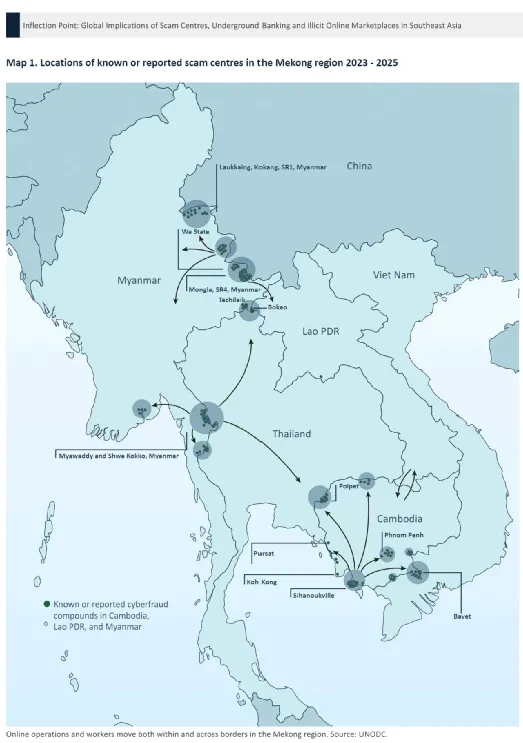

Table 2-1 Comparison of Regulatory Philosophies and Strategic Goals in Hong Kong and the U.S.

2.3.2. Regulatory Structure and Authority

The U.S. stablecoin regulatory system is characterized by a dual-track system, with a complex multi-tiered federal/state structure involving multiple federal banking regulatory agencies, such as the Federal Reserve, OCC, FDIC, and NCUA. Although a Stablecoin Certification Review Committee (SCRC) has been established to facilitate coordination, this multi-headed regulatory model may still lead to regulatory fragmentation.

In stark contrast, Hong Kong adopts a centralized regulatory model, with the Hong Kong Monetary Authority (HKMA) serving as the sole primary prudential regulator. This "one-stop" regulatory approach provides greater clarity and efficiency for market participants. For institutions wishing to enter the market, Hong Kong's centralized regulatory structure offers a clear path and transparent rules, contrasting with the complexity that U.S. issuers may face due to interstate and inter-federal agency interactions, potentially leading to a higher compliance burden.

2.3.3. Reserve Assets and Custodial Requirements

In terms of reserve assets, both the U.S. and Hong Kong adhere to the principle of 1:1 full backing, requiring stablecoins to be supported by high-quality, highly liquid assets. This is a common consensus in global stablecoin regulation.

However, there are significant differences in specific implementation. The U.S. "GENIUS Act" strictly limits the types of eligible reserve assets, primarily to U.S. dollars and short-term U.S. Treasury securities. Additionally, the act mandates that reserve assets must be held by qualified third-party custodians and strictly segregated from the issuer's operating funds. This stringent limitation reflects the U.S. policy consideration of using stablecoins to reinforce the dominance of the dollar and support the U.S. Treasury market. In contrast, while Hong Kong emphasizes the high quality and liquidity of reserve assets, it provides greater flexibility. Although asset segregation is also required, Hong Kong allows issuers to self-custody or entrust management to qualified institutions such as banks. This flexibility aims to balance prudent regulation with market innovation, allowing for a broader range of operational models while still ensuring asset safety.

2.3.4. Retail Investor Access and Consumer Protection

The U.S. "GENIUS Act" aims to establish federal safeguards to protect the interests of stablecoin holders and enhance public confidence in the payment stablecoin market. Its consumer protection measures are reflected in strict requirements for reserve assets, transparent disclosures, and redemption mechanisms. Hong Kong, on the other hand, has adopted a more stringent and detailed investor protection strategy, particularly for retail investors. According to the Stablecoin Ordinance, only stablecoins issued by licensed fiat stablecoin issuers authorized by the HKMA can be sold to retail investors. Furthermore, Hong Kong imposes strict restrictions on the advertising of stablecoins to prevent fraud and misleading statements. This protective strategy is more cautious, aiming to isolate retail investors from the risks associated with stablecoin investments.

2.3.5. Cross-Border Cooperation and Reciprocity Arrangements

In terms of cross-border cooperation, both the U.S. and Hong Kong recognize the importance of international coordination. The U.S. "GENIUS Act" authorizes the Treasury Secretary to establish reciprocity arrangements or other bilateral agreements with foreign jurisdictions that have "comparable" stablecoin regulatory regimes to facilitate international transactions and interoperability with U.S. dollar-denominated stablecoins. In Hong Kong, the HKMA has the authority to assess on a case-by-case basis whether to modify or waive certain minimum standards for applicants that are fully regulated in other jurisdictions. This is not an automatic mutual recognition but is based on prudent case-by-case review. Although both sides are committed to international cooperation, their differing reciprocity mechanisms may create friction in practice or require further bilateral agreements to achieve true seamless cross-border interoperability.

Despite both jurisdictions acknowledging the necessity of cross-border cooperation, the lack of an immediate, automatic mutual recognition framework poses a significant challenge to the global adoption of stablecoins. This means that issuers seeking to operate in both markets will face a dual compliance burden, which may hinder the seamless flow of stablecoins in cross-border trade and payments and limit their full potential. The future success of stablecoins as a global payment rail depends on the practical implementation and breadth of these reciprocity arrangements.

2.3.6. Comparison of AML/CFT Policy Requirements

Table 2-2 Comparison of AML Regulations in Hong Kong and the U.S.

2.4 Stablecoin Regulatory Policies in Other Countries and Regions

2.4.1 Singapore Stablecoin Regulatory Policy

The Monetary Authority of Singapore (MAS) released the "Stablecoin Regulatory Framework" in 2023, but this framework has not yet been legislated. In 2025, MAS plans to conduct public consultations on stablecoin legislation and draft amendments to formalize the "Stablecoin Regulatory Framework." Until the amendments are officially implemented, Singapore will regulate stablecoins under the existing "Payment Services Act" (PSA) and the "Stablecoin Regulatory Framework."

