Core Points

- Stable 10% Annualized Return: The XT Simple Earn USDT investment plan helps your large USDT assets achieve continuous double-digit stable returns.

- Three-Tiered Crypto Investment Strategy: A combination of flexible investment, fixed-term investment, and premium investment to comprehensively optimize your crypto passive income.

- Designed for Large USDT Investments: Covering from 50,000 to 1.5 million USDT, ensuring that every bit of your funds appreciates efficiently.

- Repeatable Income Opportunities: The weekly "Crazy Wednesday" event keeps your crypto investments yielding high annualized returns over the long term, no longer relying solely on short-term promotions.

- Practical Investment Portfolio Demonstration: Three strategy configurations show how to continuously achieve 10%+ annualized returns with 100,000 USDT.

If you hold 100,000 or more USDT for investment, your assets should work as hard as you do when making money.

However, many users discover a harsh reality: the more funds you have, the lower the actual annualized return on crypto investments.

A 10% high annualized return seems attractive, but it usually only covers the first few hundred to a few thousand USDT, while the remaining funds can only earn a basic interest rate of 3%-5%. For example, with 100,000 USDT, you might earn over 6,000 USDT less in a year, severely diluting your passive income.

Instead of exhausting yourself chasing short-term high-interest activities or moving funds back and forth between different platforms, it’s better to choose a USDT investment plan that can scale with your funds and maintain stable returns over the long term.

Based on real market data, we simulated a crypto investment portfolio of 100,000 USDT, calculated the actual income gap, and provided solutions.

XT Simple Earn helps you create an efficient, replicable passive income portfolio through flexible investment, fixed-term investment, and premium investment strategies, allowing your crypto investments to achieve long-term stable growth.

Table of Contents

Why USDT Investments Are Often Diluted: The Reality and Methodology of Large Fund Crypto Investments

XT Simple Earn USDT Investment Portfolio: Stabilizing Crypto Investment Annualized Returns at 10%+

USDT Investment Risks and Disclaimers: Key Details for Steady Crypto Investment Passive Income

Why USDT Investments Are Often Diluted: The Reality and Methodology of Large Fund Crypto Investments

When we step back from promotional posters and high-interest headlines, we find a pattern: the more funds you have, the actual annualized return does not increase proportionally and may even be lower.

The Real Reasons for Lower Stable Returns: High-Interest Limits and VIP Bonuses

- Limited High-Interest Amounts: Most platforms' highest annualized return rates only cover the first 200 to 2,000 USDT, while the majority of funds can only earn the basic rate, leading to a decline in overall USDT investment returns.

- Limited VIP Bonuses: Even the highest-level VIPs usually only receive an additional 0.5% to 1% interest, which has a very limited impact on a 100,000 USDT crypto investment portfolio.

- Short-Term Promotions Are Unsustainable: New user promotions or seasonal activities can temporarily boost annualized returns but cannot serve as a long-term passive income reliance.

The end result is an "invisible drag" that discounts overall investment returns. For investors seeking stable returns, this means potentially losing thousands of USDT in potential earnings each year.

Data-Driven Real Cases

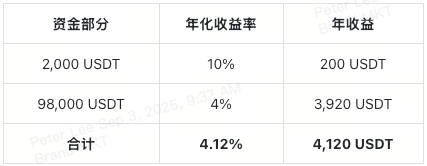

To make the analysis more specific, we established a standard test portfolio with 100,000 USDT. We researched publicly available USDT investment rates as of August 2025 and calculated the weighted effective annualized return, considering high-interest ranges and the basic rates for remaining funds, yielding the following results:

EAY Formula

EAY = (High-Interest Rate × Amount in Range + Basic Rate × Remaining Funds) ÷ Total Investment

Example Calculation:

Even though the high-interest amounts in this example are relatively "generous," the overall annualized return is still only about 4.12%. For a 100,000 USDT crypto investment, this means earning nearly 6,000 USDT less per year compared to achieving a stable 10% annualized return.

Even though the high-interest amounts in this example are relatively "generous," the overall annualized return is still only about 4.12%. For a 100,000 USDT crypto investment, this means earning nearly 6,000 USDT less per year compared to achieving a stable 10% annualized return.

