Author: Tuo Luo Finance

In the cryptocurrency space, consensus has always been abundant. To some extent, as the carrier of the dream economy, consensus is the gold of the crypto world. From the summer of DeFi to the once widely popular NFTs, from glimpses of the future in Web3 to the sudden explosion of AI, the continuous trends in the crypto space all stem from consensus itself. Today, the winds of consensus are blowing towards RWA.

As institutions continue to bridge the gap between crypto and traditional finance, RWA, or Real World Asset tokenization, is also seen as the next trend that can bring sufficient incremental growth. In Hong Kong, internet giants, financial institutions, and large banks seem to be watching this potential future trend closely. In mainland China, projects under the banner of RWA are emerging like mushrooms after rain, hoping to dissipate the chill in the industry with the heat of RWA.

However, lifting the veil on "everything can be tokenized," whether true RWA is really the gold that the market imagines is still a big question mark.

01 Current Development of RWA: Overseas Focus on Finance, Domestic Development of Industry

RWA, short for Real World Assets, broadly refers to the mapping of real-world physical assets onto the blockchain through tokenization. In a strict sense, stablecoins are also a product form of RWA. From the perspective of assets, RWA has many characteristics and advantages. First is the divisibility of assets. Compared to the traditional sales model where assets are sold in fixed units, tokenization allows for the fragmentation of assets, enabling them to be sold in smaller units, which not only lowers the financing entry threshold but also provides trading flexibility for large assets constrained by scale. Secondly, there is broader price discovery and liquidity. Under the existing financial product trading infrastructure, financial asset trading has obvious time and space limitations, but through on-chain tokenization, trading can occur around the clock with pricing from around the world, aligning more with the characteristics of a free market. Finally, there is higher efficiency. Relying on the high transparency of on-chain tokenized trading, with lower intermediary costs and time, RWA generally has higher issuance efficiency.

With a series of advantages, traditional institutions have also flocked in. Starting in 2019, many traditional institutions such as JPMorgan, Goldman Sachs, DBS Bank, UBS Group, Santander Bank, Société Générale, and Hamilton Lane began exploring this sector and tested the issuance of some products. But why has RWA only exploded in popularity now? The reasons lie in policy and cyclical drivers. First, the change in the policy environment. The United States has significantly reduced regulatory pressure on tokenized assets this year, even showing high interest in stablecoins and RWA assets, and Hong Kong is no different. The relaxed regulatory cycle has allowed previously hesitant institutions to freely conduct pilot projects. Second, there is the issue of industry cycles. To date, the core driving force of the crypto space has shifted from technology and application to the capital side, with the prominent issue constraining the crypto space being the severe lack of incremental growth. The market can no longer rely solely on existing resources within the circle for development; it must introduce flows of people and capital from outside the circle, and the large-scale influx of traditional institutions corresponds perfectly to this solution. Thus, RWA, as the best entry point for traditional institutions and crypto finance, has become highly sought after.

In terms of current development, the paths of RWA development at home and abroad are quite different, much like attitudes towards blockchain. Overseas RWA, primarily in the United States, focuses on finance, with tokenized assets mainly consisting of government bonds and money market funds; while domestic RWA emphasizes empowering the real economy, with the underlying assets having significant industrial characteristics. Currently, overseas RWA has developed more comprehensively due to an earlier start, and the underlying assets are showing diverse characteristics.

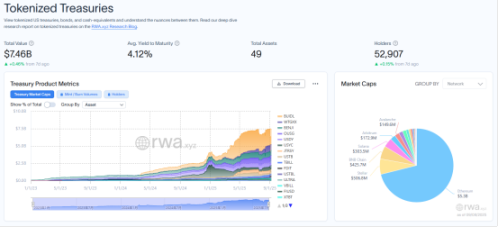

According to data from Rwa.xyz, after excluding stablecoins, the total scale of on-chain RWA has reached $28.44 billion, soaring 14.74 times from $1.929 billion in 2022, with 274 asset issuers and over 380,000 asset holders. In terms of asset categories, private credit is the core area of RWA, with a scale of $16.1 billion, accounting for 56.61%. U.S. government bonds rank second at $7.5 billion, followed by commodities ($2 billion), institutional alternative funds ($1.8 billion), and public equity ($4.2 million), while non-U.S. government bonds and corporate bonds are the least involved, with a combined total of only $600,000.

