In the second half of 2025, the stablecoin industry entered a new phase.

In the past few years, companies like Tether and Circle have become core players in the stablecoin space, but their roles have remained as issuers. The design and operation of the underlying networks have been left to public chains like Ethereum, Tron, and Solana. As the issuance scale of stablecoins has grown, users have continued to rely on others' systems for transactions.

In recent months, this pattern has begun to change. Circle launched Arc, Tether almost simultaneously released Plasma and Stable, and Stripe, in collaboration with Paradigm, introduced Tempo. The emergence of three public chains aimed at payments and settlements signifies that issuers are no longer satisfied with merely issuing coins; they want to control the network itself.

Such concentrated actions are hard to explain as mere coincidence.

Why Build Their Own Public Chains?

Early stablecoins almost entirely relied on public chains like Ethereum, Tron, and Solana for growth, but now an increasing number of issuers are choosing to build dedicated chains, firmly grasping issuance and settlement in their own hands.

The most direct reason lies in value distribution. The fees taken by the underlying networks are far larger than one might imagine.

Tether processes over $1 trillion in transactions each month, but most of the fees are siphoned off by public chains. On the Tron network, each USDT transfer incurs a fee of about 13 to 27 TRX, which, at current prices, amounts to approximately $3 to $6. Considering the massive transaction volume of USDT on Tron, this represents a significant income. If we calculate based on Tron’s daily processing of hundreds of millions of USDT transactions, just the fees alone could bring in hundreds of millions of dollars annually for the Tron network.

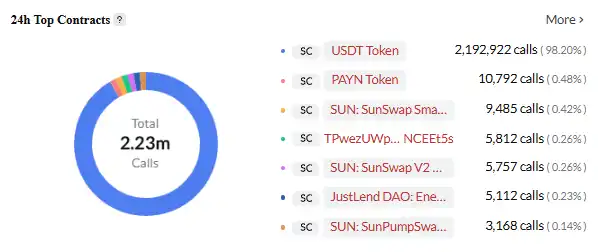

USDT is the most active smart contract on the TRON network, image source: Cryptopolitan

Although Tether's own profits are also extraordinarily high, they primarily come from interest rate spreads and investment returns, unrelated to USDT's transaction volume. For every additional USDT transaction, Tether receives zero direct revenue, as all fees go into the pockets of the public chain.

Circle's situation is similar. Each transaction of USDC on Ethereum consumes ETH as gas fees. At Ethereum's current transaction fee levels, if USDC could reach the transaction scale of USDT, just the fees could generate billions of dollars in annual revenue for the Ethereum network. However, Circle, as the issuer of USDC, receives not a penny from these transactions.

What frustrates these companies even more is that the larger the transaction volume, the more missed revenue they incur. The monthly transaction volume of USDT has grown from several hundred billion dollars in 2023 to over $1 trillion now, but Tether's revenue from transaction activities remains zero.

This "visible yet unattainable" pattern is the core motivation driving them to build their own public chains.

In addition, the technical constraints of existing public chains are also accumulating. Ethereum has high fees and slow speeds, making small payments unfeasible; Tron has low costs but is heavily criticized for security and decentralization; Solana is fast but not stable enough. For a year-round payment service, these are hard to bear.

User experience is also a hurdle. Ordinary users need to switch between different chains, requiring different native tokens and wallets. Cross-chain transfers are even more complex, being both costly and risky in terms of security. From a regulatory perspective, transaction monitoring and anti-money laundering functions on existing public chains mostly rely on external solutions, which are limited in effectiveness. In terms of competition, differentiation has become a necessity; Circle aims to provide faster settlements and built-in compliance modules through Arc, while Stripe hopes to achieve programmable payments and automated settlements with Tempo.

When the contradictions of value distribution, technical limitations, user experience, regulatory compliance, and competition converge, building a chain becomes an inevitable choice.

The Stance of the Giants

In the face of these challenges and opportunities, different companies have chosen different technical paths and business strategies.

