Author: White55, Mars Finance

Recently, the global cryptocurrency market has been experiencing a general correction, but the strategic layout of the financial technology platform under Jack Ma has injected a shot of adrenaline into Ethereum, accelerating the pace of institutional investors entering the market.

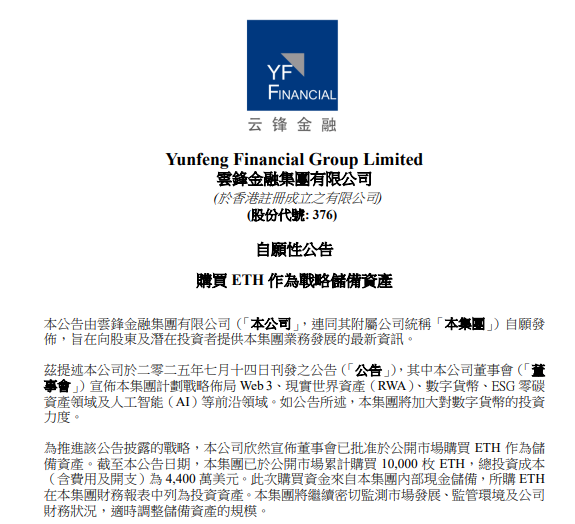

On September 2, Hong Kong-listed company Yunfeng Financial (00376.HK) announced that its board of directors has approved the purchase of ETH in the open market as reserve assets. As of the announcement date, the group has cumulatively purchased 10,000 ETH, with a total investment cost (including fees and expenses) of 44 million USD.

The funds for this purchase come from the group's internal cash reserves, and the purchased ETH is listed as investment assets in the group's financial statements. This action has attracted widespread market attention primarily due to the close connection between Yunfeng Financial and Jack Ma.

Jack Ma and Yunfeng Financial's Crypto Layout

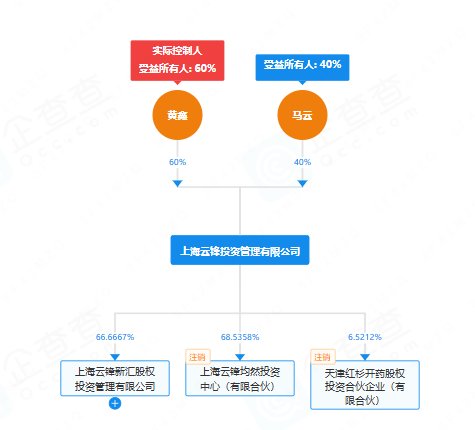

Yunfeng Financial is not an ordinary listed company; its controlling shareholder is Yunfeng Capital, co-founded by Jack Ma and Yu Feng, the founder of Focus Media, in 2010. The "Yun" comes from Jack Ma, and "Feng" comes from Yu Feng. Through equity penetration, it can be seen that Jack Ma indirectly holds about 11.15% of Yunfeng Financial's shares, with a 29.85% stake in Yunfeng Financial Holdings Limited and a 40% stake in Shanghai Yunfeng Innovation (without voting rights).

Yunfeng Capital also holds 4.27% of Ant Group's equity, which keeps Yunfeng Financial highly linked with the Ant ecosystem in terms of capital and business.

For this reason, the outside world generally believes that Yunfeng Financial has become an important financial capital platform for Jack Ma in Hong Kong and is, to some extent, part of his private capital landscape.

The predecessor of Yunfeng Financial can be traced back to Wansheng International Securities, established in 1982. After listing on the Hong Kong Stock Exchange in 1987, it gradually developed into a leading local brokerage in Hong Kong. In 2015, Jack Ma and Yu Feng led Yunfeng Capital to invest 3.9 billion HKD to gain control, starting a transformation path by acquiring 60% of the shares of American insurance company Winton Insurance (in 2018), integrating licenses for securities, insurance, asset management, and building a "finance + technology" ecological closed loop.

