Key Points

- The total market capitalization of cryptocurrencies is $4.06 trillion, up from $3.84 trillion last week, representing a 5.73% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.5 billion, with a net inflow of $246 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.73 billion, with a net outflow of $787 million this week.

- The total market capitalization of stablecoins is $282.6 billion, with USDT having a market cap of $168.9 billion, accounting for 59.76% of the total stablecoin market cap; followed by USDC with a market cap of $72.5 billion, accounting for 25.65%; and DAI with a market cap of $5.36 billion, accounting for 1.89%.

- According to data from DeFiLlama, the total TVL of DeFi this week is $152.1 billion, down from $154.5 billion last week, a decrease of approximately 1.55%. By public chain, the top three chains by TVL are Ethereum at 59.47%; Solana at 7.54%; and Bitcoin at 5.19%.

- On-chain data shows that the overall activity of public chains is under pressure this week. Daily transaction volume increased only for the BNB chain (+24.8%) and Aptos (+5%), while others declined, with Ethereum, Ton, and Sui all dropping over 34%, and Solana slightly down by 5.5%. In terms of transaction fees, Ethereum decreased by 50%, while BNB and Ton remained flat, and Solana and Aptos increased by 22.6% and 7.6%, respectively. Daily active addresses saw only Sui increase significantly by 66%, while other chains generally declined, with Ethereum and Aptos experiencing larger drops. In terms of TVL, Solana, BNB, and Ton saw slight increases, while other chains declined, with Aptos experiencing the largest drop of 5.1%.

- New project focus: MECCA is a diversified blockchain ecosystem based on Solana that integrates shopping, gaming, web comics, and payments, with the MEA token running throughout the system. Aria is a compliance platform that integrates real-world assets (RWA) and intellectual property (IP), focusing on the tokenization and fragmentation of RWIP (real-world intellectual property) to help release liquidity in secondary and lending markets. Pharos is a high-speed, EVM-compatible internet-level public chain dedicated to building the best infrastructure for RWA and enterprise-level DeFi.

Table of Contents

Key Points

Table of Contents

I. Market Overview

Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion

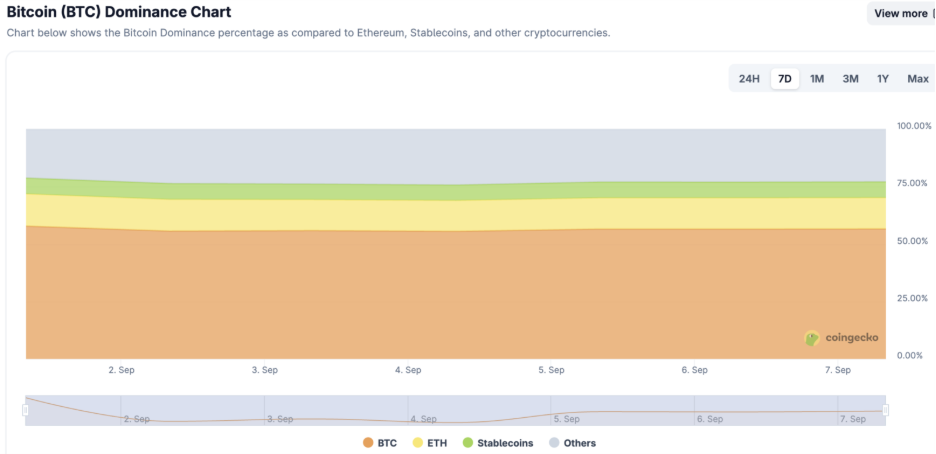

The total market capitalization of cryptocurrencies is $4.06 trillion, up from $3.84 trillion last week, representing a 5.73% increase this week.

Data Source: cryptorank

Data as of September 7, 2025

As of the time of writing, the market cap of Bitcoin is $2.21 trillion, accounting for 54.4% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $282.6 billion, accounting for 6.96% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of September 7, 2025

2. Fear Index

The cryptocurrency fear index is at 50, indicating a neutral sentiment.

Data Source: coinglass

Data as of September 7, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.5 billion, with a net inflow of $246 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.73 billion, with a net outflow of $787 million this week.

