Written by: Bitpush

Today, American Bitcoin Corp (ABTC) officially listed on Nasdaq. This company, co-founded by Eric Trump and closely related to the Trump family, staged a thrilling "capital roller coaster" on its first day of trading.

ABTC's Pump & Dump

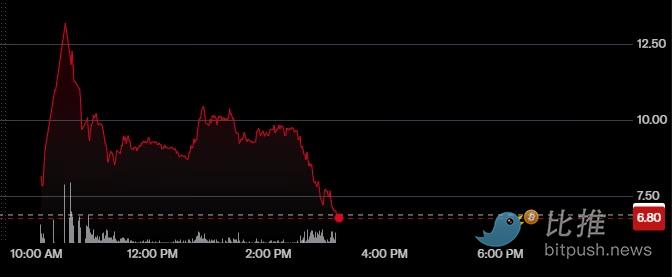

Market data shows that ABTC surged over 110% at its peak during the opening, but ultimately closed up about 17%.

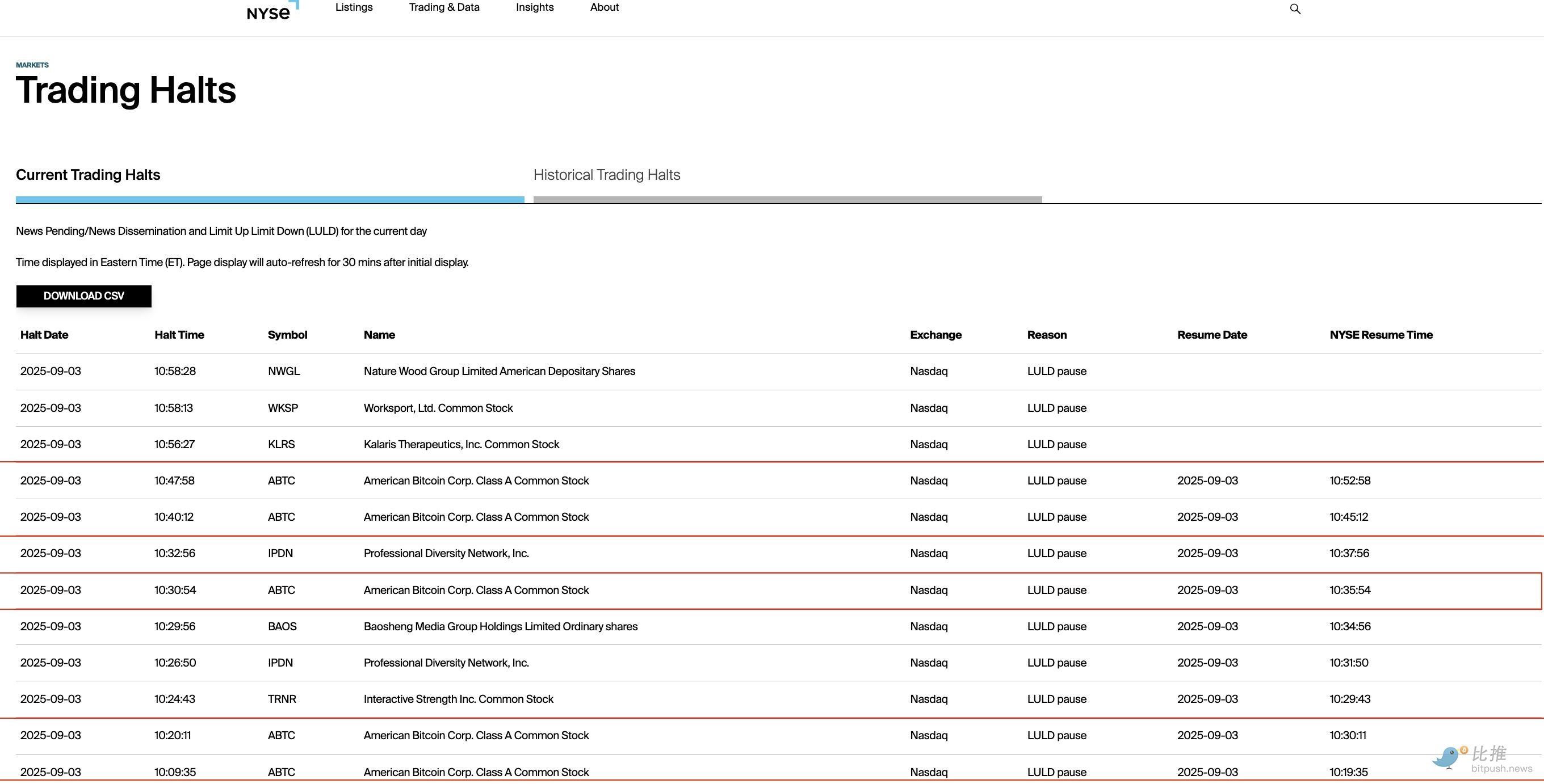

ABTC was suspended from trading five times by Nasdaq within the first hour due to extreme volatility, reaching highs of $14 before falling back to around $9.50, retracing more than half of its gains.

This trend typically exemplifies the "Pump and Dump" model: first, leveraging political exposure and enthusiasm in the capital market to inflate stock prices, then cashing out profits, leaving ordinary investors to take the losses.