Institutional Confidence Amid Market Correction

Yunfeng Financial's investment coincides with a general correction in the cryptocurrency market. The price of Ethereum has dropped 15% from its historical high on August 24, but it still holds around 4,300 USD. This correction comes at a time when the cryptocurrency market is generally retreating, which may reflect a deterioration in the macroeconomic situation.

U.S. President Donald Trump made negative comments about U.S.-India business relations, prompting investors to choose to reduce their holdings. Trump's remarks came after Indian Prime Minister Narendra Modi met with the leaders of China and Russia on Monday. The tech-heavy Nasdaq index fell 1.3%, while gold prices hit a historic high, supported by continued demand from foreign central banks.

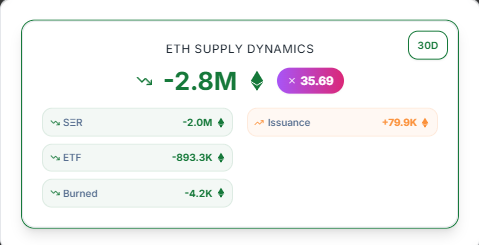

Despite the market correction, institutional investors' interest in Ethereum continues to grow. According to data from StrategicETHReserve.xyz, companies have increased their holdings in reserve accounts by 2 million ETH over the past 30 days. Multiple companies, including Bitmine Immersion Tech (BMNR), SharpLink Gaming (SBET), and The Ether Machine (ETHM), currently hold a total of 4.71 million ETH, valued at over 2.02 billion USD.

Source: X/ETHZilla_ETHZ

Source: X/ETHZilla_ETHZ

More importantly, some of these companies have begun investing in Ethereum-based DApps. ETHZilla (ETHZ) announced new investment commitments on Tuesday, highlighting the increasing vitality of the entire ecosystem.

Network Activity and On-Chain Metrics

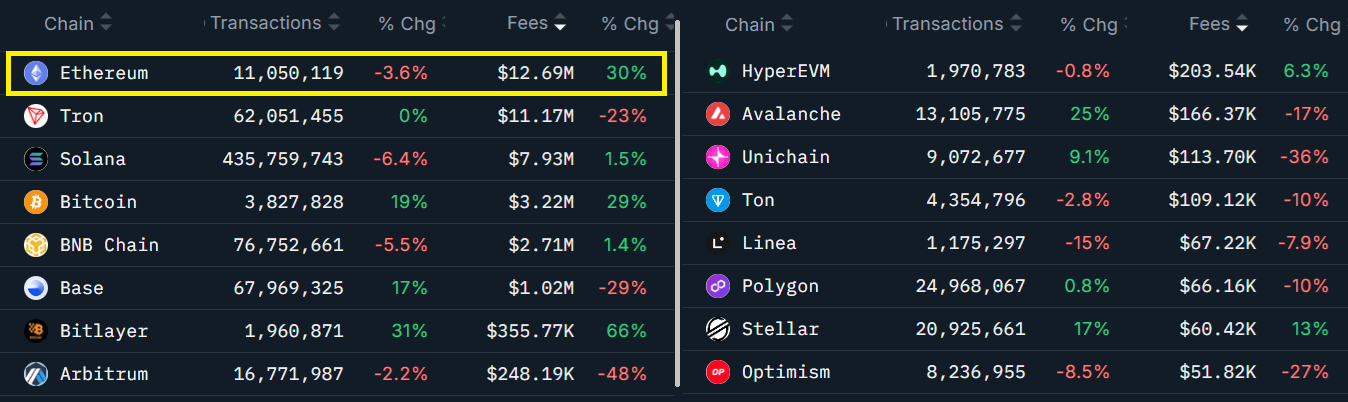

_ Blockchain ranked by 7-day fees. Source: _Nansen

Blockchain ranked by 7-day fees. Source: _Nansen

Ethereum's network activity shows significant strong momentum. Weekly fees surged by 30%, allowing Ethereum to surpass Tron and become the highest-earning network. Including Layer 2 activity, Ethereum's total fees reached 16.3 million USD, more than double Solana's 7.9 million USD.