Data Source: sosovalue

Data as of September 7, 2025

4. ETH/BTC and ETH/USD Exchange Rates

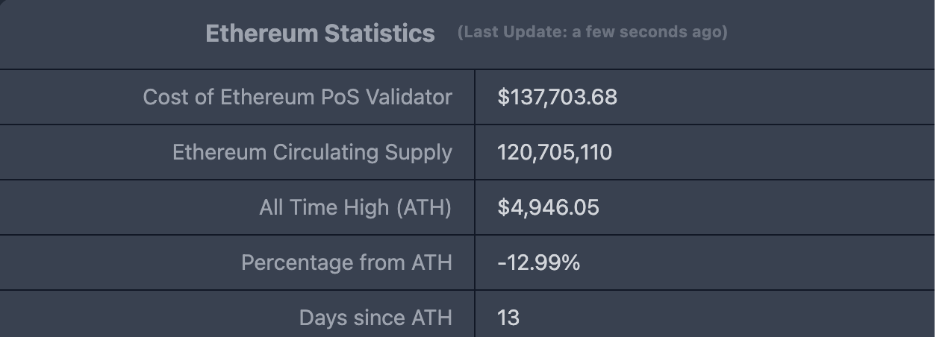

ETHUSD: Current price $4,301.13, all-time high $4,878.26, down approximately 12.99% from the all-time high.

ETHBTC: Currently at 0.038691, all-time high at 0.1238.

Data Source: ratiogang

Data as of September 7, 2025

5. Decentralized Finance (DeFi)

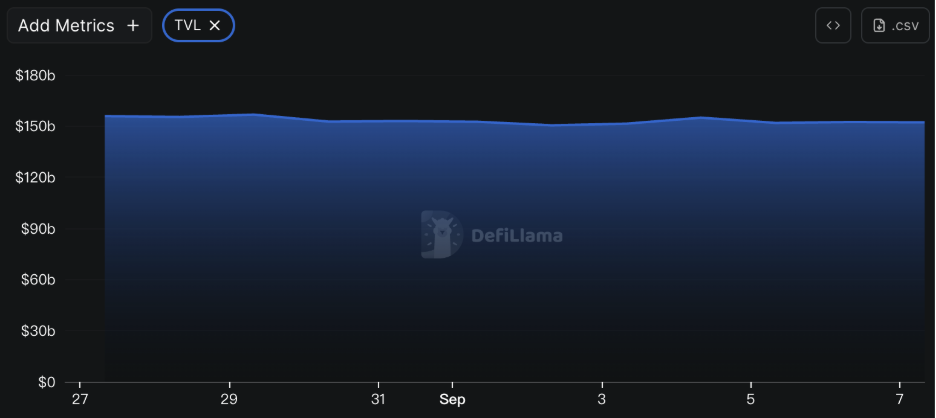

According to data from DeFiLlama, the total TVL of DeFi this week is $152.1 billion, down from $154.5 billion last week, a decrease of approximately 1.55%.

