Original Title: What If: Upbit and Bithumb Launch Their Own Blockchains?

Original Author: Tiger Research

Original Translation: Ismay, BlockBeats

Editor's Note: This research report was originally published on August 20 and mainly explored various paths that Upbit and Bithumb might take if they were to build their own blockchains, remaining at the level of hypothesis and deduction at that time. Just last night, South Korea's largest trading platform, Upbit, officially announced the launch of its own L2 Giwa, making this deduction a reality.

This development not only validates the accelerating trend of "CEX self-built chains" but also signifies that Korean platforms are moving from a business model centered on trading fees to a more imaginative infrastructure competition. Combined with previous analyses, market participants will further observe how Upbit leverages its large user base and liquidity advantages to turn Giwa into a new ecological entry point, and what chain reactions this move will have on Bithumb and even the landscape of the Korean crypto market.

The following is the full content, with some additions and deletions for readability:

Global centralized trading platforms are gradually launching their own blockchains to open up new revenue sources. Upbit and Bithumb may also join this competition.

The four possible paths include: a Layer 2 network based on OP Stack, infrastructure for a Korean won stablecoin, leveraging Korea's unique market liquidity, and the tokenization of equity in unlisted companies. Each scenario reflects the uniqueness of the Korean market.

However, regulatory restrictions and technical complexities remain major obstacles, making short-term implementation very challenging. But as trading volumes decline and global competition intensifies, the two platforms urgently need to find new growth drivers.