Stripe Tempo: A Neutral Platform's Technical Choice

Tempo is a dedicated payment chain co-developed by Stripe and Paradigm. Its biggest difference from traditional public chains is that it does not issue its own native token but directly accepts mainstream stablecoins like USDC and USDT as gas. This decision is both a statement and an ambition.

Image source: X

This design seems simple, but the technical challenges behind it are significant. Traditional blockchains use a single native token as a fee, making system design relatively straightforward. Tempo needs to support multiple stablecoins as fees, which requires complex token management and exchange rate calculation mechanisms at the protocol level.

Tempo's technical architecture has also been optimized for payment scenarios. The improved consensus mechanism can achieve confirmations in sub-second times while maintaining extremely low costs. It also includes built-in payment primitives that developers can directly call to build complex applications like conditional payments, scheduled payments, and multi-party payments.

Tempo has built a strong ecosystem alliance. Its first batch of design partners spans key areas such as artificial intelligence (Anthropic, OpenAI), e-commerce (Shopify, Coupang, DoorDash), and financial services (Deutsche Bank, Standard Chartered, Visa, Revolut). This list itself is a signal that Stripe aims to establish Tempo as a foundational infrastructure across industries.

Circle Arc: Deep Customization through Vertical Integration

In August 2025, Circle launched Arc, a public chain specifically designed for stablecoin finance. Unlike Stripe's neutral stance, Arc represents a thorough vertical integration strategy.

Image source: Circle

Arc uses USDC as its native gas fee token, meaning that all transactions on the Arc chain must pay fees in USDC, directly increasing the demand and application scenarios for USDC. This design allows Circle to benefit from every transaction on the network, achieving a closed-loop of value.

Arc also includes an institutional-grade spot foreign exchange engine that enables rapid exchanges between different currency stablecoins and aims to achieve sub-second transaction finality. These features are designed to meet the actual needs of institutional clients, reflecting Circle's deep understanding of its target market.

By owning its own public chain, Circle provides a more efficient and controllable environment for USDC's operation. More importantly, it can create a closed-loop financial ecosystem around USDC, firmly locking value within its own system.

Tether's Dual-Chain Strategy: An Aggressive Comprehensive Layout

As the world's largest stablecoin issuer, Tether launched both Plasma and Stable in 2025, showcasing a more aggressive vertical integration stance than its competitors.

Image source: Bankless

Plasma is a Layer 1 blockchain supported by Tether's sister company Bitfinex, designed specifically for stablecoin transactions. Its biggest selling point is providing zero-fee transfers for USDT. This setup directly challenges the Tron network, which has long dominated USDT circulation. In July 2025, Plasma raised $373 million in a token sale, indicating strong market interest in this public chain.

Compared to Plasma, Stable's goals are even more comprehensive. Tether refers to it as the "exclusive home for USDT," adopting a dual-chain parallel architecture, with one main chain responsible for core settlements and Plasma as a parallel chain handling massive small transactions and micropayments, regularly settling on the main chain. In this network, USDT serves both as a transaction medium and a fee token, eliminating the need for users to hold additional tokens to pay gas, significantly lowering the usage threshold.

To further enhance flexibility, Stable has also introduced various USDT variants. The standard USDT is used for everyday transactions, USDT0 is specifically for cross-chain bridging, and gasUSDT is used for paying network fees. All three maintain a 1:1 value peg, allowing users to exchange them at zero cost, thus ensuring a consistent user experience across multiple scenarios.

In terms of consensus mechanism, Stable employs a customized StableBFT. This mechanism is developed based on the CometBFT engine (an improved version of Tendermint) and belongs to a delegated proof-of-stake system. StableBFT separates "transaction propagation" from "consensus propagation," aiming to solve congestion issues during high traffic periods and provide a more stable network environment for large-scale payments.

Through the dual-chain combination of Plasma and Stable, Tether not only addresses the limitations of existing networks in terms of fees and stability but also attempts to build a comprehensive closed-loop system for USDT, encompassing transactions, fees, and cross-chain activities.

