Compiled | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Editor's Note: Recently, one of the hottest and most interesting narratives in the crypto industry comes from Collector Crypt's attempt to bring TCG (trading card games) on-chain. Its native token CARDS has surged nearly tenfold in a short period, prompting a reevaluation of the potential for the integration of crypto and real-world collectibles. The author Kyle focuses on the core moat of Collector Crypt, arguing that this project has far more depth and barriers than the conventional RWA narrative. Due to the length of the original text, Odaily Planet Daily has condensed and organized the content. It should also be noted that the author holds CARDS, and readers are encouraged to maintain independent judgment.

Anyone who thinks CARDS is "just a crypto RWA" is seriously underestimating the value of this project. While this statement is not entirely incorrect, it oversimplifies the business model that Collector Crypt has built.

I believe that Collector Crypt actually possesses multiple moats, which can be summarized in the following aspects:

- Token Barrier

- Strong Distribution and Logistics Capabilities

- High Alignment of Interests Between Founders and the Project

- Unique Supply-Side Advantages

- Extremely Resilient Business Model

The importance of these factors cannot be overlooked. In the past few days, the explosion of the TCG narrative has shown us a typical crypto phenomenon of a "mini gold rush": everyone wants to mine gold, trying to replicate existing successes. However, many people do not realize that this is not a product that can be easily replicated.

In fact, I even believe that, unlike AI Agents driven by a SaaS model (which have inherent scalability and replication advantages), replicating a TCG RWA is a thousand times more difficult than one might imagine. This is because it involves a vast logistics network and deep real-world relationships, which is completely different from most "purely digital businesses" in the crypto space. Writing a few lines of code and quickly forking features will not get a TCG business off the ground.

In my view, a strong business model combined with a rapidly growing sector will create a compounding advantage that will become increasingly difficult for competitors to replicate over time. Collector Crypt's defensive capabilities far exceed those of most crypto projects, and it has a time advantage that others do not possess: they have spent years building the boring yet crucial infrastructure—procurement networks, authentication processes, logistics systems, and more importantly, they have earned market trust and reputation through handling $75 million in transactions.

Market Opportunities for TCG

Before diving into Collector Crypt, let's first look at the market opportunities for TCG. Although I am not an industry expert and my personal experience is limited to playing "Duel Masters" as a child, this does not prevent me from seeing the enormous potential. Here, we focus on Pokémon cards—this is currently the core product of CARDS and the cornerstone of the entire TCG industry.

Pokémon cards have increased by 3261% over the past 20 years, the highest increase among all types of cards. More broadly, the market for art, cars, and collectibles even exceeds the market value of gold, with TCG reaching $7.43 billion in 2024 and expected to continue expanding at a compound annual growth rate of 7.86%.

However, beyond the cold numbers, what is more important are the social trends and logic driving these figures. Based on my observations, three key trends are reshaping this market:

Wealth Transfer from Millennials to Generation Z

In the next decade, global wealth will undergo the largest intergenerational transfer, with Millennials and Generation Z gradually gaining control over asset allocation. This group is far more accepting of collectibles, trendy toys, and digital assets than the previous generation, and they are more willing to pay for emotional value and identity recognition. The TCG sector that Collector Crypt operates in aligns perfectly with this intergenerational preference shift.

"Labubu-ization" of Society

Driven by social media amplification and consumerism, young people are chasing symbolic items such as Labubu, blind boxes, and limited-edition sneakers. Collecting has become not just a hobby but an externalization of social identity and cultural labels. Collector Crypt taps into this "symbolic consumption" wave through the combination of cards and tokens, allowing collecting to satisfy emotional value while also being financialized and liquidated.

Growth After the Bubble

The frenzy of the NFT market has faded, but the demand for physical collectibles like cards has not disappeared. On the contrary, players who have experienced the bubble are now more focused on scarcity, real value, and long-term holding returns. In this context, Collector Crypt has emerged as a new vehicle: it meets the financialization needs of digital asset players while capturing the steady growth trend of the collectibles market.