CEX-Dominated Infrastructure Competition Begins

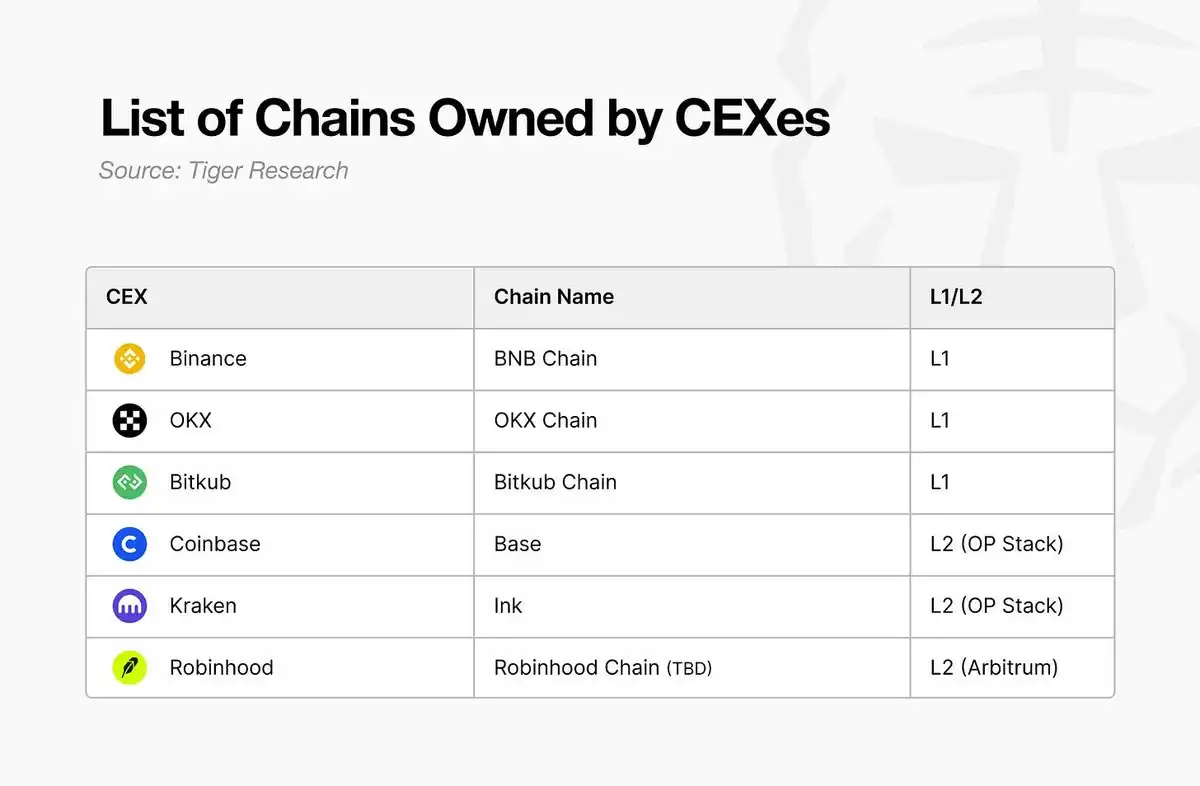

Platforms are actively investing in the competition for blockchain infrastructure. Coinbase (@coinbase) has launched Base (@base), Kraken (@krakenfx) has released Ink (@inkonchain), and Robinhood (@RobinhoodApp) has recently joined the fray, making competition increasingly fierce.

The root of this fierce competition lies in the limitations of the fee-based business model. Fees are the most stable source of income in the crypto industry, but they are highly dependent on market conditions, thus lacking resilience, forcing CEXs to seek revenue diversification. In the past, platforms mainly competed within limited regulatory jurisdictions, but now the competitive landscape has expanded globally. At the same time, decentralized platforms also pose challenges to centralized ones, with market share at one point exceeding 25%.

Meanwhile, the mainstream application of cryptocurrencies is accelerating, opening up new business opportunities for CEXs beyond trading, with blockchain infrastructure being key to this trend, further accelerating the competition for self-built chains among major platforms.

What If Upbit and Bithumb Launch Their Own Blockchains?

Global centralized trading platforms are igniting a trend of building their own public chains. This naturally raises the question: "Will Korea's two leading platforms, Upbit and Bithumb, also join in?" To assess this possibility, we need to review their current situations and past explorations.

