Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

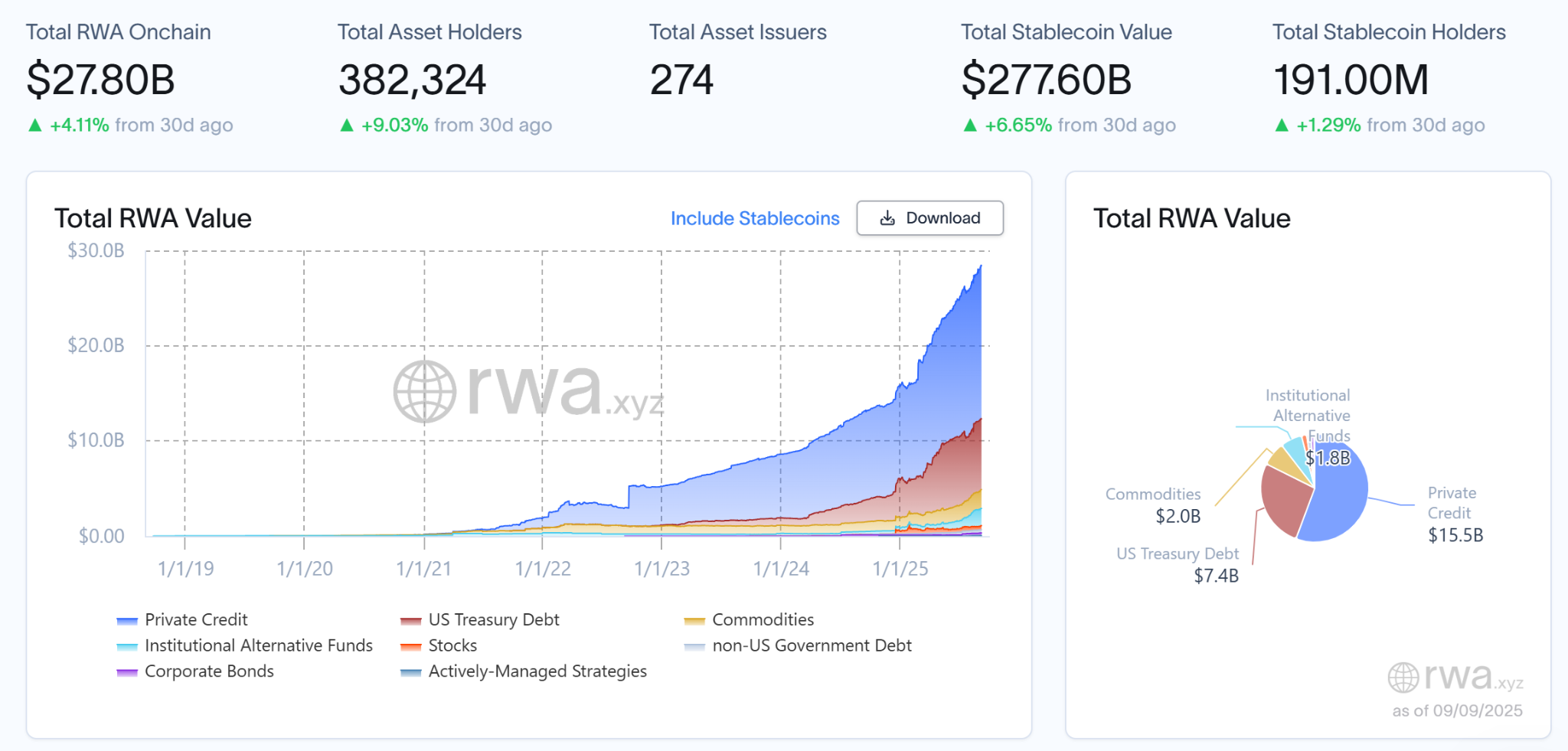

RWA Market Performance

As of September 9, 2025, the total on-chain value of RWA is $27.8 billion, a decrease of $150 million compared to $27.95 billion on September 2, representing a decline of 0.54%. Despite a slight market cap retreat, it remains at a high level. The total number of asset holders increased from 373,348 to 382,324, with a weekly growth of about 9,000 people, an increase of 2.41%. The number of asset issuers rose from 272 to 274, adding 2 new issuers, with stable growth. The total value of stablecoins increased from $273.18 billion to $277.6 billion, growing by $4.42 billion, an increase of 1.62%. The number of stablecoin holders decreased from 191.89 million to 191 million, a decline of 0.01%.

In terms of asset structure, private credit remains the mainstay of the RWA market, although its total value slightly decreased from $15.9 billion to $15.8 billion. U.S. Treasury bonds continued to retreat slightly, from $7.5 billion to $7.4 billion, a decline of 1.33%. Commodity assets rose from $1.9 billion to $2 billion, an increase of 5.26%, reflecting a renewed demand for commodities and inflation hedging. The value of institutional alternative funds increased from $1.7 billion to $1.8 billion, an increase of 5.88%. Other asset classes, such as non-U.S. government debt and corporate bonds, remained stable.

