On September 5, Hyperliquid officially announced the upcoming auction for the "USDH" ticker. This is a native stablecoin designed specifically for the Hyperliquid ecosystem. Several institutions, including Paxos, Ethena, Frax, Agora, Native Markets, and Ethena Labs, have submitted proposals, competing for the issuance rights of USDH.

The lineup for this competition includes both established compliant institutions and emerging DeFi projects. The intense competition stems from Hyperliquid's rapid rise as a new decentralized trading platform: its perpetual contract monthly trading volume has approached $40 billion, with August's monthly fee revenue reaching $106 million, accounting for about 70% of the decentralized perpetual market share. Additionally, Hyperliquid's native token HYPE has recently reached an all-time high. Related reading: “The Battle for USDH Begins, Everyone is Eyeing the Stablecoin + Hyperliquid Concept”

Currently, the dollar liquidity on Hyperliquid mainly relies on external stablecoins like USDC, with a circulation scale reaching $5.7 billion, accounting for about 7.8% of USDC's total issuance. If USDH is successfully launched, it could mean hundreds of millions of dollars in annual interest income directly benefiting the community. Therefore, who can secure the issuance rights of USDH not only concerns market share but also determines the dominance of this substantial potential revenue. The final ownership of the stablecoin issuance will be revealed during the on-chain voting from 10:00 to 11:00 (UTC) on September 14. In this battle of titans, who will emerge victorious? BlockBeats will continue to monitor and provide real-time updates:

September 10

Hyperliquid: Deadline for USDH Auction Proposal Submission is Today at 18:00, Validator Voting Starts on the 14th at 18:00

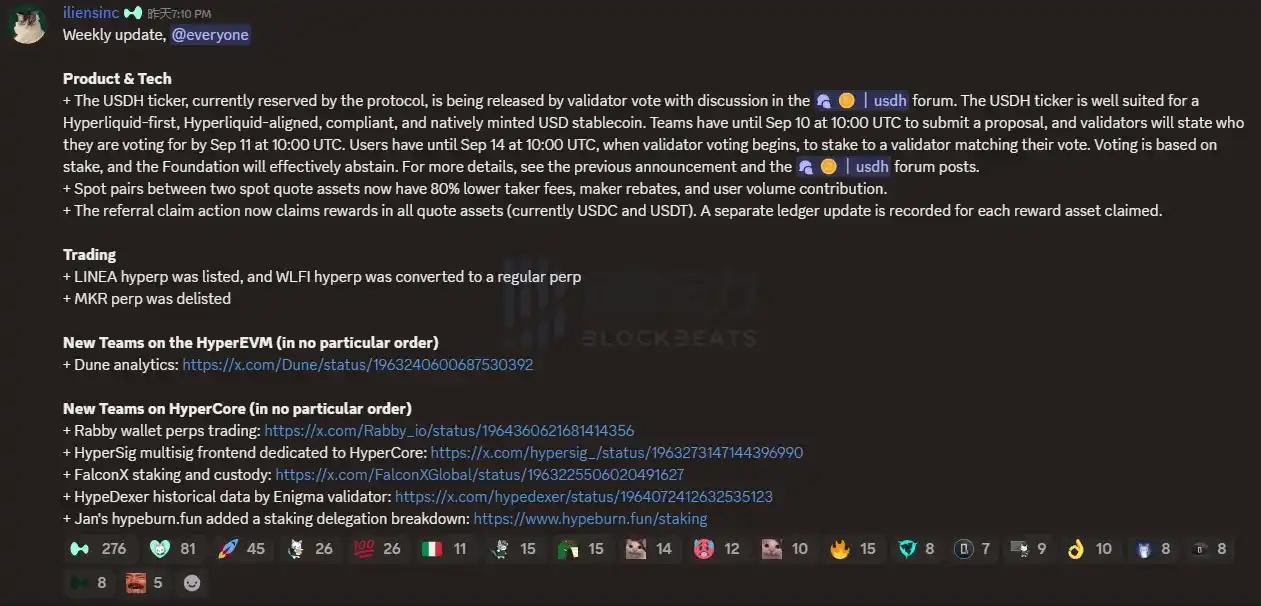

On September 10, the Hyperliquid team announced that teams bidding for USDH must submit their proposals by 10:00 UTC on September 10; validators will publicly vote on the candidates by 10:00 UTC on September 11. Users can delegate their stakes to validators aligned with their intentions before the validator voting begins at 10:00 UTC on September 14. Voting weight is calculated based on the amount staked, and the foundation will effectively abstain.

In the USDH auction predictions, "Native Markets" leads in winning probability, while Paxos is only at 15%

On September 10, according to the Polymarket page, in the auction battle for Hyperliquid's stablecoin USDH, Native Markets currently reports a 74% chance of winning, leading among various third-party bidders, with Paxos in second place at 15% and Ethena in third place at 12%.

