TL;DR

In August 2025, the U.S. economy is at a delicate turning point with inflation above target but marginally slowing, significant weakening in employment momentum, and declining consumer confidence. The market widely bets that the Federal Reserve will begin a rate cut in September to address the combination of "easing inflation + weakening employment." However, international geopolitical friction and uncertainty in domestic policy transparency continue to pose significant constraints on investor confidence and market risk appetite.

The popular projects launched in August are mainly focused on infrastructure and DeFi sectors, with representative projects like PROVE, TOWNS, and TREE landing on more than a dozen mainstream exchanges, showing high liquidity and market recognition. Meanwhile, Kanye West's personal MEME token YZY saw its market cap briefly exceed $3 billion but then quickly fell back, experiencing significant volatility.

Bitcoin (BTC) hovers below the key support level of $110,530, with strong bearish pressure; if it fails to hold, it may drop to $105,000–100,000. Conversely, if it breaks above $117,500, it could enter a wide range consolidation. Ethereum (ETH) fell back to $4,424 after reaching a new high of $4,956, with key support at $4,349; if it rebounds, it may aim for $5,000–5,500, while institutional funds continue to flow in, highlighting a preference shift towards ETH. Solana (SOL) is consolidating around $188, with a price pattern resembling an ascending triangle; a breakout above $210 could initiate a new rally to $240–265, but a drop below the trendline may lead to a pullback to $155.

The Solana ecosystem is seeing an increase in reserve-type institutions, with Galaxy Digital, Multicoin, Jump Crypto, and Pantera planning to raise billions to invest in SOL, enhancing market liquidity and ecosystem expansion potential. Meanwhile, Uniswap submitted the DUNI proposal to register the DAO in Wyoming as DUNA and establish a new entity, providing legal identity and off-chain operational capabilities for governance, promoting the compliance process of DeFi and enhancing UNI's value capture ability.

1. Macroeconomic Perspective

In August 2025, the U.S. macroeconomy remains in a situation of "inflation still above target, growth momentum continuing to weaken." Overall inflation has not seen a significant decline, but market expectations for future easing are gradually increasing. Meanwhile, the marginal weakness in the labor market and declining consumer confidence lead the market to bet that the Federal Reserve will enter a rate cut path in the fall. International geopolitical risks and domestic policy uncertainties continue to constrain investor confidence and market risk appetite.

Inflation Still Above Target

From an inflation perspective, the July CPI increased by 0.2% month-on-month and rose by 2.7% year-on-year, unchanged from June; the core CPI year-on-year rose to 3.1%, higher than last month's 2.9%. Price pressures in service sectors such as housing, healthcare, and transportation are significant, while a slight decline in energy prices offsets some of the increases. Overall, inflation remains above the Federal Reserve's 2% target, but the market generally expects a marginal decline in August, providing conditions for monetary policy easing. Several Federal Reserve officials emphasized the need to see more data to confirm the sustainability of the inflation decline.

Weakening Labor Market

In July, non-farm employment added only 73,000 jobs, significantly below expectations, and the unemployment rate rose to 4.2%. Since August, initial jobless claims have increased to 235,000, the highest since June, and the number of continuing claims has also risen to 1.97 million. These data indicate that the labor market is gradually weakening, and employment confidence is declining.

Weak Consumer Rebound

In terms of consumption, high interest rates and rising credit costs continue to suppress residents' willingness to consume. In August, the consumer confidence index further declined, with the University of Michigan index dropping to 58.6 and the Conference Board index falling to 97.4, both indicating increased household concerns about future income and employment prospects. Retail and some online consumption have seen a mild rebound, but the overall spending base remains weak, with insufficient recovery in demand for travel, accommodation, and durable goods. Consumption has not experienced a cliff-like drop, but it lacks resilience.

