Original source: Four.Meme

In the past year, the narrative around on-chain financing has quietly shifted. Since the Believe platform ignited market sentiment for the "Internet Capital Market," discussions about fundraising mechanisms in the crypto industry have rapidly heated up.

After enduring a long bear market and a liquidity desert, the market craves a truly decentralized, verifiable, and sustainable on-chain financing tool. Four.Meme emerged in this context, successfully and efficiently raising funds multiple times by combining various fundraising mechanisms, such as standard presales and Bonding Curve sales, solidifying its position as a leading Launchpad on the BNB Chain. Four.Meme provides technical support for various sub-projects, but the true core lies in the platform's stability and the accumulation of trust.

If the Pump model of 2024 represented the mainstream narrative of crypto fundraising at the time, then the subsequent Slerf and other purely on-chain presales demonstrated how to build transparency and trust directly on-chain. Slerf raised approximately $10 million; although the amount was limited, it allowed the market to intuitively feel the trust brought by completely transparent funding paths for the first time, providing an important reference for the subsequent mechanism innovations of Four.Meme.

Four.Meme's Diversified Fundraising Mechanisms: Fair, Transparent, Scalable

Four.Meme does not rely on a single mechanism but instead meets the needs of different projects and users through a combination of various fundraising tools.

In April of this year, the AI application project SkyAI became the first pilot, raising a total of 83,000 BNB through a presale mechanism on Four.Meme, valued at tens of millions of dollars, with an oversubscription rate as high as 160 times. This experiment validated the feasibility of "fair sale + instant liquidity."

Following closely, UpTop raised approximately $15 million through Four.Meme's Build Mode Bonding Curve mechanism. This mechanism allows for dynamic pricing based on demand, sequential order matching, and automatic liquidity injection. UpTop's sale demonstrated that the Four.Meme Launchpad can efficiently support medium-sized projects, ensuring that both investors and project parties experience a smooth closed loop from fundraising to liquidity.

The real turning point occurred on August 28, when the decentralized identity and credit protocol CreditLink (CDL) pushed the fundraising amount on Four.Meme to a historical high. Within just one hour of the presale opening, it raised approximately $40.16 million in USD1 and 620,000 FORM; by the end of the sale, the total subscription amount for USD1 exceeded $194 million, along with a contribution of 16.21 million FORM, setting a new fundraising record on the BNB Chain.

The consecutive successes of SkyAI, UpTop, and CDL prove that Four.Meme's mechanisms can seamlessly connect fundraising to liquidity for projects ranging from tens of millions to over a hundred million dollars, truly establishing the position of a new generation of on-chain fundraising standards.

How Four.Meme Enhances the On-Chain Fundraising Experience

Traditional Token Generation Events (TGE) often have several pain points, such as pricing power being held by a few VCs, an opaque allocation process, a disconnect between launch and liquidity injection, and almost no compensation for participants in failed projects. As a leading on-chain fundraising platform on the BNB Chain, Four.Meme has nearly eliminated these pain points through diversified mechanism design.

Four.Meme has transformed this landscape by providing diverse fundraising paths, from fixed-price presales to Bonding Curve sales under Build Mode, all built on transparent and verifiable smart contracts.

The presales on the platform adopt a simple blind box-style fixed price, allowing projects to quickly and fairly complete large-scale fundraising. This model has already created some of the most remarkable results on the BNB Chain, such as SkyAI and CreditLink, proving Four.Meme's strong effectiveness in aggregating community demand.

For projects looking to introduce market dynamic mechanisms, Four.Meme's Build Mode integrates Bonding Curve pricing, fair queue distribution, instant liquidity injection, and even compensation mechanisms for unfulfilled orders. These designs address the deepest inefficiencies in traditional TGEs, creating a more robust, community-driven process.

By combining these two models, Four.Meme has standardized key fundraising processes into transparent smart contracts and shifted the power of issuance from institutions to the community. More importantly, Four.Meme's track record has established a reputation: sales on the platform almost always exceed expectations, solidifying its position as the preferred Launchpad on the BNB Chain.

