I. Introduction

During his campaign, Trump promised to become the "cryptocurrency president," advocating that digital assets could improve the banking system and strengthen the dominance of the dollar. After taking office, Trump quickly appointed crypto-friendly individuals to key regulatory positions and promoted several policies favorable to the industry's development. This paved the way for his family's overall foray into the crypto space. Since then, the Trump family has bundled political appeal, media traffic, and capital tools into an "accelerator," rapidly building a multi-track crypto asset portfolio through Trump Media & Technology Group, family subsidiaries, and joint venture platforms: from issuing personal meme coins to constructing the stablecoin USD1 and the WLFI platform, to strategies for crypto asset treasury, Bitcoin mining companies, as well as NFTs and crypto ETFs, creating a business landscape that spans the crypto ecosystem.

This article will uncover the path taken by the Trump family to reshape wealth using political influence and capital leverage, breaking down the background and performance of the Trump family's business landscape in the crypto field, including meme coins, stablecoins, DeFi platforms, treasury strategies for exchanges, mining public companies, NFTs, and ETFs. It will summarize the opportunities and potential risks of their crypto strategy from both opportunity and risk dimensions, helping investors rationally understand the "Trump crypto phenomenon" in a situation where enthusiasm and risk coexist.

II. Personal Meme Coins and Crypto Dinner Marketing

On January 18, 2025, just before Trump was set to take office again as President of the United States, he launched his personal meme coin $TRUMP on the Solana chain. The Trump Group's subsidiary CIC Digital and the jointly held Fight Fight Fight company hold 80% of the token. On January 20, Trump's wife Melania also took the opportunity to launch her own crypto meme currency $MELANIA, sparking a global FOMO. These two tokens essentially lack innovative technological support, with their value primarily driven by online hype and political topicality, making them "purely emotional speculation" assets. With the fervent support of Trump supporters and viral spread on social media, the market capitalization of $TRUMP soared to about $9 billion shortly after its launch, with trading volume surpassing BTC, ranking among the top meme coins by market cap; meanwhile, the peak market cap of $MELANIA also reached about $1.6 billion. This crazy market even surpassed many mainstream crypto projects, highlighting the personal IP appeal of Trump in the crypto space.

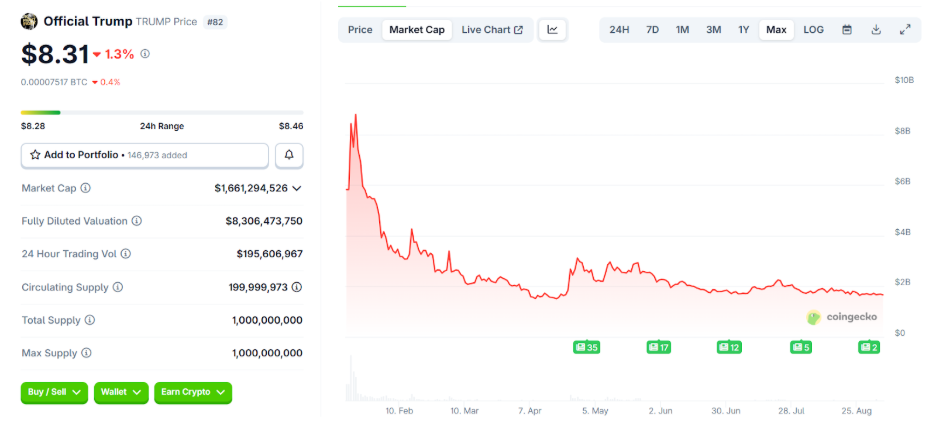

However, the good times did not last long, as the initial speculative frenzy faded, and the prices of these two meme coins plummeted significantly. As of now, the market cap of $TRUMP has dropped to about $1.7 billion, more than an 80% decline from its peak; $MELANIA has fallen even further to about $144 million, less than 10% of its highest point. Many ordinary investors who bought in at high prices suffered losses, leading to public outcry against the Trump family. Industry commentators sharply pointed out that the Trump family's actions were akin to "harvesting the chives," exploiting the trust of their supporters to make a significant profit in the crypto space. Social media is filled with criticisms of the presidential couple for issuing air coins to raise money, arguing that their actions harm public interest and the presidential image.