Conclusion and Insights: Choosing Scalable USDT Investment Plans for Stable Returns

This analysis illustrates why investors need a solution that can scale with their funds and continuously provide stable passive income. The goal is not just to see high-interest promotions but to truly achieve an overall USDT investment portfolio that approaches or exceeds a 10% annualized return. The next section will introduce how XT Simple Earn can help you narrow this income gap through flexible investment, fixed-term investment, and premium investment strategies, creating a long-term replicable crypto investment system.

XT Simple Earn USDT Investment Portfolio: Stabilizing Crypto Investment Annualized Returns at 10%+

Many high-net-worth individuals find that as their balances grow, the investment efficiency of most platforms decreases. XT Simple Earn is designed for users seeking stable returns, providing a clear, replicable crypto investment plan that transforms funds into long-term sustainable passive income. By combining flexible investment, fixed-term investment, and premium investment strategies, along with trading bonus rewards, XT Simple Earn can help large USDT investment portfolios maintain high levels of annualized returns over the long term.

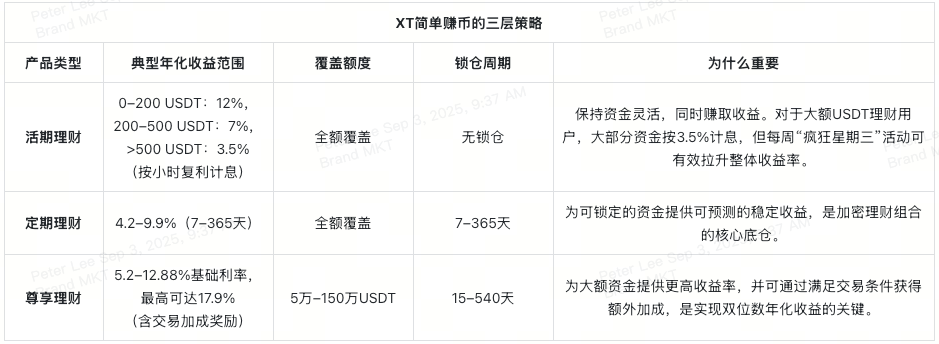

How the Three-Tiered Strategy Works Together: Flexible investment ensures funds are available for withdrawal, fixed-term investment locks in basic returns, and premium investment further enhances returns once conditions are met. When combined, your USDT investment annualized return can reach or even exceed 10%, achieving true stable returns.

How the Three-Tiered Strategy Works Together: Flexible investment ensures funds are available for withdrawal, fixed-term investment locks in basic returns, and premium investment further enhances returns once conditions are met. When combined, your USDT investment annualized return can reach or even exceed 10%, achieving true stable returns.

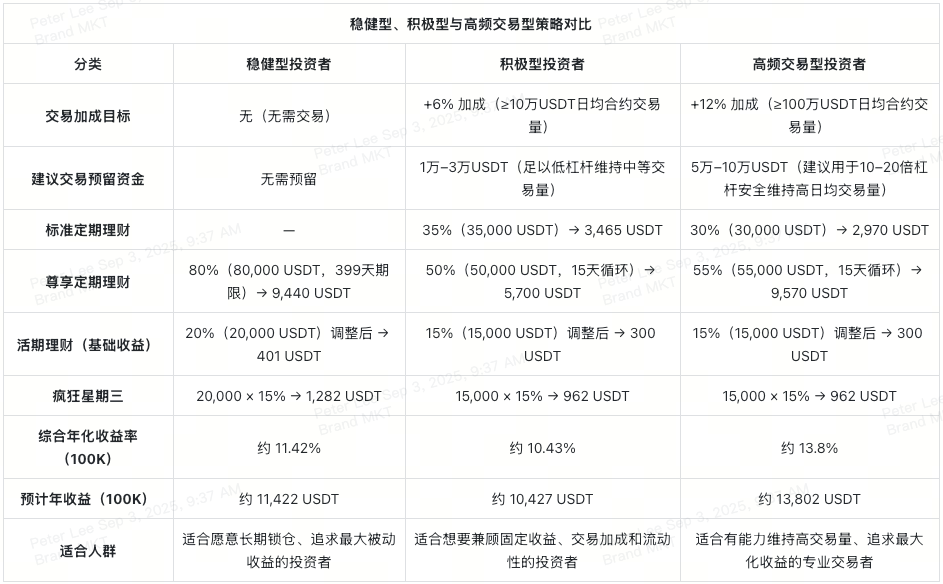

Portfolio Demonstration: Three Configurations for 100,000 USDT to Achieve Long-Term Passive Income and Stable Returns