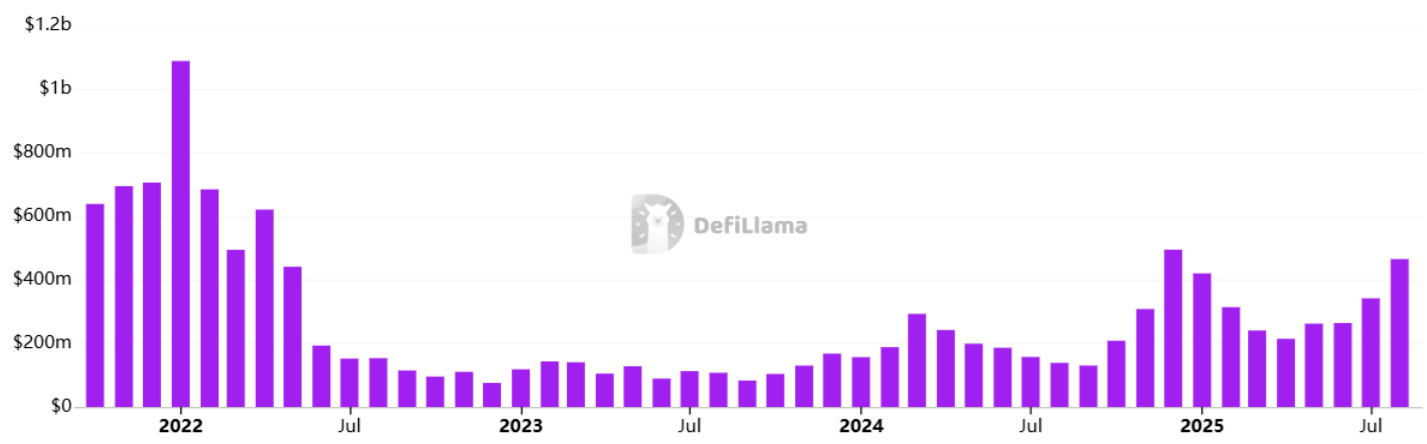

According to data from DefiLlama, Ethereum's decentralized application (DApp) fees hit the second-highest level since February 2022.

Ethereum DApp weekly fees (USD). Source: DefiLlama

Ethereum DApp weekly fees (USD). Source: DefiLlama

In August, Ethereum DApp transaction fee revenue reached 466 million USD, a month-on-month increase of 36%. In contrast, Solana DApp transaction fees fell by 10% during the same period, while BNB Chain's transaction fees shrank by 57%. The projects contributing the most to Ethereum DApp transaction fees include Lido (91.7 million USD), Uniswap (91.2 million USD), and Aave (30-day transaction fees of 82.9 million USD).

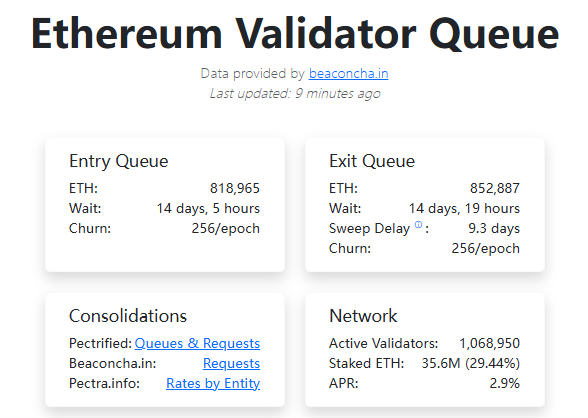

The demand for staking from new validators on the Ethereum PoS network has also significantly increased, reaching record levels. According to data from the validator queue tracking site, the admission queue has 820,000 ETH, valued at approximately 3.5 billion USD, with a current waiting time of 14 days and 5 hours. The current exit queue for the Ethereum PoS network reports 853,000 ETH, remaining at a high level. At current prices, the ETH exiting the PoS network is approximately 3.7 billion USD, with withdrawal delays of 14 days and 23 hours.

