Today's homework difficulty continues to rise. First, the non-farm payroll data was released, and the figures matched expectations, with employment numbers halving compared to last month. This indicates that the U.S. labor market is not very healthy. Coupled with the fact that job openings are less than the number of unemployed, it seems that the U.S. economy may indeed be showing signs of a downward trend. Although the market anticipates an increase in rate cuts in September, the actual data suggests that the economic downturn could be more significant.

In addition to economic data, there are also unfavorable policies affecting cryptocurrencies. This is the first occurrence since Trump took office, mainly because Nasdaq announced that U.S. stocks purchasing cryptocurrencies must not only be approved by the board of directors but also require approval from the shareholders' meeting. This increases the complexity for listed companies to purchase tokens.

Overall, the impact is not significant; those who need to buy will still buy, and the most it will affect is the frequency of purchases, without interfering with the total amount bought. So, while it is a slight negative, the impact will not be substantial.

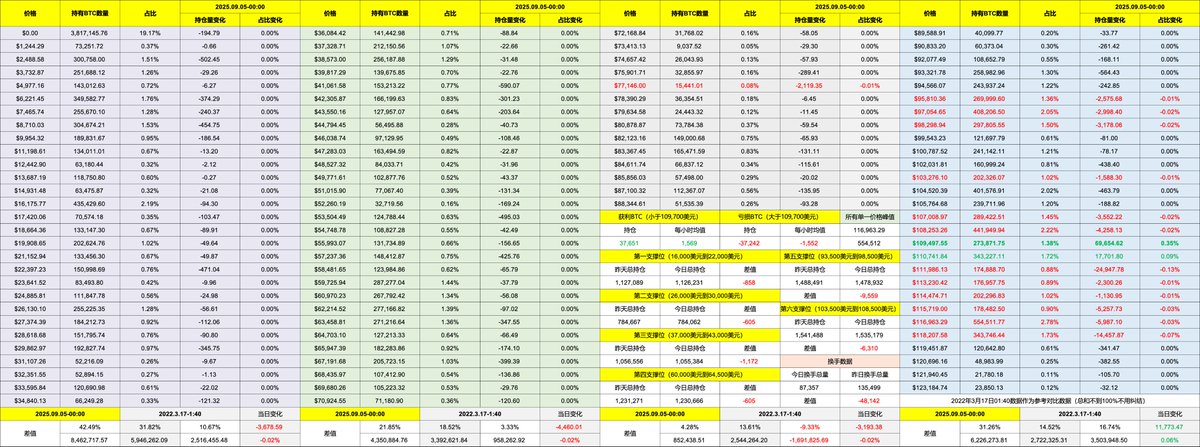

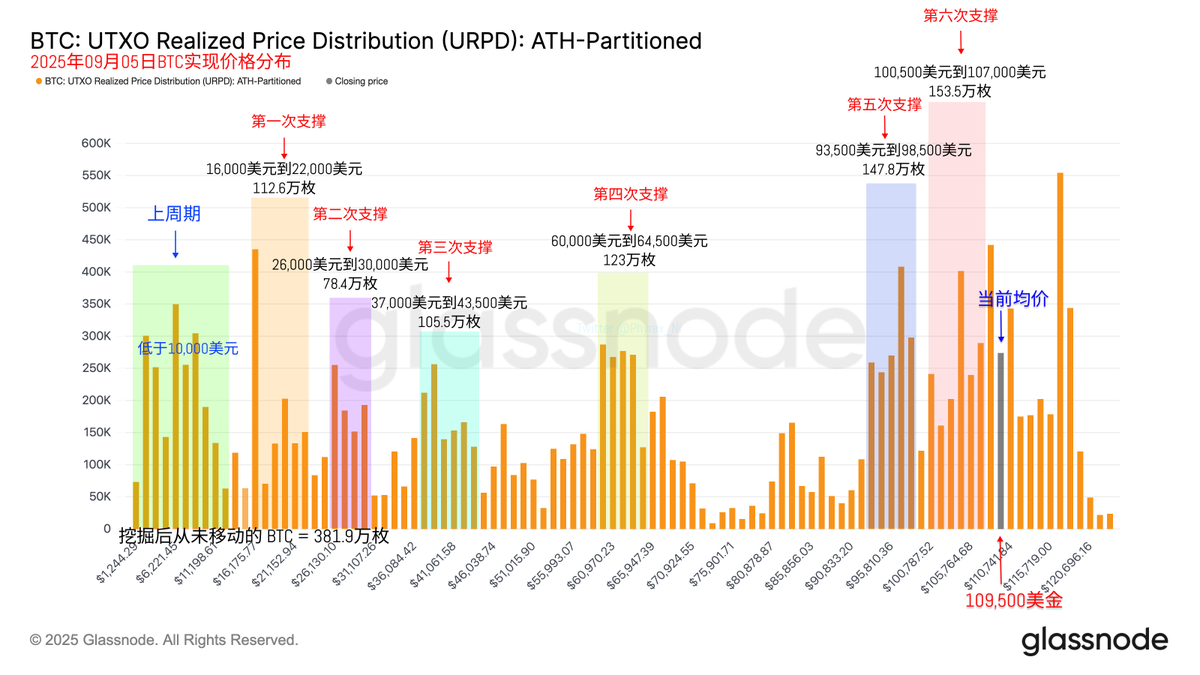

Looking at Bitcoin's data, as the price of $BTC declines, the turnover rate is also decreasing, and investors' interest in trading is starting to wane. Investors who bought the dip yesterday are the largest sellers today, mainly due to the potential economic downturn that may come with rate cuts, which is more concerning for investors than not cutting rates. The market's short-term focus remains on Friday's non-farm payroll data.

The way to warm up the market is not necessarily through worse labor data tomorrow, but rather the market's expectation of a 100% rate cut in September, which may not be a good thing for the economy. However, the support situation is still quite stable, and the sixth support range may need to be adjusted next week.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。