While it seems that private credit is in the lead, in reality, only the on-chain mortgage Figure has a scale of $15.5 billion in private credit, but it merely records transactions of the core product HELOC mortgage on the Provenance chain. Strictly speaking, it is just putting data on-chain, not a pure RWA enterprise. Therefore, in the RWA field, the most eye-catching track remains U.S. government bonds.

The U.S. government bond track is crowded with institutions. The third-ranked entity in this track is also a large institution, with the first being BlackRock's tokenized fund BUIDL, which currently has a scale of $2.283 billion, followed by WisdomTree's WTGXX ($830 million) and Franklin Templeton's government money market fund BENJI ($740 million), together accounting for 37.78% of the government bond track. The commodity market is dominated by precious metals, with gold categories exceeding $1.88 billion, accounting for over 70% of the market.

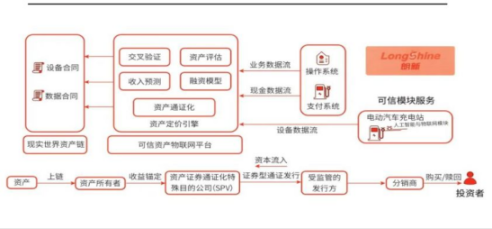

If we shift our focus from overseas to domestic, the composition of the underlying assets changes. China's RWA practice is still in a very early stage, with the industrial chain continuously improving. The development path mainly focuses on empowering the real economy, with implementations in financial assets, physical assets, trade financing, supply chain traceability, and cultural heritage protection and tourism. Typical cases include the charging pile asset project by Longxin Group, the photovoltaic asset project by GCL-Poly Energy, the green energy battery swap asset project, the Malu grape agricultural product project, and the Greenland Jinchuang real estate project, among others. For example, the first domestic charging pile asset RWA project in collaboration between Ant Group and Longxin Technology successfully raised 100 million RMB through tokenization based on 9,000 charging pile assets owned by GCL-Poly.

Source: Huaxi Securities

There are also differences in infrastructure. Overseas RWA is mostly based on public chains, with Ethereum holding over 57% market share, while domestic RWA follows traditional patterns, primarily using consortium chains with public chains as a supplement. Currently, blockchain companies like Ant Group and Shuqin Technology are developing dedicated RWA platforms.

Despite the differences in infrastructure and underlying assets, a preliminary consensus on RWA has formed both domestically and internationally. According to a joint forecast by Boston Consulting Group (BCG) and ADDX, by 2030, the global asset tokenization market size is expected to reach $16.1 trillion. Against this backdrop, not only are large enterprises eager to act, but even small and medium-sized enterprises are diving into this new wealth mine. However, behind the seemingly limitless potential, is there really no hidden danger in the current development of RWA? Is issuing an RWA really as simple as reaching into a pocket?

02 The Dilemma of RWA: High Issuance Threshold and Liquidity Challenges

The answer is no. First, although it claims that everything can be tokenized, the underlying assets of RWA are not without requirements. The name of the asset implies that the issued RWA must be an asset that can objectively generate returns. Therefore, a relatively excellent underlying asset should meet three basic conditions: standardizability, high liquidity, and more attractive return on investment. Essentially, on-chain asset issuance merely provides a new financing channel; the key to attracting market liquidity still lies in the inherent value of the asset. If we consider scalability, scalable assets must have value stability, clear legal rights, and verifiable off-chain data; otherwise, widespread issuance is difficult to achieve. This explains why government bonds are the largest overseas RWA product, as they naturally possess high liquidity and certain returns, along with a high degree of regulatory certainty, which aligns perfectly with the RWA concept.

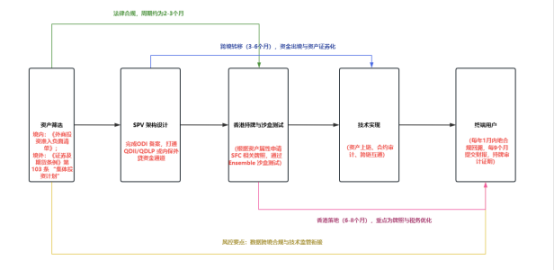

Even if the asset issue is resolved, issuing RWA in the current environment in China is not an easy task. Currently, due to the inherent securities nature of RWA, the process of issuing RWA encompasses both legal compliance and technical complexity. For example, when issuing RWA in Hong Kong, the initial asset screening must clarify that the asset is clear and has a tradable basis. In typical practices, a special SPV entity should also be established to link domestic and foreign, facilitating the cross-border compliance flow of funds and assets, and completing the licensing application and sandbox testing in Hong Kong. After ensuring compliance, the technical implementation must ensure the interoperability of data and assets. There are already complete solution providers that can offer such solutions, with technical focuses on asset on-chain, smart contract auditing, and cross-chain interoperability. From the entire process, if relying solely on the enterprise's own resources to issue RWA in Hong Kong, it takes at least over 8 months.