The Infrastructure Ambitions of Tech Giants

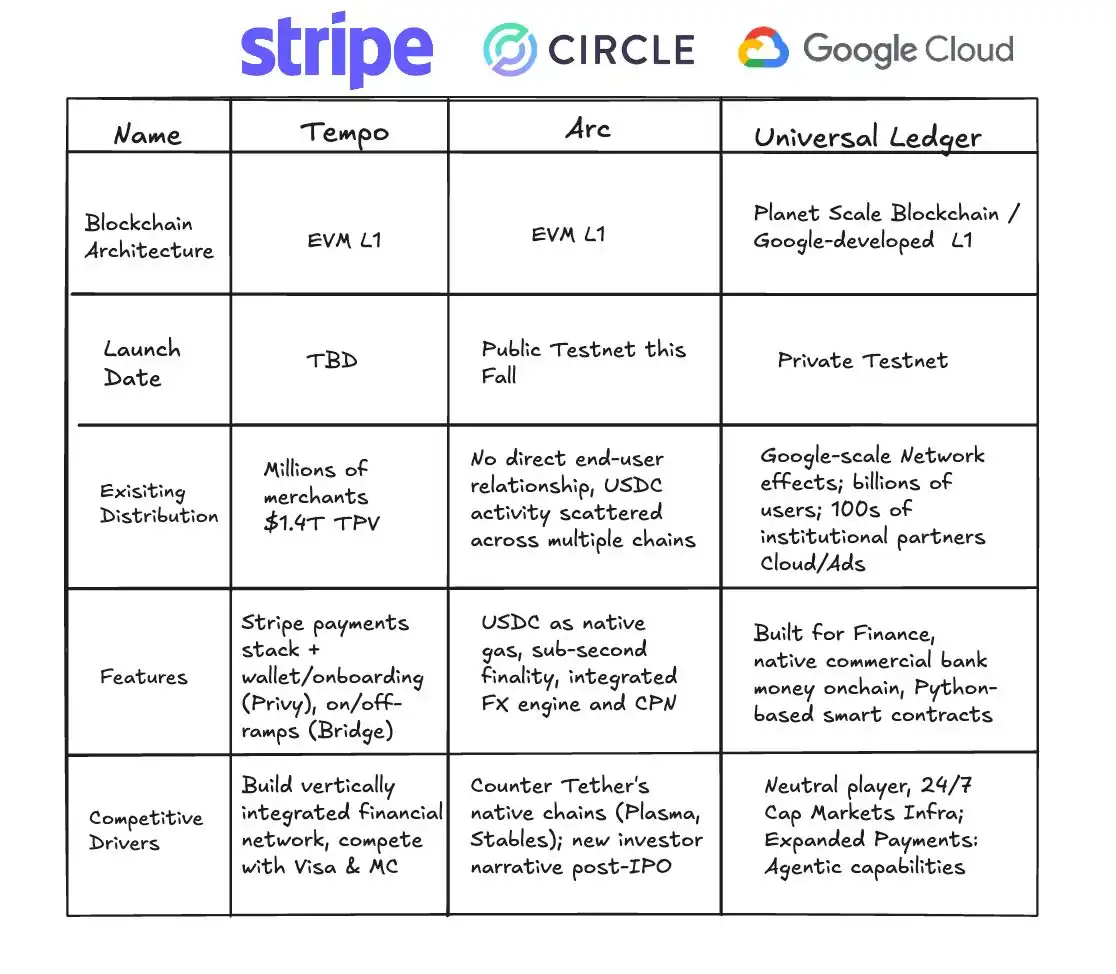

Google is also reaching out, turning its attention to the underlying infrastructure of stablecoins through Google Cloud Unified Ledger (GCUL). GCUL is an enterprise-level blockchain platform specifically designed to support the issuance, management, and trading of stablecoins for banks and financial institutions.

Comparison of GCUL with Tempo and Arc, image source: Fintech America

Its core advantage lies in its deep integration with Google Cloud's existing enterprise services. Financial institutions can quickly launch stablecoin products on GCUL without having to build infrastructure from scratch. For banks accustomed to using Google Cloud services, this is an almost seamless digital asset solution.