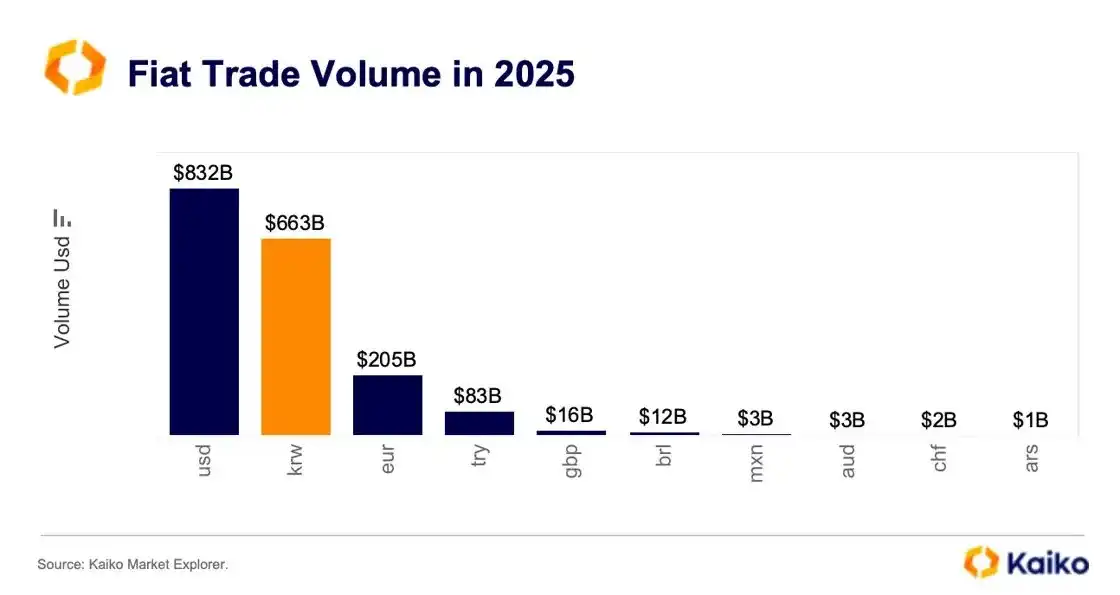

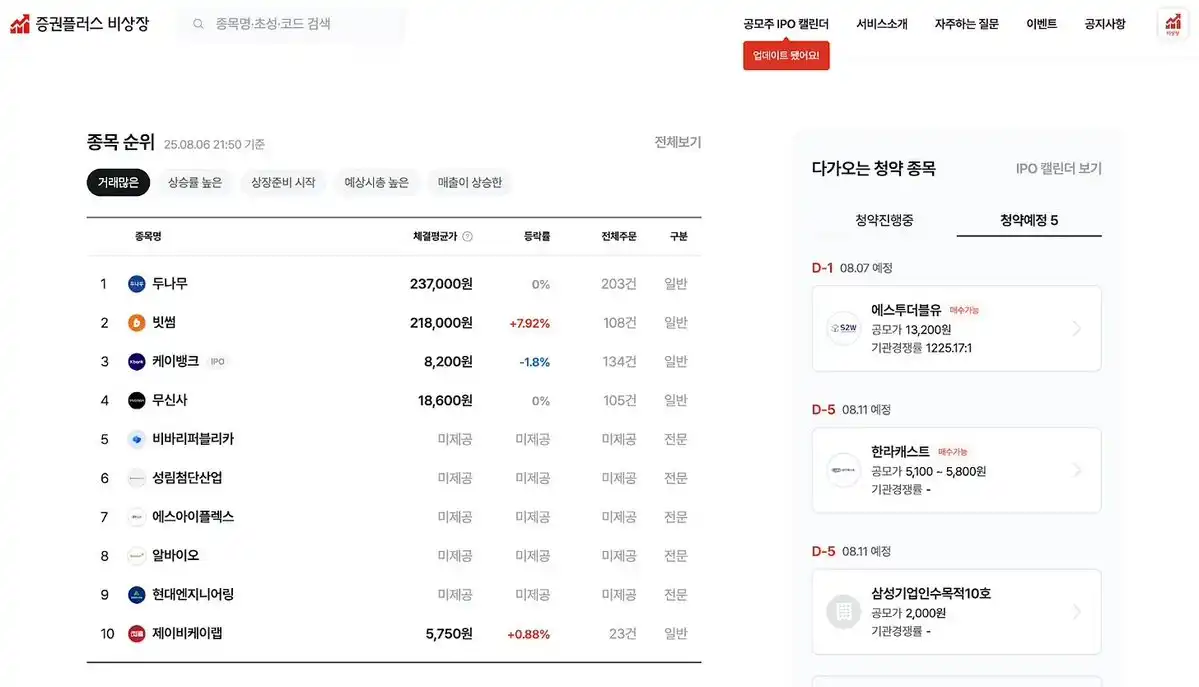

Korea holds a unique position in the global crypto market. In terms of fiat-denominated trading volume, the Korean won (KRW) has long ranked second globally, only behind the US dollar (USD), and sometimes even surpasses it. No other single country contributes such a large trading volume. This market environment has allowed Upbit and Bithumb to grow into large enterprises in Korea (defined as companies with assets exceeding 5 trillion KRW).