Collector Crypt's Moats

1. Token Moat

CARDS is the native token of Collector Crypt, and here, the existence of the token is justified:

- It is a high-growth business in a rapidly growing industry, with a strong thematic intersection with the crypto industry;

- It provides a highly liquid exposure, being the "one and only" in this field, which is precisely where everyone wants to enter.

Pokémon card players, crypto traders, and sneaker collectors are often closer than people think. Those who understand the value of a PSA 10 Charizard are almost the same group as those who understand the value of digital tokens. Crypto traders are inherently speculative, and when speculation combines with TCG, the token can naturally unleash previously unmet latent demand. Not everyone wants to buy Pokémon cards directly, but if a token can, to some extent, represent the entire TCG market, it would be highly attractive.

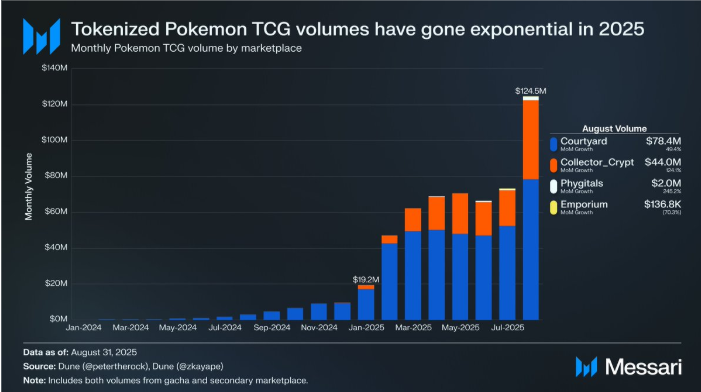

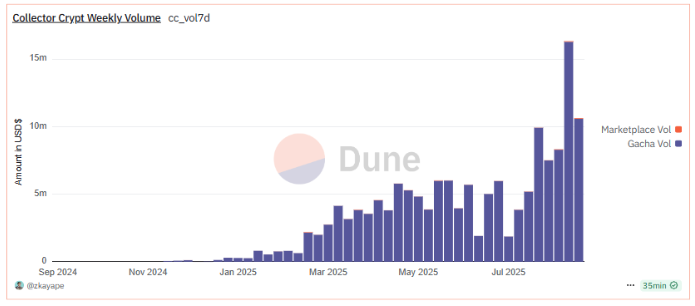

Data has already validated this trend—by 2025, the trading volume of card tokenization is expected to grow exponentially.

CARDS provides liquidity exposure to this vertical field, which is an important component of the "hyperfinancialization" narrative. The most successful products in the crypto industry revolve around "financialization": whether it is DeFi, perpetual contract DEX, or prediction markets. Today, the Pokémon market has become one of the hottest alternative assets globally.

At the same time, CARDS is backed by a fundamentally sound high-growth business. Other tokens often only bet on a theme without fundamental support, at best providing a Beta exposure that cannot truly capture Alpha. Currently, CARDS is the only asset in the market that individual investors can bet on for liquidity: Courtyard has no token, and Phygitals' trading volume is insufficient, even if they issue a token, it lacks investment value.

Therefore, when "growth fundamentals" and "huge market size" overlap, CARDS becomes a "golden egg"—a fundamentally sound, continuously growing token situated in an industry with a large and expanding Total Addressable Market (TAM).

2. Deep Distribution and Logistics Moat

Many people overlook this point. The reason Collector Crypt is difficult to replicate lies in its advantages in distribution and logistics.

First, Collector Crypt is one of the largest card buyers on eBay, purchasing about $500,000 worth of cards each week. They have developed the world's first end-to-end eBay auction scraping tool, capable of monitoring thousands of auctions daily, pricing based on proprietary algorithms, and bidding on hundreds to thousands of cards simultaneously. No other team in the world possesses this capability.

Moreover, in most of the auctions they participate in, Collector Crypt is already the largest buyer. The relationships and reputation built from long-term large-scale procurement are barriers that are extremely difficult for newcomers to replicate.