The complexity of the process leads to high costs. According to reports from PAnews, the cost of issuing RWA products in Hong Kong can range from 3 to 6 million RMB, covering legal compliance costs, technical on-chain costs, brokerage costs, and fundraising and QFLP costs. Among these, brokerage costs, as the core of RWA trading, account for a major portion of the expenses, with channel fees reaching up to 2 to 3 million RMB. Moreover, from a long-term strategic perspective, issuance costs are even higher; just obtaining a Hong Kong license exceeds one million, and the threshold for the virtual asset service provider (VASP) license is extremely high, with application fees potentially reaching tens of millions, allowing only resource-rich large players to participate.

More importantly, issuance is just the beginning; subsequent liquidity challenges must also be faced. In fact, even in larger overseas markets, the liquidity of RWA products is not optimistic. For example, BlackRock's BUIDL, with a market value of $2.238 billion and a monthly transfer volume exceeding $170 million, is considered a market leader overseas, but it has only 89 holders, with only 51 monthly transfer addresses and fewer than 20 monthly active addresses, indicating a significant reliance on issuers and a few large institutions. This is consistent with the performance of traditional government bond markets, where such assets typically focus on large-scale interest generation rather than relying on trading markets. Tokenization cannot change the inherent nature of the asset. Overall, the institutional market for RWA generally exhibits characteristics of high market value, concentrated control, and low liquidity, with only products like gold-related RWA having relatively broad trading channels capable of breaking this curse.

It can be seen that the issuance threshold for RWA is not only low but quite high. Companies hoping to achieve extraordinary profits and create something from nothing through RWA should think twice before taking action. After all, if there are good assets, there will naturally be sellers. If the underlying assets are difficult to classify as high-quality, tokenization is not only unlikely to yield good results but may also lead to losses. In reality, many RWA products currently flooding the market are largely just concepts wrapped around poor assets, packaged as new products, which not only goes against the original intention of RWA but also poses compliance risks.

Take the recently widely circulated project Hainan Huatie as an example. This company relies on the "Wasp Brother" digital collectibles, binding the collectibles to cash dividends from 50,000 shares of stock rights each year from 2025 to 2027. As a further development strategy, the company has also announced the issuance of a non-financial RWA product worth 10 million yuan, which will digitize the usage rights and operational rights of all its equipment onto the blockchain in the form of "membership cards," allowing users to circulate them through on-chain transfers, consignment, etc., while enjoying certain usage rights or benefits. Although both projects have been quite successful, with the Wasp Brother digital collectible achieving a floor price leap from 200 to 15,000 yuan in just three days, a closer examination reveals that both the NFT and RWA have very unclear ownership structures, with extremely vague disclosure of information, and involve the division of securitized returns, presenting obvious compliance risks.

03 The Future of RWA: A Dialectical Unity of Brightness and Twists

In summary, although driven by both policy and market forces, RWA has developed rapidly in the past two years, with the industrial chain steadily extending, the coverage of underlying assets continuously increasing, and a diversification trend in product types, the issuing entities are also constantly expanding. However, it objectively faces challenges such as insufficient infrastructure, long issuance cycles, high costs, low liquidity, and a lack of regulatory chains. To achieve long-term development, it is essential to improve infrastructure technically, build ecosystems for service providers, and create structural markets.

Fortunately, the market is also taking action. Professional platforms for RWA issuance are emerging, accelerators, organizations, and associations themed around RWA are beginning to appear, and the standard system for product issuance is continuously improving. Even regarding the challenging issue of liquidity, the market is attempting to address it by opening up the DeFi space and developing on-chain distribution methods. In terms of regulation, both the United States and Hong Kong are providing a better environment for innovation within the rules, with Hong Kong's Ensemble sandbox being a good example.

The future is bright, but the road is winding. Behind the gold rush, there is a mix of sand and mud. For RWA, the journey ahead is still long and arduous.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。