Original Title: "Linea TGE Countdown: This Article is Enough"

Original Source: BitpushNews

As the competition in the Ethereum Layer 2 ecosystem intensifies, Linea, developed by ConsenSys as a zkEVM network, has become the market focus due to its technical advantages, strong ecosystem growth, and highly anticipated Token Generation Event (TGE).

The Linea TGE is scheduled for September 10, 2025, when the LINEA token will be officially issued, accompanied by a large-scale airdrop and liquidity incentive program. Pre-market trading has shown high volatility and market enthusiasm, attracting a large number of investors and speculators. This article will provide an in-depth analysis of Linea's pre-market trading performance, key information about the TGE, ecosystem advantages, and potential risks, offering comprehensive reference for investors.

1. Core Information of Linea TGE: Token Economics and Airdrop Mechanism

Overview of TGE and Airdrop Design

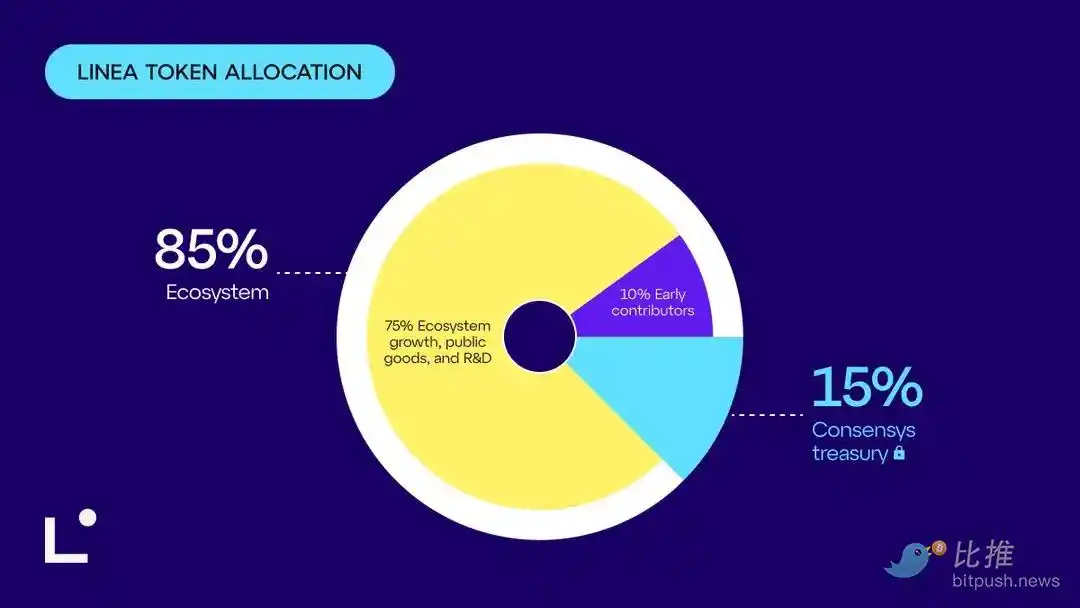

The Linea TGE is set to launch on September 10, 2025, with a total issuance of 72 billion LINEA tokens. The token distribution plan is clear, aiming to balance ecosystem development and community incentives:

85% (61.2 billion tokens) allocated to the ecosystem for community development, infrastructure construction, and support for Ethereum public goods, with 75% of the ecosystem fund gradually released over the next 10 years.

10% (7.2 billion tokens) for airdrops, rewarding early users, builders, and MetaMask ecosystem participants, with tokens fully unlocked and no lock-up period.

Initial circulation: Approximately 22% (15.8 billion tokens) will enter circulation at TGE, mainly distributed through airdrops and liquidity incentives (such as the Linea Ignition program).

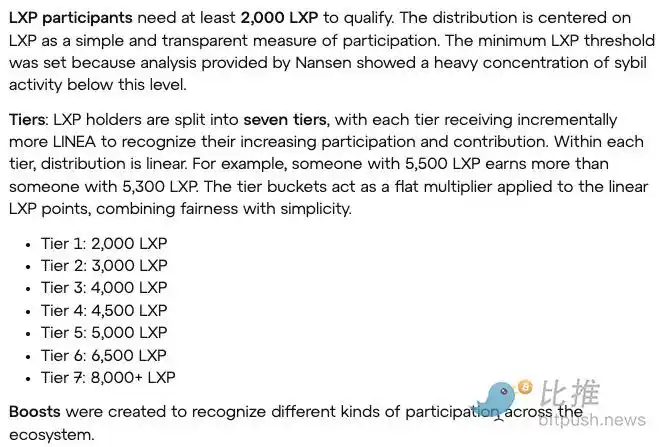

Airdrop eligibility is based on LXP and LXP-L points, with a minimum threshold of 2,000 LXP (divided into 7 levels) or 15,000 LXP-L (linear distribution), with about 500,000 addresses qualifying.