More critically, they are highly efficient throughout the entire process of procurement, logistics, and on-chain minting. This is not just about writing code, but about achieving extreme operational efficiency: completing inventory intake, authentication, scanning, and on-chain processes in the shortest time possible. This alone constitutes a formidable moat.

In the verification process, Collector Crypt employs professional appraisers and has established a comprehensive after-sales mechanism. For example, CEO Tuom Holmberg mentioned in a podcast that if a sold card is found to be a counterfeit, Collector Crypt will provide a 100% refund. In an industry rife with scams, this kind of integrity is particularly valuable.

These capabilities are not built overnight but are the result of years of accumulation.

3. Founder Moat

Collector Crypt's achievements today are inseparable from CEO Tuom Holmberg. He has been deeply involved in the TCG field for decades and is a principled person with a passion for cards. Although he was once a biotech executive, he ultimately chose to devote himself to TCG, which has been his lifelong interest.

What is even more commendable is that he has used all the financing funds for card procurement rather than personal enjoyment. He still drives a used Prius from 2021 while leading Collector Crypt to achieve $75 million in revenue. His token is locked for over 12 months, and despite numerous private acquisition offers, he remains committed to integrity and a long-term vision.

This level of alignment between the founder and the market is extremely rare, cannot be faked, and is difficult to compete against. When a founder genuinely loves their business and reinvests every dollar back into building the business, competitors face not just a company, but a life’s work.

4. Resource Acquisition Moat

Collector Crypt has a clear advantage in "card resource acquisition," especially in providing high-value prize pools. Many users report that Collector Crypt's card draw rewards are more cost-effective than those of platforms like Phygitals and Grailed. This is crucial for the card draw mechanism that relies on the "80/20 rule": 20% of rare rewards drive 80% of transaction volume. The ability to procure the best cards and place them in the prize pool directly determines the platform's trading activity.

This is particularly important for core players. Heavy users often avoid platforms with low-quality or ungraded card inventories, and Collector Crypt excels in this regard, allowing it to firmly attract "whale" users like leading exchanges or perpetual DEXs, driving the majority of trading volume.

5. Resilient Business Model

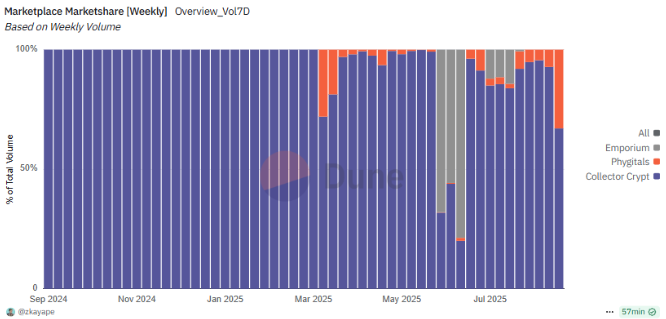

Ultimately, these advantages converge to establish Collector Crypt's dominance in the market.

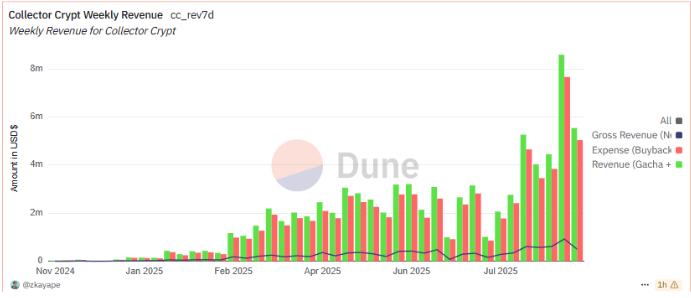

Image source: dune.com

Compared to its competitor Courtyard, which raised $43 million, Collector Crypt has raised less than $3 million but has already achieved two-thirds of its revenue, relying solely on Pokémon cards.