Interest Rate Policy Shift Imminent

In terms of monetary policy, Federal Reserve Chairman Powell acknowledged the weakening labor market at the Jackson Hole meeting and signaled the possibility of moderate rate cuts in the future. Treasury Secretary Bessent directly called for a 50 basis point rate cut in September to hedge against economic risks. Market expectations for a rate cut in September have rapidly heated up, with the belief that there may be two or more cumulative cuts within the year. Although inflation has not fully receded, the combination of "weakening employment + easing inflation" makes the rate cut path almost a consensus in the market.

Geopolitical Uncertainty

On the international front, conflicts in the Middle East and the war in Ukraine remain unresolved. Although the U.S. and China have resumed some economic and trade dialogues, significant differences persist in core areas such as high technology and data regulation. Domestically, after a significant downward revision of July labor data, the president fired the head of the Bureau of Labor Statistics, raising market concerns about data independence and policy transparency. Signs of political intervention make the market cautious about the continuity and credibility of policies, compounded by external geopolitical friction, leading to high uncertainty risks.

Outlook

In summary, the U.S. economy in August 2025 is at a delicate turning point. Inflation remains above target but is marginally slowing, employment momentum is significantly weakening, and consumer confidence is declining, providing more substantial reasons for the Federal Reserve to cut rates. The likelihood of starting a rate cut path in September is extremely high. However, international and domestic uncertainty factors remain prominent, and policy transparency and geopolitical risks may still constrain market confidence. The upcoming release of August inflation, employment, and consumption data will be key to assessing the pace and magnitude of rate cuts.