Data Source: defillama

Data as of September 7, 2025

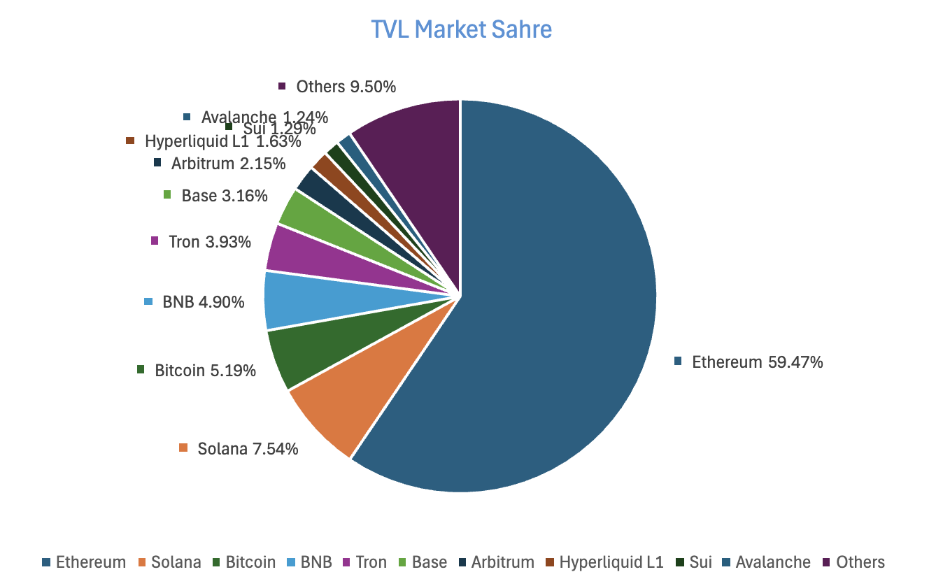

By public chain, the top three chains by TVL are Ethereum at 59.47%; Solana at 7.54%; and Bitcoin at 5.19%.

Data Source: CoinW Research Institute, defillama

Data as of September 7, 2025

6. On-Chain Data

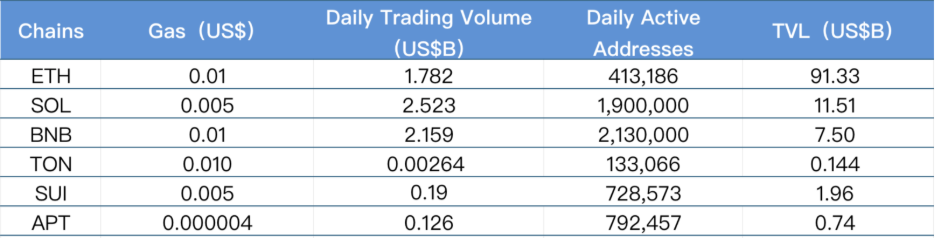

Layer 1 Related Data

Mainly analyzing daily transaction volume, daily active addresses, and transaction fees for the major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of September 7, 2025

- Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, only the BNB chain (+24.8%) and Aptos (+5%) saw increases, while others declined. Ethereum (-35.2%), Ton (-34%), and Sui (-36.67%) experienced similar declines, with a slight drop of 5.51%. In terms of transaction fees, the BNB chain and Ton chain remained flat compared to last week; Ethereum decreased by 50%, Sui (-3.07%) saw a slight decrease; while Solana and Aptos increased by 22.58% and 7.57%, respectively.

- Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, only the Sui chain saw an increase of 65.96% in daily active addresses, while others declined. Ethereum and Aptos experienced relatively large drops of 16.06% and 14.14%, respectively, while BNB (-3.18%) and Ton (-7.18%) saw slight declines. In terms of TVL, Solana (+0.37%), BNB (+0.81%), and TON (+2.86%) achieved slight growth, while other public chains declined, including Ethereum, Sui, and Aptos, which dropped by 0.91%, 2.29%, and 5.13%, respectively.

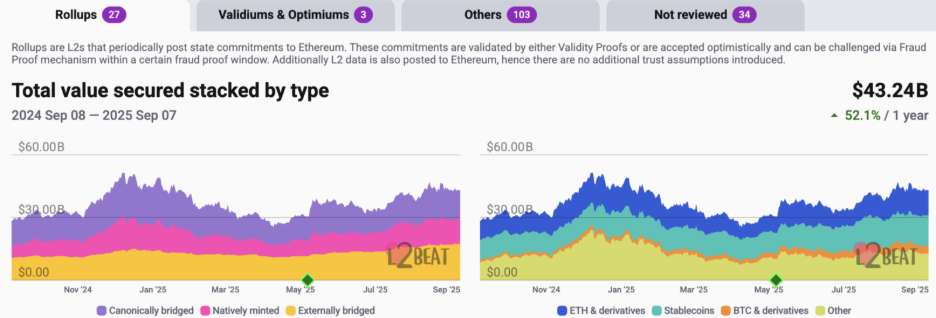

Layer 2 Related Data

According to L2 Beat data, the total TVL of Ethereum Layer 2 is $43.24 billion, with an overall increase of 0.6% this week compared to last week ($42.98 billion).

