Selected News

Ethereum Foundation completes partial sell-off, withdrawing 3.387 million DAI from CEX

Justin Sun transfers $9 million worth of unlocked WLFI to HTX

James Wynn's "shout-out" meme coin with a market cap of only $157,000 has now surged over 240%

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

WLFI

Today's discussion around WLFI mainly focuses on the controversy involving Justin Sun. World Liberty Financial (WLFI) blacklisted Sun's address after its token was allegedly manipulated. It is claimed that Sun sold off user tokens on the HTX exchange, driving down the WLFI price; after the project team froze his allocation, WLFI's market cap saw a significant increase. This incident has sparked debates about the ethics and credibility of Sun and the WLFI team, with some users expressing skepticism about the project's future.

HYPERLIQUID

Today's discussion about HYPERLIQUID centers on its strong presence and innovative features in the market. The platform's latest HIP-3 upgrade allows users to create permissionless perpetual contracts, seen as a major innovation, leading Hyperliquid to be dubbed the "AWS of liquidity." Additionally, the platform's strong performance in revenue, buybacks, and market cap has garnered attention, with $HYPE becoming the 17th largest digital asset. The community also highlighted the potential of HyperEVM, with some remaining skeptical, but many believing it will play a key role in the entire ecosystem. Meanwhile, there is also focus on the platform's strategic buyback operations and its ability to attract institutional investors.

XRP

XRP is in the spotlight today due to several key developments. Ripple's expansion of the RLUSD stablecoin into the African market and partnerships with Chipper Cash, VALR, and Yellow Card are among the highlights. Additionally, the open interest in XRP futures contracts reached $1 billion in record time, and Bitwise has launched an XRP ETF on Switzerland's main stock exchange. Meanwhile, the XRP community is believed to have played a role in Ripple's victory against the SEC in their lawsuit. On the other hand, Coinbase has reduced its XRP holdings by 69%, sparking discussions about institutional fund outflows. These events collectively contribute to XRP's prominent position in today's cryptocurrency discussions.

Featured Articles

In the second half of 2025, the stablecoin industry enters a new phase. Over the past few years, companies like Tether and Circle have been core players in the stablecoin space, but their identities have remained as issuers. The design and operation of the underlying networks have been left to public chains like Ethereum, Tron, and Solana. As the issuance scale of stablecoins grows, users have always relied on others' systems for transactions. In recent months, this pattern has begun to change. Circle launched Arc, Tether almost simultaneously released Plasma and Stable, and Stripe, in collaboration with Paradigm, introduced Tempo. The emergence of three stablecoin public chains aimed at payments and settlements indicates that issuers are no longer satisfied with just issuing coins; they want to control the network itself. Such concentrated actions are hard to explain as mere coincidence.

In early September, the personnel and power landscape surrounding the Federal Reserve continues to evolve rapidly. On September 3, reports indicated that the White House had clearly stated it would finalize the next Federal Reserve Chair candidate as soon as possible. Treasury Secretary Scott Bessenet has initiated the interview process for 11 candidates, with a series of interviews starting this Friday and continuing for a week. Meanwhile, there has been an increase in personnel and power actions surrounding a "smooth transition." On one hand, Trump previously dismissed the head of the Bureau of Labor Statistics (BLS), raising concerns about the independence of official data. On the other hand, Federal Reserve Governor Adriana Kugler officially submitted her resignation in early August, making room for a new governor. The newly appointed Federal Reserve Governor, former White House Council of Economic Advisers (CEA) Chair Stephen Miran, was nominated by Trump and attended a Senate Banking Committee hearing on September 4. In his written testimony, Miran emphasized "monetary policy independence," and he will focus on "maintaining independence" during the confirmation process, with expectations for a rapid advancement. With more and more actions taking place, the market is shrouded in uncertainty about the future, and the question of who will become the next Federal Reserve Chair has become the focal point of market attention.

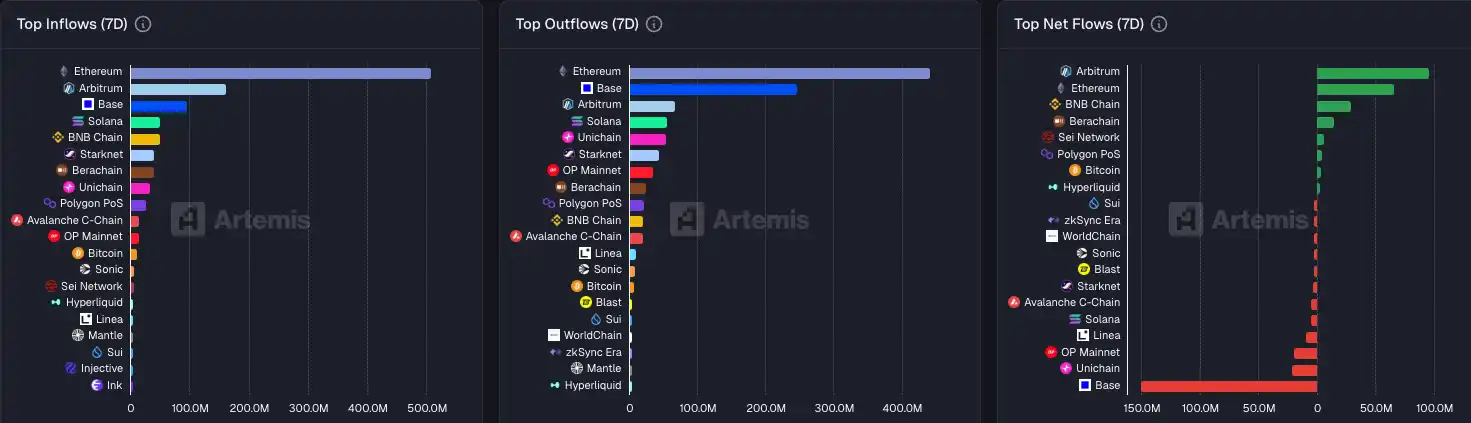

On-chain Data

On-chain capital flow for the week of September 5

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。