Original|Odaily Planet Daily (@OdailyChina)

With the release of the U.S. non-farm payroll data last night, the market once again welcomed expectations of interest rate cuts. However, after a brief surge, the market fell again, currently stabilizing above $110,000.

According to Coingecko data, the total market capitalization of the cryptocurrency market has dropped to $3.91 trillion, a decrease of nearly $0.3 trillion from the previous market cap of over $4.2 trillion; OKX market data shows that the BTC price is currently around $111,000, with a 24-hour decline of 0.3%; the ETH price is currently around $4,318, with a 24-hour increase of 0.1%.

Odaily Planet Daily will provide a brief analysis of the market outlook in conjunction with market perspectives in this article.

Analysis of the main reasons for the market's volatile decline: Weak BTC buying pressure, ETH reserve strategy pending verification

According to SosoValue data, on September 4, the U.S. BTC spot ETF experienced a net outflow of $227 million in a single day, following net inflows of over $300 million on September 2 and 3, indicating a bearish sentiment towards BTC price trends. Currently, the total net inflow for the BTC spot ETF is $54.55 billion; the U.S. ETH spot ETF data has been even more dismal, with continuous net outflows from August 29 to September 4, and a single-day net outflow of $167 million on September 4, bringing the total net inflow to $13.04 billion.

Overall, the market has entered a "proof of concept" phase, with BTC buying pressure appearing somewhat dispersed and weak; whether the "ETH reserve strategy" of listed companies can achieve a "coin-stock dual rise" effect is also in the verification phase; coupled with the tightening of U.S. regulatory policies on "listed companies establishing crypto reserves," the market is entering another period of dormancy.

BTC institutional buying pressure peaks temporarily: Listed companies' holdings exceed 1 million BTC

On September 4, BitcoinTreasuries reported that the total amount of Bitcoin held by global listed companies has surpassed 1 million, reaching 1,000,442 BTC, with Strategy ranking first, holding 636,505 BTC.

Strong as Strategy is, compared to the currently large-scale "BTC listed company reserves" and the even larger gradually awakening BTC OG, ancient whale selling pressure, the buying power still appears somewhat weak. It is worth mentioning that latest news indicates that despite meeting relevant requirements, Strategy has failed to enter the S&P 500 index.

Moreover, more listed companies merely view BTC reserve strategies as one of the means to boost stock prices, lacking both the ability and motivation to buy more BTC, resulting in a buying increment that pales in comparison to selling pressure. Thus, it can be seen that the "BTC institutional buying" from listed companies has temporarily peaked and requires more positive stimuli to accelerate again.

ETH reserves enter verification phase, related concept stocks show weak performance

