The weekend's homework has become a bit simpler; what needed to be said on Friday has mostly been covered. It’s already good that there hasn’t been significant volatility over the weekend. The market is gradually digesting the Federal Reserve's stance on interest rate cuts in September. In fact, rate cuts are just part of the picture; more importantly, it’s about how to handle the current situation. For instance, if there are expectations of an economic downturn, what should be the response? Does an economic downturn necessarily mean a significant drop?

Not necessarily. An economic downturn does not always equate to a recession, and even if a recession occurs, there is a possibility of recovery. For example, the economic recession in 2020 was the shortest in U.S. history, lasting only two months. Although the S&P 500 dropped over 30% in a short time, it rebounded within six months, and seven months later, it even exceeded the pre-recession peak.

Therefore, it is difficult to make a direct judgment about the future trajectory of the economy. Personally, as I mentioned yesterday, my strategy is to try to sell or switch out some altcoins, retain mainstream coins, and ensure I have cash on hand to buy the dip. If a significant drop occurs, I will buy the dip; if not, I can still benefit from the rise of mainstream coins.

Moreover, my personal bet is not on the present but on waiting for the Federal Reserve's interest rates to return to a low point. Regardless of history, as long as there are rate hikes, there will inevitably be rate cuts; I am just waiting for that.

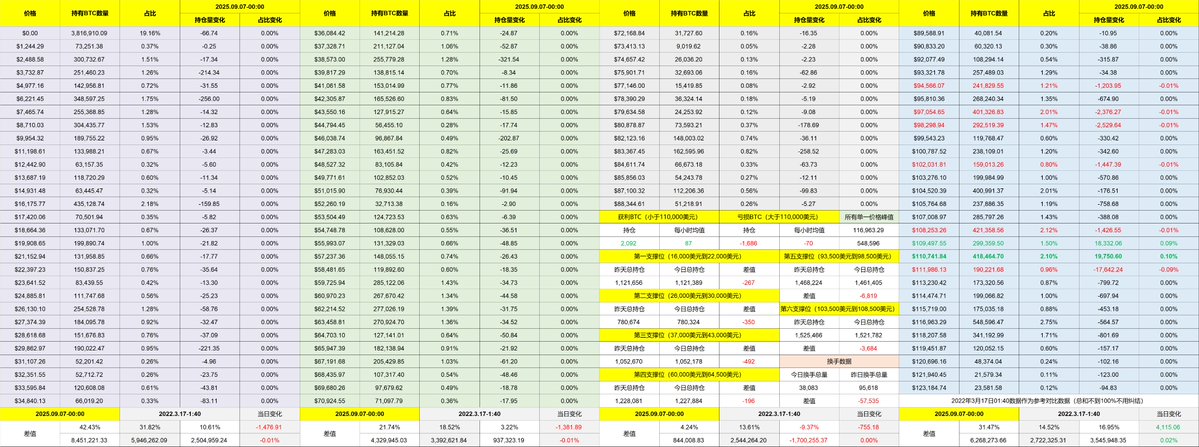

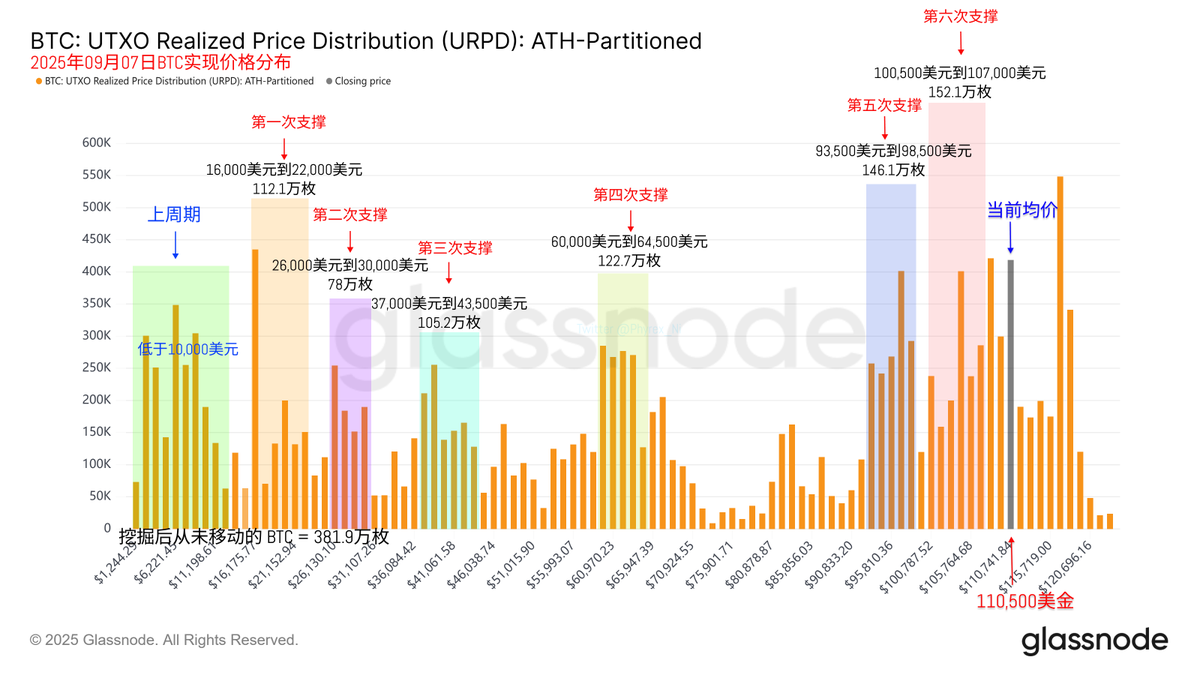

Looking at Bitcoin's data, the turnover rate has significantly decreased, indicating that most ordinary investors lack the motivation to trade $BTC at the current price. More likely, they are waiting for the competition between Trump and the Federal Reserve to become clearer.

Although market sentiment is not very good, it feels like the $100,000 level is a relatively solid bottoming position. I still maintain the same expectation: if there is no systemic risk, the likelihood of breaking below $100,000 is not very high.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。