Written by: Yangz, Techub News

In the wave of digital asset treasury (DAT) becoming an increasingly strategic choice for more listed companies, this narrative welcomes a highly anticipated new participant. Last night, Hong Kong-listed company Yunfeng Financial (stock code: 00376.HK) announced on the Hong Kong Stock Exchange announcement that the company's board of directors has approved the purchase of Ethereum (ETH) as a reserve asset in the open market. According to the announcement, the company has currently accumulated 10,000 Ethereum, with a total investment amount of $44 million (including related fees and expenses).

In fact, this is not Yunfeng Financial's first foray into the digital asset space. Looking back at its strategic announcement released on the Hong Kong Stock Exchange in mid-July, the company has clearly identified Web3, real-world assets (RWA), digital currencies, ESG zero-carbon assets, and artificial intelligence (AI) as key areas for strategic layout, and this purchase of Ethereum is a substantial advancement of that strategy. There is a clear trend that Yunfeng Financial's recent continuous actions in regulatory compliance and strategic cooperation indicate that it is systematically increasing its investment in the digital ecosystem.

Systematic Investment in the Digital Ecosystem

According to announcements made by Yunfeng Financial on the Hong Kong Stock Exchange over the past two months, this Ethereum reserve strategy is not an isolated decision but a key step in the company's systematic investment in the digital ecosystem and pursuit of innovative financial transformation.

In terms of regulatory compliance, according to Yunfeng Financial's mid-2025 performance report, the company has clearly planned to move towards a new era of Web3. Its licensed securities company has submitted applications to the Hong Kong Securities and Futures Commission for upgrading licenses of types 1, 4, and 9. Once these license upgrades are approved, Yunfeng Financial will be able to provide comprehensive virtual asset-related trading services and manage investment portfolios in virtual assets. Additionally, to support its strategic transformation, the company's board of directors has also approved the adoption of a new employee stock incentive plan to attract and retain top talent.

In terms of ecological cooperation and technology investment, Yunfeng Financial announced on September 1 that it has reached a strategic cooperation agreement with Ant Group and simultaneously made a strategic investment in Pharos Network Technology Limited. Specifically, this cooperation aims to integrate Ant Group's technological accumulation in the blockchain and digital finance fields with Yunfeng Financial's expertise in asset management, securities, insurance, and new energy carbon assets. The two parties will work together to expand RWA tokenization and Web3 in cutting-edge fields through Pharos—a new generation Layer 1 public chain platform focused on building institutional-level real-world asset (RWA) application scenarios—while adhering to compliance frameworks and placing a high emphasis on security.

Although there are currently not many initiatives, this series of actions is coherent and clear, indicating that Yunfeng Financial is systematically advancing its digital asset ecosystem strategy from multiple dimensions, including license applications, partner selection, and underlying technology layout, laying a solid foundation for expanding virtual asset services within a compliance framework in the future.

"Aristocratic Gene": Deeply Coordinated Ecological Layout

Of course, Yunfeng Financial's forward-looking layout in the digital asset field is not accidental; its profound shareholder background and ecological resources may provide crucial strategic support and a buffer for trial and error.

Firstly, the "Yun" and "Feng" in Yunfeng Financial are derived from Alibaba co-founder Jack Ma and renowned investor Yu Feng. In 2015, the Yunfeng Fund, co-founded by them, led the acquisition of Hong Kong's Rui Dong Group and transformed it into today's insurance and financial platform—Yunfeng Financial. This has allowed it to deeply integrate the innovative genes of internet giants with the industrial vision of top investors from its inception.

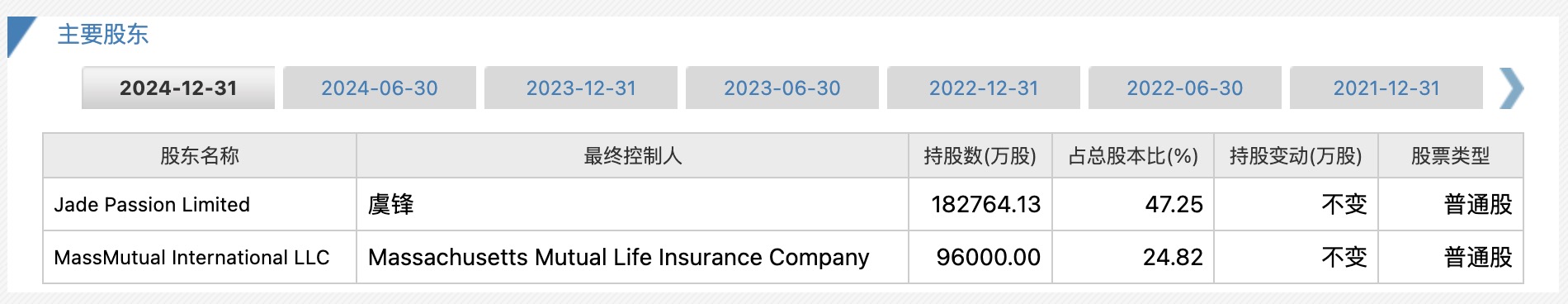

Secondly, its unique shareholder structure forms a powerful ecological alliance that combines internet innovation genes, international financial professional backgrounds, and cross-industry resources. According to information disclosed by Tonghuashun platform, the main equity structure of Yunfeng Financial is as follows:

Jade Passion Limited: As the controlling shareholder, Jade Passion Limited is backed by the Yunfeng Fund, whose co-founders include Yu Feng and Jack Ma. This allows Yunfeng Financial to deeply integrate the innovative genes of internet giants with the industrial vision of top investors from its inception, gaining forward-looking strategic insights and rich ecological resources.

MassMutual: MassMutual is not only a financial investor but also a deep strategic partner. The relationship between the two stems from Yunfeng Financial's leading acquisition of MassMutual's business in Hong Kong (MassMutual Asia) in 2017, which made MassMutual an important shareholder of Yunfeng Financial. This American life insurance company, with over 170 years of history, provides Yunfeng Financial with profound professional experience and global credibility in traditional insurance and asset management.

Strategic investors like Ant Group: Although not directly listed among the main shareholders, Ant Group (through its affiliated entities) has always been an important strategic investor and business ecological partner of Yunfeng Financial. The recent strategic cooperation with Ant Group is the latest manifestation of their synergistic effects.

Additionally, it is worth noting that HashKey Group Chairman and CEO Xiao Feng has served as an independent non-executive director of Yunfeng Financial, as well as a member of the audit committee and remuneration committee since March 28, 2019.

Conclusion

In less than two months, Yunfeng Financial has demonstrated remarkable strategic execution from establishing a Web3 strategy to substantively purchasing 10,000 Ethereum as reserve assets. Behind this series of actions is the company's "aristocratic gene," which continuously provides an irreplicable competitive barrier and strategic depth in the uncertain field of innovation.

In my view, Yunfeng Financial's digital transformation is not a simple follow-the-trend attempt, but a "precision operation" with top-level design, resource support, and ecological collaboration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。