# 1. Latest Project Progress

In the past year, World Liberty Financial (WLFI) has gradually built a DeFi ecosystem covering multiple fields such as lending, trading, payments, Meme, LSD, AI, and public chains, centered around the USD stablecoin USD 1. Its strategic path can be summarized in "three steps": first, landing DeFi scenarios such as lending and trading on mainstream public chains like BSC, Ethereum, and Solana to establish the basic demand for USD 1; second, integrating USD 1 into emerging sectors like Meme, stablecoins, and AI through investments and partnerships to enhance usage frequency and user stickiness; finally, strategically investing in and participating in potential projects to acquire token rights and promote further penetration of USD 1.

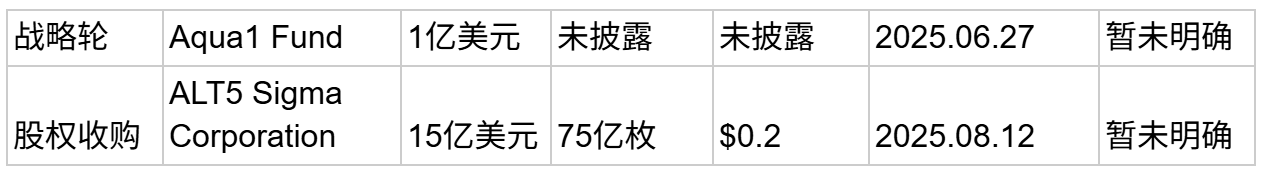

WLFI has completed four rounds of major financing to date, with the pricing of the two public rounds set at $0.015 and $0.05, respectively. The strategic round gathered leading institutions such as Sun Yuchen (Tron DAO), DWF Labs, Aqua 1 Fund, and Web 3 Port. The most iconic event comes from the deep binding between WLFI and Nasdaq-listed company ALT 5 Sigma. In the latest submitted S-1 document, ALT 5 Sigma announced plans to invest $1.5 billion to purchase WLFI governance tokens. This arrangement is widely viewed in the market as analogous to MicroStrategy's Bitcoin treasury model, where the tokens are incorporated into the corporate financial system through the holdings of a listed company, thereby granting them higher financialization and compliance attributes. Eric Trump has joined the board of ALT 5 Sigma, while WLFI CEO Zach Witkoff has directly taken on the role of chairman of the company.

Overview of WLFI Purchase Costs

# 2. WLFI Token Economics and Market Performance

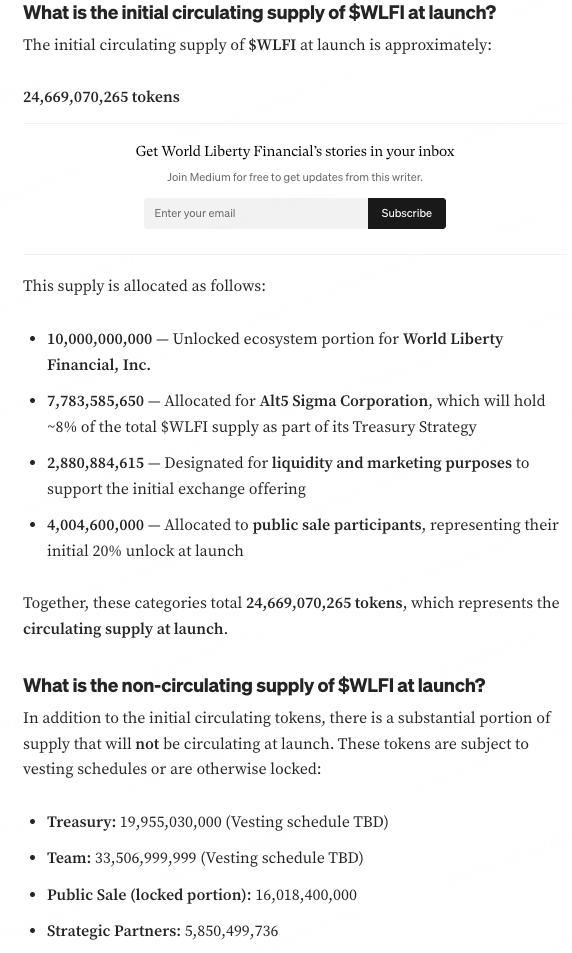

According to WLFI's blog, the initial circulation at TGE was 24,669,070,265 tokens, or 24.6%, including:

