"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and hot news, passing you by.

Therefore, our editorial team will select some high-quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

ArkStream Capital: A Guide to the Rebirth of Crypto VC, Why It's Hard to Outperform BTC

This round of declining returns is not only a result of the liquidity from the interest rate hike cycle but also reflects a paradigm shift in the underlying structure of the crypto primary market: from valuation-driven to value-driven, from broad net casting to heavy certainty, from chasing narratives to betting on execution capability. Understanding and adapting to this paradigm shift may become a necessary prerequisite for achieving excess returns in future cycles.

Delphi Digital: Lessons from History, How Will Rate Cuts Affect Bitcoin's Short-Term Trends?

Bitcoin may see a surge before the FOMC meeting, but the increase may struggle to break new highs. The next round of increases may form lower peaks (around the $118,000 to $120,000 range).

Guide to Listing on Korean Exchanges: Decoding the Black Box of Listing on Korean Exchanges

The Korean market leads the world in size and activity; the rhythm of listings is driven by both policy and market sentiment; Bithumb and Coinone play a "bridge effect" in the listing rhythm, with some tokens listed on the two exchanges before entering the larger trading volume of UPbit; for project teams, they should match the type of exchange and listing order based on token characteristics, community structure, and promotion budget to improve the return on investment; promotion in the Korean market needs to be localized and combined with multiple channels.

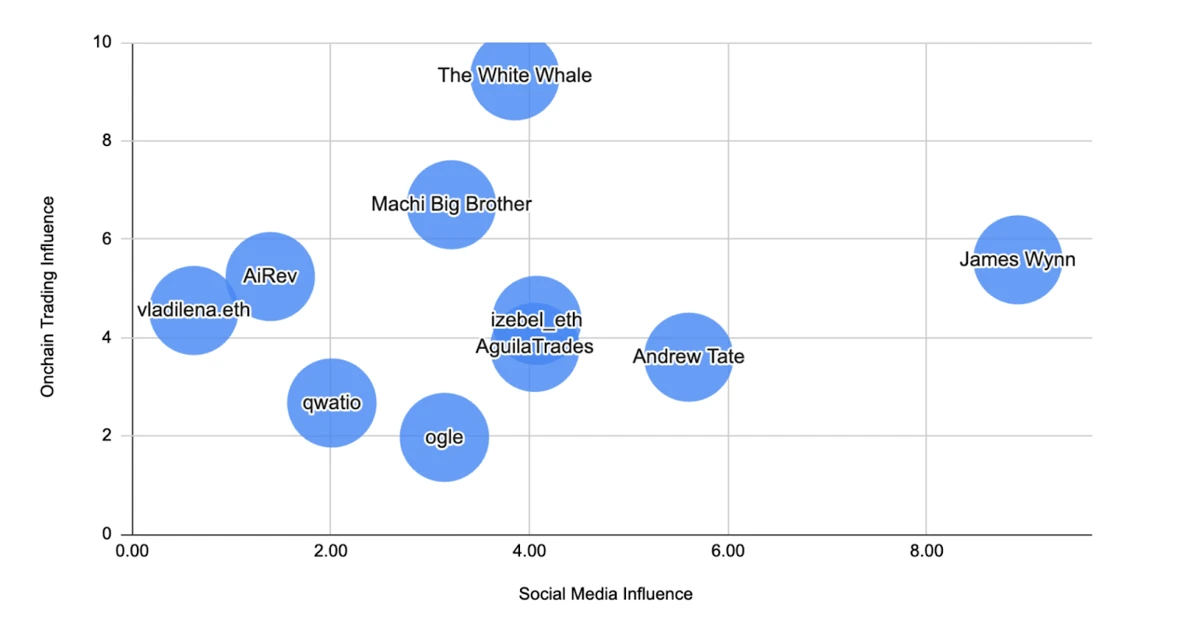

2025 Hyperliquid KOL Influence Report

Also recommended: "Foreign KOL's Tricks to Harvest Retail Investors: Clustering, Creating Momentum, and Concealment" and "Crypto KOL's Self-Reflection: Our Era Has Ended".

Stablecoins

The First Year of Stablecoin Public Chains: Giants Enter the Arena, What's Next for Stablecoins?

When the contradictions of value distribution, technical limitations, user experience, regulatory compliance, and competition overlap, building a chain becomes an inevitable choice.

