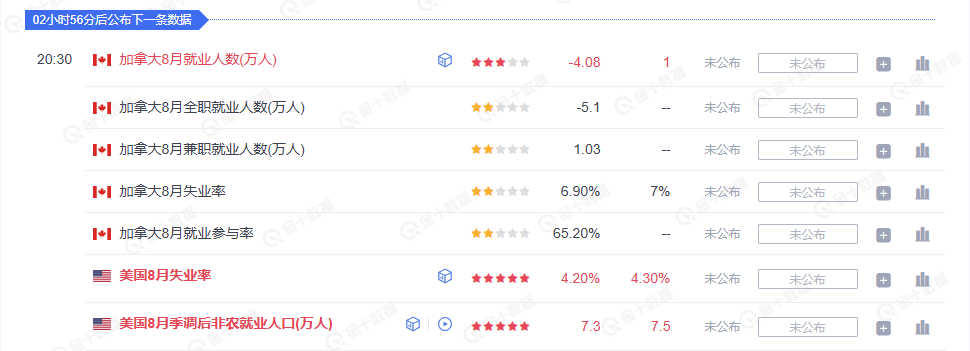

The U.S. Bureau of Labor Statistics will release the August non-farm payroll report at 8:30 PM Beijing time on Friday. The previous data for July showed an average of only 35,000 new jobs added per month from May to July, which led to the dismissal of the agency's former head by Trump. Last month, 75,000 new jobs were added, slightly higher than July's 73,000. The unemployment rate is expected to rise slightly from 4.2% to 4.3%, reaching a new high since 2021.

Market focus is on whether the data can fall within the "perfect range": weak enough to support a rate cut in September, but not too poor to raise recession concerns. The market has fully priced in a 25 basis point rate cut in September, but if the data significantly deviates from expectations, it may reignite aggressive rate cut expectations.

The median forecast from institutions is for an addition of 75,000 jobs, with 48 out of 54 forecasts concentrated in the 60,000 to 100,000 range. Most believe the equilibrium point is between 50,000 and 100,000. If the data falls below 40,000 and the previous value is not revised, it may trigger market bets on a 50 basis point rate cut. History shows that non-farm revisions often have a pro-cyclical nature, with weak data commonly accompanied by downward revisions of previous values.

Regarding the unemployment rate, the actual value for July was 4.25%, and the August expectation of 4.3% indicates that the market does not believe it will spike. Unless employment is exceptionally weak or the unemployment rate exceeds 4.4%, a reading of 4.3% is unlikely to drive aggressive rate cuts.

The August ADP employment data released on Thursday evening showed an increase of only 54,000 jobs, far below the revised 106,000 for July; initial jobless claims rose to 237,000 last week; and July job openings fell to 7.18 million, the lowest in 10 months, all indicating that the labor market is cooling.

The impact of employment data on risk assets can be categorized into three scenarios: clearly weak, moderately weak, and clearly strong. When the data is clearly weak, the market will increase expectations for a September rate cut, leading to a decline in U.S. Treasury yields and a weaker dollar, which benefits risk assets like Bitcoin. For example, if the reported data shows new jobs below 50,000, an unemployment rate above 4.4%, slow wage growth, and downward revisions of previous data.

If the data is moderately weak or meets expectations, the market will maintain the expectation of a 25 basis point rate cut in September, and Bitcoin may fluctuate slightly stronger, depending on wage data and revisions. For example, if the reported data shows new jobs between 60,000 and 90,000, an unemployment rate of 4.2%-4.3%, and wage growth of 0.2%-0.3%.

When the data is strong, expectations for a rate cut will weaken or be delayed, U.S. Treasury yields and the dollar will strengthen, risk appetite will cool, and Bitcoin may face downward pressure. For example, if the reported data shows new jobs exceeding 150,000, an unemployment rate below 4.1%, wage growth above 0.4%, and upward revisions of previous data.

It is essential to pay close attention to average hourly wage data, as it significantly impacts inflation expectations. The revision of previous values is also crucial; substantial downward revisions may change market interpretations. Additionally, the labor force participation rate and hours worked can reflect the state of economic demand.

Before and after the data release, market volatility often concentrates in the 20:30-21:00 time frame, with the potential for sharp fluctuations and V-shaped reversals. Prioritize monitoring wage and revision data, set reasonable risk control measures, and observe the correlation effects between U.S. Treasuries and the dollar. If U.S. Treasury yields and the dollar rise simultaneously, the probability of making a profit from Bitcoin will decrease; conversely, it will increase if they move in opposite directions.

Giving you a 100% accurate suggestion is not as valuable as providing you with the right mindset and trend. After all, teaching someone to fish is better than giving them a fish; advice may earn you a moment, but learning the mindset can earn you a lifetime! The focus is on the mindset, grasping trends, and planning positions in the market. What I can do is use my practical experience to help you, guiding your investment decisions and management in the right direction.

Written on: (2025-09-05, 18:00)

(Text - Master Coin Talks) Disclaimer: Online publication has delays, and the above suggestions are for reference only. The author is dedicated to research and analysis in investment fields such as Bitcoin, Ethereum, altcoins, forex, and stocks, having been involved in the financial market for many years with rich practical experience. Investment carries risks; please proceed with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。