2. Overview of the Crypto Market

Cryptocurrency Data Analysis

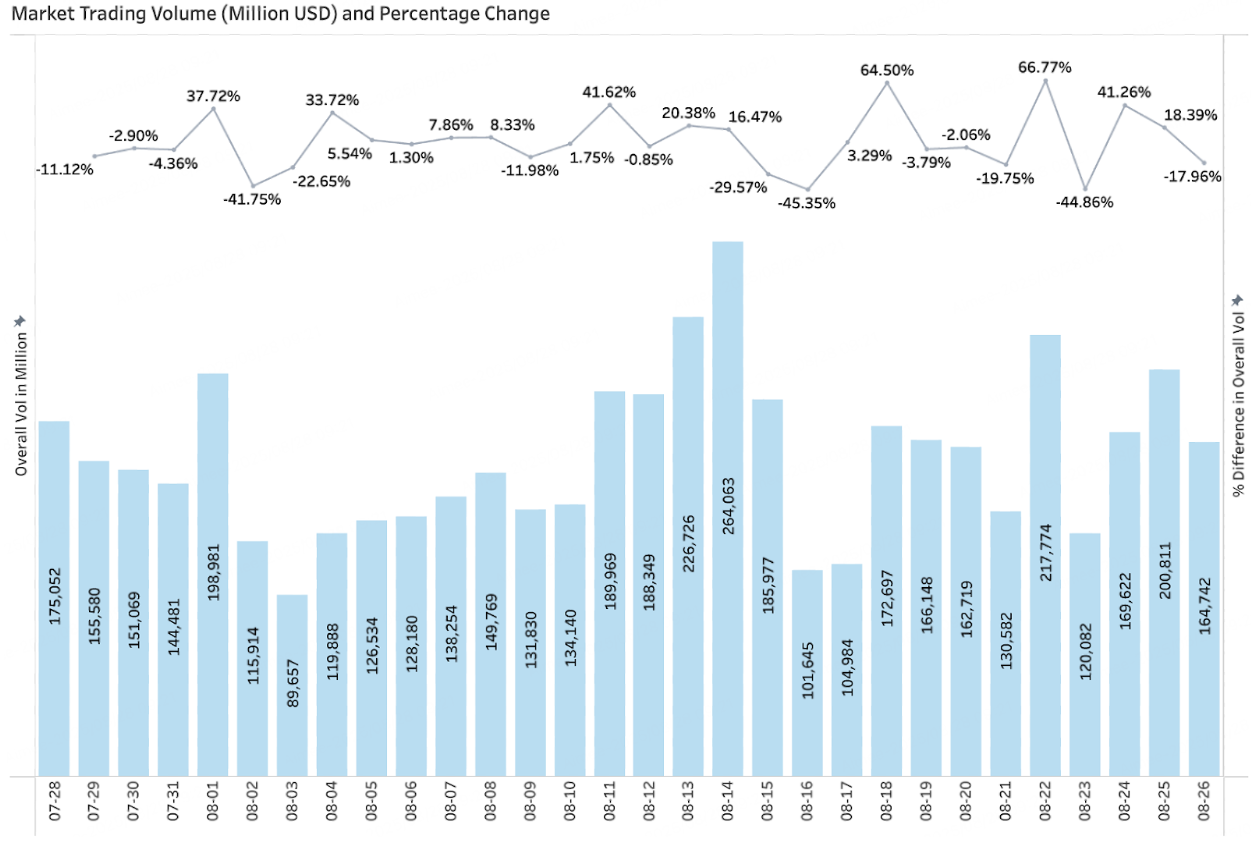

Trading Volume & Daily Growth Rate

According to CoinGecko data, as of August 26, the trading volume in the crypto market showed significant fluctuations in August, with an average daily trading volume of approximately $157.5 billion, a slight increase of 0.38% compared to the previous period. After the release of the PPI data on August 14, market risk aversion heightened, leading to a sharp increase in trading volume, which peaked at $26.4 billion for the month, followed by a rapid decline, maintaining a range of $10-16 billion from August 16-21. On August 22, Federal Reserve Chairman Powell released dovish signals in his speech, increasing the probability of rate cuts, which supported the market, and crypto asset sentiment improved, with trading volume rising back above $20 billion, but overall remained highly volatile. Overall, the activity in the crypto market in August was significantly driven by macro events, with a faster pace of capital inflow and outflow, continuing the characteristics of high volatility and high uncertainty.