Source: https://www.coingecko.com/en/coins/official-trump

The Trump family does not seem to shy away from directly using political influence for token marketing. In May 2025, Trump hosted a "cryptocurrency dinner" at his private club, inviting the top 220 holders of $TRUMP meme coins to join him for dinner. Each invitee was required to donate $1.5 million to attend, raising tens of millions of dollars for Trump through this crypto dinner. In no time, the Washington political dinner had seemingly transformed into a "big player symposium" in the crypto space. This high-profile move triggered strong unease among Democratic lawmakers and ethics watchdogs, criticizing Trump for formulating regulatory policies favorable to the crypto industry while his family profited significantly from it, posing serious risks of conflicts of interest.

III. World Liberty Financial: The Core DeFi Platform of the Trump Family

The centerpiece of the Trump family's activities in the crypto field is the decentralized finance platform World Liberty Financial (WLF). This project was co-founded in September 2024 by Trump's eldest son Donald Trump Jr. and his second son Eric Trump, gaining significant attention after Trump won the presidential election. WLF is positioned as a one-stop DeFi ecosystem, including key products such as the governance token WLFI and the stablecoin USD1. In return, Trump-related enterprises hold nearly 60% of the shares in the WLF holding company through the entity "DT Marks DEFI LLC" and enjoy 75% of the token sale revenue rights from the platform. The Trump family and its affiliates have pre-allocated 22.5 billion WLFI tokens, occupying a substantial share, equivalent to the "major shareholder" position in traditional companies. The WLFI website lists Trump himself as the "Chief Crypto Advocate" and "Honorary Co-Founder," while his sons Eric and Donald Jr. are given titles such as "Web3 Ambassadors."

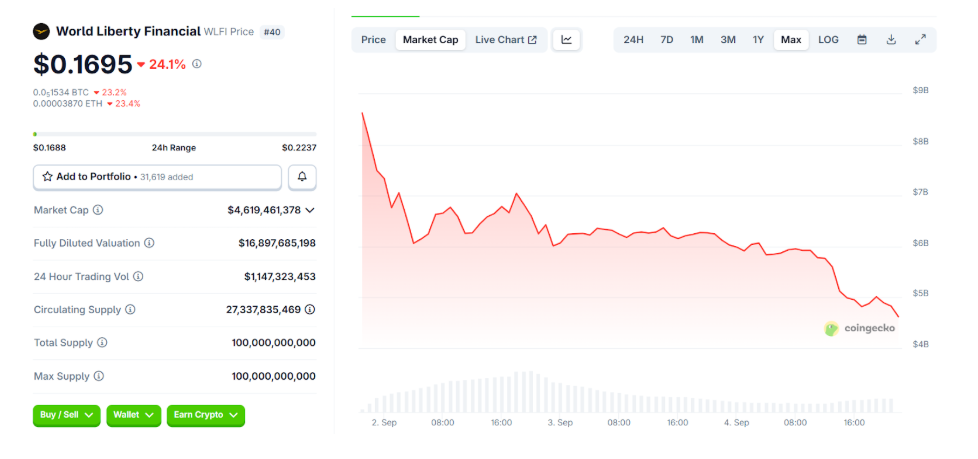

WLFI Governance Token: The WLFI token officially opened for trading on September 1, 2025, attracting significant market attention. The opening price on the first day was $0.20, which surged to about $0.40 within the first few minutes, before retracting to close around $0.23. According to CoinGecko data, as of September 4, the total market cap of WLFI was approximately $5 billion, ranking 41st in the global crypto token market cap. Given that the Trump family holds 22.5 billion WLFI tokens, their estimated paper wealth at that time was about $5 billion. This figure even exceeds the total valuation of all real estate and golf course assets under the Trump Group. Although the performance of WLFI on its first day did not meet the expectations of some early holders, the Trump family had already locked in substantial profits through special agreements. ALT5 Sigma invested $1.5 billion to purchase tokens at the time of WLFI's listing, and according to the agreement, 75% of the net sale revenue directly belongs to the Trump family. WLF subsequently confirmed that it had sold over 7.5 billion WLFI (about 8% of the total supply) to ALT5. This transaction brought the Trump family hundreds of millions of dollars in cash immediately, avoiding the impact of secondary market price fluctuations.