The real advantage lies in how to scientifically combine the three-tiered strategies. Below are three optimized plans for a 100,000 USDT portfolio, all assuming participation in the weekly “Crazy Wednesday” event, helping investors flexibly adjust based on their liquidity needs and risk preferences.

Crazy Wednesday Explained: How a 3-Day Product with 15% Annualized Return Boosts Overall Returns

To enhance overall annualized returns, “Crazy Wednesday” is one of the highlight events of XT Simple Earn. Once a week, it helps you capture higher returns while ensuring the safety of your principal:

- Increased Interest Earnings: 3-day fixed-term USDT and USDC investments can yield annualized returns of up to 15%

- Principal Protection: Short-term lock-up, 100% principal safety

- Weekly Availability: Open for subscription all day on Wednesdays, limited to 24 hours

- Individual Quota: Each user can subscribe up to 50,000 USDT

By cycling a portion of your flexible funds into “Crazy Wednesday” each week, you can significantly increase the overall passive income of your crypto investments without adding extra risk, achieving a more robust USDT investment portfolio.

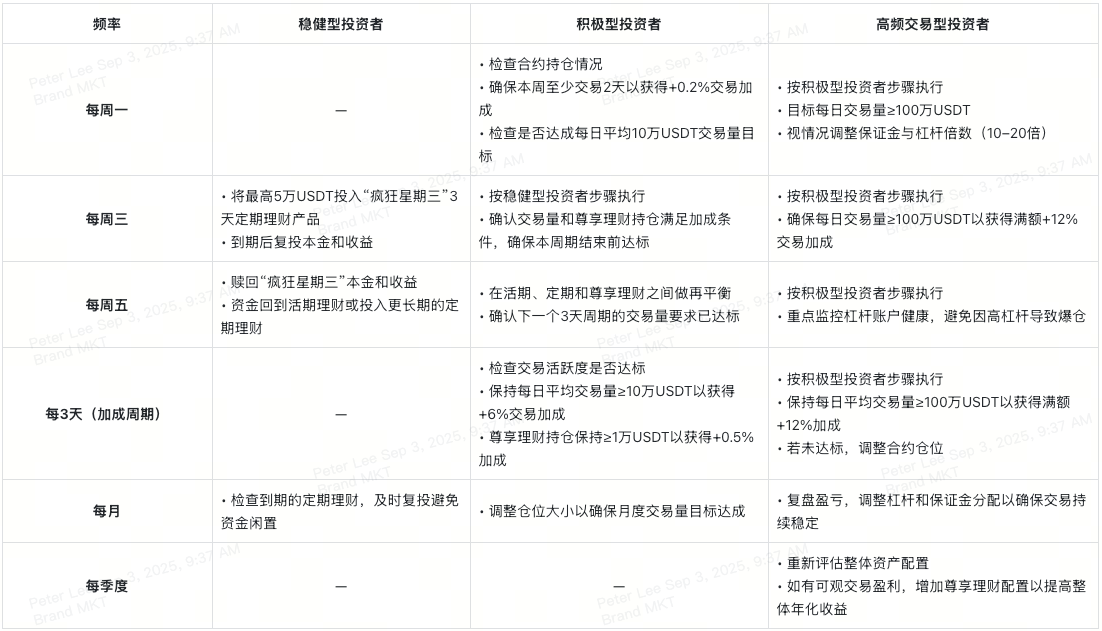

Execution Calendar: Weekly and Periodic Action Checklist to Ensure Trading Bonuses and Stable Returns

To fully leverage the combined effects of flexible investment, fixed-term investment, premium investment, and “Crazy Wednesday,” execution is crucial. The trading bonus for premium investment is calculated every 3 days, and “Crazy Wednesday” occurs weekly. The following calendar helps you maintain the rhythm:

Choose the Right Crypto Investment Plan for You

Conservative Investors:

- This plan is designed for investors seeking stable returns who want to minimize operations. By allocating most of your portfolio to long-term premium investment, you can achieve the highest basic annualized return without the need for trading, making it ideal for users who prefer to "buy and hold" with peace of mind, enjoying stable growth and passive income.