The PSA clarifies the definitions of stablecoins, entry thresholds, reserve assets, and stablecoin redemption, among other regulations. The subsequently released "Stablecoin Regulatory Framework" includes regulations for single-currency stablecoins issued in Singapore that are pegged to the Singapore dollar or G10 currencies, adding regulations regarding stablecoin issuance services to further protect the rights of stablecoin holders and reduce financial risks.

Under the "Stablecoin Regulatory Framework," the regulatory requirements that stablecoin issuers must follow include:

- Reserve Asset Requirements

- Composition: Cash/equivalents, low-risk bonds (government/central bank or AA-rated international institutions) with a remaining maturity of ≤3 months, ensuring the stability of asset value;

- Valuation: Daily marked to market, with a value ≥100% of the circulating SCS face value, to avoid redemption risks due to insufficient reserves;

- Custody: Segregated accounts must be held at custodians rated A- or above to prevent the misappropriation of reserve assets;

- Audit: Monthly independent audits + annual audits, reducing market trust risks through transparency.

- Capital Requirements

- Base Capital: ≥1 million SGD or 50% of annual operating expenses (whichever is higher), ensuring the issuer has sufficient financial strength to address operational risks;

- Solvency: Liquid assets ≥50% of annual operating expenses or the amount required for settlement (to be independently verified annually), ensuring orderly redemption even in extreme situations.

- Anti-Money Laundering Requirements

- Stablecoin issuers and intermediary services must strictly comply with AML/CFT regulations, including customer due diligence (CDD), transaction monitoring, and reporting of large and suspicious transactions.

It is noteworthy that Singapore's "Stablecoin Regulatory Framework" exhibits a "voluntary" characteristic, meaning stablecoin issuers can choose whether to apply to MAS for certification of their stablecoins as "MAS-regulated stablecoins." Those who do not choose this path can continue to operate as "digital payment tokens" under the PSA framework. The amendments that MAS is preparing may still adhere to the previous "voluntary" characteristics of stablecoin regulation, providing flexibility for different stablecoin issuers.

2.4.2 Japan Stablecoin Regulatory Policy

Japan has established a stablecoin regulatory system through the "Payment Services Act" (PSA), characterized by "issuer limitation + reserve transparency + full-process monitoring," emphasizing a balance between compliance and innovation. Its core logic is to incorporate stablecoins into the traditional financial regulatory framework, reducing money laundering risks through measures such as KYC, the travel rule, and asset segregation, while planning to enhance the market competitiveness of its stablecoins by allowing flexible reserve investments (e.g., permitting 50% allocation to government bonds).

According to the amendments effective June 2023, fiat-backed stablecoins are classified as "Electronic Payment Instruments" (EPI) and must comply with strict anti-money laundering (AML) and counter-terrorism financing (CFT) obligations. This system is designed to achieve a balance between compliance, financial stability, and innovative development.

- Core Requirements for Anti-Money Laundering

- Customer Identity Verification (KYC) and Transaction Record Keeping: Stablecoin issuers and intermediaries (such as exchanges) must verify users' identities, including name, address, identification documents, etc., and record the information of both parties in a transaction. For example, stablecoins issued by money transfer service providers have a transaction limit of 1 million yen per transaction, and KYC verification is required for the recipient.

- Transaction Record Keeping: User information and fund flows must be retained for at least five years.

- Suspicious Transaction Reporting (STR): If abnormal transactions are detected, they must be reported to the Japan Financial Intelligence Center (JAFIC), as failure to do so may result in criminal liability.

- Travel Rule: Starting from June 2023, the circulation of stablecoins across borders or between platforms must include the identity information of both the sender and the recipient to prevent anonymous fund flows.

- Regulatory Classification of Intermediaries and Businesses

Entities engaged in stablecoin trading, exchange, custody, etc., must register as Electronic Payment Instrument Service Providers (EPISP) with the Financial Services Agency (FSA) and meet capital adequacy, system security, and other requirements. For example, exchanges supporting stablecoin trading must undergo regular reviews by the Japan Virtual Asset Exchange Association (JVCEA).

- User Asset Protection and Bankruptcy Response

- Domestic Asset Retention Order: If the issuer or exchange goes bankrupt, the FSA can order that user assets be retained within Japan to prevent cross-border transfers. (This mechanism was practically applied during the bankruptcy of FTX's Japanese subsidiary in 2022, ensuring that user assets were not affected by overseas liquidation.)

- Reserve Preservation and Independent Audits: Issuers must fully back stablecoin issuance with demand deposits or highly liquid assets (such as government bonds), and the adequacy of reserves must be verified by a third-party auditing firm quarterly. For example, the first yen stablecoin, JPYC, expected to be approved by the Japanese Financial Services Agency in the fall of 2025, plans to publicly disclose reserve proof monthly and introduce hardware security modules (HSM) to manage private keys.

- International Standards and Cross-Border Cooperation: As a member of the FATF, Japan has fully implemented the "Travel Rule" and is engaged in stablecoin interoperability and cross-border compliance cooperation with South Korea, ASEAN, and the G20 mechanism. This strategy not only strengthens international consistency in AML/CFT but also promotes the compliant application of Japanese stablecoins in the global market.

2.4.3 South Korea's Stablecoin Regulatory Policy

- Legislative Implementation and Background

The "Virtual Asset User Protection Act" (VAUPA) was promulgated on July 18, 2023, and will officially take effect on July 19, 2024, marking South Korea's first regulatory approach to digital asset platforms through dedicated legislation. The draft "Digital Asset Basic Act," proposed on June 10, 2025, aims to further expand the regulatory scope, including clarifying the stablecoin issuance framework and regulatory standards. This reform stems from the market trust crisis caused by the collapse of Terra-Luna in 2022, with legislative intent to strengthen compliance foundations and risk control systems.