Airdrop Opportunities and Interaction Guide

Volume Manipulation, Game Theory, and Disillusionment: Have Crypto Airdrops Reached Their End?

Reflections from an experienced airdrop participant.

Post-Token Era: A Guide to Participating in 10 A-Level Projects

Based, Liminal, Legion, Fogo, Backpack, Axiom, prediction markets (Polymarket, Limitless, Myriad), Kinetiq.

Also recommended: "This Week's Featured Interaction Projects: Poseidon Recording for Points; Kaia's New Product Superearn Whitelist Application; New 'Mouth Token' Project Edgen".

Bitcoin Ecosystem

Ethereum and Scalability

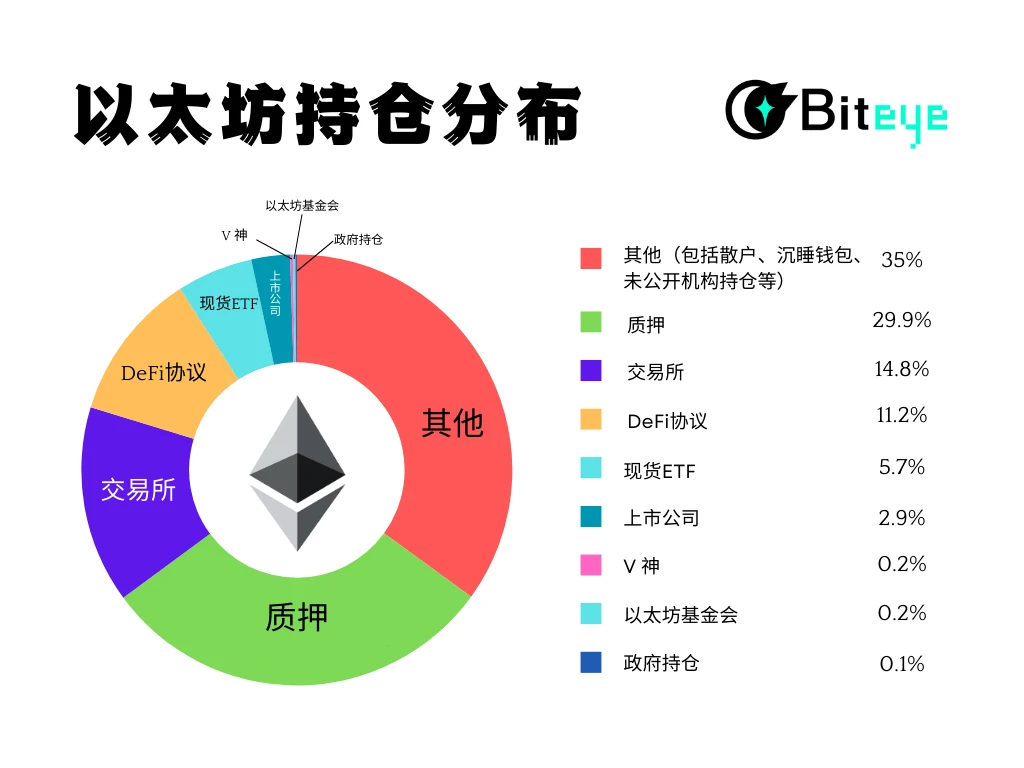

Who Are Ethereum's "Financial Backers," and Do Ordinary People Still Have a Chance?

The "reallocation of ETH holdings" has just begun. If the past valuation logic of ETH was "technology + narrative," then in the future it will be more about "capital + liquidity." This pattern means that ETH may be closer to being an "institutional asset" than ever before.

Ethereum DAT Treasury Strategy Company: When Will They Sell ETH?

Focus on three key indicators: cost of acquisition, changes in CEO/CFO/board personnel, and mNAV long-term below 1. (Next post preview)

This article discusses the six outcomes for Ethereum DAT: good outcome, cashing out or moving on; ordinary outcome, hedging or being ignored; bad outcome, financial pressure or stop-loss.

The two main drivers of the significant success of Ethereum's core engineering are: the economic transformation triggered by the Dencun upgrade in early 2024; and the governance evolution brought by the Pectra upgrade completed in May this year.

However, it should be noted: the maturity of the Restaking track and its inherent systemic risks, as well as the severe fragmentation brought by the prosperity of the L2 ecosystem.