Additional rewards are calculated based on user participation in Linea Voyage, Surge events, ongoing activity, and MetaMask product usage. The airdrop claim window is from September 10 to December 9 (90 days), and unclaimed tokens will return to the ecosystem fund.

2. Token Economics and Functionality

The LINEA token is not used for gas fees (which will still use ETH) but serves as an ecosystem incentive and funding coordination tool, with specific uses including:

Rewarding liquidity providers for DeFi protocols (such as Etherex, Euler Finance).

Supporting public goods in the Ethereum ecosystem (such as ENS).

Incentivizing community activities and developer contributions.

Linea introduces an innovative dual destruction mechanism:

20% of Layer 2 ETH net income is directly destroyed, enhancing Ethereum's economic model.

80% is used for repurchasing and destroying LINEA tokens, aimed at reducing circulating supply and increasing token scarcity.

In terms of governance, Linea is currently centrally managed by the Linea Alliance (including ConsenSys, Eigen Labs, ENS Domains, SharpLink Gaming, and Status), responsible for strategic decisions and ecosystem fund allocation. Decentralized governance mechanisms such as token voting may be introduced in the future, but no timeline has been specified yet.

3. Security and Transparency

The token contract of Linea has undergone comprehensive auditing by OpenZeppelin, with no high-risk or critical issues found, providing security assurance for the smooth conduct of the TGE. The Linea Alliance is committed to maintaining ecosystem trust through transparent fund allocation and regular community updates, ensuring Ethereum's priority principles.

2. Pre-Market Trading Performance: High Volatility and Market Enthusiasm

1. Price Volatility and Trading Volume

Pre-market trading of Linea is taking place on platforms such as Binance, Bybit Alpha, Hyperliquid, KuCoin, and XT.com, showing significant market attention, but with severe price volatility:

- Current price: As of September 8, 2025, the LINEA price ranges from $0.029 to $0.052, down approximately 34.64% from the initial opening price of $0.08 (Binance data).

High point: Some platforms (such as Logx) reported that the price once soared to $3.6 but then significantly retraced, reflecting the low liquidity and high speculation of pre-market trading.

Trading volume: The trading volume in the past 24 hours was approximately $82.39 million to $115.29 million (DropsTab data), indicating market enthusiasm, but a thin order book leads to large spreads.

Fully diluted valuation (FDV): Linea's FDV is approximately $3.6 billion, lower than Arbitrum ($5 billion) but higher than Optimism ($3 billion), positioning it as a mid-tier Layer 2 project.

2. Trading Platforms and Leverage

Binance: Offers 5x leverage, with high trading volume and relatively stable price discovery, making it a primary pre-market trading venue.

Bybit Alpha: Supports 10x leverage, attracting high-risk speculators, but high leverage exacerbates price volatility.

Hyperliquid: Offers 3x leverage, with lower liquidity and larger spreads, suitable for short-term traders.

KuCoin: Supported pre-market trading starting September 2, with the latest price around 0.03 USDT and the highest buy order price at 0.0271 USDT.

XT.com: Supports OTC pre-market trading, with prices set freely by users, resulting in lower trading volume, suitable for small-scale investors.

3. Market Sentiment and Driving Factors

Positive Factors:

About 500,000 addresses qualify for the airdrop, with high enthusiasm for claiming. The community predicts that each 1 LXP can be exchanged for about 4.32 LINEA tokens, valued at $0.15 to $0.3. The Linea Ignition program allocates 160 million tokens (increased from the original plan of 150 million), with 80% for liquidity providers in lending pools and 20% for Etherex trading, attracting a large number of DeFi users.