- Regulatory Agencies and Compliance Requirements

The Korea Financial Intelligence Unit (KoFIU) is responsible for the registration supervision and AML/CFT compliance review of digital asset service providers; the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) oversee market operations, user rights protection, and on-site enforcement.

- AML/CFT Regulatory Compliance Measures

South Korea implements highly detailed AML/CFT regulations for digital asset service providers. All digital asset service providers must register with KoFIU before conducting business and obtain ISMS (Information Security Management System) certification, as well as open accounts with financial institutions that support real-name bank accounts. If these requirements are not met, KoFIU may reject their registration application, and they cannot conduct any digital asset business before registration. Customer identity verification (KYC) and customer due diligence (CDD) are basic requirements; digital asset service providers must verify identities when users open accounts or when transactions reach 1 million won (approximately $700), and they must enhance due diligence for high-risk users. The Travel Rule has been in effect since March 25, 2022, requiring digital asset service providers to provide the names and wallet addresses of both the sender and recipient when a customer initiates a transfer of 1 million won or more to another digital asset service provider, and to submit identity information, including identification numbers, within three business days upon request from the registering party or authorities. Relevant records must be kept for five years, and violators may face fines of up to 30 million won. Suspicious transaction reporting (STR) and transaction monitoring systems are also mandatory. If abnormal transactions are detected, digital asset service providers must report to KoFIU or FSS.

- User Asset Protection Mechanisms

Asset Isolation Requirements: Digital asset service providers must keep user assets separate from the platform's own assets to prevent user property risks due to platform bankruptcy.

Bankruptcy Custody and Preservation Mechanisms: If a digital asset service provider goes bankrupt, the FSC/FSS can execute asset retention orders to ensure that user assets remain in South Korea, free from the impact of overseas liquidation.

Reserve Transparency and Audits: Stablecoin issuers must maintain sufficient backing of assets for stablecoin issuance, implement regular audits, and enhance the transparency of reserve asset disclosures.

- Strategic Trends and International Cooperation

The Bank of Korea will establish a "Digital Asset Task Force" in July 2025 to enhance policy response capabilities and track international trends in stablecoin regulation (such as the U.S. GENIUS Act) in preparation for subsequent legal institutionalization.

Prominent media reports indicate that the government plans to submit a "Phase Two" VAUPA tax proposal in October 2025, including stablecoin issuance, secure custody, and internal control mechanisms, to further improve the regulatory system.

2.4.4 UAE Stablecoin Regulatory Policy

The UAE divides token regulatory responsibilities among the Dubai Virtual Assets Regulatory Authority (VARA), the Abu Dhabi Financial Services Regulatory Authority (FSRA), and the Securities and Commodities Authority (SCA). In 2024, the Central Bank of the UAE issued the "Payment Token Services Regulations" (PTSR), formally regulating stablecoins.

Definition of Stablecoins: The Central Bank of the UAE clearly classifies stablecoins as "payment tokens." Payment tokens are digital assets that maintain stable value by being pegged to fiat currency or another payment token denominated in the same fiat currency.

Stablecoin Issuance: This includes dirham stablecoins and foreign currency stablecoins. Entities issuing dirham stablecoins must obtain a payment token issuance license issued by the Central Bank of the UAE. Key conditions include that the entity must be registered in the UAE under Federal Law No. 2 of 2015 concerning commercial companies; the issued stablecoins must be fully backed by independent reserve assets; and independent audits and financial disclosures must be conducted. Foreign entities issuing stablecoins pegged to currencies other than the UAE dirham must register with the Central Bank of the UAE as foreign payment token issuers. Additionally, foreign currency stablecoins are only allowed for digital asset trading and are not permitted for transactions involving goods and services, nor can they be used for local payments in the UAE.

Stablecoin Custody and Transfer: Obtain permission from the SCA or any local licensing authority to act as a digital asset service provider. Individuals providing custody services for digital assets can apply for a no-objection registration to execute the custody and transfer of stablecoins. Any other parties seeking to execute the custody and transfer of payment tokens must obtain a license from the Central Bank for stablecoin custody and transfer.

Licensed stablecoin service providers must meet the following requirements when conducting stablecoin custody and transfer or stablecoin exchange services:

If the average monthly value of stablecoin transfers initiated, facilitated, executed, guided, or received by the service provider as part of stablecoin services reaches 10 million dirhams or more, they must hold at least 3 million dirhams in regulatory capital;

If the average monthly value of payment token transfers initiated, facilitated, executed, guided, or received by the service provider as part of stablecoin services is less than 10 million dirhams, they must hold at least 1.5 million dirhams in regulatory capital.

Additionally, it should be noted that the "Payment Token Services Regulations" apply to individuals or legal entities providing "payment token services" in the UAE, but do not include financial free zones such as the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM). Currently, the Dubai Financial Services Authority (DFSA) has approved the use of USDC, EURC, and RLUSD in the Dubai International Financial Centre.

2.5 Chapter Summary

In summary, this chapter reveals the current international stablecoin regulatory differences and convergence trends in concepts, goals, and institutional design through a systematic comparison of the stablecoin regulatory frameworks in Hong Kong and the U.S., as well as a review of policies from other countries and regions (such as Singapore, Japan, South Korea, and the UAE).

First, in terms of regulatory philosophy and strategic goals, Hong Kong primarily emphasizes financial stability and systemic risk prevention as its primary objectives, highlighting licensing systems, reserve transparency, and comprehensive AML/CFT controls, reflecting a "risk-first" prudent model; the U.S., on the other hand, has recently attempted to establish a federal-level stablecoin regulatory framework through the "GENIUS Act" based on the horizontal application of the BSA, primarily aimed at safeguarding the core position of the dollar in the global payment system while gradually strengthening prudential requirements for issuers. Singapore's regulation of stablecoins reflects a balance between "encouraging innovation" and "risk prevention"; Japan's regulation is closer to the logic of traditional financial licenses, with banks and trust institutions as issuers; South Korea tends to focus on investor protection, emphasizing the compliance responsibilities of exchanges and issuers; the UAE adopts a "regulatory sandbox + segmented regulation" model, demonstrating strong institutional flexibility and a preference for attracting foreign investment.

