Author: 0xWeilan

Affected by U.S. economic and employment data, expectations for a restart of interest rate cuts have fluctuated, with primary pricing capital inflows and outflows being inconsistent. Coupled with cross-cycle long-hand selling and on-site capital rotation, the overall cryptocurrency market in August exhibited a "weak - strong - then weak again" trend, with prices showing a "hump" shape.

BTC fell 6.49% for the month, closing at $108,247.95. The altcoin representative ETH surged 18.75%, closing at $4,391.83.

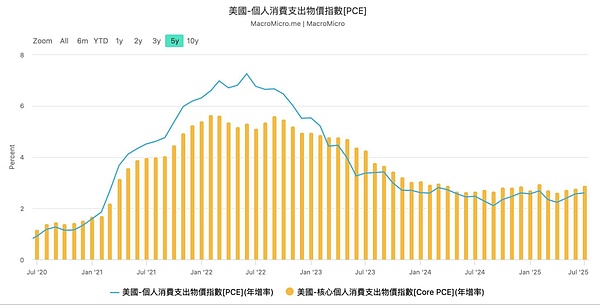

According to eMerge Engine, BTC is currently in the late stage of a bull market rise. In the June report, we judged that BTC would initiate the fourth wave of increases in the third quarter and reach a new historical high. This judgment was confirmed in July, and as August began, the impact of the "reciprocal tariff war" started to reflect in U.S. economic data, with both CPI and PCE showing a rebound. This continuously undermined market expectations for a restart of interest rate cuts in September, leading to ongoing fluctuations in the U.S. stock market, which had overly high pricing for interest rate cuts. This fluctuation was transmitted to the cryptocurrency market through the Crypto Spot ETF, causing BTC, which had reached a historical high in the middle of the month, to ultimately be repriced downward, a typical phenomenon of risk preference rebalancing.

During the volatility, capital did not continuously flow out, appearing indecisive. Overall, BTC still saw an inflow of $329 million this month. The fundamental reason for the price decline was the internal selling of cross-cycle long hands in the cryptocurrency market and sector rotation.

The significant selling by ancient whales locked in profits and squeezed the not-so-abundant liquidity, while simultaneously, tens of billions of dollars flowed from BTC into ETH both on and off the market. EMC Labs believes this collectively constitutes the fundamental reason for BTC's price falling back to the "Trump bottom" (between $90,000 and $110,000) after reaching a historical high.

The market has basically completed the repricing of interest rate cut expectations, with implied pricing indicating "September rate cut, two cuts within the year, totaling 50 basis points." In the future, before September 17, there are still several economic employment and inflation data to be released, and the market will continue to experience fluctuations.

However, the restart of interest rate cuts, with the U.S. economy achieving a "soft landing" driven by AI capital expenditure and technology, and employment data declining but not deteriorating significantly, remains a high-probability event. EMC Labs holds a cautiously optimistic view on the September market, believing that after experiencing necessary short-term fluctuations, BTC will continue its fourth wave of increases.

Macroeconomic Finance: "Inflation Rebound" and "Cooling Employment" Pulling Interest Rate Cut Expectations

In August, the U.S. capital market was mainly controlled by the interplay of three major variables: "performance of economic and inflation data, when the Federal Reserve will restart interest rate cut expectations, and concerns over the Fed's independence." The market overall exhibited a trend of first cooling, then heating, and then cooling again.

On August 1, employment data was released first. The U.S. unemployment rate rose month-on-month in July, with non-farm jobs increasing by 73,000, far below the previous expectation of 100,000. Meanwhile, the U.S. Bureau of Labor Statistics made significant downward revisions to the data for May and June, with the June revision exceeding 90%.

Following the release of this disappointing data, the Nasdaq fell 2.24% on the same day, with BTC following suit, dropping 2.17%. As a result of the data, FedWatch indicated that the probability of the Federal Reserve cutting rates by 25 basis points in September surged from 37.7% the previous day to 75.5%.

On that day, the U.S. dollar index plummeted 1.23% and continued to decline thereafter. This data reignited market expectations for a September rate cut, leading to a sustained rise in U.S. stocks and BTC, which reached a historical high of $124,533.00 on August 14.

On August 12, the U.S. released CPI data that met market expectations and did not have a significant impact on the market. However, the market, which had already fully priced in the interest rate cuts, remained highly sensitive to inflation data.