Source: https://www.coingecko.com/en/coins/world-liberty-financial

USD1 Stablecoin Layout: In addition to the governance token WLFI, the USD1 stablecoin under WLF is also developing rapidly. USD1 is a stablecoin pegged to the value of the dollar, issued in March 2025, and claims to be backed by high-quality assets such as U.S. Treasury bonds and cash. With the Trump family's aura and compliant packaging, USD1 quickly accumulated circulation after its launch. As of September 4, the issuance volume of USD1 had reached $2.6 billion, making it one of the fastest-growing emerging stablecoins. The Abu Dhabi sovereign wealth fund's institution MGX also announced plans to use $2 billion worth of USD1 to invest in Binance exchange. Although this move has been criticized by ethics experts for potential conflicts of interest, it is undeniable that USD1 has entered the ranks of major global stablecoins. WLF also plans to launch its own layer one blockchain for the tokenization of real assets and has attracted interest from traditional financial giants such as Franklin Templeton and Google Cloud for collaboration.

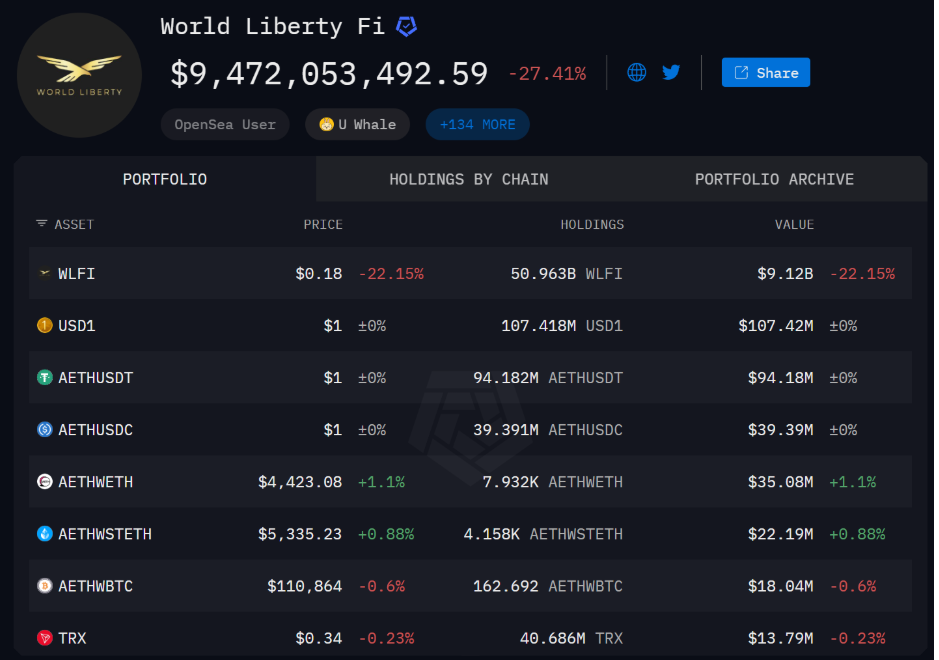

Diversified Crypto Asset Reserves: To enhance risk resistance and expand influence, WLF has added a "macro strategy reserve" plan to its business landscape, actively allocating various mainstream crypto assets, including Bitcoin (BTC), Ethereum (ETH), TRON (TRX), Chainlink (LINK), Sui (SUI), and Ondo (ONDO) tokens into its strategic reserves. It claims that this move helps buffer market volatility, provide funding support for DeFi innovation projects, and establish sufficient capital reserves.

Source: https://intel.arkm.com/explorer/entity/worldlibertyfi

Overall, the Trump family intends to build WLF into a comprehensive crypto financial empire that integrates stablecoins, lending, and on-chain governance. With the endorsement of the Trump family, WLF has achieved a leap from obscurity to crypto unicorn in just over a year, but its aggressive profit distribution mechanism and the intertwined political and business background also cast a shadow over the project's long-term credibility.