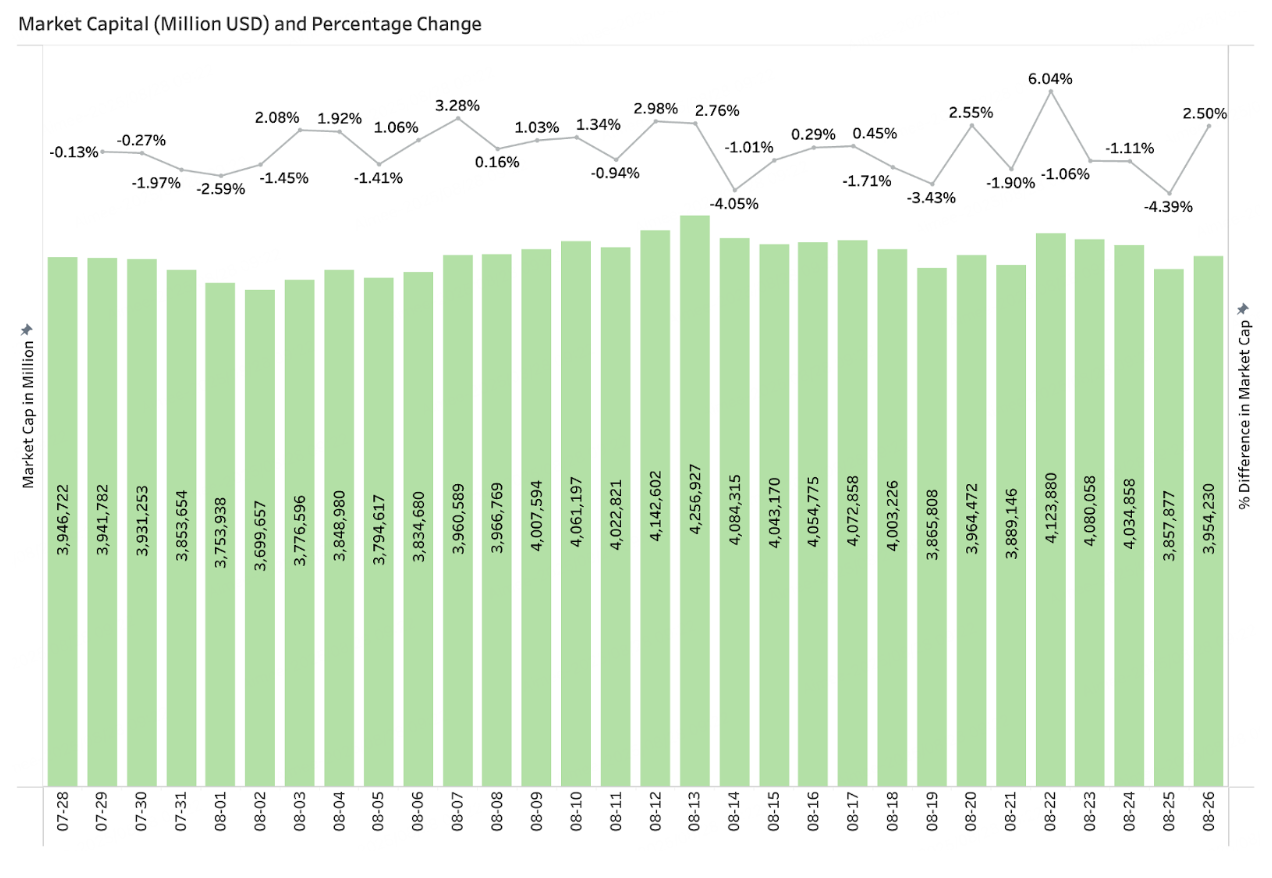

Total Market Capitalization & Daily Growth Rate

According to CoinGecko data, as of August 26, the total market capitalization of cryptocurrencies was $3.95 trillion, down 1.73% from the previous month, fluctuating around $4 trillion. During August, BTC's market share decreased to 57.5%, while ETH's market share increased to 14.1%, with the ETH/BTC exchange rate continuing to rise to 0.40, indicating ETH's strong performance. The total market capitalization continued to decline from $3.85 trillion at the end of July, hitting a monthly low of $3.69 trillion on August 2; subsequently, capital inflows drove a rapid market rebound, reaching a peak of $4.25 trillion on August 13, a rebound of about 15% from the low. However, the high did not form an effective breakthrough, and under the influence of macro factors, the market entered a phase of consolidation, with increased volatility in market capitalization in late August. Overall, while the market capitalization in August rebounded from the beginning of the month, it was clearly driven by macro factors, with insufficient upward momentum and significant pressure at high levels, leading to cautious market confidence.

New Popular Tokens Launched in August

Among the popular tokens launched in August, the new projects are mainly concentrated in the infrastructure and DeFi sectors, with projects like PROVE, TOWNS, and TREE standing out, having been listed on more than ten mainstream exchanges, showing ample liquidity and high market recognition. At the same time, Kanye West's personal MEME token YZY quickly gained market attention after its launch, with its market cap briefly exceeding $3 billion, but then the price rapidly fell, resulting in significant volatility.

