Decentralized derivatives exchanges (Perp DEX) have become one of the hottest sectors in the current market.

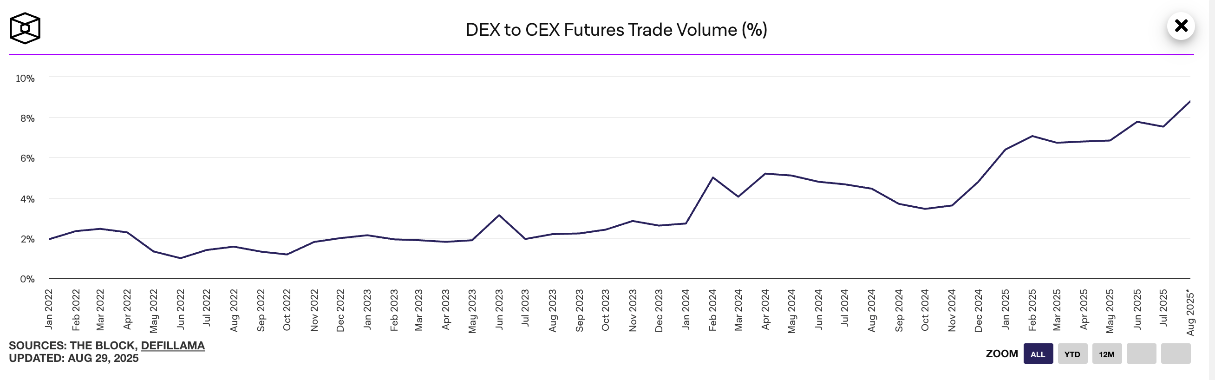

On one hand, over the past few years, Perp DEX has been continuously eating into the market share of centralized derivatives exchanges (CEX). Data from The Block shows that the ratio of contract trading volume on DEX to that on CEX has consistently increased over the past few years, reaching a historical peak of 8.8% in the recently concluded August.

On the other hand, the explosive growth of Hyperliquid has directly opened up the valuation ceiling for such projects. With more funds and talent pouring in, the entire Perp DEX sector has entered a period of accelerated development. Following Hyperliquid, new derivatives players like Ethereal, EdgeX, and Lighter are emerging with more innovative mechanisms or more focused products, preparing for a second wave of explosive growth in the sector. CoinW's newly incubated DeriW has quickly gained prominence due to its extreme capital efficiency, positioning itself as a seed player in the new round of Perp DEX competition.

DeriW: The First Zero-Fee Perp DEX on the Internet

DeriW is positioned as a new generation "zero-fee" Perp DEX, expected to support hundreds of different types of trading assets, with a maximum leverage of 100 times to meet the needs of users with different risk appetites. DeriW is developed by the CoinW team, which has eight years of experience in the perpetual contract sector, achieving a user experience comparable to centralized services while ensuring decentralized transparency and reliability. Overall, DeriW's core advantages are reflected in the following four aspects.

First is DeriW's core advantage, which is the extreme cost advantage. DeriW employs a unique "PendulumAMM" mechanism, enabling zero-fee trading under specific conditions; at the same time, DeriW trading incurs no Gas fees at all; regarding trading fees, DeriW only charges a 0.01% industry-low rate, significantly lower than competitors like Hyperliquid (0.045%).

- Note from Odaily: The so-called PendulumAMM is a new trading mechanism created by DeriW. Unlike traditional order book matching mechanisms that require matching buy and sell orders, PendulumAMM can accept all user trading demands in real-time, achieving "order execution upon placement." Additionally, thanks to PendulumAMM's higher capital efficiency, liquidity providers can also earn substantial annualized returns.

Second is the performance advantage. DeriW operates on the Layer 3 network DeriW Chain, inheriting Ethereum's security while seamlessly integrating with Layer 2 infrastructure (Arbitrum). This Rollup multi-layer architecture breaks the performance limitations of traditional architectures, supporting up to 80,000 transactions per second, effectively addressing the pain points of traditional Perp DEX such as "slow," "lag," and "high-pressure paralysis." Furthermore, DeriW also provides convenient API access services to meet the needs of high-frequency trading users.