IV. Trump Media Group: Bitcoin and CRO Strategic Reserves

The Trump family's foray into the crypto field is also reflected in the strategic transformation of the Trump Media & Technology Group. In May 2025, the group announced plans to raise $2.5 billion through the issuance of stocks and bonds to purchase Bitcoin as asset reserves, emulating the strategy of incorporating Bitcoin into its balance sheet. As of now, approximately 41% of the shares of Trump Media Group are held by a trust under Trump's eldest son Donald Trump Jr., with this portion valued at about $2 billion. This move indicates that the Trump family is using the media group platform to combine traditional business with crypto assets to achieve wealth appreciation.

In addition, Trump Media Group has partnered with Crypto.com to lay out its strategic reserve plan for the platform token CRO. In August 2025, Trump Media Group and Crypto.com established a new company called "Trump Media Group CRO Strategy," specifically for accumulating and holding Crypto.com CRO tokens. It has been disclosed that the expected funding composition for this new company includes: 6.3 billion CRO tokens, $200 million in cash, $220 million in warrants, and a $5 billion equity credit line provided by investment firm Yorkville. This move by the Trump family effectively gives them control over a significant portion of the circulating supply of CRO, deeply binding to the Crypto.com ecosystem.

In addition to directly holding crypto assets, Trump Media Group is also advancing the implementation of crypto investment tools in traditional financial markets. The group is collaborating with Yorkville to prepare the launch of at least three cryptocurrency-related exchange-traded funds (ETFs), covering Bitcoin spot, a Bitcoin + Ethereum combination, and an index fund encompassing various mainstream coins such as Bitcoin, Ethereum, Solana, XRP, and CRO. If these ETF plans are approved, they will further consolidate the Trump family's influence in compliant crypto investment channels.

V. American Bitcoin: Bitcoin Mining Business

The Trump family's ambitions in the crypto industry chain are not limited to issuing tokens and trading investments; they have also expanded into the foundational field of Bitcoin mining. In March 2025, Eric Trump announced the establishment of a joint venture focused on Bitcoin mining, aiming to integrate the Trump family's resources with existing mining technology, aspiring to become a core participant in the U.S. mining landscape. Shortly thereafter, Eric formed a new Bitcoin mining company—American Bitcoin Corp.—through an asset acquisition and merger with the established North American mining company Hut 8. Documents show that Eric Trump serves as the co-founder and Chief Strategy Officer (CSO) of American Bitcoin, holding approximately 9.3% of the shares; his brother Donald Jr. is also reported to hold a similar proportion of equity. Together, they hold about 20% of the shares, while Hut 8 retains about 80% of the new company's equity. From the outset, American Bitcoin has proclaimed ambitious goals, claiming it aims to become "the largest and most efficient pure Bitcoin mining company in the world."

On September 3, 2025, American Bitcoin officially listed on NASDAQ through a stock-for-stock merger with Gryphon Digital Mining, with the stock code "ABTC." On its first day of trading, ABTC's stock price performed explosively: it was highly sought after at the opening, peaking at $14.52 during the day, doubling from the issue price, with an increase of nearly 103%. Although the stock price later retreated, it still closed at $8.04, up about 16.5% from the issue price. The ability of a new mining company to gain such attention in the capital market is largely attributed to the appeal of the "Trump" brand and the market's optimistic expectations for the U.S. Bitcoin mining industry under a relaxed regulatory environment.

Eric Trump stated, "The crypto field now occupies almost half of my energy." To promote the U.S. Bitcoin industry, Eric frequently travels to the Middle East and Asia to lobby, waving the flag for the crypto industry in international metropolises such as Dubai, Hong Kong, and Tokyo. Although Eric Trump publicly denounces criticisms regarding conflicts of interest as "absurd," emphasizing that his father "has no involvement in our business" and that the family's actions are legal and compliant, public opinion calls for the government to establish stricter firewall mechanisms to avoid confusion between policy-making and private interests.

