Original|Odaily Planet Daily (@OdailyChina)

On September 2, spot gold rose over 1% during the day, surpassing $3,510 per ounce, reaching a high of $3,512.27 per ounce, setting a new historical high; on the morning of the 3rd, spot gold surged over $10 in a short time, reporting a new high of $3,547 per ounce. Surprisingly, there are reports that the World Gold Council is seeking to launch "digital gold," which could change the $900 billion physical gold market in London. Odaily Planet Daily will summarize recent trends in gold prices, industry dynamics, and mainstream gold tokenization projects in this article for readers' reference.

Gold resumes its upward momentum, analysts predict prices may rise to $3,900 per ounce

On September 1, spot gold stood at $3,470 per ounce, continuing to set new highs since April 22 of this year, with a daily increase of 0.67%.

Subsequently, in just 2 days, gold prices quickly broke above $3,500 and gradually stabilized, leading to a highly bullish outlook within the industry regarding the future direction of gold prices.

Analyst: Gold prices are expected to reach the $3,600-$3,900 range in the coming months

Philip Nova analyst Priyanka Sachdeva stated in a report that if spot gold prices continue to break above $3,500, gold prices may reach the $3,600 - $3,900 range per ounce in the coming months. She noted that the aggressive tariff stance of the U.S. has increased geopolitical risks, fueling safe-haven investments. She indicated that factors such as expectations of interest rate cuts, political turmoil, and strong ETF demand have transformed gold from a tactical hedge into a strategic essential asset for many investors. Sachdeva believes that the $3,800 per ounce target may be the first clear psychological barrier for gold prices to break through the current high.

Financial Times: The World Gold Council is planning to launch "digital gold"

According to a report by the Financial Times, the World Gold Council (WGC) is seeking to launch a digital form of gold, which could create a new way of trading, settling, and collateralizing gold, fundamentally changing the $900 billion physical gold market in London.

WGC CEO David Tait stated in an interview that this new form will make it possible for "gold to be used as collateral, digitally transferred for the first time within the gold ecosystem." Although many investors value gold for its physical nature and lack of counterparty risk, viewing it as a safe-haven asset, Tait believes that gold must be digitized to expand its market coverage. Tait stated, "We are trying to establish a standardized digital layer for gold so that various financial products used in other markets can also be applied to the gold market. My goal is to have numerous asset managers around the world reassess gold."

This move is seen as a change by the World Gold Council to respond to the new financial investment environment—despite gold being regarded as a safe-haven asset due to its physical attributes and lack of counterparty risk, many banks and investors view gold as a low-liquidity and non-yielding asset. As Tait said, "From a collateral perspective alone, banks can earn huge profits—because they have the opportunity to use gold on their balance sheets as collateral."

It is understood that the plan is primarily driven by a new digital sector called "pooled gold interests (PGIs)," which will allow banks and investors to buy and sell partial ownership of physical gold stored in independent accounts. In Q1 2026, commercial institutions in London will participate in a pilot of this model.

Currently, trading in the London gold market is divided into "allocated gold" trading (involving specific gold bars) and "unallocated gold" trading (only specifying the quantity of gold without designating specific bars), and the emergence of "digital gold" may introduce a third type of trading in the London over-the-counter gold market.

Market Status: The market capitalization of gold tokenization projects is less than 1% of the gold ETF market capitalization

According to Coingecko data, the overall market capitalization of tokenized gold is currently around $2.6 billion, which is less than 1% of the gold ETF market, which has a market capitalization of $400 billion. In comparison, the gold tokenization market is still in its early stages and has significant growth potential. Below are specific introductions to gold tokenization projects:

XAUT: Backed by Tether, market capitalization of $1.32 billion

According to on-chain data, Tether minted 129,000 XAUT on Ethereum in early August, currently valued at approximately $455 million, bringing its market capitalization to $1.32 billion.

Previously, Tether CEO Paolo Ardoino disclosed that if Tether were considered a "country," it would rank in the top 40 for physical gold holdings; in July, Tether released an XAUT audit report stating that at that time, the circulating supply of XAUT tokens was 246,524,330 (now increased to about 375,572), with the circulating XAUT tokens backed by over 7.66 tons of physical gold.

PAXG: Backed by Paxos, market capitalization of about $1 billion

PAXG was launched by the U.S. stablecoin company Paxos, and its market capitalization has soared to a record over $1 billion in the past three months. Since June, the token has seen continuous net inflows, with monthly inflows reaching as high as $141.5 million. The current circulating supply of the token is 282,566.

KAU: Backed by Kinesis & ABX, market capitalization of about $160 million

KAU was launched by the British digital asset utility platform Kinesis registered in the Cayman Islands, with each KAU linked to 1 gram of investment-grade gold stored in Kinesis vaults. Unlike other gold tokens, KAU supports purchasing, trading, consuming, and transferring. In addition to supporting redemptions, users holding assets on the Kinesis platform can also earn monthly income through redistributed trading fee revenue; spending KAU on the Kinesis virtual card also generates income, as the card supports buying gold, silver, and cryptocurrencies through real-time, instant conversion at over 80 million locations worldwide.