Trends (Comparing to Last Week)

From the overall market trend, the RWA market continues to maintain a "high-level consolidation + structural adjustment" pattern. Although there has been a slight market cap adjustment, the growth in on-chain users and asset issuers proves that the market ecosystem's expansion momentum remains strong. Private credit and alternative asset classes continue to attract investor inflows, especially in high-yield sectors, with market confidence remaining stable. The slight decline in U.S. Treasury bonds may indicate a change in investor expectations regarding future interest rates or a slowdown in demand for safe-haven assets.

Key Events Review

Nasdaq Strives to Launch Tokenized Securities Trading

As the Trump administration relaxes cryptocurrency regulations, exchange operator Nasdaq is collaborating with U.S. regulators to introduce tokenized securities trading, becoming the latest major financial firm on Wall Street to bet heavily on the tokenization boom. If approved, this would be the first time tokenized securities are allowed to trade on a major U.S. stock exchange. On Monday, Nasdaq submitted a proposal to the U.S. Securities and Exchange Commission (SEC) suggesting rule adjustments to allow listed stocks and exchange-traded products to trade in "traditional digital or tokenized form" on Nasdaq's main market. Nasdaq stated in the filing that it believes the market can utilize tokenization while "continuing to provide the benefits and protections of a national market system." A few days ago, the SEC announced its rule-making agenda for the coming months, which includes potential revisions to allow cryptocurrencies to trade on national securities exchanges and alternative trading systems.

On September 6, the U.S. Senate's cryptocurrency regulatory bill advanced to a new phase, with a new draft outlining protections for cryptocurrency developers, bankruptcy guidelines for digital asset issuers, and how to enable federal regulators to support tokenization in financial markets.

Highlights of this draft include:

- Developer Protection: Legal protections for individuals or companies involved in the development, issuance, management, maintenance, or distribution of distributed ledger systems or decentralized finance messaging systems.

- Bankruptcy Provisions: Amendments to existing bankruptcy laws to clarify that "ancillary assets" and digital goods should be treated as customer property in bankruptcy proceedings.

- Tokenization Research: The draft requires the SEC and the Commodity Futures Trading Commission (CFTC) to jointly conduct research on tokenized securities and other real-world assets to establish standards for how third-party custodians should handle tokenized assets and the standards these assets should follow.

Additionally, the draft emphasizes that tokenized securities should continue to be regarded as securities, while tokenized real-world assets that do not qualify as securities should not be considered securities.

The introduction of this draft is an important supplement to U.S. cryptocurrency regulatory policy, but it remains unclear whether it will gain support from Democratic senators in the Senate. The Senate's work still faces time pressure, although the draft is expected to complete the legislative process before the fall of 2025.

The rapid development of stablecoins globally in the first half of the year has led many to believe that stablecoins bring more possibilities for the internationalization of the renminbi. With the Hong Kong "Stablecoin Regulation" coming into effect on August 1, 2025, discussions on using renminbi stablecoins to counteract U.S. dollar hegemony have been ongoing. A blockchain technology practitioner in Hong Kong's cross-border trade sector stated that according to relevant Hong Kong regulations, if stablecoins are used as value transfer tools for cross-border payments, the exchange of stablecoins for fiat currency or remittance functions fall under the Money Service (MSO) regulations of the Anti-Money Laundering Ordinance, requiring an MSO license issued by Hong Kong Customs.

Ondo Launches 100+ Tokenized U.S. Stocks, OKX Wallet and Others Provide Technical Support

According to official news, Ondo Finance and Ondo Foundation have officially launched over 100 tokenized U.S. stocks and ETFs on Ethereum, providing 24/7 on-chain trading services for eligible international investors. The platform is open to users in the Asia-Pacific, Europe, Africa, and Latin America, but does not provide services to investors in the U.S. and the U.K. to ensure compliance. Ondo plans to expand to BNB Chain and Solana within the year, with the number of supported tokenized assets exceeding 1,000, covering individual stocks like Apple and Tesla, as well as mainstream fixed-income ETFs.

This launch has received support from several leading crypto infrastructure providers, with OKX Wallet as one of the technical partners, providing users with convenient on-chain access and asset management experiences. The platform supports free transfers between wallets, exchanges, and protocols, secured by Chainlink oracles and LayerZero cross-chain technology for price and interoperability. Ondo emphasizes that its Global Markets model not only values liquidity and transferability but also provides users with a safer and compliant channel for tokenized securities investment within regional compliance frameworks, accelerating the adoption of real-world assets on-chain.

Paxos Proposes to Launch Stablecoin USDH for Hyperliquid, Most Revenue to be Used for HYPE Buybacks

Stablecoin infrastructure company Paxos has submitted a proposal to launch a compliant stablecoin USDH within the Hyperliquid ecosystem, adhering to GENIUS Act and MiCA regulatory standards. The announcement states that 95% of the interest generated from USDH reserves will be used for HYPE token buybacks and distributed to users, validators, and partner agreements.