Cautious Signals from the Derivatives Market

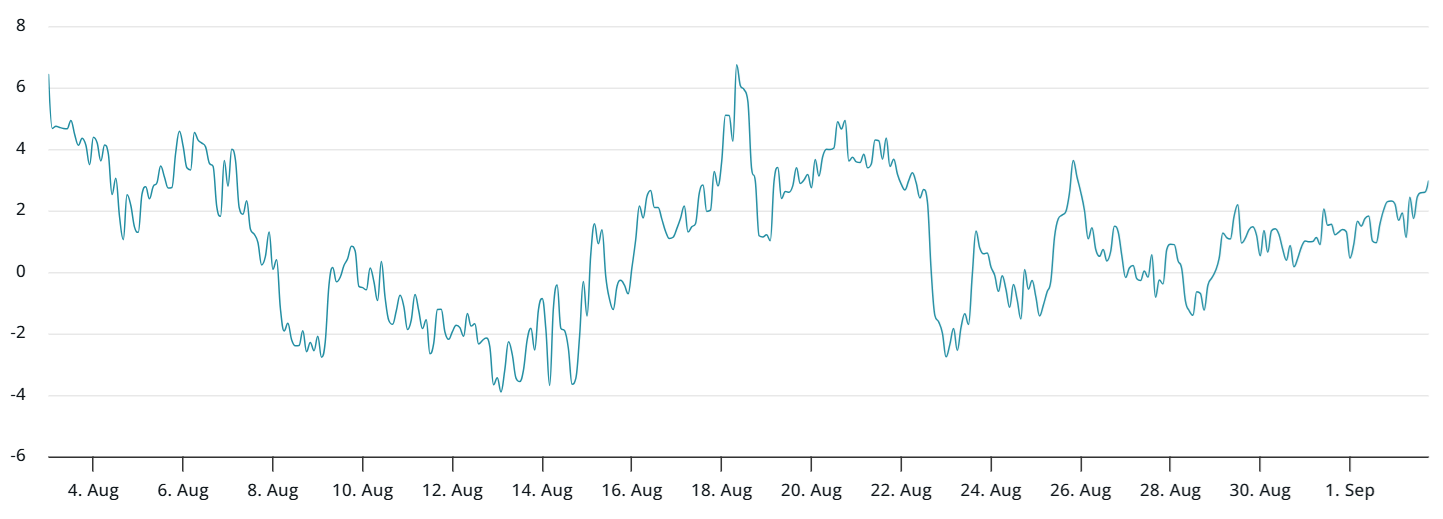

_ Ether 2-month futures premium. Source: _Laevitas.ch

Ether 2-month futures premium. Source: _Laevitas.ch

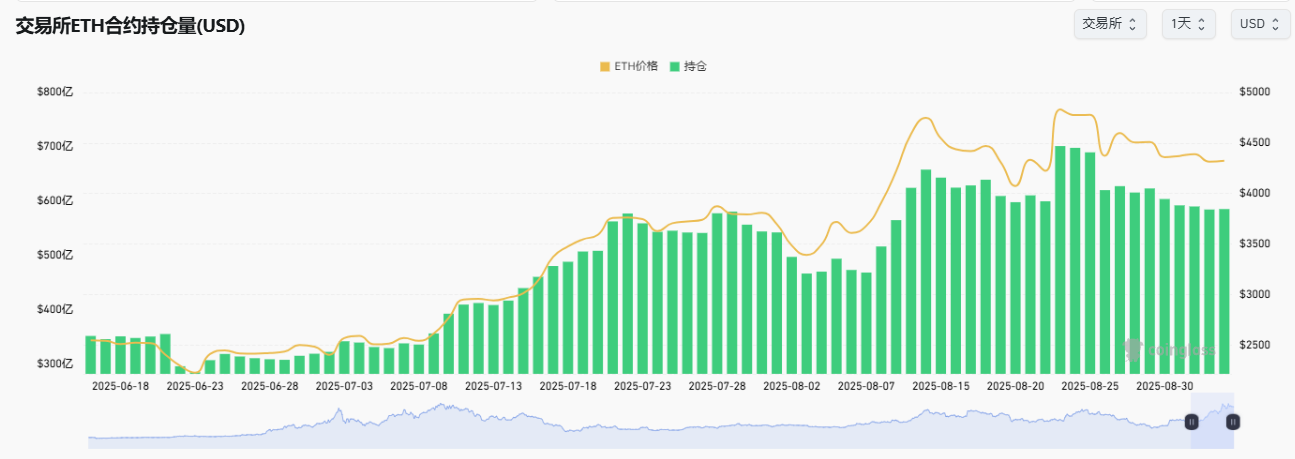

Despite the on-chain activity showing progress, Ethereum derivatives indicate that traders remain skeptical about ETH reclaiming 5,000 USD in the short term. The monthly futures premium is at 5%, hovering at the edge of a neutral to bearish market. This cautious sentiment is expected after a 15% drop from the historical high on August 24.

However, the total open interest in futures has increased by 26% over the past 30 days, reaching 58.5 billion USD, indicating that traders have not given up on the asset.

_ Deribit's ETH 30-day options skew (put/call). Source: _laevitas.ch

Deribit's ETH 30-day options skew (put/call). Source: _laevitas.ch

On Monday, the skew of Ether options was at 3%, far below the neutral range of -6% to +6%, as traders believe the likelihood of unexpected volatility in Ether is roughly the same.

If the skew of Ether options significantly exceeds the neutral threshold, it would indicate that prices are likely to fall below 4,200 USD, but this expectation has not materialized. This cautious sentiment in the derivatives market sharply contrasts with the strong on-chain activity, reflecting a divergence among market participants regarding short-term price trends.

Movements of the Ethereum Foundation

Additionally, according to CoinDesk, the Ethereum Foundation plans to sell 10,000 ETH in the coming weeks. The proceeds will be used to support research and development work, ecosystem funding, and related donations; these ethers will be exchanged in multiple small orders rather than a single large transaction.