XAUm: Backed by Matrixport, market capitalization of about $47 million

In early August, Matrixport announced the official launch of XAUm fixed income products, supporting a wide range of investment periods from 7 to 365 days, and supporting 15 mainstream assets including BTC, ETH, SOL, BNB, and USDT. Additionally, the Matrixport platform supports XAUm Mint, Swap, and XAUm collateralized lending; this token is issued by Matrixport's RWA tokenization platform Matrixdock; last month, it completed its second annual gold 100% reserve audit conducted by the internationally renowned company CoinW, with its gold management scale increasing by 500% within six months.

VRO: Backed by VeraOne, market capitalization of about $41 million

VRO was launched by VeraOne based in London, UK. The project was co-founded by the AuCOFFRE.com group and cryptocurrency industry figure Owen Simonin, initially established in 2019. The token price is currently reported to be around $113, with relatively limited liquidity.

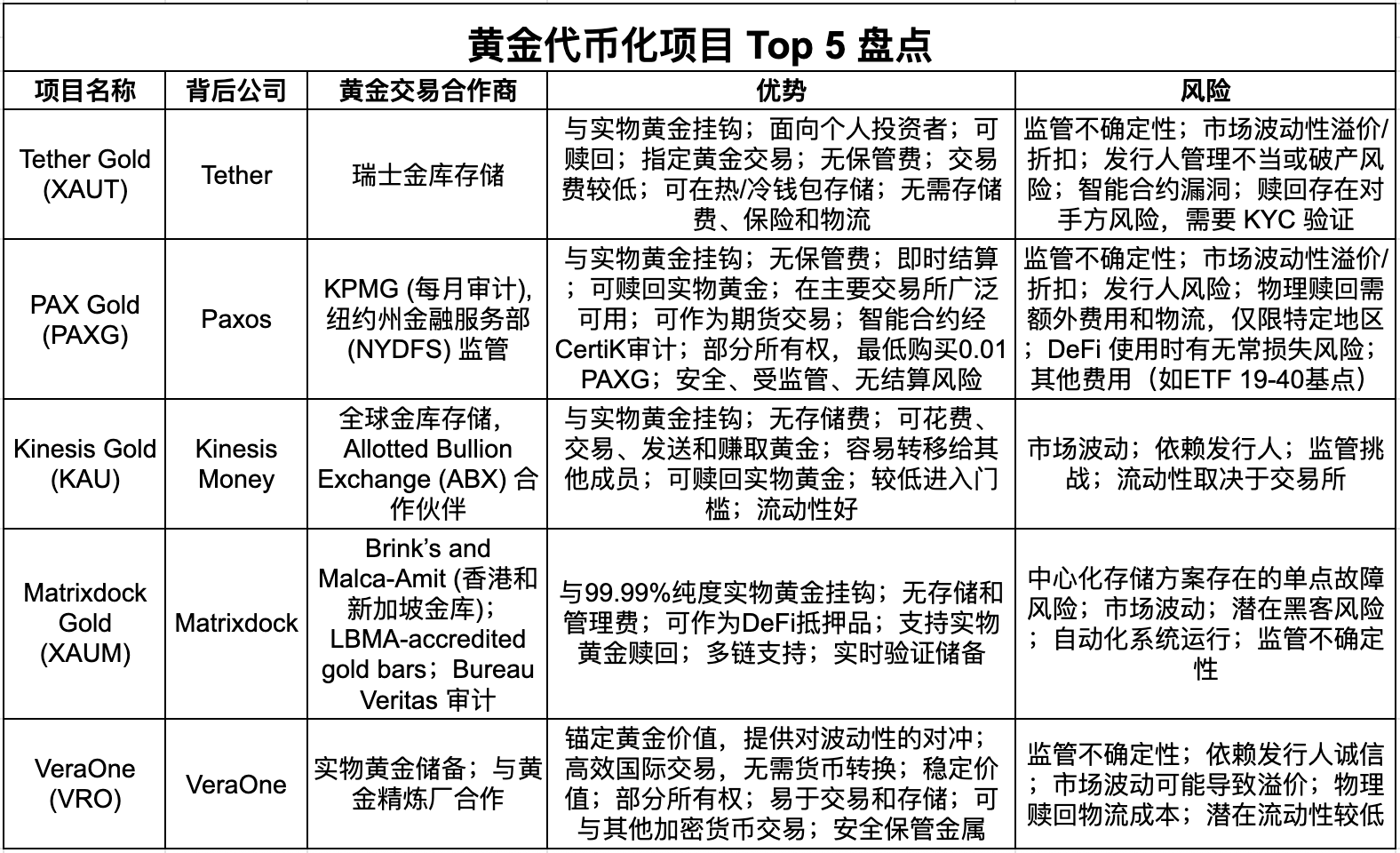

Below is the basic information of the main projects (compiled from @Grok):

Conclusion: The safe-haven and tax-advantaged properties of gold

It is worth mentioning that the recent surge in gold prices is not unrelated to the performance of the dollar and U.S. Treasury bonds. Ray Dalio, founder of Bridgewater Associates, recently stated that: the poor debt situation of the dollar indirectly drives up gold prices; international investors have begun to shift from U.S. Treasury bonds to gold. Former U.S. President Trump stated in August that "gold will not be taxed."

Now, gold tokens, which combine the safe-haven and tax-advantaged properties of gold, may become an investment choice for an increasing number of people.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。