Second, in terms of regulatory tools and institutional arrangements, Hong Kong has clearer definitions of the scope of stablecoins, requiring them to be pegged to fiat currencies and establishing stricter regulations regarding reserve asset custody, consumer redemption guarantees, and cross-border cooperation; the U.S. places more emphasis on functional orientation, particularly in AML/CFT (such as the Travel Rule, SAR/CTR reporting) and consumer protection, forming a multi-layered, multi-agency parallel regulatory policy. Other countries such as Singapore, Japan, and South Korea have also introduced AML/CFT obligations and investor protection measures within their regulatory frameworks, but the focus and openness of each country vary.

Based on the above analysis, the current regulatory paths for stablecoins in various countries and regions mainly reflect three types: the first type, represented by Hong Kong and Japan, emphasizes ex-ante regulation and financial stability; the second type, represented by the U.S., emphasizes a functional orientation, seeking a balance between compliance and market development; the third type, represented by Singapore and the UAE, is more flexible in regulation, promoting innovation through pilot programs and regulatory sandboxes. As stablecoins gradually embed themselves in cross-border payments and financial market infrastructure, there is a potential for gradual convergence among different jurisdictions in mechanisms for AML/CFT cooperation, reserve transparency, and cross-border mutual recognition.

Chapter 3 Financial Security Risks Faced by Stablecoins

3.1 Characteristics of Stablecoin Risks

Stablecoins, due to their anonymity, rapid cross-border transactions, and the complexity of regulatory environments, have been exploited by criminals in various scenarios, posing new challenges to financial order stability and social security. Their risk characteristics are mainly reflected in the following aspects:

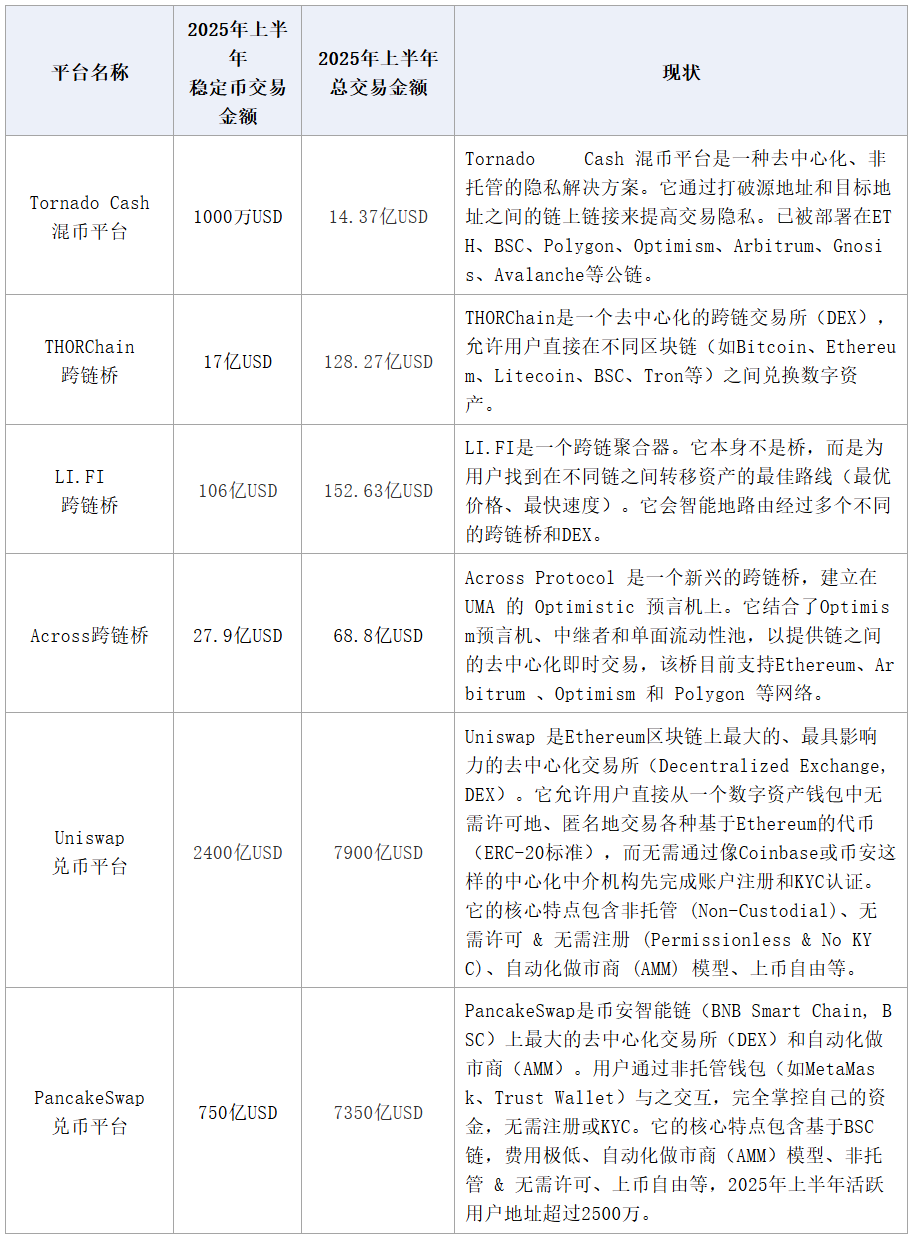

- Anonymity and Tracking Difficulties

Criminals exploit the anonymous addresses and complex transaction behaviors of stablecoins, increasing the difficulty of tracking. By splitting transactions, using mixing services (such as Tornado Cash), and transferring funds across blockchain bridges, they create complex paths of fund flow, making it difficult for regulatory agencies to trace the source and destination of funds. This technical characteristic provides a natural cover for illegal activities such as money laundering and terrorist financing.