A Mysterious Transaction: From Mining Machine "Donation" to IPO

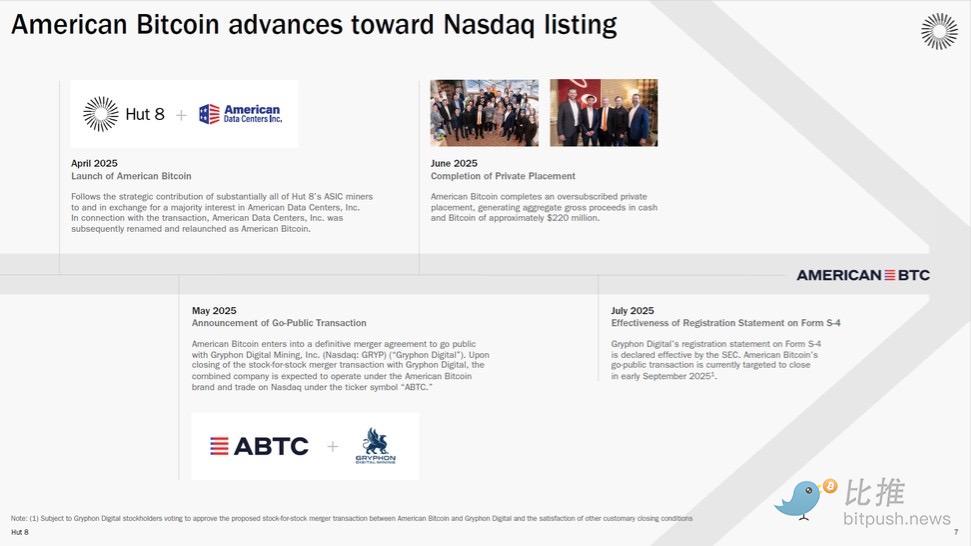

In late March this year, Eric Trump and Donald Trump Jr. reached a deal with Hut 8, one of the largest publicly listed Bitcoin mining companies in the U.S., to establish a new entity called "American Bitcoin."

According to the agreement, Hut 8 donated all 61,000 of its mining machines to American Bitcoin. In return, Hut 8 received 80% of the shares in American Bitcoin.

The most puzzling aspect of this transaction is that the mining company gave up its 100% ownership of the equipment, instead collaborating with the Trump sons to obtain a smaller shareholding.

In response, Matthew Sigel, head of digital asset research at VanEck, expressed on social media at the time: "I completely don't understand why Hut 8 would trade 61,000 mining machines for 80% of a subsidiary it already fully owned."