3. On-Chain Data Analysis

Analysis of BTC and ETH ETF Inflows and Outflows

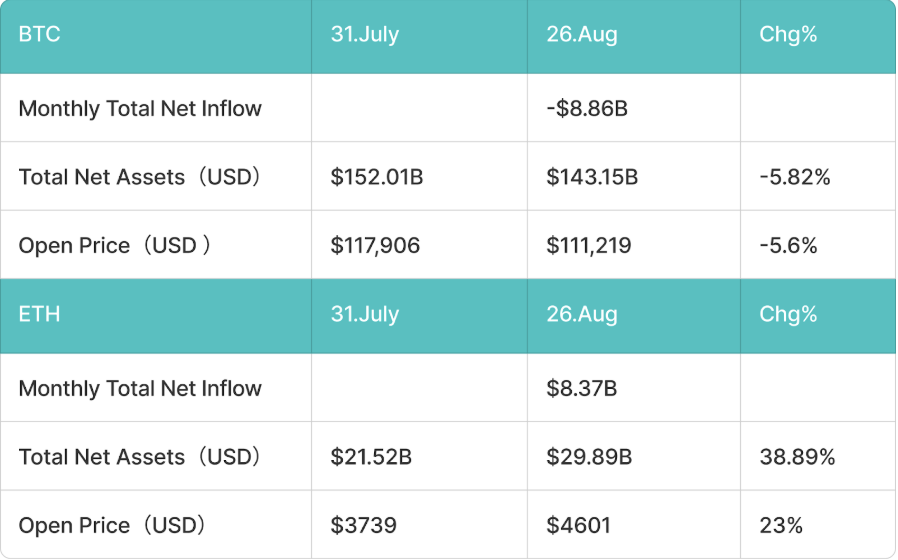

August BTC Spot ETF Net Outflow of $8.86 Billion

Market sentiment continues to improve, and Bitcoin prices maintain a steady upward trend. As of August 26, Bitcoin's opening price fell from $117,906 to $111,219, a decline of about -5.6%. Bitcoin spot ETF funds experienced outflows, with total assets decreasing by $8.86 billion, leading to a drop in Bitcoin prices.

August ETH Spot ETF Net Inflow of $8.37 Billion

In August, Ethereum outperformed Bitcoin and led the market, with significant price increases. As of August 26, ETH's opening price surged from $3,739 to $4,601, with a monthly increase of 23%. The Ethereum spot ETF simultaneously attracted a large amount of capital, with a net inflow of $8.37 billion in August, increasing total net assets from $21.52 billion to $29.89 billion (an increase of 38.89%), reflecting strong market confidence in the Ethereum ecosystem.