Third is the transparency advantage. DeriW adopts a fully decentralized development architecture, with all trading processes completed on-chain and clearly queryable through the DeriW block explorer (https://explorer.deriw.com/), thus avoiding the potential "black box" issues of traditional Perp CEX.

Fourth is the security advantage. The endorsement from CoinW speaks for itself, and DeriW's non-custodial design ensures that users have complete control over the security of their assets. The platform has completed contract design with the third-party security company CertiK and will continue to conduct regular audits in the future to ensure the long-term security of the system.

Data Performance: The Dark Horse Has Emerged

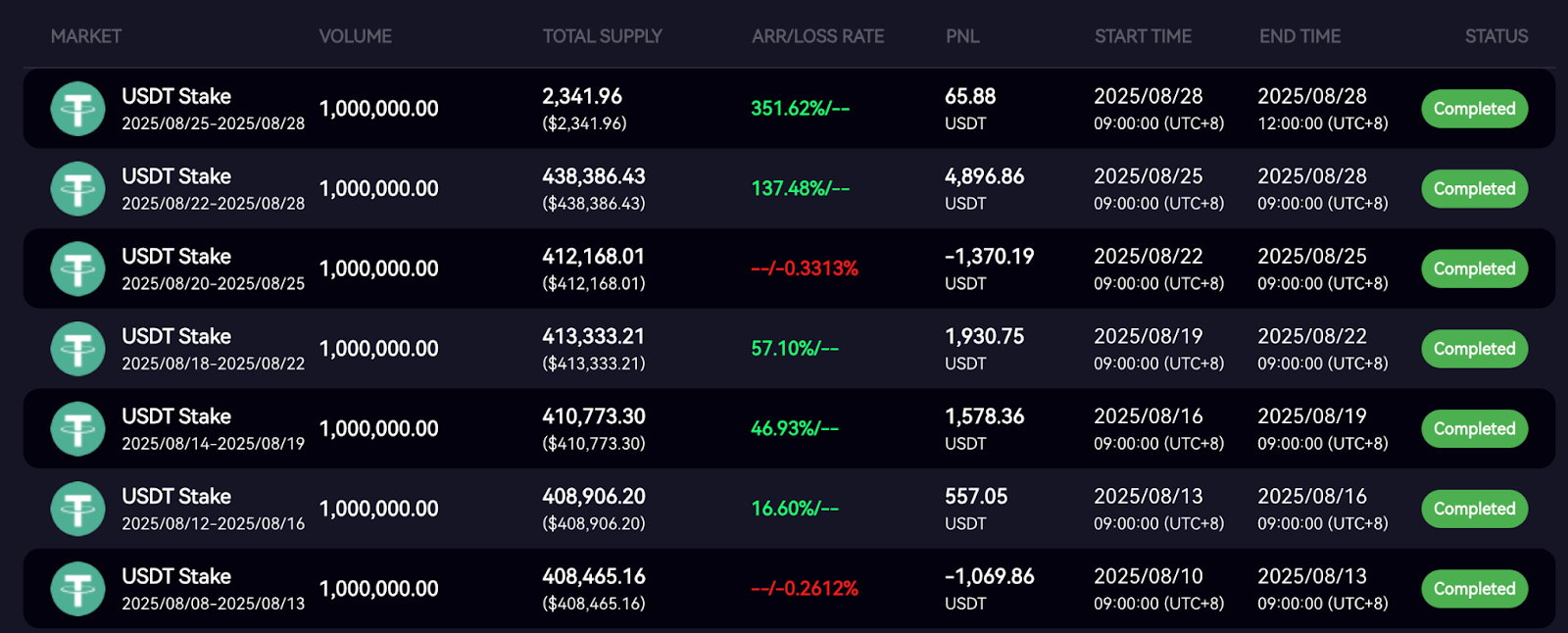

Based on the above advantages, DeriW provides an excellent experience for both liquidity providers and traders. On one hand, the PendulumAMM model can balance market demand while ensuring capital utilization efficiency, thereby maximizing participant returns — as shown in the chart below, liquidity providers on DeriW have recorded generally positive annualized returns over the past few cycles, with the highest APR reaching 351.62%; on the other hand, traders on DeriW can also enjoy lower fee costs and smoother trading speeds while opting for higher leverage, allowing for more efficient and flexible trading strategies.