Data Source: L2 Beat

Data as of September 7, 2025

Base and Arbitrum hold the top positions with market shares of 38.26% and 35%, respectively. Base's market share has slightly decreased over the past week, while Arbitrum has seen an increase.

Data Source: Footprint, data as of September 7, 2025

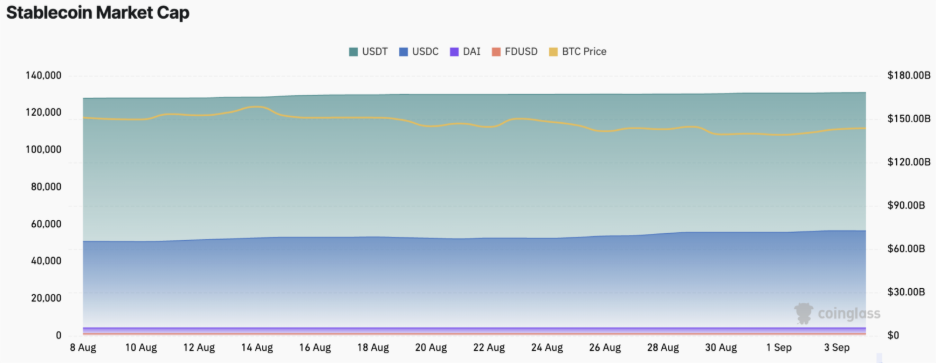

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $28.26 billion, with USDT having a market cap of $16.89 billion, accounting for 59.76% of the total stablecoin market cap; followed by USDC with a market cap of $7.25 billion, accounting for 25.65%; and DAI with a market cap of $536 million, accounting for 1.89%.

Data Source: CoinW Research Institute, Coinglass

Data as of September 7, 2025

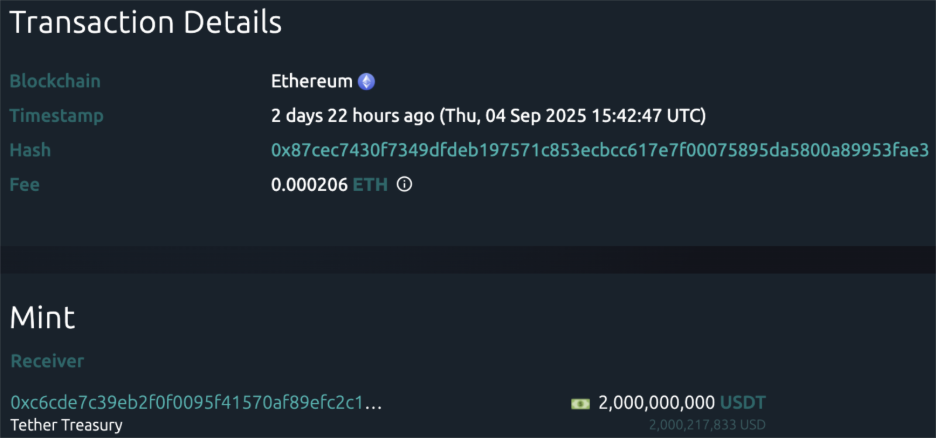

According to Whale Alert data, this week the USDC Treasury issued a total of 1.244 billion USDC, and Tether Treasury issued a total of 2 billion USDT this week. The total issuance of stablecoins this week is 3.244 billion, a decrease of 53.52% compared to last week's total issuance of 6.98 billion.