Paxos Updates USDH Proposal v2, Collaborates with PayPal and Receives $20 Million PayPal Ecosystem Incentive

On September 10, stablecoin issuer Paxos updated its USDH proposal to version 2, which includes three upgrades:

Partnership with PayPal, launching HYPE on PayPal/Venmo (subject to regulatory approval), providing free USDH deposits and withdrawals, a $20 million ecosystem incentive, and global payment integration among Checkout, Braintree, Venmo, Hyperwallet, and Xoom;

A clear AF-first incentive structure, where Paxos can only earn profits after reaching a TVL milestone, capped at 5%, with all fees charged in HYPE tokens;

Paxos can legally issue stablecoins in Europe, ensuring USDH can expand globally in full compliance.

Ethena Labs Releases Proposal to Bid for USDH Issuance Rights

On September 10, according to official news, Ethena Labs joined the competition for the USDH stablecoin issuance rights under Hyperliquid, releasing a proposal to bid for USDH issuance rights. Ethena Labs stated that if selected as the USDH issuer, USDH will be 100% backed by USDtb, issued by Anchorage Digital Bank, and fully collateralized by BlackRock BUIDL. Ethena promises to return at least 95% of the net income generated from USDH reserves to the Hyperliquid community through HYPE buybacks, reward funds, and other means. Ethena will cover the costs of migrating USDC and plans to introduce a liquidity support mechanism to enhance USDH's depth in the perpetual contract market.

Ethena has reserved at least $75 million (composed of cash and token incentives) to support the HIP-3 frontend development based on Ethena-related products (including USDe, hUSDe, and USDH), contingent upon the proposal's approval. The fee income generated from these frontends will have 50% allocated to Hyperliquid.

September 9

Sky Joins the Competition for USDH Stablecoin Issuance Rights under Hyperliquid

On September 9, Sky (formerly MakerDAO) joined the competition for USDH stablecoin issuance rights under Hyperliquid. Sky co-founder Rune posted on the X platform stating: "Sky offers the following key advantages for USDH on Hyperliquid:

USDH will gain immediate liquidity of $2.2 billion USDC for off-chain redemption;

Sky can deploy its over $8 billion balance sheet to Hyperliquid;

All USDH on Hyperliquid can earn a yield of 4.85%, higher than treasury yields, with all USDH-generated 4.85% income allocated to the HYPE buyback fund;

Sky can provide $25 million in funding to create an independent Hyperliquid Star project, autonomously developing Hyperliquid DeFi;

Sky can transfer its buyback system to Hyperliquid, utilizing over $250 million in annual profits to build USDH liquidity."

Hyperliquid Holds "USDH Stablecoin Roundtable," Representatives from Paxos, Frax, Native Markets, Bridge, Bastion Platform, and Sky Attend

On the evening of September 9, Hyperliquid held a "USDH Stablecoin Roundtable" in X Space, inviting representatives from Paxos, Frax, Native Markets, Bridge, Bastion Platform, and Sky to discuss proposals, compliance, and ecosystem integration regarding the USDH stablecoin.

Sky Co-founder Rune stated that the method Sky offers for USDH to the Hyperliquid community is to initially launch a fully decentralized stablecoin. The design of a decentralized stablecoin inherently includes many protective mechanisms to prevent issues such as corruption or incompetence that may arise from centralized issuers, thus providing users with out-of-the-box protection. However, it is clear that regulatory approval and additional clarity are still needed, which is very beneficial for compliance with regulatory frameworks. Sky will allow the community to decide how to balance decentralization and compliance. It is entirely possible to make necessary adjustments on a highly decentralized infrastructure to meet regulatory requirements.

Paxos Labs Co-founder stated that Paxos Labs is very well-suited to collaborate with the Hyperliquid ecosystem, having a dedicated team focused on Hyperliquid, developing on Hyperliquid from day one. Additionally, Paxos is one of the longest-standing compliant stablecoin issuers in the industry and the only one to have received a state trust license from the New York Department of Financial Services while also being licensed by the OCC (Office of the Comptroller of the Currency) to hold a federal license. We believe USDH will become an asset with a market value exceeding $10 billion, and possibly even larger. Only federally regulated entities can issue assets with a market value exceeding $10 billion, which is not an easy qualification to obtain, and is a very important highlight for Paxos Labs. If a compliant global stablecoin is important to the community, Paxos is currently the only provider capable of achieving this.