- Risks of Algorithmic Stablecoins

Algorithmic stablecoins maintain price stability through smart contracts that dynamically adjust supply and demand (minting/burning mechanisms), but under extreme market pressure, this mechanism may fail, leading to severe price fluctuations or even de-pegging, triggering market and social risks. For example, the "UST collapse incident": The algorithmic stablecoin TerraUSD (UST) issued by the Terra ecosystem lost its 1:1 peg to the dollar due to market panic and massive withdrawals. The price of UST plummeted from $1 to $0.05 in a short time, causing the price of LUNA tokens to crash, with a market value evaporating by over $50 billion. This incident exposed the vulnerabilities of algorithmic stablecoins under structural defects, prompting global regulators to strengthen oversight of stablecoins.

- Smart Contract Vulnerabilities

If there are defects in the smart contract code or if malicious backdoors are implanted, it may lead to theft of funds or malicious manipulation. Common vulnerabilities include insufficient input validation, calculation errors, and lack of access control.

- Functional Deficiencies of Smart Contracts

Some stablecoin projects lack necessary control capabilities in their functional design, such as freezing functions and transaction limits, making it impossible to take timely action when suspicious transactions are detected.

- Abuse of Privacy-Enhancing Technologies

Privacy technologies such as zero-knowledge proofs (ZKP) can enhance transaction confidentiality but may also be used to completely anonymize transaction details, increasing tracking difficulties. Criminals use such technologies to hide transaction paths, creating a "technical black box" that makes it difficult for regulatory agencies to obtain effective information, resulting in compliance blind spots.

- Regulatory Arbitrage and Cross-Border Regulatory Risks

Stablecoin issuers often choose to register in regions with lax regulations, evading scrutiny through structural design and reducing operational costs. This regulatory arbitrage behavior may lead to ineffective local regulation, creating a transnational regulatory vacuum, posing significant challenges to international anti-money laundering (AML) and counter-terrorism financing (CTF) cooperation.

- Classification of Risk Activities

From the perspective of the social harm of events involving stablecoins, the risk activities associated with stablecoins mainly include:

Illegal Activities: Such as terrorist financing, human trafficking, drug trafficking, ransomware, fraud, identity theft, and impersonation scams.

Suspicious Activities: Such as dark web markets, unlicensed gambling, and the use of mixing services.

3.2 Risks of Illegal Activities

3.2.1 Terrorist Financing

On April 3, 2025, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) announced that it had added eight Tron wallet addresses associated with the Houthi movement in Yemen to the Specially Designated Nationals and Blocked Persons (SDN) list, accusing these addresses of participating in illegal financial activities using Tether (USDT).

According to the Treasury, this illegal financial network is controlled by Sa'id al-Jamal, a senior financial officer of the Houthi movement based in Iran. He has been designated as a global terrorist since 2021, and the network he leads involves procuring sensitive goods such as Russian weapons and stolen grain from Ukraine, transporting these materials to areas controlled by the Houthis.

On June 15, 2025, Tether, the issuer of USDT, froze 12.3 million USDT directly targeting the Houthi wallet addresses.

The Houthi case illustrates that digital assets have become an important tool for criminal activities such as terrorist financing and arms trading. Their anonymity, rapid settlement, and cross-chain characteristics provide criminals with loopholes to evade sanctions.