Analysis of Stablecoin Inflows and Outflows

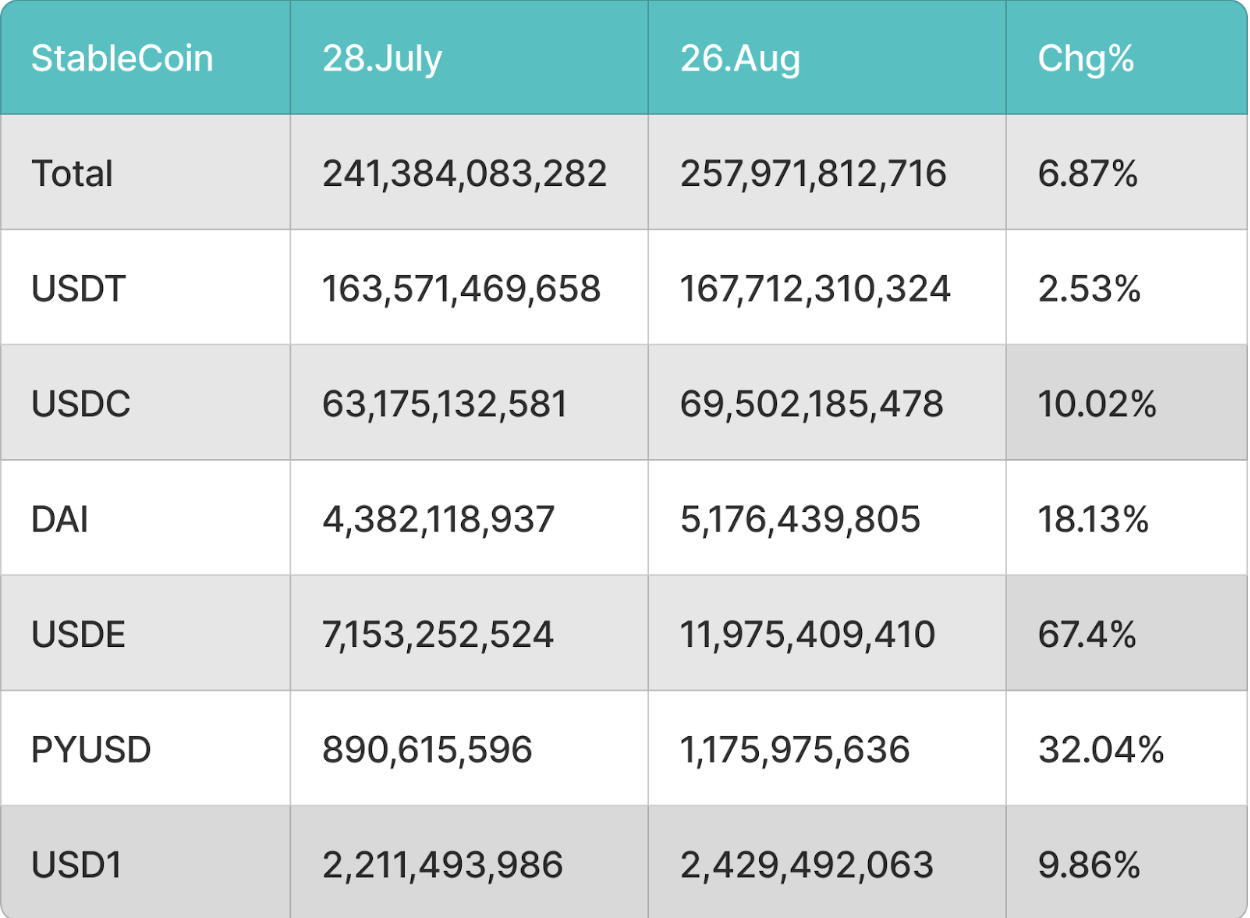

Total Stablecoin Circulation Increased by $16.58 Billion in August, with USDC Monthly Increase of 10.02%

In August, influenced by market gains and other factors, the total circulation of stablecoins surged by $16.58 billion (+6.87%), reaching $257.97 billion. USDC led the market with a monthly increase of $6.32 billion, followed by USDE (+$4.82 billion) and USDT (+$4.12 billion), all contributing to the main growth.

4. Price Analysis of Major Currencies

BTC Price Change Analysis

Bitcoin (BTC) is currently priced at $109,741, continuing to hover below the key support level of $110,530. Despite multiple attempts by bulls to defend this line, the weak rebound highlights that bearish pressure remains stubborn. Any upward attempts may face strong resistance at $115,639 (20-day moving average). If the current support area is lost, the decline may accelerate towards $105,000, while the psychological level of $100,000 will become a significant test of market sentiment. Conversely, a strong breakout above $117,500 would indicate that BTC is stabilizing within a wide range of $110,530 to $124,474, suggesting that the market may enter a consolidation phase of balance between bulls and bears.

ETH Price Change Analysis

Ethereum (ETH) fell back to $4,424 after reaching a historical high of $4,956 over the weekend. This pullback reflects investors taking healthy profits after a rapid rise, with $4,349 (20-day moving average) remaining a key support level. If a strong rebound occurs from this point, it may reignite bullish momentum, creating conditions for another attempt to reach $5,000 or even $5,500. If it falls below $4,349, it may initiate a deeper adjustment to $4,060, indicating a short-term shift in sentiment to bearish. Notably, ETH continues to receive strong institutional demand support: so far this month, ETPs have recorded an inflow of $2.5 billion, contrasting sharply with the $1 billion outflow from BTC, highlighting a significant shift in capital preference.