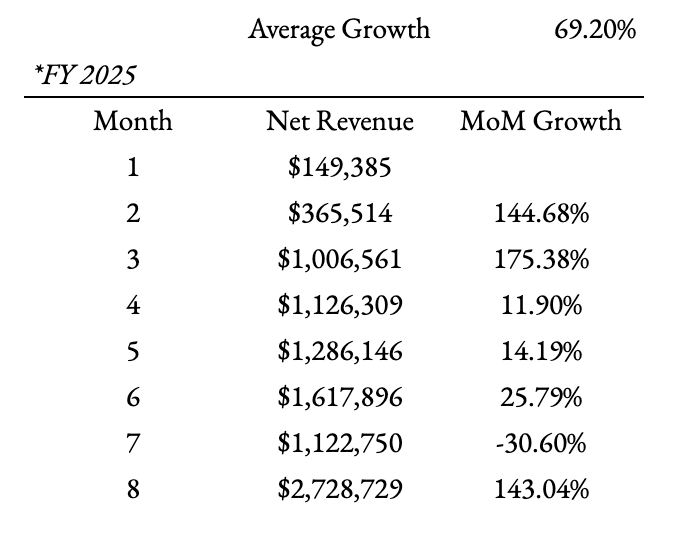

All of this has occurred in the past 8 months, with Collector Crypt's average monthly net revenue growing 69% month-over-month, achieved in a bear market environment.

Collector Crypt has become profitable: of the $75 million in revenue, profits range from $7 million to $10 million, making it a product with real cash flow.

Most importantly, the unit economics are outstanding, especially for Gacha. Users spend $50, expecting a return of $53.5, while Collector Crypt's profits come from repurchasing unwanted cards from users at a 15% discount. This not only ensures positive expected returns for users but also allows the platform to achieve sustainable profits.

With the launch of sports cards, Collector Crypt's market space (TAM) will further expand. More importantly, this model has strong scalability: they have grown from zero to $75 million in revenue in less than two years, with a streamlined team.

In summary, Collector Crypt is a high-quality business with significant barriers.

Catalysts

Beyond these moats, Collector Crypt also has clear growth catalysts:

Horizontal Expansion to Other IPs

The biggest growth driver in the future lies in expanding to more categories, such as the NBA and Magic: The Gathering (MTG).

- MTG accounts for about 20% of the TCG market (Pokémon accounts for about 65%). If successful in introducing MTG, Collector Crypt can not only capture a new audience but also strengthen its position as a "digital bridge for cards." The user spillover effect between different IPs will further enhance overall liquidity.

- NBA cards can reach a broader mainstream sports fan base, attracting a larger audience beyond the core TCG circle.

Risk Resilience from Audience Diversification

Currently, Collector Crypt is still highly dependent on Pokémon (~65% market share). By expanding into areas like MTG and the NBA, Collector Crypt will no longer be just a "Pokémon platform," but a comprehensive collectibles platform, making its user and revenue structure more resilient, with network effects continuing to strengthen.

Risks

Inventory Risk

The biggest current issue is insufficient inventory supply—cards are sold out as soon as they are listed, with demand far exceeding supply. While this is a "good problem," it still limits growth. The market has confidence in CEO Tuom Holmberg's execution ability, believing he can find solutions.

Valuation Risk

The current valuation is about $400 million FDV, which seems high.

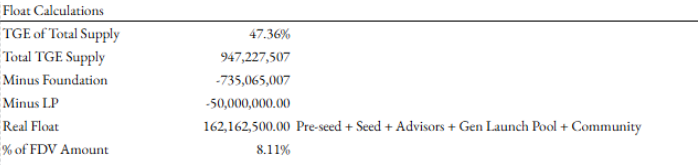

However, looking at it from another angle, if the inventory issue is resolved and successful expansion into larger markets like sports occurs, a $400 million valuation is not unreasonable. More importantly, only about 3.5% of the tokens will be unlocked in the next year, with the actual circulating market cap only accounting for 8.11% of the FDV.

Conclusion

Collector Crypt is a business that combines high growth, strong fundamentals, moats, and a clear path for expansion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。