- 10 billion: Ecosystem

- 7.78 billion: Belonging to Alt 5

- 2.88 billion: For DEX & CEX liquidity and marketing

- 4 billion: Belonging to public investors

The portion belonging to Alt 5 is theoretically not circulating at TGE due to strategic reserves, while the ecosystem portion, according to tweets from WLFI wallet department members, is related to the USD 1 points program and thus will not circulate at TGE. Therefore, the actual circulating portion is the liquidity and public offering 20% unlock (totaling 4.288 billion tokens), while the other tokens will remain locked.

Market Performance

After WLFI launched on September 1, its token price trend appeared relatively cautious due to the lack of transparency regarding the initial circulation scale. The price surged to $0.32 at TGE but quickly faced selling pressure and fell back to around $0.225 by September 2. Based on this, WLFI's initial circulating market cap was approximately $5.71 billion, with a fully diluted valuation (FDV) as high as $23.1 billion.

In terms of return performance, investors who participated in public round 1 at $0.015 saw their paper profits peak at nearly 20 times; even participants in public round 2 who entered at $0.05 still reaped several times returns during the TGE phase. Some strategic investors, such as Web 3 Port and DWF Labs, also achieved considerable returns in the short term. In contrast, ALT 5 Sigma entered with a large-scale strategic acquisition at $0.20, with its cost price nearly equivalent to the current price, thus forming a natural psychological support range in the market. Combined with pre-market trading trends, WLFI has repeatedly received buying support around $0.20; if it subsequently falls below this range, it may trigger a larger-scale emotional sell-off risk.

Currently, WLFI's price fluctuations are mainly influenced by two variables: one is the phased unlock selling pressure from public round investors, and the other is whether the ecosystem allocation and ALT 5 Sigma's strategic reserves will flow into the secondary market. If the ecosystem tokens are indeed deeply tied to the USD 1 points program as official members claim, it will be difficult to form real circulation in the short term, making market selling pressure relatively controllable. However, if there is a discrepancy in expectations regarding liquidity, such as ALT 5 Sigma or some ecosystem funds cashing out early, WLFI's price stability may still face significant challenges.

# 3. WLFI Ecosystem

DeFi

1. Dolomite

Dolomite is a decentralized lending and margin protocol deployed on Ethereum. Dolomite has taken the lead in integrating USD 1 and has adjusted its main market trading pair to DOLO/USD 1, making it one of the largest DeFi platforms for USD 1. Currently, Dolomite provides about 90% of USD 1 lending liquidity on Ethereum, making it the most important hub for WLFI in the Ethereum ecosystem. Dolomite's co-founder Corey Caplan also serves as WLFI's CTO, tightly binding it to WLFI in terms of mechanism and ecosystem.

2. Lista DAO

Lista DAO is a stablecoin and lending platform operating on BSC. In May of this year, it officially announced a strategic partnership with WLFI and incorporated USD 1 into Lista DAO's treasury system, allowing users to use it as collateral to borrow lisUSD, while a liquidity pool for USD 1/lisUSD has been established on PancakeSwap. WLFI has promoted the integration of USD 1 into Lista DAO, enhancing its lending and liquidity scenarios on BSC.

3. StakeStone

StakeStone is a cross-chain LSD liquidity protocol that announced a partnership with WLFI in May to provide infrastructure for USD 1 users, as well as cross-chain staking yields, allowing users to obtain more liquidity and returns on staked assets through USD 1.

Token Launch Platforms

1. Lets.Bonk

Bonk.fun has partnered with WLFI to become the official Launchpad for USD 1 on Solana. Its plans revolve around the popularity of stablecoins and the Meme community, promoting the launch of more new projects based on USD 1.

2. Buildon

Buildon is a Meme project initiated on BSC. It plans to launch a dedicated Launchpad feature for USD 1 in the future, integrating USD 1 into the Meme scene and leveraging traffic effects to enhance WLFI's ecological influence.

3. Blockstreet

Blockstreet is WLFI's official launch platform, with co-founder Matthew Morgan serving as an advisor to WLFI and also as the CIO of Nasdaq-listed company ALT 5 Sigma, which is raising $1.5 billion to launch WLFI's treasury.

