Content Editor: Peter_Techub News

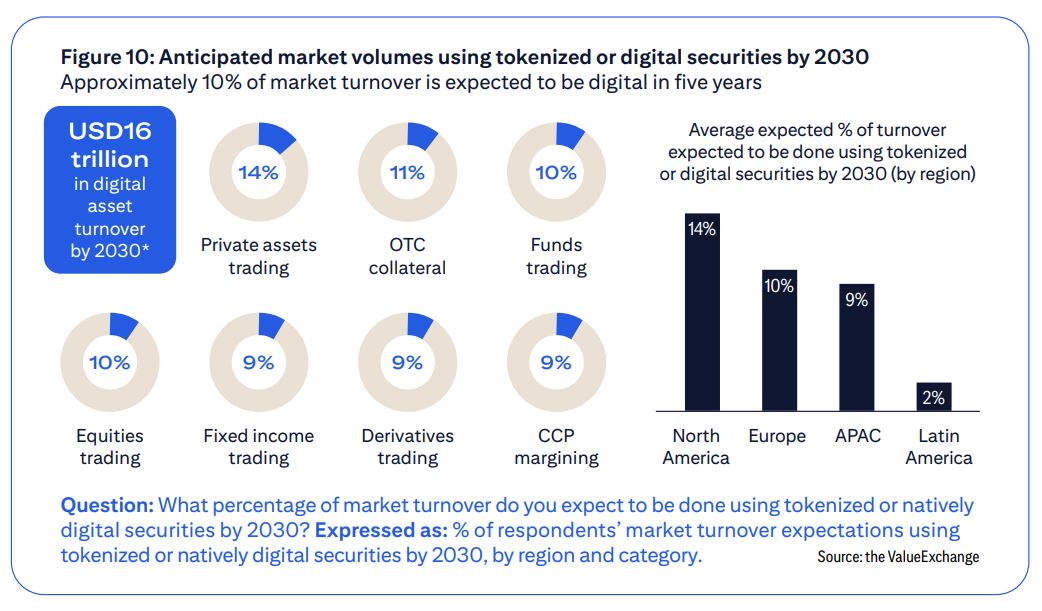

According to the latest "Securities Services Evolution Report" released by Citibank, a survey of 537 financial executives worldwide shows that by 2030, approximately 10% of global post-trade market transaction volume is expected to be processed through digital assets such as stablecoins and tokenized securities. This survey was conducted between June and July, covering custodians, banks, broker-dealers, asset management companies, and institutional investors in the Americas, Europe, Asia-Pacific, and the Middle East.

Stablecoins and Tokenized Securities Leading the Change

The report points out that bank-issued stablecoins are seen as a primary means to enhance collateral efficiency, fund tokenization, and private market securities trading. The post-trade market is responsible for ensuring the verification, execution, and final settlement of securities transactions. In recent years, interest in stablecoins on Wall Street has significantly increased, especially after the U.S. passed legislation regulating stablecoins earlier this year.

Citibank states that since 2021, the adoption of digital assets has gradually shifted from early experimental stages to strategic implementation. Although the industry has not yet reached a "tipping point," Citibank predicts that this moment is "within reach." The report emphasizes that the global post-trade industry is about to undergo an international transformation in terms of speed, cost, and resilience.

Blockchain Technology Driving Efficiency Improvements

The survey shows that enhanced liquidity and post-trade cost efficiency are the main drivers for investing in Distributed Ledger Technology (DLT). Most respondents believe that blockchain will significantly impact these areas within the next three years. Citibank notes that more than half of the respondents explicitly stated that DLT can accelerate the circulation speed of securities in global capital markets, thereby significantly reducing financing costs, financial resource requirements, and operational costs by 2028.

Regional Differences in Expectations for Digital Assets

The U.S. market is expected to become the market with the highest proportion of tokenized securities trading. Source: Citibank

The survey shows that the U.S. has higher expectations for the growth of digital assets compared to other regions, with an estimated 14% of transaction volume in the U.S. market expected to be completed through digital or tokenized assets by 2030, while Europe and Asia-Pacific are projected at 10% and 9%, respectively. The optimistic sentiment in the U.S. market is primarily driven by regulatory changes, such as the "GENIUS Act" signed by President Donald Trump in July 2025. Additionally, the leadership of major institutions like stablecoin issuer Circle and asset management company BlackRock in expanding digital liquidity has also contributed to the shift in market sentiment.

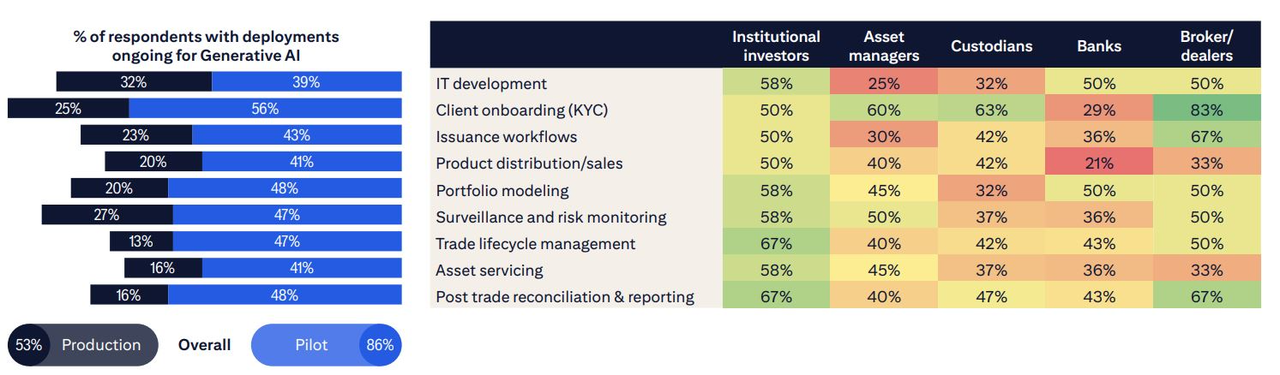

Impact of Generative Artificial Intelligence (GenAI)

_Over half of the respondents indicated that their institutions are piloting GenAI post-trade operations. Source: _Citibank

Generative Artificial Intelligence (GenAI) is also seen as playing an important role in the post-trade market. 57% of respondents stated that their institutions are piloting the use of GenAI for post-trade operations. At least 67% of institutional investors reported using GenAI for post-trade reconciliation, reporting, clearing, and settlement.

Furthermore, 83% of brokers, 63% of custodians, and 60% of asset management companies are using GenAI to optimize the customer onboarding process. Citibank points out that in an environment where "faster, more efficient onboarding directly translates to revenue," this use case is an ideal starting point for connecting retail and institutional clients.

Industry Approaching the Tipping Point

The Citibank report concludes that the global post-trade industry is on the verge of a comprehensive transformation in speed, cost, and resilience after years of foundational infrastructure development. Although the crypto industry has not fully reached a tipping point, with improvements in the regulatory environment, deeper technological applications, and the push from large institutions, digital assets and blockchain technology are expected to significantly change the way global financial markets operate in the next five years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。