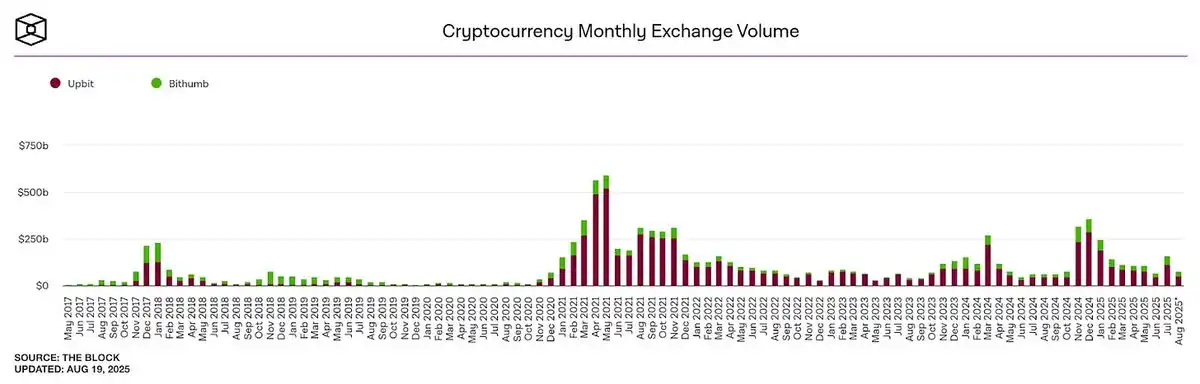

However, this landscape is changing. Since trading volumes peaked in 2021, the transaction volumes of the two major CEXs have continued to decline. Local users are gradually shifting to global platforms like Binance and Bybit or turning to decentralized platforms. This means that local Korean CEXs are gradually entering an environment where they cannot solely rely on the "Korean market liquidity premium."

The two platforms have long been aware of this trend, and both Upbit and Bithumb have attempted to drive global expansion through overseas subsidiaries and business diversification, but it has proven difficult to establish a competitive advantage overseas solely based on the "Korean CEX" label.

They have also launched various platform-type businesses, but most have ended in failure due to a lack of deep connection with their core advantages. Additionally, regulatory sanctions have constrained their diversification attempts.

Now, the external environment is changing. Trump's pro-crypto policies have improved the global regulatory atmosphere, allowing CEXs to pursue new growth strategies more actively. Against this backdrop, launching their own blockchains has become a realistic option for Upbit and Bithumb to consider.

If they do launch public chains, the outcomes could be drastically different. The two platforms could directly leverage their "asymmetric advantages": a large user base and ample liquidity, while Korea's unique market characteristics provide further potential for differentiated value creation.

Expected Scenario 1: Layer 2 Network Based on OP Stack

If Upbit and Bithumb build their own chains, they are more likely to choose Layer 2 rather than Layer 1.

The main reason lies in the complexity of development and the resources required. Developing and operating a Layer 1 chain requires an extremely large investment, while Layer 2, although it lowers the threshold through rollup services, still requires deep technical expertise. For example, Kraken's Ink project mobilized about 40 developers. For CEXs, independently developing and operating such infrastructure is too burdensome; their goal is more about expanding platform business through infrastructure rather than building high-performance underlying facilities.

Regulatory risks further complicate the implementation of Layer 1. Layer 1 chains typically require the issuance of native tokens, but under Korea's regulatory environment, token issuance is nearly impossible and comes with severe compliance risks. Therefore, the Layer 2 model that can operate without relying on native tokens becomes the most feasible choice—this aligns closely with Coinbase's path.