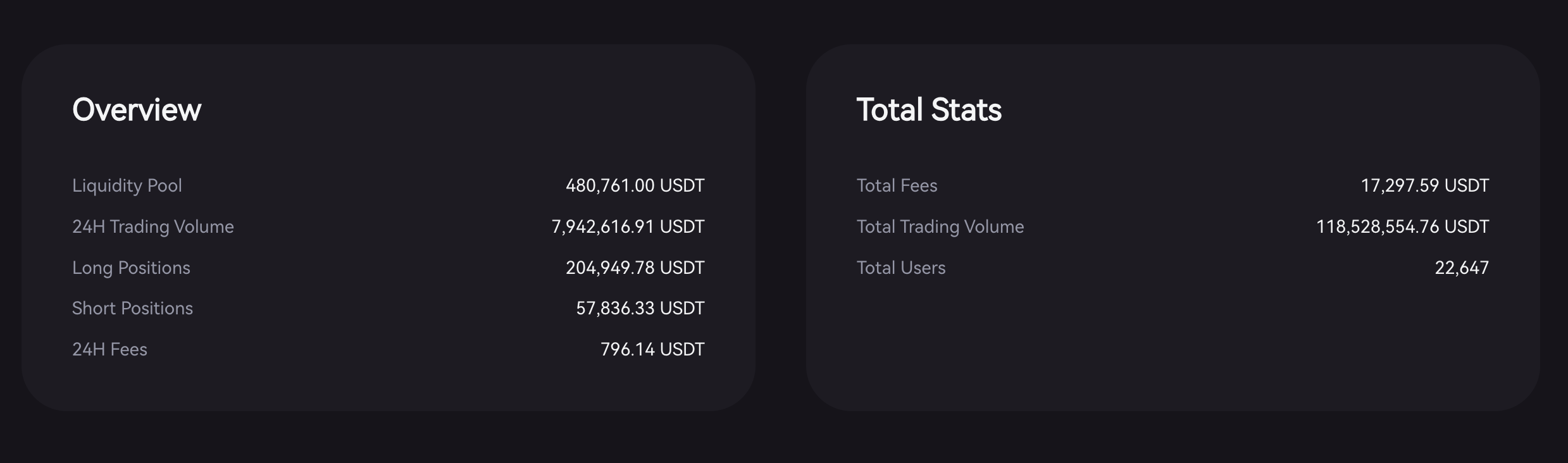

Since the mainnet launch on August 4, DeriW has attracted 22,647 trading users in less than a month, with the total historical trading volume quickly surpassing 100 million USD.

Early Bird Opportunity: Earnings and Airdrops

Shortly after the mainnet launch, DeriW also launched the Supernova+ points incentive program for early bird users on August 6. During the event, users can trade on DeriW with zero fees while also earning points incentives, thus obtaining potential airdrop benefits in addition to trading profits.

Specifically, during the event, users can earn 5 DER+ points for every 50 USDT traded. DER+ points are the core proof for future DeriW TGE token airdrops, and the number of points will directly determine the airdrop share; the more points, the more airdrops received. Besides direct trading, users can also confirm referral relationships with more users through referral links. Once bound, the referrer will continuously receive 300% of the trading points earned by the referred user as referral rewards.