Data Source: Whale Alert

Data as of September 7, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

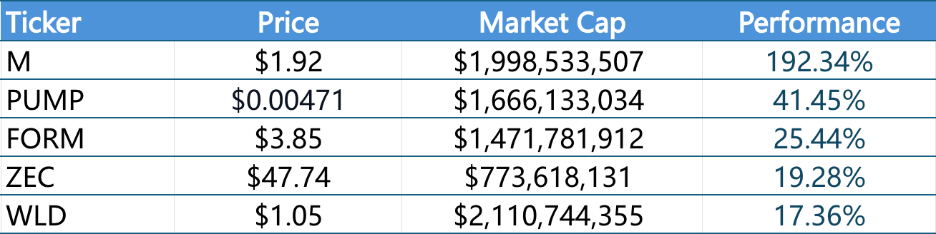

Top five VC coins by growth over the past week

Data Source: CoinW Research Institute, CoinMarketCap

Data as of September 7, 2025

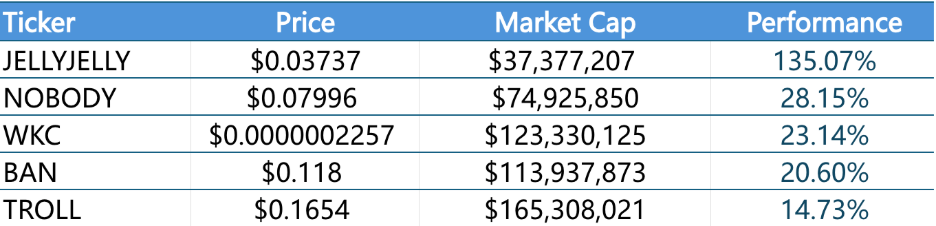

Top five meme coins by growth over the past week

Data Source: CoinW Research Institute, CoinMarketCap

Data as of September 7, 2025

2. New Project Insights

- MECCA is a diversified blockchain ecosystem based on Solana that integrates shopping, gaming, web comics, and payments, with the MEA token running throughout the system. Users can earn cashback while shopping on the platform, enjoy P2E games, read and trade webtoons in NFT form, and participate in payments, rewards, and secondary market circulation through tokens, forming a sustainable closed-loop economy. With Solana's high performance and low cost, MECCA aims to create a global, integrated decentralized entertainment and consumption experience.

- Aria is a compliance platform that integrates real-world assets (RWA) and intellectual property (IP), focusing on the tokenization and fragmentation of RWIP (real-world intellectual property) to help release liquidity in secondary and lending markets. Through distributed ownership and collaborative decision-making, Aria supports users in recreating and developing IP, creating new revenue streams.

- Pharos is a high-speed, EVM-compatible internet-level public chain founded by core members of the former Ant Financial and Alibaba blockchain teams, dedicated to building the best infrastructure for RWA and enterprise-level DeFi. Pharos supports performance of up to 50,000 TPS through trustless and decentralized design, enhancing the efficiency of payments and applications, setting a new standard for the next generation of high-performance Layer 1 chains.

III. Industry News

1. Major Industry Events This Week

- World Liberty Financial (WLFI) completed its token generation event (TGE) on September 1, 2025, distributing tokens to early users through a system called "Lockbox," where approximately 20% of the tokens were immediately unlocked, and the remaining portion will be gradually released according to community governance arrangements.

- On September 2, QuackAI (Q) publicly announced that the airdrop for its official token Q is now open for claims. Users can check the status, view allocation amounts, and follow steps to claim or transfer their tokens on the relevant portal. Quack AI is an AI-driven governance protocol with a total token supply of 10 billion, of which 10% is allocated to the core team, 11% to investors and advisors, and 79% to the community and ecosystem, with an initial circulating supply of 16.16%, starting its TGE event on September 3.

- Somnia (SOMI) officially launched its token generation event (TGE) and first airdrop activity on September 2, 2025. This airdrop allocated 5% of the total supply (approximately 50 million SOMI) to reward early participants, developers, and community members. Approximately 4.3% of the tokens were allocated to users who participated in the testnet, while the remaining portion was rewarded to creators, content contributors, and NFT holders. The airdrop adopted a method of 20% immediate unlocking and 80% linear unlocking over 60 days to encourage long-term participation.

- Hyperbot (BOT) completed its token generation event (TGE) and airdrop activity on September 3, 2025, distributing tokens to early users and community members as rewards for early participation and ecological contributions. Hyperbot is an AI-driven on-chain contract trading tool that helps users track market signals and smart fund flows. The launch of the airdrop and TGE aims to incentivize community members to participate and lay the foundation for the project's long-term development.

