Author: Yue Xiaoyu

Is U Card really a good business?

From the very beginning with Onekey Card, to Infini Card, and now to Morph Card, well-known U Cards have been shutting down one after another, yet many projects continue to emerge to create U Cards, indicating a relentless influx.

Logically, U Cards do make sense and have significant value: users can recharge stablecoins into U Cards and directly use them for daily consumption, addressing the pain point of small withdrawals in cryptocurrency.

However, in the actual operation of U Cards, many issues become apparent.

Here’s a detailed analysis.

1. First, let's look at the business model, focusing on costs and revenues

(1) U Card's profits are slim

U Cards are not high-profit businesses; their business model consists of two parts: recharge and withdrawal fees, and earning commissions from consumption, with revenues around 1%-2%.

Overall, it falls under the category of low-margin, high-volume business.

However, Infini pioneered a new model: investing user assets to earn fund management income.

But this also comes with new risk exposures, including fund management risks, such as the risk of external on-chain protocol theft and internal malfeasance risks.

The result was that Infini indeed encountered a theft incident, leading to the cessation of U Card operations and a focus on asset management business.

(2) U Card's maintenance costs are very high

The costs of U Card operations include technical maintenance costs, user support costs, compliance costs, etc.

As the user base grows, a customer service team needs to be maintained to handle refund and inquiry demands.

It’s important to note that most U Card users are retail investors, with long-term deposits of a few hundred dollars being the majority, yet they generate a massive number of issues during card usage.

Infini co-founder Christine has publicly stated that the U Card business consumed 99% of the company's time and costs, yet contributed almost no revenue.

2. Now let's look at the potential issues with U Cards

(1) First and foremost, there is compliance risk

U Card operations must adhere to strict KYC and AML (Anti-Money Laundering) requirements.

U Cards are susceptible to being used for money laundering, fraud, and other illegal activities. If issues arise, card organizations and upstream banks typically pass all AML fines onto the project party, resulting in penalties ranging from the deduction of deposits to outright termination of cooperation.

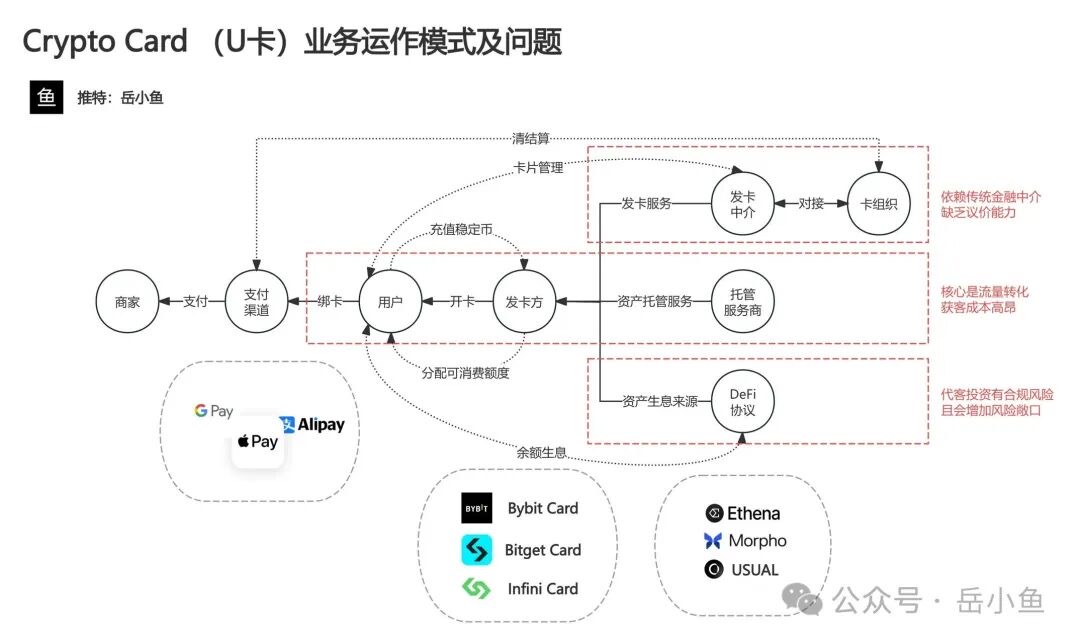

(2) Business model relies on traditional financial intermediaries

The operational model of U Cards heavily relies on traditional financial intermediaries, such as payment giants Visa and Mastercard, as well as issuing institutions.

Many projects' U Cards do not directly connect with issuing institutions but instead involve secondary agents providing issuing services.

Project parties are at the very end of the ecosystem chain, lacking bargaining power with card organizations and issuers.

If upstream issues arise, such as payment networks and banks severing cards or freezing accounts based on "risk prudence principles," project parties must deal with a large volume of customer complaints.

(3) In the long run, stablecoin payments will compress the U Card space

U Cards still belong to a Web2.5 product, which is overall very centralized.

Users transfer stablecoins to the platform, which then provides card limits. When the funds held by the platform become substantial, there is a significant incentive for the platform to abscond with the funds or become a target for hackers.

As some platforms gradually begin to accept stablecoin payments directly, the usage scenarios for U Cards will be directly impacted.

3. In summary

From a business model perspective, U Cards are low-margin, high-volume businesses with low profits and high costs, requiring a focus on traffic;

From a potential risk perspective, there are compliance risks, strong reliance on suppliers, and the potential for stablecoin proliferation to compress the U Card space.

If we define a "good business" as sustainable, high-return, and low-risk, then U Cards clearly do not fit this definition.

The U Card business is more suitable for large players with their own user traffic and ample resources, but for most startup projects, the returns are not proportional.

However, cards issued by exchanges like Binance, Bitget, and CryptoCom are operating quite well; they collaborate directly with issuers or even acquire upstream banks, thus resolving upstream bottleneck issues.

These large exchanges have core business support, allowing U Card operations to synergize with their main business, attracting new users or addressing some withdrawal needs.

Although stablecoin payments are currently very popular, whether this new business can be developed still depends on the fundamental business model and whether it can integrate with the core business to create a 1+1>2 effect.

Of course, after diversifying business, the common outcome is actually 1+12.

Stay cautious yet optimistic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。