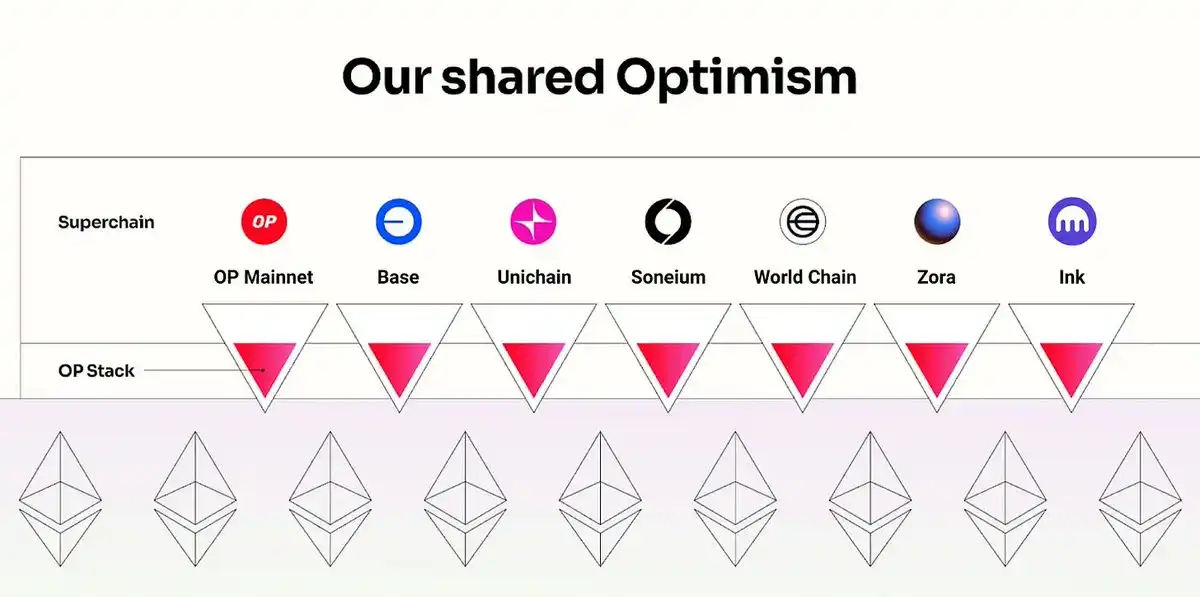

In the development path of Layer 2, there are various technology stacks to choose from, but global CEXs generally regard the Optimism (OP) Stack as the de facto industry standard. Coinbase's Base and Kraken's Ink are both built on this foundation and have gradually established a reference paradigm for "platform self-built chains." Robinhood is a special case; it chose Arbitrum due to different strategic goals. Coinbase and Kraken focus on achieving broad ecological expansion through interoperability, while Robinhood emphasizes directly moving its financial services onto the chain, making Arbitrum's higher customization flexibility more suitable for the latter's strategy.

For Upbit and Bithumb, their goals are similar to those of Coinbase: they must rely on a large user base to expand on-chain services, breaking through the limitations of a fee-driven business model and opening up new revenue sources. In this process, openness and interoperability are crucial. Therefore, if Upbit and Bithumb launch their own chains, the most likely choice would be a public Layer 2 based on the OP Stack.

Expected Scenario 2: Korean Won Stablecoin Infrastructure

Another possible path is for Upbit and Bithumb to build infrastructure specifically around a Korean won stablecoin through their own chains.

The two major CEXs have been active in the stablecoin market, with both Upbit and Bithumb submitting trademark applications related to stablecoins. Upbit has even officially announced a partnership with Korea's leading mobile payment service, Naver Pay, to enter the Korean won stablecoin market.

Focusing on Upbit as the most likely driver, a realistic scenario is that Naver Pay is responsible for issuing a Korean won-based stablecoin, while Upbit provides the blockchain infrastructure. This structure can circumvent the restrictions of the "Virtual Asset User Protection Act," which prohibits platforms from trading virtual assets issued by themselves or related parties.