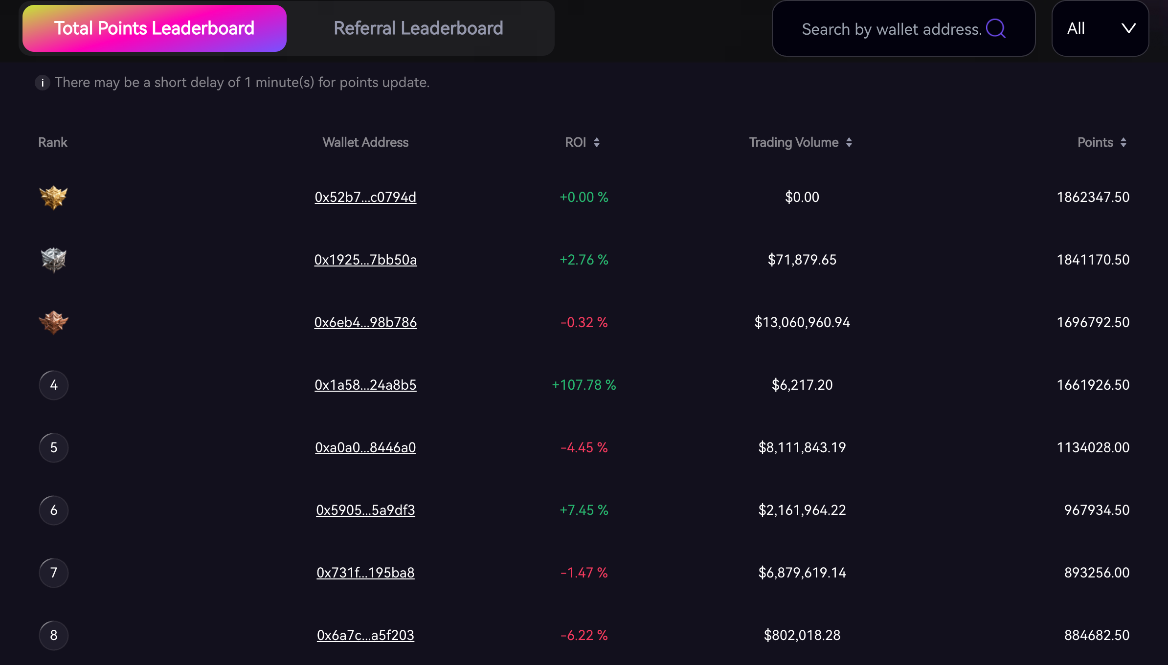

Currently, DeriW's Supernova+ event exclusive interface provides real-time points rankings, allowing users to check their points data in real-time. Considering DeriW's development prospects and real-time points scale, since the project is still in its early stages, the competition for points around DeriW has not yet "heated up," making it relatively optimistic to expect the airdrop benefits corresponding to DER+ points.

It is important to note that contract trading itself carries certain risks, so it is not advisable for users to "purely brush" trading volume for points. A more reasonable strategy is to execute trades on DeriW that align with their own judgment based on market changes. Over time, in addition to trading profits and the resulting airdrop expectations, DeriW's cost advantage over other competitors will gradually become apparent, helping users achieve "cost reduction and revenue increase" over a longer period.

The Perp DEX Competition Enters the Second Half, What is DeriW's Outlook?

Looking at the development history of the Perp DEX sector, Hyperliquid may be considered the winner of the first half — in an era where native crypto assets were the main trading objects, Hyperliquid helped a certain scale of users form the habit of conducting contract trading on-chain, while also seizing some pricing power of native crypto assets from centralized giants to a certain extent.

As trends like stock tokenization and stablecoin compliance advance, the era of "everything on-chain" is about to arrive. Looking ahead, the objects of on-chain trading will no longer be limited to native crypto assets but will gradually expand to stocks, bonds, commodities, and various real-world assets; at the same time, decentralized trading systems that solve performance and security challenges will pose a dimensionality reduction attack on the complex centralized trading systems of the traditional financial world.

In such a macro environment, more and more assets, funds, and users will flock to the chain, which will also open up the competition for the second half of the Perp DEX sector, and the scale of the new round of competition will far exceed the past few years. Standing on the brink of a sector explosion, DeriW has chosen the "extreme fee" strategy, which seems simple but is the most powerful, to achieve differentiated competition — as the market scale continues to grow, this advantage of DeriW will only become more apparent, and it may even become the breakthrough point in the second half of the Perp DEX competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。