On August 14, PPI data was released, showing an annual growth of 3.3%, significantly higher than the market expectation of 2.5%. Concerns that rising production costs would eventually be passed on to consumers initially dampened market expectations for interest rate cuts. After reaching a historical high, BTC began to decline, continuing downwards until the end of the month. During the same period, the tech-heavy Nasdaq started to weaken, with funds rotating from overvalued tech stocks into cyclical and consumer stocks, causing the Dow Jones to strengthen. This indicates that while expectations for interest rate cuts were not destroyed, the expected values were adjusted downwards, and funds began to seek safer valuation targets.

On August 20, at the Jackson Hole global central bank conference, Federal Reserve Chairman Powell released his most dovish remarks of the year, indicating that he would pay more attention to the cooling of the job market and might cut rates to promote a recovery in the job market. The market was reassured, and traders priced the probability of a September rate cut at over 70% until the end of the month.

Although the core PCE released on August 29 basically met expectations, it recorded an annual growth of 2.9%, the highest since February 2025, indicating a slight increase in potential inflation pressure. The three major U.S. stock indices responded with declines, but the Dow Jones index's drop was significantly smaller than that of the Nasdaq.

U.S. PCE Index Year-on-Year

By the end of the month, the market had fully priced in "September rate cut, two cuts within the year, totaling 50 basis points."

To push for rate cuts, President Trump escalated pressure on the Federal Reserve, directly announcing on social media at the end of the month the dismissal of Federal Reserve Governor Lisa Cook, who advocated against rate cuts, due to her "mortgage document fraud." This incident further heightened market concerns over the independence of the Federal Reserve.

Cryptocurrency Assets: BTC Returns to the "Trump Bottom," ETH Inflows Reach Historical Records

In August, BTC exhibited a "hump" trend. At the beginning of the month, it was suppressed by significantly revised employment data but quickly regained upward momentum driven by a rate cut probability exceeding 80%, reaching a historical high on August 14. After the release of the PPI data on the 14th, it entered a sustained downward trend for the latter half of the month.

Technically, BTC was hindered and returned to the "Trump bottom" (between $90,000 and $110,000), temporarily breaking the "first upward trend line" of this bull market and the important 120-day line.

BTC Price Daily Chart

On a monthly basis, after a continuous rebound for four months, BTC saw a monthly pullback of 6.49%, with trading volume slightly shrinking. The price decline of BTC this month can be viewed as a technical correction under the dual effects of "overpricing being revised and capital shifting." We believe that as the interest rate cut cycle restarts and market risk preferences change, mainstream capital will flow back into BTC, driving it to continue the fourth wave of increases in this cycle.

The decline in BTC is fundamentally linked to the Nasdaq and related to interest rate cut expectations. It is generally believed that once the market enters a rate cut cycle, risk assets will continue to strengthen. Although BTC is also a high-volatility asset, within the cryptocurrency market, it is viewed as a more "blue-chip" asset compared to altcoins.

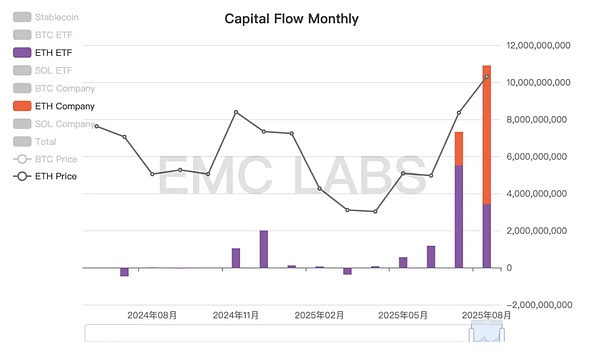

As the interest rate cuts approach and consensus around public chain assets strengthens, capital is accelerating its inflow into ETH.

Capital Flow: ETH Inflows Exceed BTC by Over $10 Billion

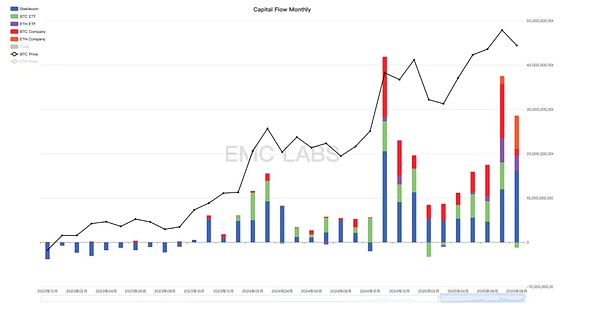

This month, the total inflow of funds into the cryptocurrency market reached $27.778 billion, including $16.414 billion in stablecoins, $3.420 billion in ETH Spot ETF, $7.485 billion in ETH corporate purchases, $0.226 billion in SOL ETF, $1.505 billion in BTC corporate purchases, but $1.176 billion flowed out of BTC Spot ETF.