4. AOL

AOL is a Meme coin launched by WLFI advisor @cryptogle on Bonk.fun, and it has announced plans to launch the Launchpad project America.fun.

RWA and Stablecoins

1. USD 1

USD 1 is the dollar stablecoin issued by WLFI in March, with a market cap exceeding $2.4 billion as of September 1. It has been deployed on BNB Chain, Ethereum, Tron, and Solana, with BNB Chain accounting for over 88.5%, making it the primary circulation network.

2. Chainlink (LINK)

WLFI has achieved cross-chain interoperability for USD 1 through Chainlink's CCIP technology, expanding its multi-chain applications.

3. Ethena (ENA)

WLFI established a partnership with Ethena Labs last December, with both parties exploring long-term collaboration centered around sUSDe.

4. Ondo Finance (ONDO)

WLFI partnered with Ondo Finance in February, planning to incorporate Ondo's RWA products (USDY, OUSG, etc.) into reserves to enhance USD 1's asset backing capability.

5. Falcon Finance

Falcon Finance is a synthetic stablecoin platform launched by DWF Labs, using a dual-token model: USDf (stablecoin) and sUSDf (yield certificate). WLFI strategically invested $10 million and allows users to participate in Falcon's minting and yields using USD 1.

6. Plume Network

Plume Network is an EVM public chain focused on RWA, supporting the issuance of native stablecoins like pUSD. WLFI has incorporated USD 1 as its reserve asset to support the stability of pUSD. USD 1 has become the benchmark currency in the Plume ecosystem, helping WLFI deeply engage in the RWA narrative.

Other Projects

1. Vaulta (formerly EOS)

Vaulta is the new public chain after EOS rebranding, positioned as Web 3 banking infrastructure, supporting asset custody, cross-chain payments, and lending. WLFI has committed to investing $6 million and integrating USD 1 as its core settlement asset.

2. EGL 1

EGL 1 is the winner of the USD 1 trading competition hosted by Four.Meme.

3. Liberty

Deployed on the BNB Chain, a Meme coin-based charity platform.

4. U

A Meme coin on the BNB Chain, with WLFI's public wallet holding over 45% of its supply.

5. Tagger

Tagger is a decentralized AI data platform that uses USD 1 as the settlement currency for Web 2 client orders and plans to reward data annotators with USD 1.

# Summary

From the perspective of WLFI's price, there are currently two potential possibilities for its actual circulation:

- Ideal Circulation Estimate

According to WLFI's official data, approximately 24.66 billion tokens were unlocked during the initial TGE, including 4 billion from public investors (about 20% circulating), and 2.88 billion for liquidity and marketing. Although the Alt 5 reserves and ecosystem allocations are nominally "unlocked," the official indication is that these tokens are bound by strategic reserves or the USD 1 points program and theoretically will not immediately enter market circulation. If estimated based on this logic, the current actual circulating tokens are about 6.88 billion, equating to a market cap of approximately $1.58 billion (based on the current trading price of $0.23).

- Potential Selling Pressure Risks in the Unlock Structure

Conversely, both Alt 5 Sigma's strategic reserves and the ecosystem's reserved portion have the potential to become channels for future sell-offs. Although Alt 5 may not sell immediately, there could be an arbitrage impulse if market returns are enticing; the 10 billion tokens allocated to the ecosystem represent a potential flood of supply, and once a large amount is unlocked and enters the market, it will exert significant pressure on trading depth and price, becoming an unstable factor in the WLFI market.

Looking ahead, WLFI's development will continue to focus on the USD 1 stablecoin ecosystem. As WLFI establishes partnerships with more projects or launches new features such as staking and lending, it is expected to enhance the market value of related project tokens and further enrich the application scenarios and ecological diversity of WLFI tokens. Additionally, ALT 5 Sigma's $1.5 billion investment and its deep binding with the board signify that WLFI has successfully embedded itself in the core narrative of a compliant financial system. If it can replicate a similar "corporate treasury" model for Bitcoin like MicroStrategy in the future, WLFI is expected to gain higher recognition in traditional financial markets and enhance its long-term financialization potential.

Risk Warning:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial management) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily represent future results. The value of digital currencies may rise or fall, and buying, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully assess whether participating in such investments is suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。