WLFI Token Dump Story: Whales, Blacklists, and Retail Traders at Risk

The WLFI token launch date was September 1, 2025, and it came with huge hype and billion-dollar trading activity. At launch, only about 6.8% of supply was tradable — 4% from community unlocks and 2.8% from liquidity and marketing. Other allocations like 10% for ecosystem and 7.8% for Alt5 Sigma weren’t locked but weren’t actively circulating either.

The token price opened at $0.20, instantly giving it a $1 billion market cap. Within hours, it spiked to an all-time high of $0.46. But the rally didn’t last. By the end of the first day, the token had already crashed over 3%, settling near $0.1829, with market cap at $4.51 billion and $1 billion in 24-hour volume. Since then, the token has fallen nearly 20% from its peak and continues to slide.

Justin Sun’s WLFI Holdings and the HTX 20% APY Controversy

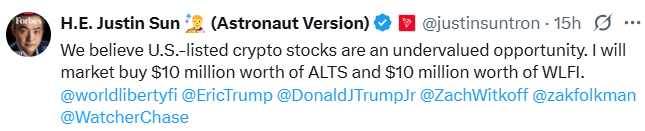

Justin Sun held around 3% of the total supply, but only 20% of his stash was unlocked at launch, with 80% still locked. He publicly claimed he wouldn’t sell and even announced plans to buy more, stating he would market-buy $10 million worth of WLFI and $10 million of ALTS .

Source: X

Source: X

However, suspicions rose when Sun’s exchange HTX launched a Flexible Earn product offering a 20% APY on WLFI deposits. Critics argue this scheme allowed Sun to funnel community deposits, disguising sales of his own locked tokens while promising users attractive returns. This is the root of the WLFI Justin Sun blacklist controversy .

Robot Price Action Suggests Exchange Dump, Not Retail Sales

Even with billions of volume traded, blockchain watchers witnessed "robotic" activity — steep declines and block deals — in opposition to institution-sized retail selling. Rather, on-chain metrics witnessed enormous transfers to exchanges before sell-offs.

This also raised suspicion that trades might have dumped their 2.8% holding, while Sun is accused of having utilized HTX deposits as a cover for dumping tokens. With low float, this type of heavy trading misrepresented the market, providing fake liquidity and confusing retail traders as the price decreased.

Exit Liquidity Again? Retail Traders Left Holding the Bag

After reports of questionable transfers, the project froze and blacklisted several wallets. According to Wu Shuo, WLFI later explained that 272 wallet addresses were blacklisted in recent days — a very small percentage of overall holders — with the stated purpose of stopping asset theft and helping users regain control.

Emergency token burns were also announced, but these measures failed to undo the damage for retail buyers who purchased near the peak. Instead, they were left being treated like exit liquidity in an offering that was dominated by insiders from the beginning.

The community today argues whether the project was merely managed poorly, or if insiders actively manipulated the system. A few caution that the case is reminiscent of previous scandals where staking reward guarantees hid coordinated sell-offs. The news shook investor confidence to the core, with most of them now asking themselves: is WLFI a scam, or a badly managed launch?

Conclusion

The drama illustrates once again that retail traders always end up holding the bag. With circulating supply in lockdown, exchanges maybe dumping, and Sun's APY scheme, faith is lost. Until and unless transparency picks up, wise traders would do well to wait on the sidelines before WLFI price prediction.

Disclaimer: This article is for informational purposes only and doesn’t provide any financial advice. Do Your Own Research before investing.

Also read: Saylor’s Strategy Miss S&P 500 Inclusion as Robinhood Joins Index免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。