Previously, the Ethereum Foundation announced a new fund management policy in early June, setting an annual operating expense cap of 15%, establishing a multi-year reserve buffer, and setting a long-term gradual reduction in spending rhythm. In July, the foundation sold an additional 10,000 ETH to SharpLink Gaming, making it the first publicly listed company to purchase ETH from the Ethereum Foundation.

This movement is worth market attention, as the Ethereum Foundation's reduction may exert some pressure on short-term prices. However, at the same time, the continued entry of institutional investors provides support for the market, creating a certain balance between the two.

Conclusion

Jack Ma once said, "Today's best performance is tomorrow's minimum requirement." Yunfeng Financial's strategic investment in Ethereum reflects its technological faith and serves as a deep reconstruction experiment of financial underlying logic.

It is noteworthy that this ETH purchase was completed through HashKey Exchange, and Yunfeng Financial's independent non-executive director, Xiao Feng, is a core figure of HashKey Group. This relationship further triggers the market's imagination about the value of the HashKey ecosystem and its token $HSK, and shows that Yunfeng's action goes beyond asset allocation; it can also be seen as an overall recognition and strategic support for Hong Kong's compliant digital asset ecosystem.

From a more macro perspective, Yunfeng Financial's move diversifies its reserve structure by increasing its Ethereum assets, reducing reliance on traditional fiat assets; on the other hand, it also reflects its strategic intention to deeply integrate traditional financial business with Web3 innovation, especially in exploring blockchain-enabled business scenarios in sectors like insurance and securities. With Hong Kong's compliance advantages in the digital asset field, Yunfeng Financial is expected to gradually develop into an important hub connecting traditional finance and the crypto ecosystem, further consolidating its leading position in the innovative financial technology track.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。