SOL Price Change Analysis

Solana (SOL) is currently stabilizing at $188.37, consolidating below the key resistance level of $210. The price pattern is forming an ascending triangle—typically a bullish continuation pattern that signals an upward breakout. If bulls successfully push the price above $210, SOL may quickly gather momentum to target $240 and $265. Currently, buyers still maintain control by suppressing downward volatility, but if a decisive break below the ascending trendline occurs, the pattern will shift to bearish dominance, and the price may seek new buying support at $155.

5. Hot Events of the Month

Ethereum's Microstrategy Drives ETH Price to New Highs

In August, Ethereum's price briefly surpassed $4,945, with a market capitalization approaching $600 billion, performing strongly under the dual drivers of institutional treasury and ETFs. Currently, Ethereum's strategic reserve has reached 4.3025 million ETH (approximately $19 billion), accounting for 3.56% of the total supply; ETF holdings have reached 6.526 million ETH (approximately $28.8 billion), representing 5.41% of the supply, becoming an important source of new market demand. Representative treasury companies include Bitmine Immersion Tech (1.41% of supply) and SharpLink Gaming (0.66%).

It is noteworthy that, unlike Bitcoin's treasury, which primarily adopts a passive "hoarding" model, ETH treasury companies are gradually moving towards on-chain monetization. SharpLink Gaming has staked most of its holdings, BTCS Inc. is earning through Rocket Pool, and companies like The Ether Machine and ETHZilla are also preparing for more proactive on-chain asset management. Overall, ETH treasuries are gradually transitioning to a "hoarding + monetization" model, further solidifying Ethereum's position as a core asset in the market.

WLFI Launches Pre-Market Trading

In August, WLFI launched pre-market contract trading on multiple trading platforms, allowing investors to place bets before the official launch. The price briefly surged to $0.55 before quickly falling back to $0.22, maintaining around $0.26 as of August 28, corresponding to a fully diluted valuation of approximately $26 billion. According to official settings, WLFI will open for initial token claims and spot trading on September 1, with early supporters (at $0.015 and $0.05 rounds) only able to unlock 20%, while the remaining 80% will require community governance voting for release, and tokens for the founding team, advisors, and partners will not unlock at the initial launch. This mechanism strengthens short-term supply constraints but also increases market speculation and price volatility. During this period, market sentiment for WLFI surged due to rumors that Aave might deploy WLFI and share 20% of protocol revenue, leading to a rapid 30% increase in related tokens, but the team later denied the news. If Aave cannot materialize, potential DeFi platforms to support the WLFI ecosystem are mainly concentrated in Lista and Dolo.

In terms of ecosystem development, WLFI's core stablecoin USD1 has achieved cross-chain expansion and has been integrated into important DeFi applications such as Dolomite in the Ethereum ecosystem, Lista DAO in the BSC ecosystem, and liquidity staking protocols BANK and STO. This layout expands the use cases of USD1 from stable payments to lending, trading, and yield applications, enhancing network activity and liquidity. At the same time, WLFI is actively expanding in investment and strategic partnerships, covering multiple sectors such as Meme, infrastructure, AI, and trading: including projects like Buildon, EGL1, Falcon Finance, Sahara, TAG, and Aster, to diversify risks and attract more user entry points.

Pendle Launches New Feature Boros, the First Funding Rate Derivatives Trading Platform

In August, Pendle officially launched Boros, the first funding rate derivatives trading platform in the crypto market on Arbitrum. Its core innovation lies in introducing Yield Unit (YU), which standardizes and tokenizes the floating funding rates that originally existed only in CEX/DEX perpetual contracts, transforming them into an independent asset that can be traded, speculated, and hedged directly on-chain. Users can choose to go long or short on funding rates, thus gaining arbitrage or hedging opportunities during extreme market volatility.