VI. NFT and Crypto Treasury Layout

In addition to the aforementioned main areas, the Trump family's gold mining map in the crypto world also extends to NFT digital collectibles and financial investment tools. As early as the end of 2022, Trump himself issued a series of NFTs called "Trump Digital Trading Cards," portraying himself as a superhero and selling digital collectibles, which sparked heated public discussion. Although opinions were mixed at first, Trump's first set of NFTs quickly sold out and soared to several times the price, proving the market potential of celebrity NFTs. According to financial data disclosed by Trump to the U.S. government in June 2025, he earned approximately $1.16 million from NFT sales, while Melania earned about $216,700 from her NFT series licensing. Although these figures are just a fraction compared to the Trump family's gains from other crypto projects, they signify that they had early on sniffed out the business opportunity in the digital collectibles craze.

In the capital market, the Trump family has also ventured into some crypto investment institutions. For instance, Eric and Donald Jr. each hold about 6.3% of a crypto asset treasury company called Dominari Holdings, indicating the Trump family's interest in the concept of a "crypto treasury." This aligns with their attempt to establish a CRO reserve in the Trump Media Group CRO strategy, all part of the idea of creating a crypto version of a "national treasury." Additionally, there have been multiple reports of the Trump family closely interacting with major exchanges, with speculation that they have invested in platforms like Binance. These developments show that the Trump family is deeply embedded in the crypto field, comprehensively laying out plans to control the profits of the entire industry chain.

VII. Conclusion: The "Trump Crypto Phenomenon" of Opportunities and Risks

The high-profile involvement in the crypto industry has rapidly expanded the Trump family's wealth map in a short period. Compared to traditional real estate businesses, crypto operations have provided them with a more explosive growth curve, successfully establishing "Trump" as a hot IP in the crypto space. The Trump family has bundled political influence, media traffic, and capital operations into the crypto track, accelerating the narrative and capital inflow of "crypto mainstreaming"; however, the fundamentals of the projects, governance transparency, and regulatory margins are the key variables that determine how far this curve can go.

Opportunities: Accelerating the Mainstreaming of Crypto Narratives

Policy and Compliance Expectations Rise: Presidential endorsement + friendly policy signals reduce the "nominal risk" for traditional institutions, making it easier for compliant funds to enter.

Traffic and Distribution Capability: The family IP carries a built-in dissemination effect, capable of amplifying the attention and liquidity of new categories (such as stablecoins, platform treasury, mining stocks) in a short time.

Industry Chain Synergy: From media/traffic entry to DeFi platforms (WLFI/USD1), then to exchange cooperation (CRO treasury) and mining (ABTC), vertical integration can create a "multiplier effect" during bull market cycles.

Institutional Demonstration: Leading political and business families personally engaging reduces "first-mover concerns," providing allocation references for pensions, family offices, and more.

Risks: Potential Minefields

Ethics and Regulatory Reflexivity: The blurred boundaries between power and private interests can easily trigger policy backlash and enforcement uncertainty; if public opinion or investigations escalate, related assets may experience "systematic discounting."

Project Sustainability and Valuation Support: The long-term value of WLFI/USD1 depends on on-chain revenue, reserve audits, and governance transparency, rather than solely on IP popularity. Meme assets (TRUMP/MELANIA) are highly dependent on emotions and topicality, with significant price elasticity and potential for deep retracement.

Structural and Liquidity Risks: High concentration of token holdings, unlocking rhythms, related transactions, and custody arrangements can amplify trading and market-making risks; the mining side (ABTC) also faces triple volatility from hash rate, electricity prices, and Bitcoin cycles.

Overall, the "Trump crypto phenomenon" serves as a powerful amplifier for crypto assets moving toward the mainstream and as a real demonstration of the interaction between power, capital, and public opinion. The Trump family's expansion in the crypto landscape reflects both their commercial ambition to rapidly accumulate wealth through personal influence and a microcosm of the current crypto industry's coexistence of enthusiasm and risk. When facing similar "Trump concept coins," only by rationally viewing opportunities and risks can one grasp truly valuable investment opportunities in this new financial revolution.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you through live broadcasts to interpret hot topics and predict trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。