Capital Flowing Back On-Chain: A Trend Shift

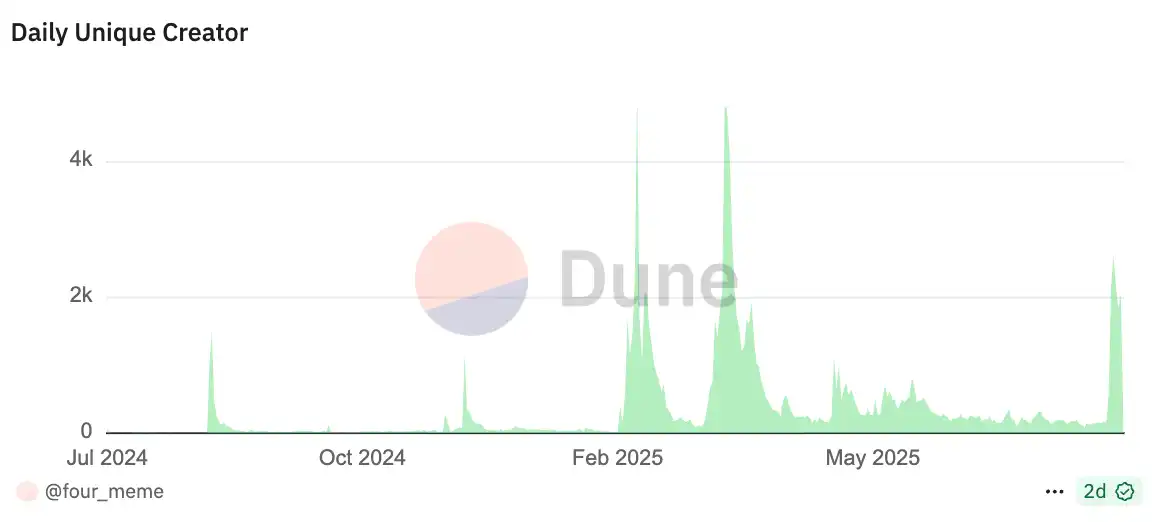

In Four.Meme's continuous experiments, a notable trend is the return of capital flow on-chain.

In the past, users were more accustomed to participating through official websites or trading platforms, as these channels had low friction and high convenience. However, as Four.Meme's advantages in fairness and transparency become increasingly prominent, capital is rapidly migrating on-chain.

The case of Creditlink is the most compelling example, with its USD1 subscription amounting to as much as $190 million occurring entirely on-chain. The scale of this purely on-chain capital flow was almost unimaginable in the past. It reflects an increase in user trust and marks the gradual emergence of decentralized fundraising mechanisms as the market mainstream.

This trend is particularly important for the BNB Chain. For a long time, although the BNB Chain ranked high in user activity and trading volume, it has always lacked native, standardized on-chain tools in the financing and liquidity construction phases. The emergence of Four.Meme fills a long-standing strategic gap in the BNB ecosystem, enhancing the efficiency of on-chain capital circulation and allowing project parties to complete a complete closed loop from financing to liquidity within the ecosystem.

Beyond Meme: Universal Financing Infrastructure

Although Four.Meme initially originated from the aggregation of meme culture, its application scenarios extend far beyond meme coins. SkyAI as an AI application and Creditlink as a decentralized credit protocol both indicate that this model possesses universality across application layers and utility tokens. This also means that Four.Meme is not a tool "born for memes," but a financing underlying architecture that can expand to broader tracks.

From the perspective of the BNBFi strategy, Four.Meme is more like a piece of the puzzle in the BNB ecosystem. It complements the efforts of Lista DAO in liquid staking and stablecoins, collectively improving the financial layer of the BNB ecosystem. For developers, this diversified fundraising mechanism lowers the financing threshold, allowing them to bypass VCs and centralized exchanges (CEX) to engage directly with community users; for users, it provides a new participation path with more symmetrical risks and rewards.

Reshaping Investment Logic

Four.Meme's platform mechanisms are also changing the market's value judgment logic. In the past, the core reason for users to participate in a project was "who the project party is" or "who the VC is." Now, they are increasingly focused on "which platform the project is launched on," and a more core question—

—"Why should I invest?"—referring to the project's narrative, application prospects, and community consensus.

Four.Meme has established a reputation where presales on the platform almost always exceed market expectations, and the fundraising results themselves become a market signal. The platform's emphasis on fairness and sustainability aligns closely with the entire market's transition from "authority endorsement-driven" to "market signal-driven" and then to "narrative and consensus-driven."

Not Just an Endpoint, But a Starting Point

The new fundraising highs created by Four.Meme and Creditlink on the BNB Chain are not an endpoint but a starting point. As the market's demand for on-chain transparency, fairness, and automation mechanisms grows stronger, Four.Meme is expected to become the fundraising standard adopted by more public chains and projects.

In the future, as the scale of on-chain capital continues to expand, Four.Meme will also face new challenges in ecosystem construction and mechanism optimization—how to ensure the robustness of mechanisms under larger capital inflows? How to further synergize with ecological facilities like BNBFi to build a more complete financial closed loop? And how to promote this model to cross-chain and even multi-chain environments, making on-chain fundraising truly the infrastructure of the entire crypto market?

Regardless of the answers, Four.Meme has proven one point with the achievements of SkyAI and Creditlink: the value of on-chain fundraising lies not in short-term fundraising amounts, but in long-term transparency, fairness, and sustainability. It is these elements that determine whether Web3 financing can truly break free from the shadow of centralization and move towards a healthy cycle.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。