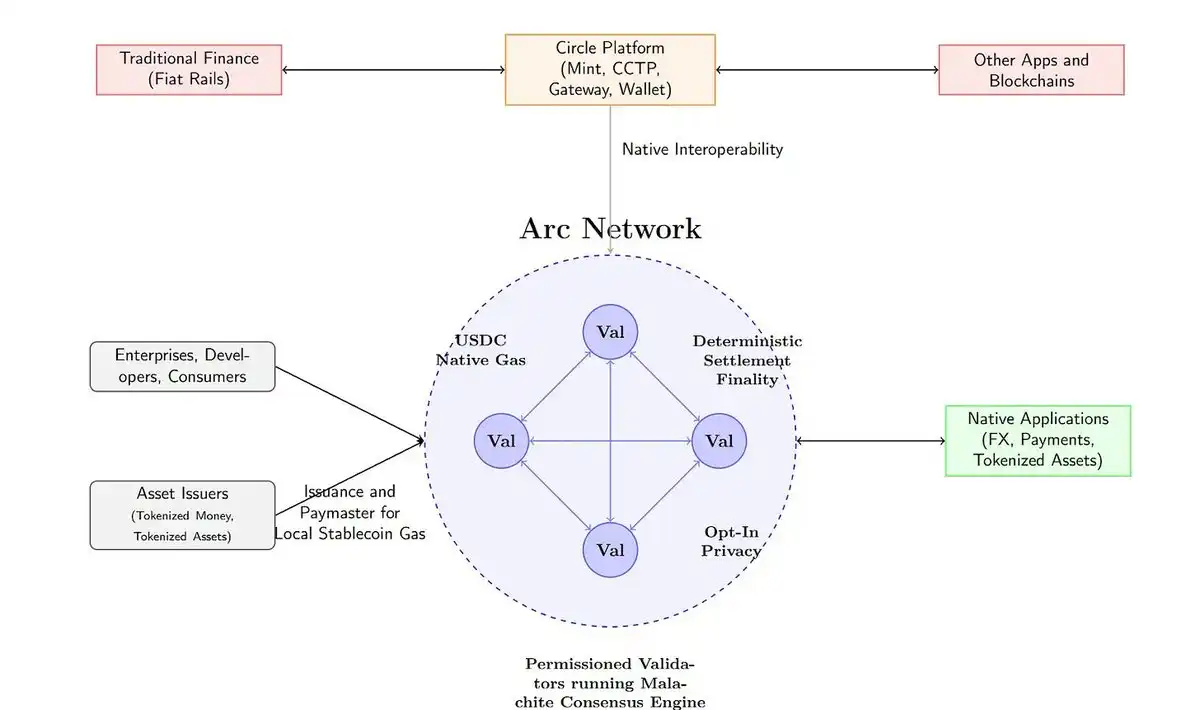

In this model, the key lies in building dedicated infrastructure optimized for stablecoins. They can add real payment functions and privacy protection mechanisms on this basis to create differentiated services. For example, the network could be designed to allow users to pay gas fees directly with the Korean won stablecoin. This is similar to the USDC's Arc Network (@arc) model, aiming to build a stablecoin-centric ecosystem where all transactions revolve around stablecoins. Such an architecture can provide users with a stable cost experience while creating sustainable market demand for the Korean won stablecoin.

Of course, there are still technical constraints. Optimism defaults to using Ethereum to pay gas fees and has stopped supporting custom gas tokens. Therefore, a Layer 2 network based on Arbitrum with higher customization capabilities, or a Layer 1 blockchain with the Korean won stablecoin as the native token, may be a more suitable choice.

Expected Scenario 3: Leveraging Korea's Liquidity Premium

One strategy that Upbit and Bithumb might adopt is to fully leverage the liquidity premium of the Korean market. Currently, Korea has substantial capital liquidity, with fiat-denominated trading volume consistently ranking second globally. However, much of this liquidity remains confined within the internal systems of CEXs.