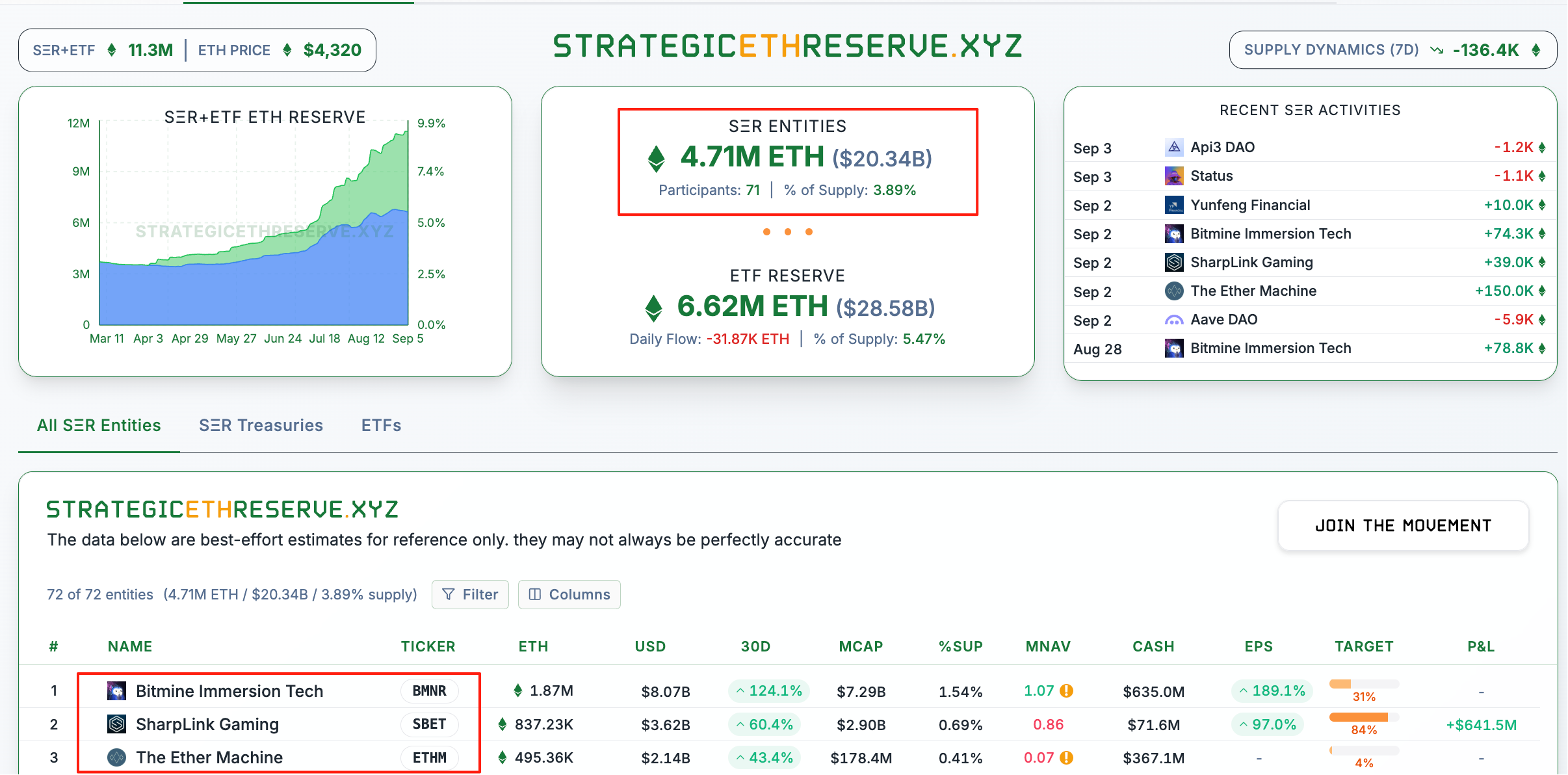

According to Strategicethreserve website data, currently, the ETH holdings of listed companies with ETH reserves have reached 4.71 million, valued at $20.34 billion, accounting for 3.89% of the total ETH supply, with the number of participating companies increasing to 71. However, regarding the stock price performance of major listed companies, the effectiveness of the ETH reserve strategy remains to be verified.

Looking at the stock price performance of the top three listed companies by ETH reserves (as of September 6):

Bitmine (BMNR) is currently priced at $42.04, down nearly 75% from the historical high of $161 in July;

Sharplink (SBET) is currently priced at $14.94, down nearly 90% from the historical high of $124.12 in May;

ETH Machine (ETHM) is currently priced at $10.75, down nearly 30% from the historical high of $15.24 in July.

Although BitMine's board chairman Tom Lee previously stated that Bitmine's cryptocurrency reserve fund size approached $9 billion in just a few months, compared to MicroStrategy, which took over 1,200 days to achieve this milestone, the long-term effectiveness of the ETH reserve strategy still requires time for verification.

Regulatory tightening: Nasdaq to strengthen scrutiny of listed companies' cryptocurrency investments

Nasdaq is strengthening its scrutiny of the cryptocurrency investment activities of its listed companies. Previously, some companies raised funds to purchase cryptocurrency assets to boost their stock performance. However, Nasdaq has expressed concerns about this behavior, believing it may mislead investors, and has decided to enhance regulatory measures.