Frax's Vice President of Communications Sean Kelley stated that regarding "whether to allocate funds from profits for buybacks," the specific allocation ratio should be decided by the community, and Frax absolutely hopes to resolve this through governance. This may require finding a balance in the following areas: allocating some funds for buybacks to support the further growth of USDH, as well as improving other areas within the ecosystem that are considered weaker. The specific percentage should ultimately be determined by the community. As for the transparency of profit distribution, Frax places great importance on data visualization and aims to ensure that the flow of funds can be transparently tracked, with data published on a dashboard for user access, essentially tracking everything on-chain within the ecosystem. Regarding buyback distribution, Frax believes that conducting it quarterly may be reasonable, with all operations executed through smart contracts.

Bastion Platform Co-founder Nass Eddequiouaq expressed a willingness to incentivize the migration of liquidity worth hundreds of billions of dollars from USDC on Hyperliquid to USDH through subsidizing costs. Bastion Platform believes that the most important core element is to build a strong flywheel effect: continuously driving the conversion from USDC to USDH through incentive mechanisms and ensuring that all new markets built on USDH use USDH natively rather than USDC. We should migrate the existing ecosystem to this financial system that benefits the entire community, and all new ecosystems should no longer be burdened by the historical monetary system, but must be built natively on USDH.

Hyperion Community Leader Max stated that building a stablecoin system first requires some degree of innovation. Although there are many existing stablecoin solutions, Hyperliquid has a unique ecological positioning. Native Markets and Bridge clearly view USDH as a collaborative project, with the protocol set to sign directly with Bridge, and believe that necessary safeguard clauses have been established. It should be pointed out that collaborating with licensed companies also provides the infrastructure advantage of accessing the Hyperliquid network—this is something we value greatly, as its worth far exceeds the institutional-level interface itself. Native Markets maintains technical neutrality and ensures that this principle becomes a core consideration throughout the decision-making process.

As the least well-known bidder for USDH, Native Markets' proposal was put forward by Max, the community leader of Hyperion, which previously facilitated the listing of Hyperliquid DAT. Native Markets plans to complete the fiat channel connection for the stablecoin through Bridge, stating that it will inject reserve interest profits into Hyperliquid's community assistance fund, with the advantage of the team having deep expertise in the Hyperliquid chain and a thorough understanding of the local ecosystem.

September 8

The issuance rights for USDH stablecoin under Hyperliquid have sparked competition among multiple institutions, with Paxos, Frax, and others submitting bidding proposals

On September 8, it was reported that stablecoin issuers Paxos, Frax Finance, Agora, and others are competing for the issuance rights of the upcoming USDH stablecoin from Hyperliquid. Paxos submitted its USDH bidding proposal on the 7th, promising to provide compliance with the MiCA and GENIUS acts, support for native deployment on HyperEVM and HyperCore, and allocate 95% of interest income for HYPE token buybacks, redistributing the repurchased tokens to "ecosystem programs, partners, and users."

Frax proposed a "community-first" initiative and plans to peg USDH to frxUSD at a 1:1 ratio, with frxUSD supported by BlackRock's yield-generating BUIDL on-chain treasury fund. Frax stated, "100% of the underlying treasury yield will be directly distributed to Hyperliquid users through on-chain programmatic means, with Frax charging no fees." Currently, stablecoin deposits on Hyperliquid can yield an annualized return of $220 million.

Agora has also formed a joint bidding team for USDH, promising that "100% of net income" from USDH will be allocated to Hyperliquid for platform assistance funds or HYPE token buybacks.

At the same time, Ethena Labs, the issuer of the third-largest dollar stablecoin USDe, hinted that it would soon join the competition for USDH stablecoin issuance rights under Hyperliquid.

Frax Founder Discusses Hyperliquid USDH Competition: Interoperability Value Exceeds Yield

On September 8, Frax founder Sam Kazemian posted on social media that the core insight from the Hyperliquid USDH event is that the true value of stablecoin issuers lies in the interoperability and deep integration of the economic distribution chain, rather than the obtainable treasury yields. He stated that candidates, including Frax and Paxos, are willing to return 100% of the profits to Hyperliquid, but the actual value should far exceed profit sharing.

September 5

Hyperliquid to Release USDH Token Symbol for Stablecoin Issuance

On September 5, according to official news, Hyperliquid will release the USDH token symbol for stablecoin issuance. The USDH trading pair symbol currently reserved by the Hyperliquid protocol will be released through validator voting, following a transparent on-chain process. After the next network upgrade, validators will be able to vote on whether to allow a specific user address to purchase the USDH symbol. The voting process will be entirely on-chain, completed through Hyperliquid L1 transactions, in the same manner as delisting votes.

Teams interested in applying for the symbol can submit proposals in the new forum, which must include the user address that will be used to deploy the USDH symbol if confirmed by the required number of validators. It is important to note that even if the team is approved, they must still participate in the regular spot deployment gas auction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。