Google's strategy appears particularly restrained; it does not directly participate in the issuance or payment competition of stablecoins but positions itself as a "shovel seller," providing underlying technology for all players. This choice means that regardless of which stablecoin ultimately prevails, Google will benefit from the dividends.

These dedicated public chains do not merely replicate the functions of existing blockchains but have made leaps in several key dimensions. Stablecoins have already eliminated the role of banks, and now they have freed themselves from reliance on public chains like Ethereum and Tron, truly taking control of the transaction channels.

They unleash stronger programmability; stablecoins are essentially a set of contracts. Stripe CEO Patrick Collison has stated that programmable payments will give rise to entirely new business models, such as "agent payments" aimed at AI agents. On the new chains, developers can directly call built-in payment primitives to assemble complex applications like conditional payments, scheduled payments, and multi-party settlements.

They also compress settlement times to nearly instantaneous. Public chains like Arc aim to reduce confirmation times to sub-second levels. For high-frequency trading, supply chain finance, and even small payments in chat applications, this "what you see is what you get" speed is revolutionary.

Moreover, they have natively considered interoperability in their architecture. Cross-chain bridges and atomic swaps are no longer additional patches but part of the system. Stablecoins on different chains can flow freely, as if direct channels have been established between the global banking systems.

The Year of Stablecoin Public Chains

The emergence of stablecoin public chains essentially represents a rewriting of the value chain. In the past, profits siphoned off by banks, card organizations, and clearing institutions within the payment system are now flowing to new participants.

Circle and Tether, through the issuance of stablecoins, have gained control over a massive pool of interest-free funds, which are invested in safe assets like U.S. Treasury bonds, generating billions of dollars in interest each year. Tether's profits reached $4.9 billion in the second quarter of 2024, almost entirely derived from this "seigniorage" revenue.

With their own public chains, the methods of value capture have become more diverse. Transaction fees are just the surface; the real potential lies in value-added services. Tempo can customize payment solutions for corporate clients, while Arc can provide institutional-level functions in compliance and foreign exchange settlements. The premiums for these services far exceed the value of a single transfer.

The greater imaginative space lies at the application layer. When payments become programmable, new business models emerge. Automated payroll, conditional payments, supply chain finance—these not only improve efficiency but also create previously non-existent value.

However, for traditional financial institutions, stablecoins are shaking their foundations. Payment intermediaries are a significant source of income for banks, and the proliferation of stablecoins may gradually render this business unnecessary. The short-term impact is limited, but in the long run, banks must redefine their roles.

This value reconstruction is not merely a commercial competition; it also carries geopolitical shadows. The global circulation of dollar stablecoins essentially continues the hegemony of the dollar in the digital age. Countries' reactions have already begun, and future competition will not only involve a single public chain and company but also a contest between different nations and currency systems.

The rise of stablecoins is not just a technological upgrade or a change in business models. What it triggers is the most profound structural reconstruction of global financial infrastructure since the advent of double-entry bookkeeping and the modern banking system.

From a longer perspective, what stablecoins trigger may be the most profound reconstruction of global financial infrastructure since double-entry bookkeeping and the modern banking system.

Historically, every transformation of underlying infrastructure has brought about a leap in the commercial landscape. The promissory notes of Venetian merchants made intercity trade possible, the Rothschilds' multinational banking network facilitated the global flow of capital, and the systems of Visa and SWIFT accelerated payments to the second level.

These transformations have reduced costs, expanded markets, and unleashed new growth momentum. Stablecoins are the latest node in this evolutionary trajectory.

Its long-term impact will manifest on multiple levels.

Inclusivity is first amplified; with just a smartphone, anyone can access the global network without a bank account. The efficiency of cross-border settlements will also be rewritten, with near-instantaneous clearing significantly improving the cash flow of supply chains and trade.

The more profound change lies in the fact that it will give rise to digitally native business models. Payments are no longer just about the flow of funds; they can also be programmed and combined like data, thus expanding the boundaries of business innovation.

In 2025, as stablecoin public chains are successively launched, stablecoins have truly stepped out of the crypto world and entered the mainstream financial and business stage. We are at this intersection, witnessing the formation of a more open and efficient global payment network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。