Currently, Nasdaq has not publicly disclosed specific regulatory actions but is expected to require relevant companies to disclose detailed information about their cryptocurrency investments, including investment scale, strategy, and potential risks. Additionally, Nasdaq may conduct special reviews of companies that frequently trade cryptocurrency assets to ensure their activities comply with market norms. This move reflects the increasing attention of regulatory agencies to the cryptocurrency market.

Considering the above information, it seems that the downward and volatile trend in the cryptocurrency market may continue. Coupled with the current U.S. economic policies, it may take an interest rate cut to bring about a new round of positive stimuli.

Non-farm data meets expectations, market reaction is muted

According to Jin10 data, the U.S. unemployment rate for August recorded 4.3%, up from 4.2%, with an expectation of 4.30%. The seasonally adjusted non-farm employment population for August recorded 75,000, down from 79,000, with an expectation of 75,000. Overall, it met expectations.

It is worth mentioning that the latest revised data from the U.S. Bureau of Labor Statistics shows that the non-farm payrolls for June were revised down from 14,000 to -13,000; the July payrolls were revised up from 73,000 to 79,000. Overall, the combined new employment figures for June and July were revised down by 21,000 from previous data. This also indicates that there was a certain degree of optimism in the previous employment data. Just three days ago, on September 3, after the U.S. employment data was released, the probability of a Fed rate cut in September rose to 98%. This suggests that a rate cut seems imminent.

Deutsche Bank: U.S. non-farm data may determine rate cut momentum

Last night, before the non-farm data was released, Thu Lan Nguyen, head of foreign exchange and commodity research at Deutsche Bank, pointed out that regarding non-farm employment data, attention should be paid to: weak employment growth will not only impact U.S. monetary policy but will also reveal whether "the head of the department responsible for statistics has been fired" has affected data collection.

Deutsche Bank's U.S. experts previously warned that annual benchmark revision data will be released on September 9—last year's revision led to a significant downward revision of employment data. They also found that actual employment dynamics may be weaker than previously published data by the Bureau of Labor Statistics. From this perspective, the dollar faces significant resistance, as (weak) data may inject new momentum into rate cut speculation. Conversely, given the current political pressure, if the report is unexpectedly strong, caution should also be exercised.

Previously, Deutsche Bank foreign exchange analyst Antje Praefcke also pointed out that Powell emphasized the downward risks facing the economy and employment in his speech at the Jackson Hole annual meeting, significantly increasing the weight of the non-farm data's impact. This also means that if labor market data falls short of expectations, it may further significantly boost Fed rate cut expectations, potentially reigniting market speculation for one or more 50 basis point cuts.

Now that the non-farm data meets expectations, it somewhat increases the likelihood of a rate cut, but the positive impact is mild, hence the market's muted response, reflected in the current slight fluctuations in the overall market.

Market outlook overview: BTC in a downward defense, ETH still has potential for upward movement

Currently, the mainstream view in the market appears somewhat pessimistic about the upward potential of BTC prices; however, there is a belief that ETH prices may experience a dip followed by a rise, potentially breaking new highs again around November. The following are the main market perspectives:

PlanC: Bitcoin no longer relies on halving cycles, Q4 price peak is pure nonsense

Crypto analyst PlanC stated that anyone who thinks Bitcoin will peak in the fourth quarter of this year does not understand statistics or probability, as from a statistical and probabilistic perspective, this is akin to flipping a coin three times and getting tails each time, then betting all your money that the fourth flip will also be tails, but in reality, relying on the previous three halving cycles does not provide sufficiently statistically significant data.

Now, with the rise of Bitcoin funding companies and a large influx of funds into U.S. spot Bitcoin ETFs, the halving cycle is no longer relevant to Bitcoin. Apart from psychological and self-fulfilling prophecies, there are no fundamental reasons to explain why Bitcoin would peak in the fourth quarter of 2025.