Also recommended: "Tom Lee's Latest Podcast: We Are Witnessing ETH's '1971 Moment,' $60,000 is a Reasonable Valuation".

CeFi & DeFi

Behind the Hyperliquid Craze: How to Overcome the Five Major Traps of Perp DEX?

Illusion of Liquidity: High trading volume ≠ good liquidity. Bid-ask spreads, slippage, and transaction fees can lead to price impact and execution loss, but related metrics may be artificially inflated due to incentive mechanisms.

Hidden Costs: Order book models require substantial market maker subsidies, while automated market maker (AMM) liquidity providers (LPs) struggle to scale, both facing economic challenges.

Black Box Liquidation: Prioritizing system security over user convenience requires risk control for open interest (OI), multi-source liquidation mechanisms, and verifiable proofs, but risks are particularly prominent in pre-market trading scenarios.

Trade Order Sacrifice: There is a trade-off between prioritizing retail investors or high-frequency trading (HFT), which is essentially a choice between fairness and efficiency.

Inefficient Margin: A dynamic and efficient margin system needs to be built, incorporating interest-bearing collateral, loan integration, and hedging identification functions to match the efficiency of centralized exchanges.

If Polymarket Doesn't Issue Tokens, What Can Prediction Markets Speculate On?

The social prediction market Flipr, which saw a hundredfold increase in two months, UMA, the king of prediction market infrastructure, Augur, the pioneer of decentralized prediction markets, Azuro from traditional gambling markets, the permissionless prediction DEX PNP Exchange on Solana, and Hedgemony, an AI-driven autonomous trading algorithm.

The Dark Side of Prediction Markets: Who Is Manipulating Your Bets?

The "misjudgment" of oracles is actually quite frequent. Or, as the community puts it, oracles "favor the whales." Prediction markets lean more towards gambling than investing. If you can't control your impulse to bet, it's best to stay away from this field.

There are some methods to mitigate risks before trading: manage your funds well (the amount bet on a single market should not exceed 1%-3% of your deposit); choose events with clear information sources (such as court rulings, official statements, on-chain data, etc.); check market liquidity and the list of top holders; take profits early (for example, exit when profits reach around 95%, don't wait for the final outcome to be determined).

On-Chain Data Unveils the Mystery, What Is the Initial Circulation Rate of WLFI?

To answer the question of WLFI's initial circulation rate, one only needs to track the token shares of early supporters who participated in the $0.015 and $0.05 fundraising rounds.

The user categories with clear metadata are the early presale user shares recorded by WLFI, with a total amount of approximately 18.43 billion tokens. The maximum initial circulation volume is 18.43 * 20% = 3.69 billion, accounting for about 3.69% of WLFI's total supply.

Considering that more users will execute the unlocking process in the next two days (from August 30 to September 1), the final initial circulation ratio of WLFI is expected to be between 3.14% - 3.69%, corresponding to an initial circulation volume of approximately 3.14 - 3.69 billion tokens.

Also recommended: "WLFI Token Launch: In-Depth Analysis of Arbitrage Opportunities", "Shell + Trump = $30 Billion, WLFI's Textbook-Level Operations", "In-Depth Investigation of the WLFI Team: 2 Honorary Co-Founders, 7 Co-Founders, 6 Key Members", "Lazy Investment Strategy | Linea Launches $1 Billion Token Liquidity Incentive; Jupiter Lend Offers One-Click Loop Loans to Amplify Returns (September 3)".

Security

Starting from "Chasing the Wind": The 2048 Words That Determine Trillions in Crypto Assets

Mnemonic phrases follow the BIP 39 standard, consisting of only 2048 words.

Weekly Hot Topics Review

In the past week, WLFI: during a major risk period, the protocol governance will be fully controlled by multi-signature (governance rules); Bonk.fun reached a partnership with WLFI, becoming the official Launchpad platform for USD 1 on Solana; WLFI's pre-launch circulation announcement data was vague and repeatedly modified; Yu Jin: WLFI's initial circulation should be 6.4%, about 6.4 billion tokens; WSJ: The Trump family accumulated $5 billion in paper wealth after the WLFI issuance; WLFI proposed to use all fees generated from the protocol's own liquidity for token buybacks and burns; Financial Times: The Trump family faced criticism from Democrats for their involvement in cryptocurrency; WLFI eight of the top ten holders chose to take profits (details); 0xSun shared WLFI's short-selling logic: shorting at high points twice and covering at low points; analysis: it may not be easy for the Trump family to monetize WLFI wealth, as even a small sell-off could trigger a price crash; WLFI: the disposal rights of unlocked WLFI tokens in the treasury belong to the community, rather than being decided by the team; Sun Yuchen: the group earns tens of billions of dollars a year, and the high-interest investment returns of WLFI come 100% from group subsidies; WLFI blacklisted Sun Yuchen's address, involving about 2.94 billion locked tokens; Sun Yuchen published a long article calling on World Liberty Financials to unlock its tokens;

