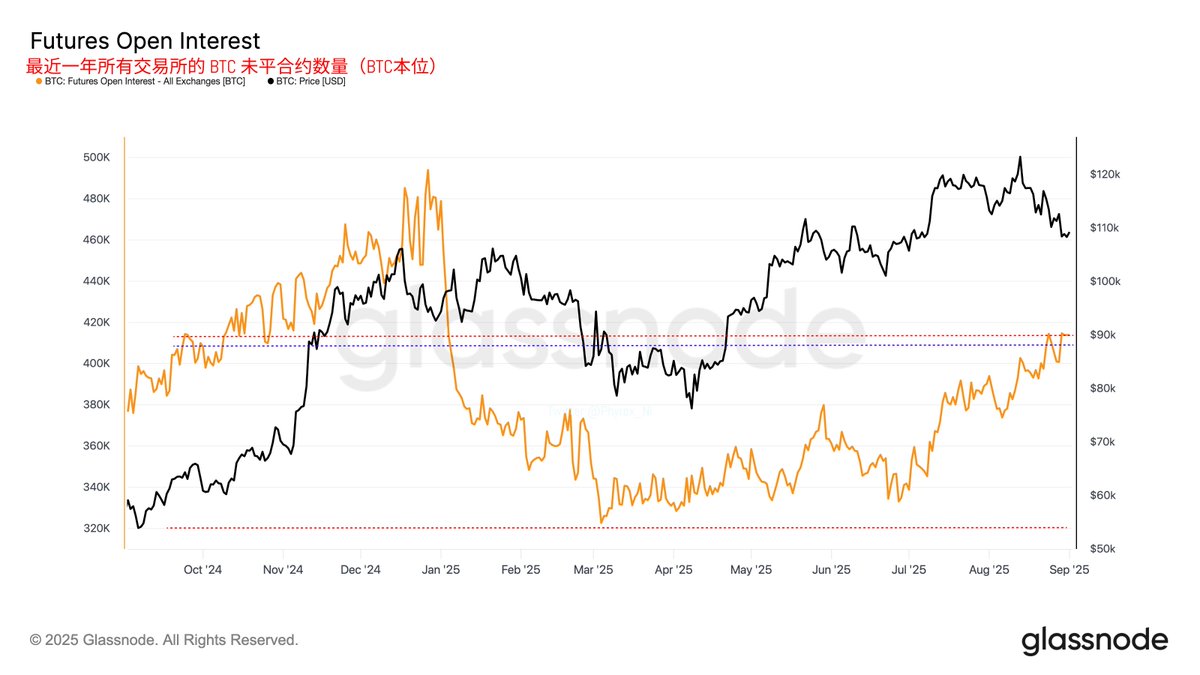

In the past two weeks, there has been significant attention on the data of open contracts, which can also reflect the current speculative situation of investors. First, regarding the open contracts of $BTC, it can be observed that although BTC's price has primarily been declining over the past two weeks, the open contracts have not shown a significant weakening trend; instead, they are oscillating upwards. This indicates that the competition between bulls and bears is increasing, and investors have begun to increase their leverage on BTC, which may lead to greater price volatility for BTC. This is not a very optimistic data point.

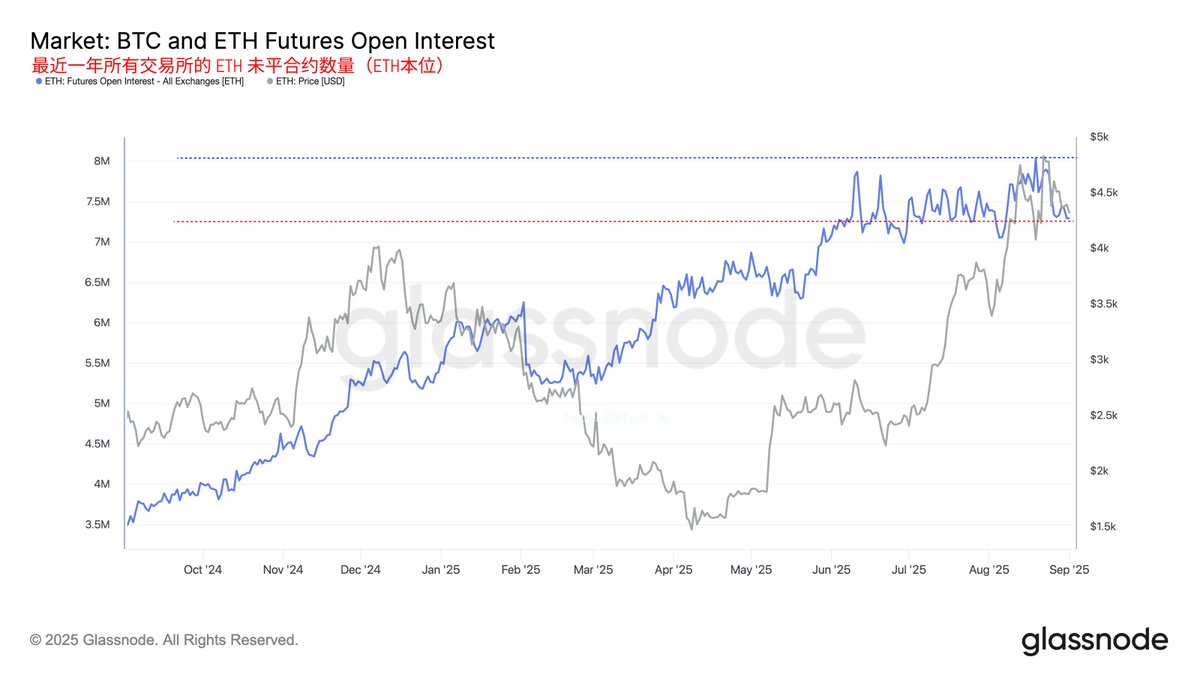

Similarly, for the open contracts of ETH, although it is at a historically high level, with the decline in $ETH's price, it can be seen that the volume of open contracts has also decreased in the past two weeks. This indicates that the leverage funds for ETH are gradually weakening. However, since it is already at a high level, the weakening is still ongoing. Currently, ETH's leverage remains high, but if it can continue to decrease, it will be beneficial for ETH's growth.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。