In this new company, Eric Trump serves as Chief Strategy Officer, and the company claims he brings "business acumen" and a commitment to "decentralized financial systems." Donald Trump Jr. did not list any executive position.

In the IPO, Gryphon Digital Mining acted as the "shell company," providing American Bitcoin with a springboard to enter the core U.S. capital market. This merger provided a direct Nasdaq listing channel for the Trump family's entity, perfectly aligning with its $210 million financing plan. Additionally, the company holds 2,443 Bitcoins as corporate treasury reserves, adding weight to its financial narrative.

On the first day, Eric Trump publicly stated: "Our Nasdaq listing marks a historic milestone for Bitcoin entering the core of the U.S. capital market, and our mission is to make America the undisputed leader of the global Bitcoin economy." Donald Trump Jr. emphasized that the company "symbolizes freedom, transparency, and core values of independence."

However, the reality is that the core of all narratives is ultimately a cash-out tool—dressed in the skin of Bitcoin faith, what lies beneath is not national rejuvenation, but capital arbitrage.

WLFI : Another Script for Wealth Harvesting

Just a few days before ABTC's listing, another crypto bet by the Trump family, World Liberty Financial (WLFI), went live for trading. Its token WLFI briefly surged to $0.46 but then plummeted about 50%, closing around $0.22.

The listing day brought the Trump family about $5 billion in paper wealth, with trading volume reaching $1 billion in the first hour, and the token's market cap nearing $7 billion. According to Reuters, the project has so far brought the family about $500 million in actual profits.

The WLFI listing was not a simple issuance; through a voting mechanism, early investors agreed in July to unlock their tokens for trading, while WLFI's governance attributes are more intriguing than its economic value—the official sources have not even clarified whether it includes rights or dividend distributions.

Political Halo + Retail Enthusiasm = Arbitrage Tool

The table below visually presents the differences in returns for investors of different identities on WLFI's first day:

Identity / Group

Cost Price Level

Listing Price (Approx.)

Return Situation

Retail Investors (Secondary Market Buyers)

$0.30–0.46

$0.22

Loss of 20%–50%

Ordinary Early Investors

$0.05

$0.22

About 4 times return

Core Insiders / Privileged Investors

$0.015–0.05

$0.22

Nearly 4–14 times return

It is not difficult to see:

Retail investors, as "high-position buyers," became the main losers;

Ordinary early investors made profits, but were not the biggest winners;

The privileged camp obtained overwhelming returns at extremely low costs, easily cashing out.

The core logic of this speculation is:

Narrative Packaging: From "American Bitcoin Economic Leader" to "Freedom and Transparency," each project is imbued with grand significance;

Identity Exposure: The endorsements of Eric Trump and Donald Trump Jr. undoubtedly enhance project attention and buying interest;

Heat Building: Social media and mainstream media collaborate to hype, triggering retail FOMO (fear of missing out);

Cashing Out: Amidst high heat, they complete their sales, while retail investors are left holding the bag at high positions.

This is a highly institutionalized "scythe-style cutting" process, and the real ones wielding the knife are always those holding the lowest cost power resources.

The Trump family's crypto path is not accidental; it is leveraging its political capital to establish a cross-cycle wealth map for itself. For instance, WLFI not only has tokens but also supporting assets like stablecoin USD1 to continue expanding its capital map. Meanwhile, the internal holding ratio of the project is as high as 60–75%, with severe interest bundling.

Coupled with billions of dollars in collaborations with allies like Abu Dhabi and Justin Sun, this cross-political cycle and cross-asset class capital deployment is not merely arbitrage; it is a "system-level ATM."

In this game, privilege enters under the guise of compliance, using narrative as a scythe, and retail investors as chives. And when the revelry ends, the only ones left in the arena are those ordinary investors holding the remnants, gazing at the K-line—they have become the only "paying audience" of this show.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。