Active Investors:

- This plan is suitable for users who already have some trading habits, allowing your trading activities to truly "generate value." As long as you meet the requirement of an average daily trading volume of ≥100,000 USDT, you can unlock a +6% trading bonus for premium investment. At the same time, keep a portion of your funds in flexible and fixed-term investments to balance liquidity and stable returns, helping your crypto investment plan operate more efficiently.

High-Frequency Traders:

- This is best suited for users with professional capabilities who can maintain an average daily trading volume of ≥1,000,000 USDT. This approach unlocks a maximum trading bonus of +12%, significantly enhancing overall annualized returns. It is important to manage leverage wisely and reserve 50,000–100,000 USDT as contract trading margin to ensure a balance between pursuing high returns and reducing liquidation risks.

Regardless of the strategy you choose, you can achieve double-digit annualized returns on your USDT investments, which are sustainable and replicable. The key is to reasonably combine flexible investment, fixed-term investment, and premium investment (including trading bonuses) based on your fund size, liquidity needs, and risk preferences to create a long-term stable income plan.

USDT Investment Risks and Disclaimers: Key Details for Steady Crypto Investment Passive Income

Achieving 10%+ annualized returns through XT Simple Earn USDT investments is entirely feasible, but to stabilize this goal, reasonable planning and a thorough understanding of key influencing factors are necessary.

1. Interest Rate Adjustments

The interest rates of XT Simple Earn are competitive but may be adjusted with market changes:

- Flexible Investment: The annualized return for the first 200 USDT is 12%, 7% for 200–500 USDT, and 3.5% for amounts over 500 USDT, calculated with hourly compounding.

- Fixed-Term Investment: Ranges from 4.20% for 7 days to 9.90% for 365 days, with daily payouts.

- Premium Investment: A basic annualized return of 5.2% for 15 days, with a maximum of 15% for up to 540 days.

- It is recommended to confirm the latest rates before each fund allocation to ensure the best returns are locked in.

2. Liquidity Restrictions

The longer the term, the higher the returns, but funds will also be locked for a longer period:

- For example, investing 80,000 USDT in a 399-day premium investment at an annualized return of 12.88% could yield about 9,440 USDT in passive income per year, but the funds must be held until maturity for redemption.

- Premium investments do not support early redemption, so it is essential to plan funds reasonably to avoid liquidity shortages.

3. Trading Bonus Eligibility

The annualized return for premium investments can be increased from 5.2% to a maximum of 17.9% by meeting trading conditions, calculated over a 3-day cycle:

- Average daily contract trading volume ≥1,000 USDT (+1%), ≥10,000 (+3%), ≥100,000 (+6%), ≥1,000,000 (+12%)

- Trading frequency ≥2 days/cycle (+0.2%)

- Average daily investment holding ≥10,000 USDT (+0.5%)

- If conditions are not met, the additional bonus for that cycle will not take effect, making it crucial to maintain a stable trading frequency and position.

4. Weekly Activity Participation Timing

The weekly “Crazy Wednesday” fixed event offers 3-day USDT/USDC fixed-term investments with a maximum annualized return of up to 15%, and 100% principal protection:

- The subscription window is only open for 24 hours, and slots may sell out early.

- Missing one event means losing the additional income opportunity for that week.

5. Market and Platform Risks

XT provides proof of reserves and security measures, but rational investors should still diversify their fund allocations and keep liquidity reserves to handle unexpected situations.