In addition, regarding policies and macro markets, USD M2 reached a historic high; gold prices hit a new all-time high, with the market almost fully pricing in a rate cut in September; Bridgewater founder: the poor debt situation of the dollar indirectly drives up the prices of gold and cryptocurrencies; U.S. Vice President Vance: prepared to take over the presidency if something happens to Trump, U.S. officials: Trump is in good health and will play golf this morning (related investment opportunities); nearly 600 economists signed an open letter supporting Fed Governor Cook, "The case of Trump firing Fed Governor Cook" will be defended by Washington's legendary lawyer Abbe Lowell; Fed nominee Milan: tariffs will not cause inflation, and it is not advisable to hand over control of the Fed to the president; sources: Musk's lawyer will serve as chairman of a Dogecoin financial company worth $200 million; prediction market Polymarket received CFTC approval to return to the U.S. market; Strategy investors withdrew the class action lawsuit accusing the company of false and misleading statements; analysis: cryptocurrency is flowing into self-managed pensions, pouring into Australia's A$4.3 trillion savings pool; market news: Bank of China Hong Kong plans to apply for a stablecoin issuer license;

In terms of opinions and voices, Nobel laureate: insufficient regulation of stablecoins may force government bailouts; California Governor Newsom plans to launch "Trump Corruption Coin" in response to his crypto controversies; K 33: Bitcoin may fall below $100,000 in September; Matrixport: some forward-looking investors have begun to synchronize their allocations of gold and Bitcoin; Bloomberg: Strategy has met all criteria for inclusion in the S&P 500 index; Ethereum co-founder Joseph Lubin: ETH may rise 100 times in the future and surpass BTC; Yunfeng Financial, indirectly held by Jack Ma, has purchased 10,000 ETH, with a total investment cost of $44 million; Yunfeng Financial: in addition to ETH, it also plans to include BTC, SOL, and others in its strategic reserve assets; analysis: USDT trading volume hit a record high, the market may be preparing for a major trend; CZ: listed company BNC currently holds the world's largest BNB reserve; OKX Star: OKX never raises funds from users, it is just a technical service provider for users' Earn; Coinbase CEO: currently about 40% of the platform's code is generated by AI daily;

In terms of institutions, large companies, and leading projects, U.S. Bank has launched institutional Bitcoin custody services and supports Bitcoin ETFs; the Trump family's Bitcoin mining company American Bitcoin is listed on NASDAQ; Galaxy has launched the first native U.S. stock token; Trump's eldest son’s holding company Thumzup plans to transform into a DOGE mining enterprise, planning to purchase 3,500 DOGE mining machines; El Salvador is splitting Bitcoin into multiple wallets due to quantum computing threats; OKX supports Google Pay; BGB has upgraded to the Morph public chain token, with a one-time destruction of 220 million tokens; the Bitcoin BRC 20 protocol has been upgraded to “BRC 2.0” (details), enabling EVM-style smart contracts; the Jito Foundation has made four updates to the JTO token economics, and the first round of $1 million JTO buybacks has been completed; Linea has opened airdrop query, with tokens available for claim on September 10 (details); the game Pudgy Party under Pudgy Penguins has launched on mobile app stores (experience);

In terms of data, the new fee model from pump.fun has distributed $2 million to creators within 24 hours of its launch; Chainalysis released the 2025 global cryptocurrency adoption index, with India, the U.S., and Pakistan ranking in the top three;

In terms of security, Venus Protocol suspected of being attacked, resulting in a loss of about $30 million, has fully recovered and retrieved previously lost user funds; Slow Mist's CISO reported that the North Korean hacker group Lazarus established a fake Calendly website to infiltrate DeFi employee systems…… Well, it has been another eventful week.

Attached is the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。