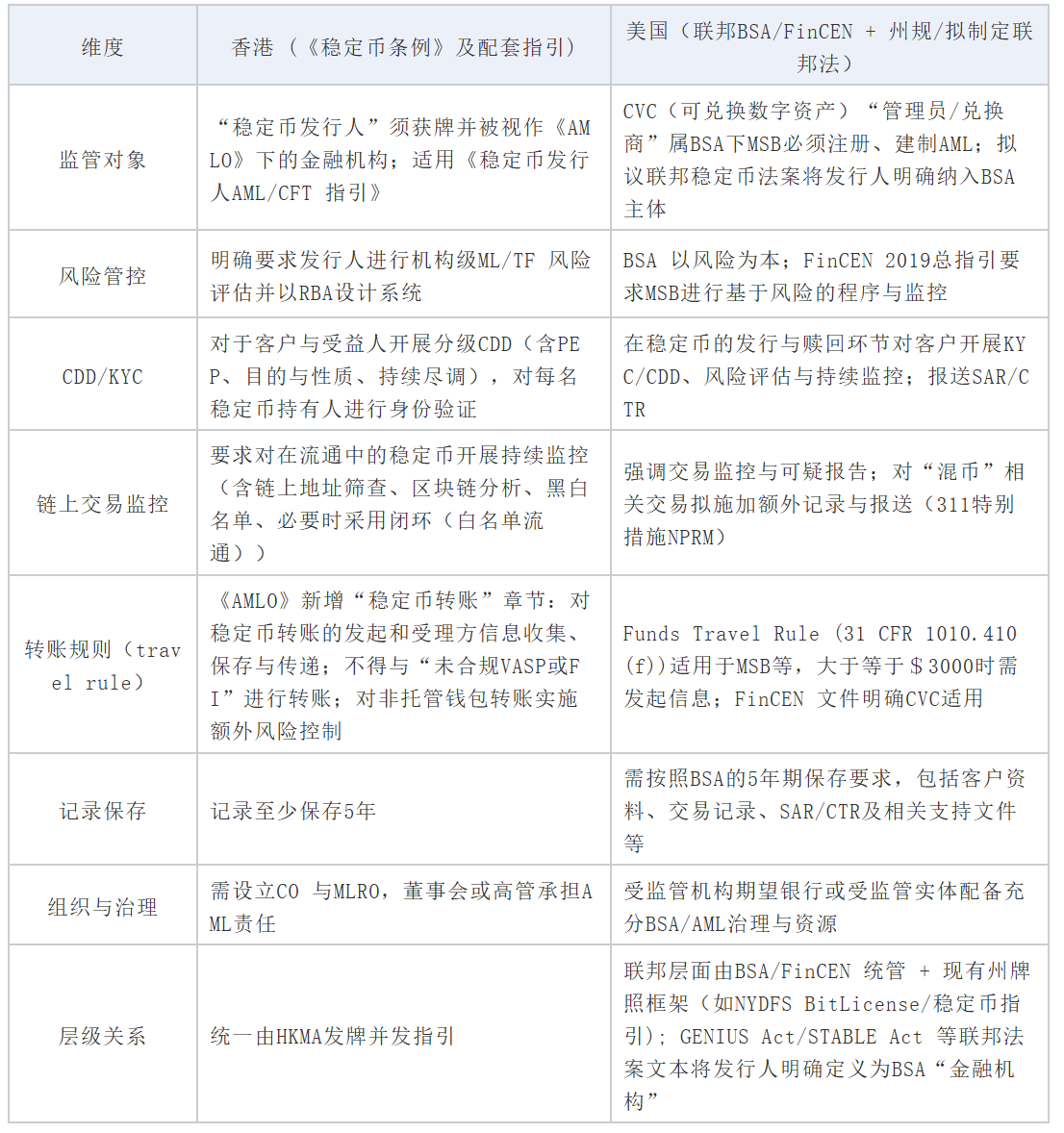

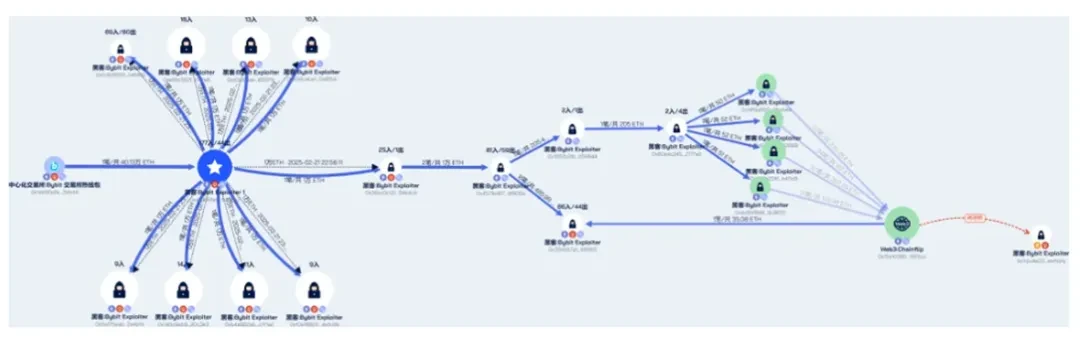

Figure 3-1 Schematic of Fund Flow in Terrorist Financing

3.2.2 Human Trafficking and Drug Trafficking

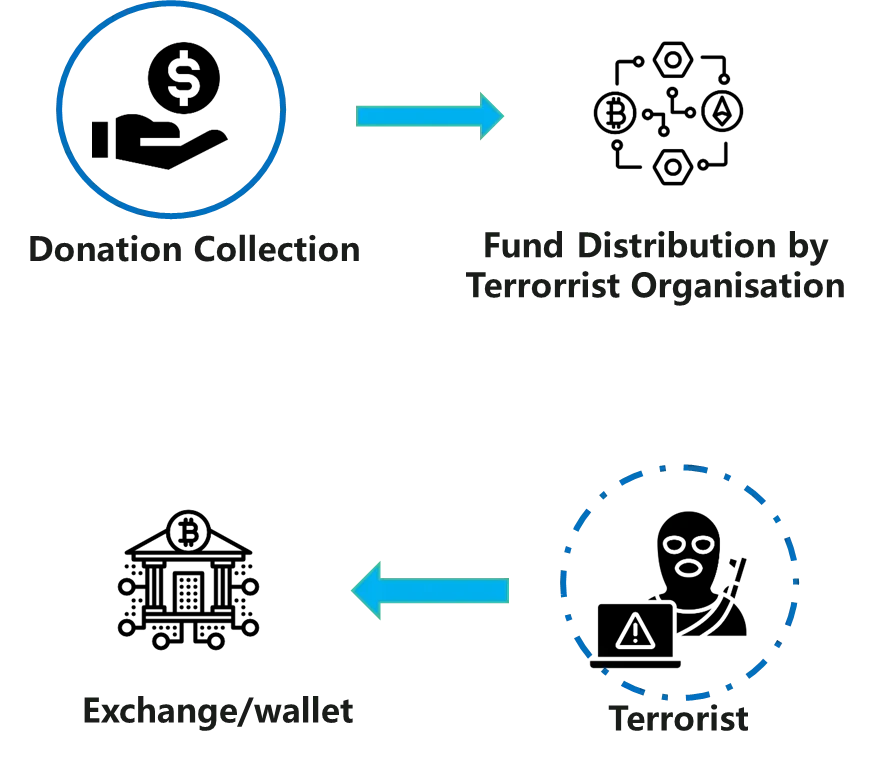

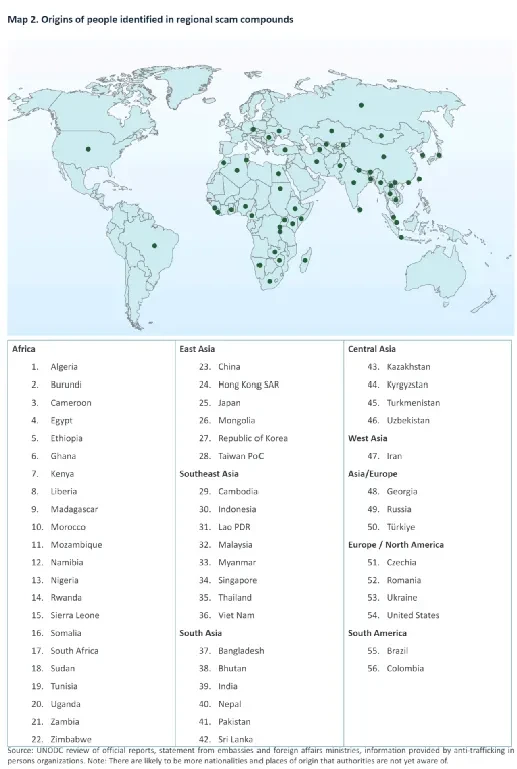

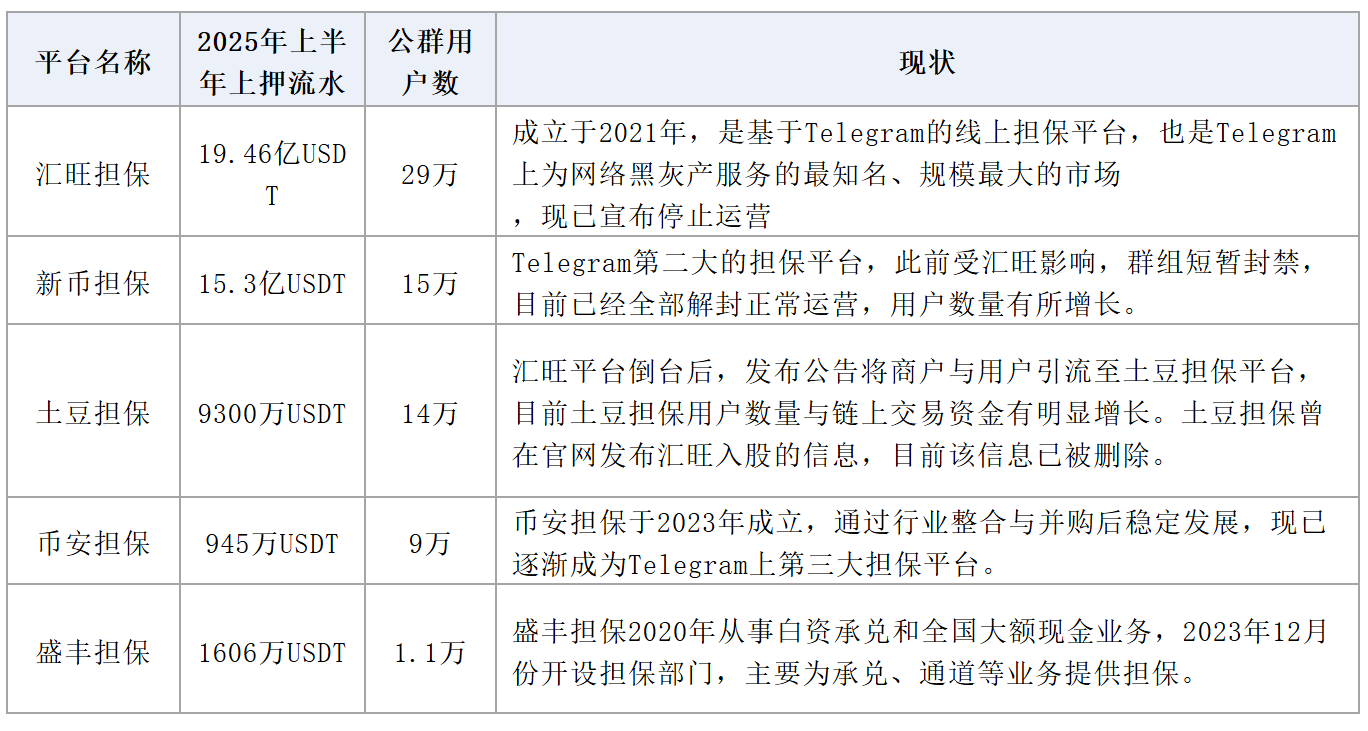

At the beginning of 2025, we provided information, data, and analytical support for a report by the United Nations Office on Drugs and Crime (UNODC) titled "Inflection Point: The Global Impact of Scam Centers, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." The report pointed out that the development of transnational organized crime in Southeast Asia is accelerating faster than at any time in history.

This is first reflected in the data related to synthetic drug production, with the supply of methamphetamine in Myanmar's Shan State increasing to record levels over the past decade. At the same time, the number of industrial-scale online fraud and scam centers driven by complex transnational groups, money launderers, human traffickers, data brokers, and an increasing number of other professional service providers and accomplices has surged.

Asian criminal groups have become authoritative market leaders in global online fraud, money laundering, and underground banking, actively strengthening cooperation with other major criminal networks worldwide. Emerging illegal online markets in Southeast Asia further exacerbate this situation, significantly expanding sources of criminal income and allowing the scale of transnational organized crime to grow. The emergence of these platforms not only creates new opportunities for expanding operational bases overseas but is increasingly used by criminal groups outside Southeast Asia to launder money and evade formal financial systems. The aforementioned online fraud and other cybercrime activities are closely related to forced human trafficking crimes. Meanwhile, major