Summary Comparison: The Long-Term Gap Between 4.12% and 11.42% Annualized Returns

A well-allocated 100,000 USDT portfolio can yield about 11,422 USDT in stable income annually (annualized return of 11.42%). If only placed in ordinary crypto investment products, calculated at an annualized return of 4.12%, it would yield only about 4,120 USDT annually, resulting in a passive income shortfall of over 7,300 USDT.

Understanding and managing these risks can bring you closer to your target range, achieving truly sustainable crypto investment passive income.

Final Summary: Using XT Simple Earn to Make USDT Investments Sustainable and Stable

On many platforms, once your balance exceeds a few thousand USDT, the investment rewards will significantly decline.

XT Simple Earn's USDT investments were created for this reason.

It operates through a scalable three-tier strategy, combining flexible investment, fixed-term investment, and premium investment (including trading bonuses), ensuring that your entire asset is working efficiently, not just the first few hundred USDT enjoying high rates.

With proper planning, a 100,000 USDT crypto investment portfolio can achieve stable annual returns of:

- Conservative Investment Strategy: Approximately 11,422 USDT annual income (11.42% annualized return)

- Active Trading Bonus Strategy: Approximately 10,427 USDT annual income (10.43% annualized return)

- High-Frequency Trading Bonus Strategy: Approximately 13,802 USDT annual income (13.8% annualized return)

Even missing one “Crazy Wednesday” event could result in a loss of about 288 USDT in interest (calculated as 20,000 USDT × 15% annualized return × 3 days). Missing it week after week will lead to accumulating losses.

The solution is to maintain a steady income rhythm: check the latest “Crazy Wednesday” events weekly, confirm whether you meet the trading bonus conditions for premium investment, and keep your USDT working around the clock, achieving predictable, replicable passive income and allowing your wealth to grow continuously.

XT Simple Earn Frequently Asked Questions

1. What is XT Simple Earn?

XT Simple Earn is the exclusive USDT investment and income platform of XT.COM. It utilizes flexible investment for fund liquidity, fixed-term investment for predictable stable returns, and combines premium investment and trading bonuses to create higher annualized returns and a more efficient crypto investment experience for large funds.

2. How can I achieve 10%+ annualized returns through USDT investments?

You can allocate funds to fixed-term investments, premium investments (choosing whether to stack trading bonuses), and participate in the Crazy Wednesday 3-day fixed-term event weekly. With this configuration, a 100,000 USDT portfolio has the opportunity to maintain over 10% annualized returns long-term and achieve sustainable passive income.

3. Is trading necessary to participate in premium investments?

No need. As long as the account balance reaches 30,000 USDT, you can unlock premium investment products, allowing you to enjoy higher interest rates even without trading. If you participate in a 15-day premium investment and meet the trading bonus conditions, the annualized return can increase from 5.2% to a maximum of 17.9%, truly achieving high yield growth for your USDT investments.

4. Can multiple investment products be used simultaneously?

Yes. Many users combine flexible investment, fixed-term investment, and premium investment to ensure liquidity while locking in stable returns, and participate in the “Crazy Wednesday” event to enhance overall returns, allowing the combined yield to exceed double digits.

5. How often are annualized returns updated?

XT Simple Earn regularly adjusts the annualized returns for flexible and fixed-term investments to maintain market competitiveness. Additionally, “Crazy Wednesday” opens weekly, providing a 3-day fixed-term opportunity with a 15% annualized return, allowing you to regularly enhance the overall performance of your crypto investments.

6. What is the deposit limit for premium investments?

Premium investments typically cover funds ranging from 50,000 to 1,500,000 USDT, making them very suitable for users with large amounts of capital, allowing the entire account to continuously generate stable returns without being restricted by the small high-interest limits of ordinary platforms.

7. Can early redemption be made?

Flexible investments can be redeemed at any time, but fixed-term investments and premium investments do not support early redemption; they must be held until maturity to receive the agreed annualized returns. It is recommended to plan fund allocation in advance to avoid affecting the user experience due to insufficient liquidity.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 1,000 quality cryptocurrencies and 1,300 trading pairs. The XT.COM cryptocurrency trading platform supports a variety of trading options, including spot trading, margin trading, and contract trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。