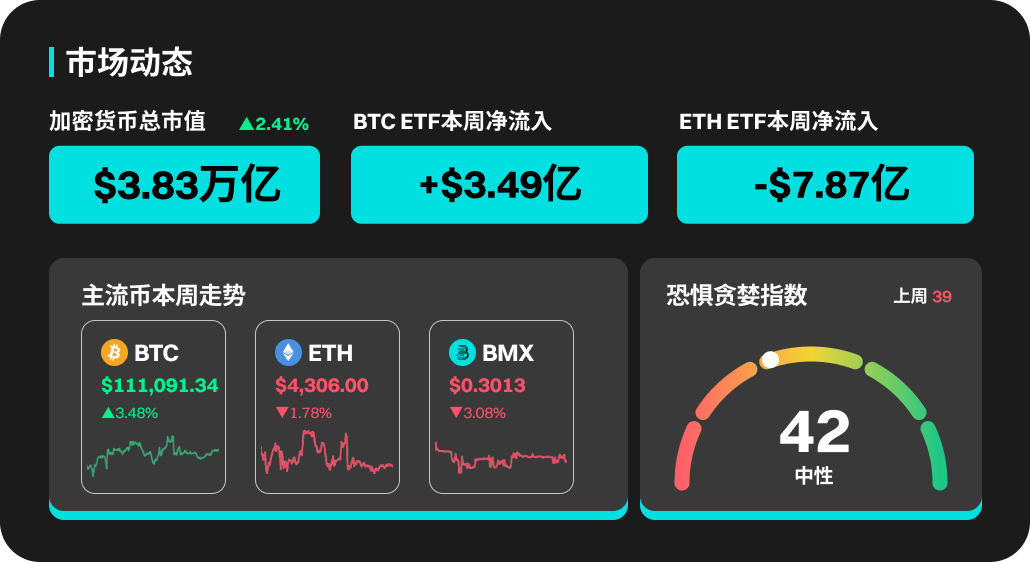

This Week's Cryptocurrency Market Dynamics

Last week (9.01-9.07), the net inflow amount for BTC ETFs was $349 million, with BTC remaining in a narrow fluctuation range of $107,000 to $113,000 throughout the week, resulting in relatively small overall market volatility. Currently, BTC's market share is reported at 57.7%, basically unchanged from last week. BTC has retraced 11% from the historical high set in August, which the market considers a normal pullback after a rise. Last Friday, the U.S. non-farm payroll data was released, clarifying expectations for a rate cut in September, while also raising concerns about an economic recession.

Last week, ETH ETFs saw a net outflow of $787 million, with daily trading volumes throughout the week showing net inflows. Despite this, ETH's market performance remained relatively stable, without significant price declines. ETH's market share is currently reported at 13.5%, showing a certain degree of decline compared to last week; the ETH/BTC exchange rate is reported at 0.0389, a significant drop of about 5% from last week, indicating that BTC outperformed ETH during this period. ETH has retraced 13% from the historical high set in August, with the market awaiting the CPI data release on September 11.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, MYX, WLD, HYPE, PENGU, and WLFI have all performed well. MYX's price increased by 217.8% this week, with a 24-hour trading volume of 3.15M. WLD's price rose by 47.6%, reaching a peak price of 1.28 USDT. HYPE and PENGU increased by 12.1% and 8.7% respectively this week.

U.S. Market Overview and Hot News

Last week, U.S. stocks experienced overall fluctuations, with the Dow Jones index slightly down by about 0.3%, the S&P 500 up by 0.3%, and the Nasdaq showing strong performance with an increase of about 1.1%. Weak non-farm employment data raised market expectations for a rate cut by the Federal Reserve in September, with technology stocks, particularly in AI and semiconductor sectors, leading the gains, while the energy sector faced relative pressure.

The U.S. SEC plans to make a decision on Bitwise's Bitcoin and Ethereum ETF physical redemption application on September 8;

The U.S. CPI data for August will be released on September 11 at 8:30 PM;

SOL Strategies has been approved to list on Nasdaq on September 9, with the stock code STKE;

Popular Sectors and Project Unlocks

Memecoin Sector

The Memecoin sector was vibrant last week, with a cumulative increase of about +10.6%, particularly with Dogecoin (DOGE) showing remarkable performance, reaching a +10.6% increase. With strong momentum and heightened market sentiment, if community support and attention continue, there remains short-term elasticity.

Aptos (APT) will unlock approximately 11.31 million tokens at 6 PM Beijing time on September 11, representing 2.20% of the current circulating supply, valued at about $48 million;

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 8 AM Beijing time on September 13, representing 3.13% of the current circulating supply, valued at about $56 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve substantial risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。