criminal groups collude with each other, often infiltrating casinos, special economic zones, business parks, and various traditional financial and digital financial services, which have proven to provide all the conditions, infrastructure, and regulatory, legal, and financial guarantees necessary for sustained growth and expansion.

In this context, many criminal groups that have developed to a considerable scale within Southeast Asia and continue to expand in other parts of the world are rapidly diversifying their business scope into multiple key infrastructure areas. This far exceeds the construction and management of physical fraud centers, encompassing online gambling platforms and software services, illegal payment platforms and digital asset exchanges, encrypted communication platforms, as well as stablecoins, blockchain networks, and illegal online markets, which are often controlled by the same criminal networks. These organizations have also developed a powerful multilingual workforce composed of hundreds of thousands of human trafficking victims and accomplices.

These developments have rapidly expanded the victim scope of Asian criminal groups globally, exacerbating the existing challenges faced by law enforcement agencies.

Figure 3-2 Situation Map of Scam Centers and Human Trafficking in the Mekong River Basin from the Report

Figure 3-3 Distribution Map of Human Trafficking Victim Sources from the Report

Report Access Link: Inflection Point: Global Implications of Scam Centres, Underground Banking and Illicit Online Marketplaces in Southeast Asia

3.2.3 Ransomware Attacks

Attackers encrypt victims' device data and demand ransom payments in digital assets such as BTC to restore access. Due to their anonymity, convenience for cross-border payments, and irreversibility of transactions, stablecoins are often used by ransomware groups in money laundering operations after receiving ransoms.