Initially, Boros supports users trading BTC and ETH funding rates, with plans to expand to more assets and platforms in the future, theoretically covering all yield/rate products (such as PoS staking yields). On its first day of launch, Boros achieved an open interest of $15 million and a nominal trading volume of $36 million, indicating strong market demand. As of August 28, Pendle's TVL reached a new high of $10.9 billion, with August revenue of $6.79 million, reflecting a 2-3 times increase in monthly revenue compared to the first half of the year. Although it is still in the early stages, only supporting BTC and ETH funding rate trading, its potential is enormous.

6. Outlook for Next Month

Solana Reserve Plan

Over the past year, the models of Bitcoin treasury companies (represented by Strategy) and Ethereum reserve enterprises (represented by BitMine) have been fully validated in the market, attracting significant capital inflows. This trend is now rapidly extending to the Solana ecosystem, with a batch of new SOL reserve-type treasuries preparing to enter the market.

On August 25, Galaxy Digital, Multicoin Capital, and Jump Crypto announced a joint action, negotiating with potential supporters to raise approximately $1 billion specifically for accumulating Solana. In fact, Multicoin and Jump have already made deep investments in the Solana ecosystem, while Galaxy has previously raised about $620 million to acquire SOL from the bankrupt assets of FTX. The collaboration among the three parties indicates a clear commitment to increasing their stakes. Following this, on August 26, Pantera also disclosed plans to raise up to $1.25 billion to acquire a Nasdaq-listed company and transform it into a business focused on Solana investments, even planning to name it "Solana Co." These actions indicate that core institutional supporters of Solana are concentrating their investments, not only with substantial capital but also with long-term holding advantages, and have received official support from the Solana Foundation. This not only helps them maintain strategic flexibility amid market volatility but also promotes ecosystem expansion and new capital inflows, thereby enhancing Solana's liquidity and market recognition. Currently, the Solana reserve market has not seen an absolute leader like Bitcoin's "Microstrategy," leaving ample narrative space and potential to attract more institutions to continue entering. Coupled with the increasing probability of approval for Solana spot ETFs, market confidence in SOL and its reserve enterprises is expected to further strengthen, amplifying the positive effects of capital inflows.

Uniswap Submits DUNI Community Proposal, Taking a Step Towards Compliance

In August, the Uniswap Foundation (UF) submitted the DUNI proposal to the community, suggesting that the Uniswap DAO be registered as DUNA (a centralized non-profit association) in Wyoming and establish a new entity, DUNI, to provide legal identity and operational support for Uniswap governance. The core goal of the proposal is to provide legal protection for governance participants without changing the core mechanism of on-chain governance, while allowing the DAO to interact with the off-chain world as necessary, such as signing contracts, hiring professional service providers, and fulfilling tax and legal obligations.

Legal identity and limited liability protection: DUNI will be recognized as an independent legal entity, providing legal and tax liability protection for governance participants. Members will not bear personal responsibility for potential legal or tax risks of the DAO.

Off-chain operational capabilities: DUNI can sign contracts, hire professional service providers, and manage financial and compliance matters, ensuring that governance and operations proceed smoothly within the legal framework.

Funding arrangements: The proposal plans to allocate approximately $16.5 million worth of UNI from the treasury for historical tax and legal defense budgets, and to pay $75,000 worth of UNI to Cowrie for compliance management services.

Support for the implementation of fee rate switches: The DUNA structure provides a legal basis for the distribution of protocol revenue, allowing for the potential future transfer of a portion of trading fee income to the DAO treasury for public spending, research and development, or incentives, enhancing UNI's value capture capability.

If the DUNI proposal is successfully passed, Uniswap DAO will become the largest decentralized organization to adopt the DUNA structure to date, providing a compliance demonstration for the entire DeFi industry. DUNI not only offers legal and tax liability protection for governance participants, reducing personal risk, but also grants the DAO more efficient off-chain execution capabilities, ensuring the security of contract signing, financial management, and compliance matters while maintaining the authority of on-chain governance. This will create legal feasibility for the implementation of fee rate switches, bring stable capital inflows, enhance UNI's value capture capability, and is expected to improve governance efficiency and community participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。