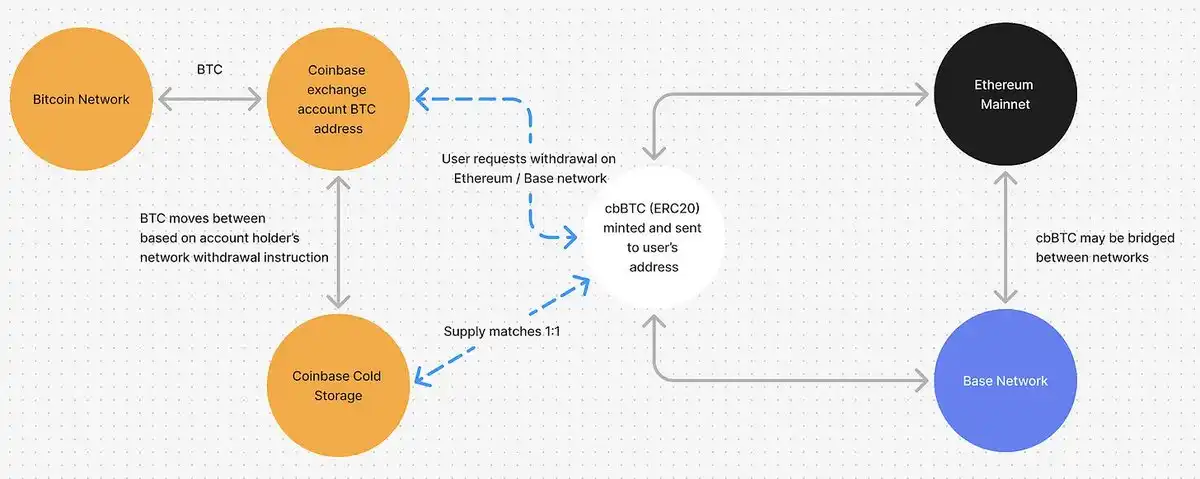

CEXs can issue wrapped tokens based on the assets deposited by users, such as upBTC or bbBTC. Coinbase's cbBTC is a typical example. Although these wrapped tokens can be used on other chains, if the platform provides one-click integration features within its own applications, users are likely to remain on the platform's self-built chain. This not only attracts projects to join the relevant ecosystem to gain liquidity but also promotes ecosystem activity, thereby helping the platform generate revenue at the infrastructure level. Additionally, the platform can use these wrapped tokens to directly test more business models, including lending.

Expected Scenario 4: Entering the Pre-IPO Equity Tokenization Market

Another potential path is for Upbit and Bithumb to enter the unlisted company equity tokenization market. Currently, Upbit operates Pre-IPO equity trading through the Ustockplus platform and has accumulated some experience. However, this model still remains at the P2P matching level, meaning buyers must wait for sellers to list their orders, and if there are no trading counterparts, the transaction cannot be completed. This model suffers from issues such as insufficient liquidity and unpredictable execution efficiency.

Tokenizing Pre-IPO equity on their own chain can significantly change the status quo. Tokenized stocks can achieve continuous trading through liquidity pools or market makers, and ownership transfers can be automatically executed and transparently processed by smart contracts. In addition to improving trading efficiency, it can also enable on-chain automatic dividends, conditional trading, programmable shareholder rights, and other functions, designing financial products that are difficult to achieve under traditional securities systems.

It is worth noting that Naver recently expressed interest in acquiring a portion of the equity in Ustockplus, a subsidiary of Dunamu. In this model, Upbit can provide on-chain infrastructure, while Naver is responsible for platform operations and physical equity management. This structure is feasible under the existing regulatory framework: it effectively separates trading infrastructure from securities management functions, thereby reducing institutional risks, while also allowing the platform to enter the equity tokenization market and address the shortcomings of existing services.

Conclusion

We have explored various possible scenarios for Upbit and Bithumb to launch their own blockchains, but there are still many obstacles in reality. Among them, regulation is the biggest constraint. Korea adopts a "positive list" regulatory approach, which means that services not explicitly stated in the law are difficult to implement. Additionally, after being recognized as large corporate groups, the two platforms face higher compliance burdens. Furthermore, they lack Web3-native leaders like Jesse Pollak, the head of Coinbase Base, and the technical complexity further increases the difficulty. In the short term, the likelihood of such public chains truly taking shape remains low.

However, this does not mean that the prospects are entirely bleak. Since trading volumes peaked in 2021, local transaction volumes have continued to decline; global competition is intensifying; the growth potential of a single fee model is limited; and previous diversification attempts have not yielded significant results. To achieve sustainable growth, new driving forces must be sought. In this context, bold experiments in self-built chains may become a new pillar, which is also the most realistic diversification strategy that aligns with their competitive advantages (large user base and ample liquidity).

Of course, all of this hinges on a shift in regulatory attitudes. If policies can provide more institutional flexibility while ensuring healthy market development, Upbit and Bithumb will be able to more actively promote diversified business explorations. This could not only drive the growth of the two platforms themselves but also enhance the competitiveness of the entire Korean blockchain ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。