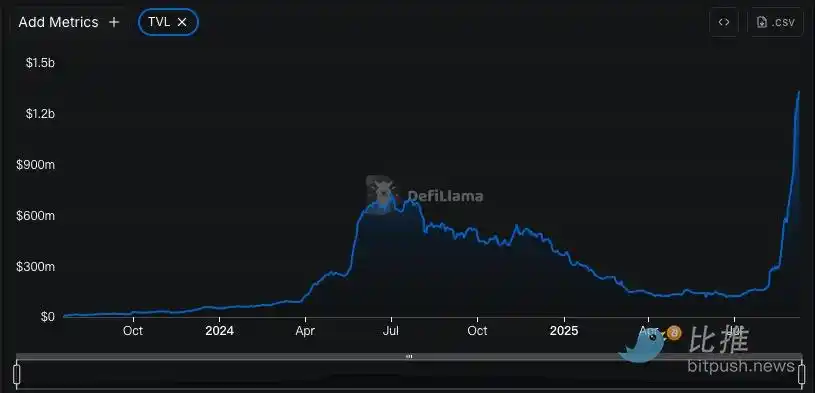

Technical advantages: As a zkEVM Layer 2 network, Linea provides a fully compatible environment with Ethereum, with low fees and high throughput driving its TVL growth to $1.2 billion.

Institutional endorsement: Development support from ConsenSys, deep integration with MetaMask, and participation from the Linea Alliance enhance market confidence.

Negative Factors:

High volatility: The low liquidity and high leverage in pre-market trading lead to severe price fluctuations, such as dropping from $3.6 to $0.05, significantly increasing short-term speculation risks.

High FDV concerns: The $3.6 billion FDV is considered high by some investors, potentially limiting long-term growth potential, especially in the context of intensified Layer 2 competition.

Selling pressure: After the TGE, the full unlocking of airdrop tokens may trigger sell-offs, with the initial circulation (22%) potentially causing short-term price fluctuations.

4. Price Expectations and Community Predictions

Community predictions for LINEA's price after the TGE vary widely: some users (such as @Nazo_ku) believe the fair price range is $0.15 to $0.5, based on LXP exchange value and ecosystem potential.

Some analyses suggest that Linea's FDV could reach $8 billion, citing its TVL ($1.2 billion) as significantly higher than other overvalued projects (such as Mantra, which has a TVL of only $4 million but an FDV of $8 billion).

Historical data shows that over 50% of projects listed in pre-market trading on Binance have seen their value drop by more than 50%, and LINEA may face similar retracement risks, especially during the market downturn in September.

3. Linea Ecosystem: The Cornerstone of Technology and Growth

1. Technical Advantages

As Ethereum's zkEVM Layer 2 solution, Linea offers the following core advantages:

Fully EVM compatible: Developers can seamlessly migrate Ethereum applications without modifying code.

Low fees and high throughput: Compared to the Ethereum mainnet, Linea's transaction costs are significantly lower, suitable for high-frequency scenarios such as DeFi, NFTs, and gaming.

Zero-knowledge proofs (zkRollup): Ensures transaction security and privacy while maintaining high scalability.

2. Ecosystem Growth

The Linea ecosystem is rapidly expanding, with key metrics including:

- TVL: Exceeding $1.3 billion, ranking among the top in Layer 2 networks.

Partnerships: Collaborating with over 400 projects, including Aave, PancakeSwap, SushiSwap, and Etherex.

Community activity: Through Linea Voyage and Surge events, it has attracted 7 million wallets and 2.8 billion transactions, demonstrating a strong user base.

3. MetaMask Integration

Linea is one of the default Layer 2 networks for MetaMask, allowing users to easily participate in the Linea ecosystem through the MetaMask wallet, bridging ETH, interacting with DeFi, or registering a Linea Name Service domain. This deep integration significantly lowers the participation threshold for users and promotes ecosystem adoption.

4. Investment Recommendations and Risk Warnings

Participation Strategy

Check Airdrop Eligibility: Visit the Linea official eligibility checker (https://linea.build/hub) to confirm LXP or LXP-L points and participate in the airdrop claim.

Ecosystem Interaction: Bridge ETH through Linea Bridge, participate in DeFi protocols (such as Etherex, Euler Finance), or register a Linea Name Service domain to increase points and rewards.

Risk Warnings

Liquidity Risk: The thin order book and high leverage in pre-market trading may lead to severe price fluctuations, so caution is advised when participating in high-leverage trading.

Selling Pressure: The full unlocking of airdrop tokens after the TGE may trigger short-term sell-offs, and the initial circulation (22%) could exacerbate price volatility.

Market Environment: September is traditionally a month of decline in the crypto market, which may put pressure on LINEA's initial performance.

Speculation Risk: Only 9.5% of Alpha projects successfully transitioned to spot listings after pre-market trading on Binance, and LINEA's long-term performance needs further observation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。