2. Major Upcoming Events Next Week

- Linea (LXP) officially confirmed on September 3, 2025, that airdrop checks are now open and announced that the TGE will officially start on September 10. Linea adopts an initial distribution plan similar to Ethereum: 85% of the total supply is allocated to the ecosystem, with 10% for early users and builders (fully unlocked), and the remaining 75% allocated to the ecosystem fund, of which 4% is for liquidity provider community airdrops. The project team and investment institutions do not allocate shares, focusing on the sustainable development of the ecosystem. The airdrop claim window will open on September 10 and last for 90 days until December 9, with all airdrop tokens fully unlocked, and unclaimed tokens will be returned to the ecosystem fund after the window closes.

- Blockchain security company Firewarm is conducting an airdrop for early supporters and community members, with a total reward pool valued at $35,000. Participants need to complete a series of tasks. The airdrop activity started on September 3, 2025, and will last until October 19, 2025, with winners receiving token rewards ranging from $250 to $750. The project has not yet announced the official token generation event (TGE) date, and this airdrop aims to incentivize community participation and pave the way for future ecological development.

- In September 2025, Lemonade is conducting an author reward program called the GHO airdrop, aimed at encouraging platform users to earn GHO stablecoin rewards by publishing high-quality content, organizing events, and building communities. The program does not set a fixed snapshot time or end date but instead provides dynamic rewards based on users' ongoing contributions to the platform. The official token generation event (TGE) date has not yet been announced.

- Betura plans to launch its first decentralized exchange token issuance (IDO) on September 15, 2025. The airdrop activity started on August 5, 2025, and ended on September 5, 2025, with a total reward of 100,000,000 BETURA tokens, approximately $500,000. The IDO will go live on the Spores Network platform on September 15, 2025, with an expected fundraising of $437,500. The specific date for the token generation event (TGE) has not yet been announced.

3. Important Investments and Financing from Last Week

- AI blockchain startup Kite announced the completion of a $18 million Series A funding round, led by PayPal Ventures and General Catalyst, with participation from 8 VCs, Samsung Next, and others, bringing the company's total funding to $33 million. Kite is building a blockchain infrastructure specifically designed for AI, offering features such as real-time payments, programmable governance, cryptographic identity, and verifiable attribution, aimed at creating a secure, independently operating underlying transaction layer for AI agents, facilitating the implementation of a globally interoperable AI service network. (September 2, 2025)

- SonicStrategy announced it has secured a $40 million investment from SonicLabs (approximately CAD 55 million), which will be used to expand the team, drive product development, and accelerate market expansion. SonicStrategy, launched by multinational tech public company Spetz Inc., aims to be the cornerstone of revitalizing the Sonic token ecosystem by creating value through token accumulation, active participation in staking, and other DeFi projects. (September 2, 2025)

- German digital asset custody company Tangany announced the completion of a €10 million Series A funding round, led by Baader Bank, Elevator Ventures/Raiffeisen Bank International, and Heliad Crypto Partners, with continued support from HTGF and Nauta Capital. Tangany is a regulated German crypto financial institution providing market-leading B2B solutions for digital asset custody on the blockchain. With the Tangany Custody suite, clients can store digital assets such as cryptocurrencies (Bitcoin, Ethereum, etc.), stablecoins, security tokens, crypto securities, and NFTs in hot or cold wallets. (September 3, 2025)

- Etherealize completed a $40 million Series A funding round, led by Electric Capital and Paradigm, and received rare participation from Ethereum co-founder Vitalik Buterin and the Ethereum Foundation. As the "institutional-grade product and marketing team" of the Ethereum ecosystem, Etherealize will use this funding to build institutional-grade infrastructure, including platforms for the issuance, management, and settlement of tokenized assets, as well as an automated compliance system, and plans to introduce zero-knowledge proof privacy features. (September 3, 2025)

IV. Reference Links

- Kite AI: https://gokite.ai/

- SonicStrategy: https://www.sonicstrategy.io/

- Tangany: https://tangany.com/

- Aria: https://ariaprotocol.xyz/

- MECCA: https://meccain.com/

- Pharos: https://pharosnetwork.xyz/

- Etherealize: https://www.etherealize.io/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。