Greeks.live: The market is in a clear downtrend, BTC short-term IV rises to 40%

Greek.live macro researcher Adam stated that the market is in a clear downtrend, with BTC short-term implied volatility (IV) rising to 40% and ETH short-term IV rising to 70%. The increase in short-term IV indicates a rise in market expectations for volatility this week. The decline of cryptocurrency concept stocks in the U.S. stock market, especially MicroStrategy's series of stocks, is a trigger for this drop. September has historically been a month of weak capital, while the last quarter will see more abundant funds. The volume of bearish options trades today is also rapidly increasing, totaling $1.17 billion, accounting for 30% of the total trading volume for the day, indicating a defensive mindset has taken hold.

CryptoQuant: BTC monthly key support at $107,600, market in a repair phase

CryptoQuant analyst Axel Adler Jr indicated that on a monthly level, BTC is currently priced at $110,700, slightly above the short-term holder realized price (STH Realized Price) of $107,600, which is viewed as a key monthly bull market support level. The overall realized price is $52,800, and the long-term holder realized price (LTH RP) is $35,600, with the current price significantly above both, confirming a structural upward trend.

Additionally, the NUPL indicator is at 0.53, showing that the market is in a broadly profitable state but has not yet reached the extreme levels of previous cycles. Higher time frames (Higher TF) remain bullish, but the market is still in a repair phase and is sensitive to profit-taking. The key reference point is the STH realized price of $107,000; holding this area will support the continuation of the upward trend. Currently, NUPL has not shown signs of final euphoria, indicating that there is still room for further increases after consolidation.

Analyst: ETH may pull back to $3,350 support in September, rebound in October and challenge new highs

Crypto analyst Johnny Woo stated: “ETH may initially appear bearish, but if the trend develops as expected, this could be the largest short trap I have ever seen.” He added that charts indicate ETH may form a "head and shoulders" pattern in September, then break out during the "October rise." In this scenario, Ethereum could pull back to around $3,350 in September, then rebound in October and challenge new historical highs in November.

A similar situation occurred in September 2021 when ETH dropped 30% from $3,950 to $2,750, then rebounded to a historical high in November.

Data perspective: Whale accumulation of ETH may drive further Ethereum increases

As large whales have increased their accumulation during the recent cryptocurrency market pullback, Ethereum is gradually turning bullish. Analysts stated that with institutional funds continuing to flow in, ETH may further increase in the future.

According to on-chain analysis platform Santiment, addresses holding 1,000 to 100,000 ETH have increased their holdings by 14% over the past five months.

According to Artemis data, the concentrated accumulation by whales aligns with the $9.9 billion net inflow on the Ethereum chain over the past three months, along with $6.7 billion in stablecoin inflows.

Traders vote with their feet: Long positions suffer heavy losses, cautious openings, firm stop-losses

Whales lose $10.67 million chasing ETH after non-farm data

According to crypto analyst Yu Jin monitoring, a whale that had sold HYPE and then turned bullish on ETH added to their long position at a price of $4,446 after the non-farm data was released at 8:30, but ETH quickly retraced. They stopped out of their entire position of 52,800 ETH at around $4,265, incurring a loss of approximately $10.67 million. Since July 25, this whale has continuously gone long on ETH and frequently stopped out, with cumulative losses reaching as high as $35.84 million.

Trader Eugene opens SOL long position, claims BTC stabilizes at $110,000 support

Trader Eugene stated that he has attempted to open a long position in SOL. He believes that with BTC regaining the $110,000 level, SOL is the strongest asset among major cryptocurrencies. Due to weakening ETH momentum and a compressed mNAV indicator (BMNR below 1.1, SBET below 1), he expects the market to shift towards allocating more resilient emerging tokens. Eugene also noted that if BTC falls below $110,000, he will immediately stop-loss and exit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。