Risk Case: On March 7, 2025, the U.S. Department of Justice (DOJ) took joint action with German and Finnish authorities to seize the Russian digital asset exchange Garantex, which had been investigated multiple times for allegedly helping ransomware groups launder money. It is said to have deep connections with the global cybercrime economy, with the now-dismantled ransomware group Conti relying on Garantex for money laundering. The exchange helped ransomware groups launder the digital assets obtained from ransoms, allowing them to convert Bitcoin into USDT and other crypto stablecoins before transferring them to other exchanges for conversion into fiat currencies like the dollar.

3.2.4 Fraud and Identity Theft

Identity theft and fraud are among the most serious cybercrimes. They can have long-term, devastating, and even irreversible consequences for affected individuals, groups, and companies. In recent years, stablecoins have increasingly appeared in related scenarios due to their widespread acceptance and rapid transaction characteristics, such as the sale of hacking tools, illegal rental of personal accounts, illegal sale of personal information, payments by fraud victims, and payments by extortion victims.

Risk Cases:

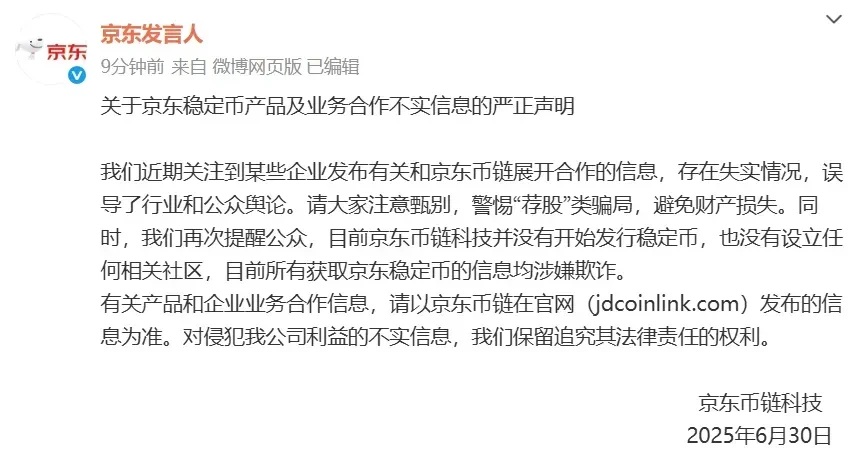

- Fraudulent Activities Using Stablecoins: With the implementation of the "Stablecoin Regulation" in Hong Kong, the concept of "stablecoins" has gained significant attention. However, as the market becomes euphoric, illegal activities exploiting "stablecoins" have also begun to emerge.

For example, since July 2025, financial management departments and industry self-regulatory organizations in multiple regions, including Zhejiang, Shenzhen, Beijing, Suzhou, Chongqing, Ningxia, and Henan, have issued risk warning announcements, emphasizing and reminding that "stablecoins" are being exploited by criminals, and their potential risks warrant high vigilance. Hong Kong regulatory authorities have also issued multiple warnings, reminding the public to be cautious of scams using the concept of stablecoins. Additionally, authoritative media such as the Economic Daily have focused on reporting the risks associated with stablecoins.

Recently, several scams claiming to be "JD Stablecoin" have emerged. They boast of "state-owned background," "guaranteed profits," and "backed by Dong Ge," with some even sharing "profit screenshots" urging people to "get on board" quickly. JD.com has issued two statements clarifying that the so-called "JD Stablecoin" has not been issued at all, and all related investment information in the market is a scam.

Figure 3-4 Fake JD Stablecoin

- Fraudulent Activities Using Stablecoins as a Channel: On June 26, 2025, a wealth management platform called "Xinkangjia," claiming to be backed by the "Dubai Gold Exchange (DGCX)" and promising "daily interest of 1%," collapsed. The platform had companies in multiple locations across the country (Guizhou, Suzhou, Chongqing, Sichuan, Xiangtan, Shenzhen, etc.), with the amount involved reaching hundreds of billions, affecting approximately 2 million investors.

The DGCX Xin Kang Jia platform participates in projects and funds settlement through the digital asset USDT. The platform requires an invitation code for registration, which is almost exclusively spread within familiar circles. Participants must pay a minimum entry fee of 1000 USDT, and users need to purchase USDT for recharge themselves. However, due to the difficulty of the operation and the complexity of the steps, most newcomers will directly exchange U for RMB and transfer it to their superiors. The USDT deposited by users goes directly into a private wallet controlled by the platform.

- Personal Identity Information Theft: In March 2025, the incident of a "13-year-old girl participating in 'unboxing' online bullying against a pregnant woman" quickly became a focus of online discussion, bringing the term "unboxing" into the spotlight and exposing a corner of the black and gray industrial chain of citizen information leakage. On the overseas instant messaging software Telegram, accounts providing unboxing services listed over 50 items of user privacy information, including ID card information, household registration, marriage records, exit and entry records, delivery addresses, and asset flow under their name, which could be obtained as long as users recharge a sufficient amount.

From the perspective of the leakage paths of personal information, identity information theft has formed a gray industrial chain. In this chain, there are groups and individuals specifically engaged in collecting and leaking personal information, intermediaries who purchase personal information data from leaking sources, and individuals and groups who buy personal information from intermediaries to commit various crimes. The transaction payment links between them involve not only WeChat and Alipay but also digital assets like USDT. If one needs to inquire about the phone number, address, and educational background of the person being "unboxed," the price ranges from "dozens of U" to "hundreds of U" per item.

According to monitoring by Beosin's Alert platform, there are currently at least hundreds of public groups on Telegram involved in the buying and selling of personal data, most of which conduct payments through USDT. These public group businesses include loans, insurance and other financial data, hacked government or corporate data, and the buying and selling of personal privacy data related to unboxing.

3.2.5 Impersonation Fraud Attacks