The homework for Monday is okay, not very difficult. After Shiba Mabu resigned on Sunday, there was an expectation that the market environment would ease a bit. Over the past three weeks, the discussion has gradually shifted from whether there will be a rate cut in September to whether the U.S. economy will enter a recession. Today, even JPMorgan published an article stating that after a rate cut in September, the market might have exhausted its bullish sentiment and could turn to a decline. Of course, I personally do not see it that way, because there is something more important in September: the dot plot.

We have mentioned countless times that the main contention in the market right now is neither economic issues, nor tariffs, nor even inflation, but rather the game between Trump and the Federal Reserve regarding interest rates. Trump wants a rate cut, and to achieve that, he can ignore all data, while the Federal Reserve maintains a conservative stance, hoping for lower inflation and economic stability.

Although the Federal Reserve holds the power to raise and lower interest rates, it is not a monolith internally. There is now concern that after September, the Federal Reserve may continue to tighten, possibly cutting rates once in 2025. Such a limited number of cuts raises market fears of a recession, while if Trump can gain the support of the majority of the committee for a significant rate cut in a short time, that would be the information brought by the dot plot.

If the September dot plot shows that there could be a 75 basis point cut in 2025 and a 200 basis point cut in 2026, I believe the market will still respond with an increase. However, if it remains like June, with a total cut of 50 basis points in 2025 and another 50 basis points in 2026, then the market will likely become even more pessimistic.

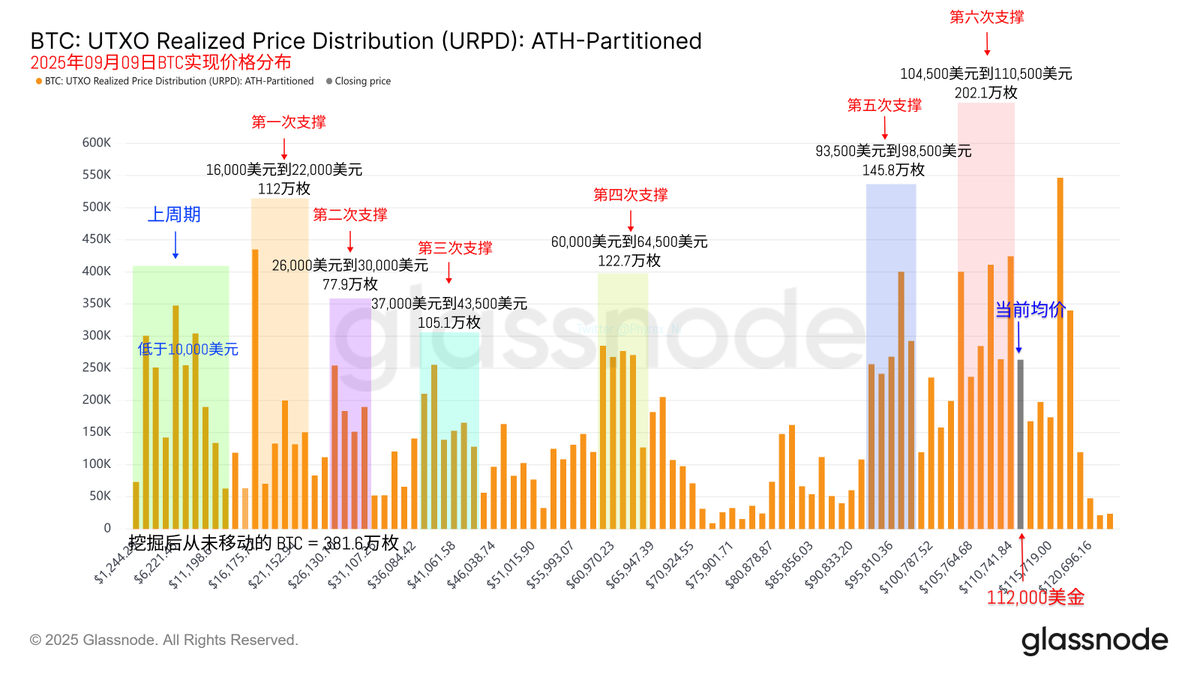

Looking back at Bitcoin's data, although the turnover rate began to rise after the weekend, it is still much lower compared to the same period last week, further indicating that investors are starting to tire of the current price. Trading volume has also seen a significant decline, as everyone seems to be waiting for the results in September. Personally, I do not care much about tomorrow's labor data; it is already an undisputed fact that labor is low, and even Trump cannot do anything about it.

The more important data might be the PPI and CPI figures. However, even if inflation data rises somewhat, in the face of the risk of economic decline, the market will still believe that the Federal Reserve should cut rates. I suddenly find it amusing to think about what would happen if the Federal Reserve firmly states that there will be no rate cut in September. Just thinking about it makes me want to laugh; I guess Trump would be furious.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。