This plan is managed by Paxos Labs, a newly established internal division of Paxos, which has acquired Molecular Labs, the developer of Hyperliquid's foundational components LHYPE and WHLP. USDH will be deployed on the HyperEVM and HyperCore chains, aiming to attract institutional and mainstream fintech platforms by connecting with global banking channels and compliance systems.

Additionally, Paxos stated it will integrate HYPE into its brokerage infrastructure, which has provided crypto services for PayPal, Venmo, and MercadoLibre. According to DefiLlama data, Hyperliquid holds a 70% share in the decentralized perpetual futures market, with nearly $400 billion in trading volume last month and revenue exceeding $106 million.

Stripe and Paradigm Announce Private Testnet Launch for Payment-Focused Blockchain Project Tempo

Valued at $91.5 billion, fintech company Stripe and cryptocurrency venture capital firm Paradigm announced the launch of a private testnet for their jointly developed blockchain project Tempo, which is a Layer-1 blockchain built on stablecoins (typically pegged to the U.S. dollar) and may compete with Circle's Arc blockchain, as well as Plasma and Stable.

Fidelity Asset Management Launches Blockchain-Based U.S. Treasury Market Fund on Ethereum

On September 7, Fidelity Asset Management quietly launched the Fidelity Digital Interest Token (FDIT), a tokenized U.S. Treasury market fund based on the Ethereum blockchain network. This fund is the blockchain version of Fidelity's Treasury Money Market Fund, currently holding over $200 million in assets.

The FDIT product matches shares of Fidelity's Treasury Digital Fund (FYOXX), with the fund's portfolio entirely composed of U.S. Treasury bonds and cash. Fidelity charges a management fee of 0.20% for this fund, while BNY Mellon is responsible for asset custody.

Currently, the fund's asset size has grown to over $200 million, although participation is limited, with only two holders at present—one holding approximately $1 million in tokens, and the other managing the remaining assets.

Hot Project Updates

PicWe Global (WEUSD)

One-Sentence Introduction:

PicWe Global is a DeFi protocol focused on RWA, dedicated to transforming traditional financial assets such as U.S. stocks and bonds into tradable digital tokens through blockchain technology. Its core product is the native stablecoin WEUSD, which supports users in minting, redeeming, and transferring assets across multiple blockchains (such as BNB Chain, Arbitrum, Base Chain, Movement, etc.), providing high liquidity and low-cost investment channels. PicWe Global optimizes the cross-chain ecosystem through a bridge-less CATM architecture, reducing liquidity fragmentation and operational costs, while seamlessly connecting CEX and DEX liquidity pools using state channel technology to enhance market efficiency.

Latest Updates:

On September 5, according to PicWe official news, PicWe received a non-dilutive ecological grant of 868,160.000166 MOVE from the Movement Foundation. The grant will be used to accelerate PicWe's R&D efforts in RWA and full-chain liquidity infrastructure, facilitating the implementation and adoption of Movement's ecosystem in scenarios involving RWA (real-world assets), stablecoins, and cross-chain payments.

Previously, PicWe officially announced that it now supports the Invesco U.S. Senior Loan Strategy Fund (iSNR) issued by the regulated on-chain digital asset platform DigiFT. Through PicWe Invest, users can access high-quality, institutional-grade RWA products without barriers, enjoying a 24/7 smart contract redemption mechanism and a settlement experience that accrues interest by the second.

MyStonks (STONKS)

One-Sentence Introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing U.S. stocks and enabling on-chain trading. The platform collaborates with Fidelity to achieve 1:1 physical custody and token issuance, allowing users to mint stock tokens like AAPL.M and MSFT.M using stablecoins such as USDC, USDT, and USD 1, and trade them around the clock on the Base blockchain. All transactions, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradFi and DeFi, providing users with a high liquidity, low-barrier entry into U.S. stock investments on-chain, building "the NASDAQ of the crypto world."

Latest Updates:

On September 3, MyStonks officially announced a strategic partnership with the RWA protocol Paimon Finance, where both parties will engage in multi-faceted collaboration on RWA ecosystem construction and application exploration. Additionally, Paimon is set to launch a new product, Stockpad, which plans to support users in purchasing tokenized stocks on-chain at discounted prices. The following day, data from the MyStonks official website showed that the total number of users on the platform surpassed 40,000, setting a new historical high. On September 6, a formal strategic partnership was established with the oracle project APRO, focusing on deep data collaboration in the RWA field.

On September 8, MyStonks announced that it has completed a comprehensive audit conducted by blockchain security firm CertiK. On the same day, it launched a "Cryptocurrency Contracts" section, initially opening 11 mainstream trading pairs including BTC, ETH, and WLFI.

Related Links

Summarizing the latest insights and market data in the RWA sector.

《Explaining ERC-364: Why is it the Most Suitable Token Standard for RWA?》

This article discusses the characteristics, advantages, and common cases of the ERC-3643 standard.

《When Slow Assets Meet Fast Markets: The Liquidity Paradox of RWA》

Non-liquid assets wrapped in on-chain liquidity are replaying the financial mismatches of 2008.

How do compliance, liquidity, and user experience interact from synthetic assets to CFD contracts to physical stock custody?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。