Cryptocurrency Market Fund Inflow Statistics (Monthly)

Statistics show that the current main purchasing power for BTC, with only $329 million inflow from BTC Spot ETF and corporate purchases combined, is significantly lower than last month. This is the fundamental reason for BTC's weak performance this month.

In contrast, ETH Spot ETF and ETH corporate purchases totaled $10.805 billion, setting a historical record. EMC Labs believes that there is a clear trend of funds flowing from BTC into ETH, both on and off the market.

ETH Fund Inflow Statistics (Monthly)

There are three reasons for this. First, the consensus around BTC in major countries like the U.S. has largely completed its diffusion over the past few years, and more funds are beginning to focus on the second-largest cryptocurrency asset, ETH. Second, as the U.S. enters a crypto-friendly period, the trend of using blockchain technology to transform traditional financial industries has begun to emerge, and as the largest native currency of the first smart contract platform, ETH is receiving increasing attention and allocation from industrial capital. Finally, during this cycle, BTC has already reached a historical high, while ETH has not yet surpassed its previous bull market peak, combined with the historical experience that low interest rate environments will eventually lead to an Altseason explosion, speculative funds have poured into ETH, driving its price to rise rapidly.

Based on the restart of the interest rate cut cycle, the risks in production repricing, and the historical rate of Altseason, we proposed in last month's report that Altseason is opening up. We now believe that ETH is in the mid-stage of price rediscovery in this cycle, with significant upward potential remaining. As the interest rate cuts restart and risk preferences increase, a broader range of altcoin prices may also experience rapid increases driven by speculative buying.

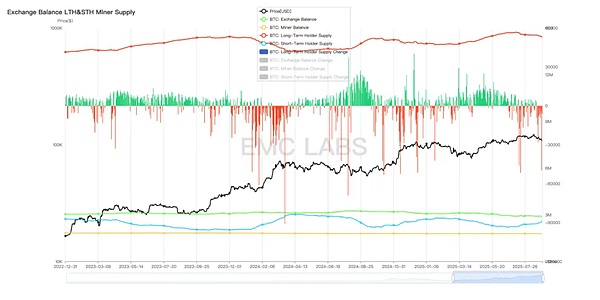

Chip Structure: The Third Wave of Selling Continues

In addition to capital rotation, another important reason for the price divergence between BTC and ETH in August is that cross-cycle and intra-cycle long hands have initiated the third wave of selling in this cycle for BTC (previous bull markets only had two waves of selling).

In August, long hands accelerated their reduction, with a reduction scale exceeding 150,000 coins, including ancient accounts with substantial profits from the Satoshi era. These reductions drained the not-so-abundant inflow of funds, pushing prices down for rebalancing. Due to the enormous scale of a single entity, the selling by ancient whales made the large sell-off data somewhat coincidental. Currently, the long hand holding scale is still higher than in February, and with subsequent liquidity increasing, it is expected that selling will continue.

Long Hands, Short Hands, Miners, and Centralized Exchange Holding Statistics

From the exchange's perspective, this month saw an outflow of 38,620 BTC, slightly less than last month, consistent with the characteristics of a bull market rising phase.

Conclusion

eMerge Engine shows that the BTC Metric is 0.375, indicating that BTC is in a rising continuation phase.

We believe that with the entry of treasury companies, Spot ETFs, and industrial capital, the cryptocurrency market has entered a new stage of "mainstreaming" development. For BTC, volatility will gradually decrease, and its correlation with U.S. stocks, especially the Nasdaq, will strengthen. For assets like ETH and SOL on smart contract platforms, the entry of mainstream capital is just beginning, and the diffusion of consensus will inevitably lead to a repricing.

As we enter September, which is about to initiate interest rate cuts, the market will not be smooth sailing; the high valuations in the U.S. stock market and concerns over the Fed's independence will still trouble the market.

However, the cycle will continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。