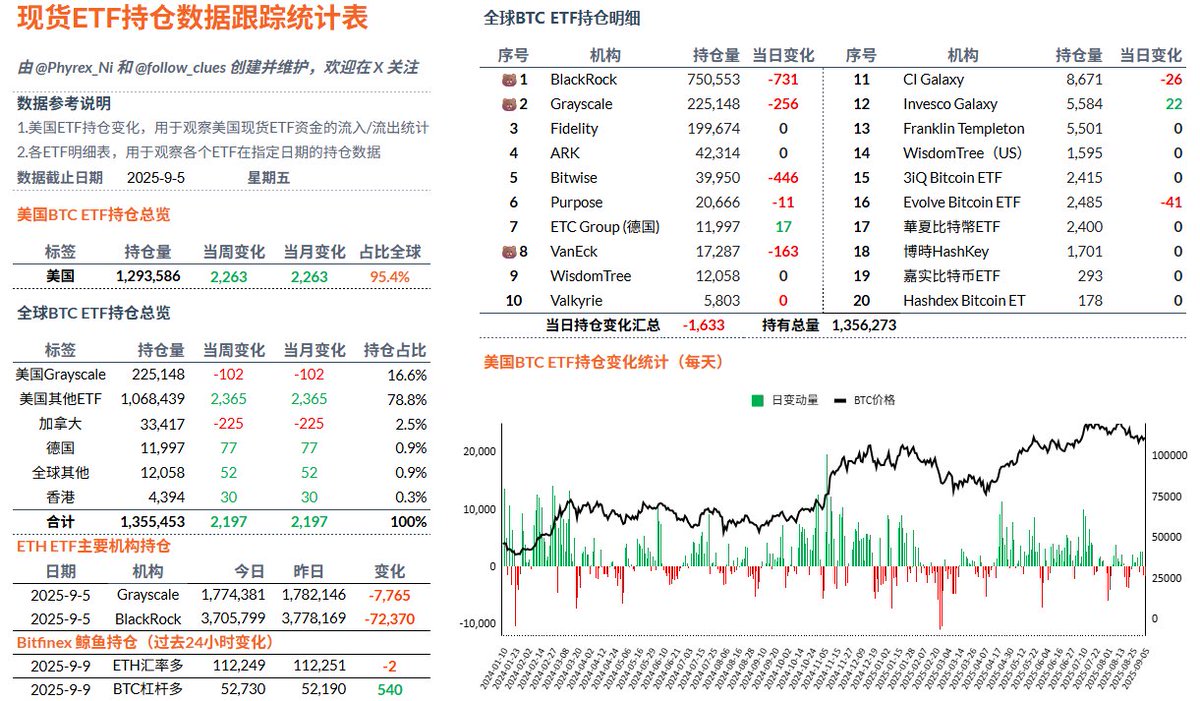

When writing the data for Friday, I realized that I had gotten the dates wrong. Last week started the workdays from Tuesday, and I mixed up a week, which is really something to be scolded for. The data for Friday's $BTC spot ETF, although not good, is still within a small range of fluctuations, with a net inflow of around 2,000 coins and a net outflow of about 2,000 coins, which I consider to be a normal small fluctuation range without much impact. This has been the trend for Bitcoin's spot ETF for quite a long time recently.

During this week, BlackRock's investors had a net inflow of over 3,400 BTC, Fidelity had a net inflow of over 100 BTC, while almost all other data showed net outflows. Investor sentiment has still not improved. In the data for week 86, all U.S. investors collectively net bought over 2,400 BTC, which is a reduction of half compared to week 85.

The market is mainly influenced by the game between Trump and the Federal Reserve, and we will see the results of their first round of negotiations next Thursday.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。