Original | Odaily Planet Daily (@OdailyChina)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Old Mining Follow-Up

Avantis Officially Launches Token, Season 3 Starts Simultaneously

The leading derivative trading platform in the Base ecosystem, Avantis, which was recommended in June, will officially open the airdrop claim for the token AVNT today. Users who stored LP at that time should be able to receive airdrop rewards. Currently, several exchanges have announced the listing of AVNT, with Binance Alpha opening trading at 21:00 and Binance Contracts at 23:00.

At the same time as the TGE, Avantis has also launched the points activity for Season 3, but the specific amount of tokens to be allocated this season has not yet been disclosed (Note: In the initial airdrop, a total of 2.19% of AVNT was distributed to LPs of Season 1 and Season 2).

In addition to the potential airdrop earnings corresponding to the points, the yield of Avantis LP itself is also relatively considerable. Avantis' LP is divided into high-risk and low-risk types, with high-risk bearing higher market-making losses (65%) but also earning higher fee income (35%); low-risk bears lower market-making losses (65%) but also has lower fee income (35%). Currently, the base yield for choosing the high-risk Vault is 4.37% APR, which can be amplified to a maximum of 15.76% if LP is locked; the base yield for choosing the low-risk Vault is 3.23% APR, which can be amplified to a maximum of 11.75% if LP is locked.

- Season 3 Portal: https://www.avantisfi.com

Resolv Season 2 is About to End

In addition to Avantis, another project that is about to conclude is Resolv, which has already conducted a round of airdrops. The Season 2 points for this project started on May 9 and will last until September 9, with the total token distribution for this season determined to be 5.75% of the total supply, of which at least 4% will be used for the Season 2 points program.

Currently, Resolv has not officially announced the claim time for the Season 2 airdrop, so we will wait for the announcement.

New Opportunities

Arbitrum Launches DRIP Incentive Program

Arbitrum announced a new incentive program called DRIP last week, which will provide a total of 80 million ARB (approximately $41.5 million) for incentives, to be executed in four seasons, with each season targeting a specific DeFi vertical for incentives.

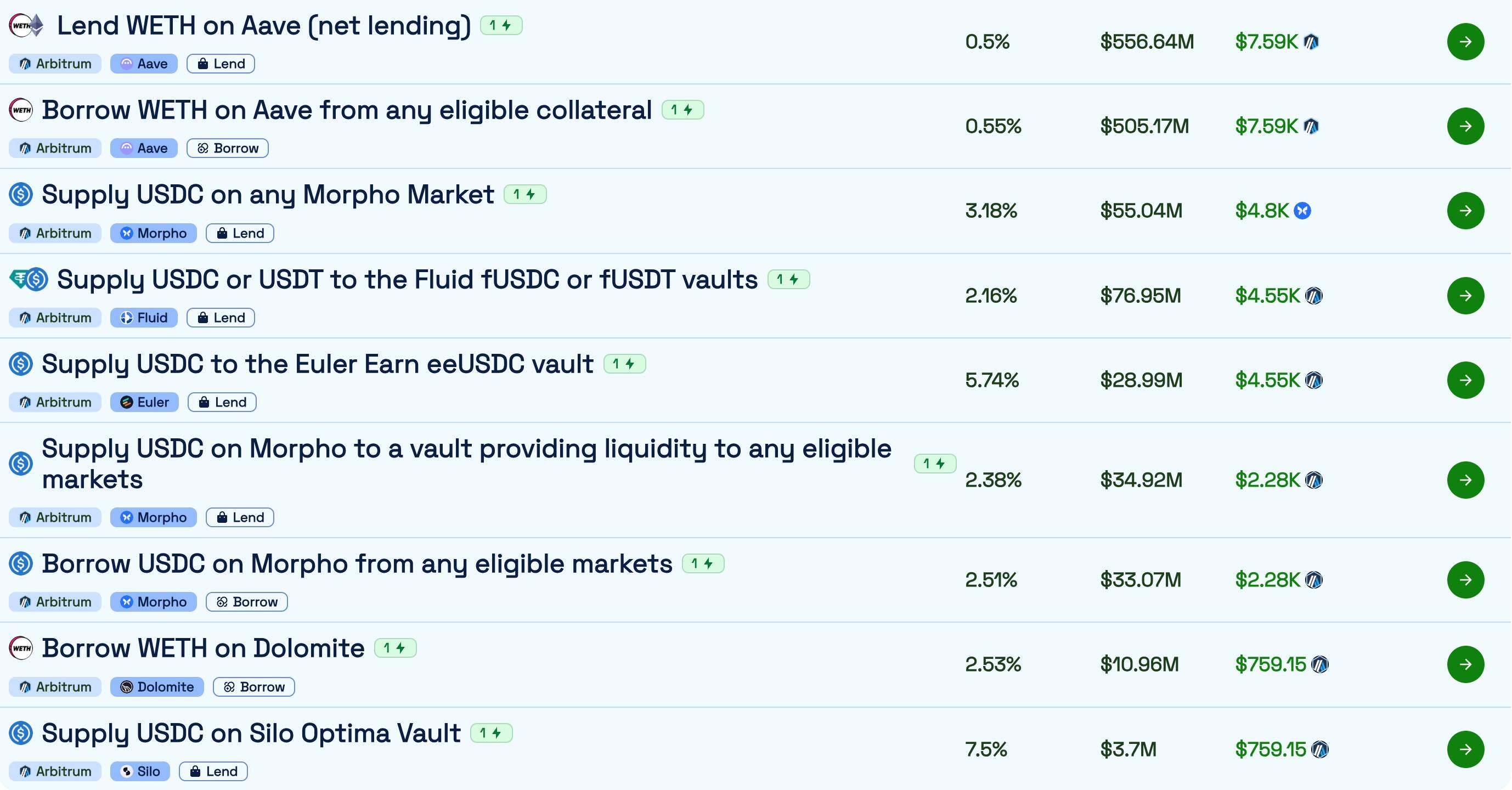

Currently, the first season of DRIP started on September 3 and is expected to last until January 20 next year, providing approximately 24 million ARB (about $12.72 million) as incentives to promote the growth of circular leverage in the lending market within the ecosystem. The lending protocols included in the incentive scope currently are Aave, Fluid, Morpho, Euler, Dolomite, Silo, etc. The specific pools and incentive situations (including daily ARB incentive amounts and corresponding APY increases) are shown in the figure below.

River Launches 45-Day Limited Time 40% APR Yield Pool

On September 8, the chain-abstract stablecoin protocol River announced that it will launch a new yield pool Smart Vault at 22:00 Beijing time on September 10. The specific information for this pool is as follows:

- Deposit Opening Time: September 10, 22:00;

- Deposit Period: 5 days;

- Supported Assets: USDT;

- Total Pool Cap: $10 million USDT (first come, first served);

- Yield Period: 45 days;

- Lock-up Period: 3 days;

- Total Annualized Yield Rate (APR): 40.8% — 16.8% in satUSD form (guaranteed yield); 24% in River Pts form (based on $200 million FDV, future redeemable for token RIVER);

Although the yield situation sounds exaggerated, considering that this pool is limited in time and cap, and most of the yield comes from points (corresponding to future tokens), the actual interest cost paid by the protocol is not too high — if one does not mind having their funds locked, it may be worth considering depositing an amount acceptable to one's risk preference; personally, I would lean towards participating (if I can grab a spot).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。